- Canada

- /

- Oil and Gas

- /

- TSX:SU

A Rising Share Price Has Us Looking Closely At Suncor Energy Inc.'s (TSE:SU) P/E Ratio

Those holding Suncor Energy (TSE:SU) shares must be pleased that the share price has rebounded 34% in the last thirty days. But unfortunately, the stock is still down by 47% over a quarter. But that will do little to salve the savage burn caused by the 50% share price decline, over the last year.

Assuming no other changes, a sharply higher share price makes a stock less attractive to potential buyers. While the market sentiment towards a stock is very changeable, in the long run, the share price will tend to move in the same direction as earnings per share. So some would prefer to hold off buying when there is a lot of optimism towards a stock. One way to gauge market expectations of a stock is to look at its Price to Earnings Ratio (PE Ratio). A high P/E implies that investors have high expectations of what a company can achieve compared to a company with a low P/E ratio.

Check out our latest analysis for Suncor Energy

How Does Suncor Energy's P/E Ratio Compare To Its Peers?

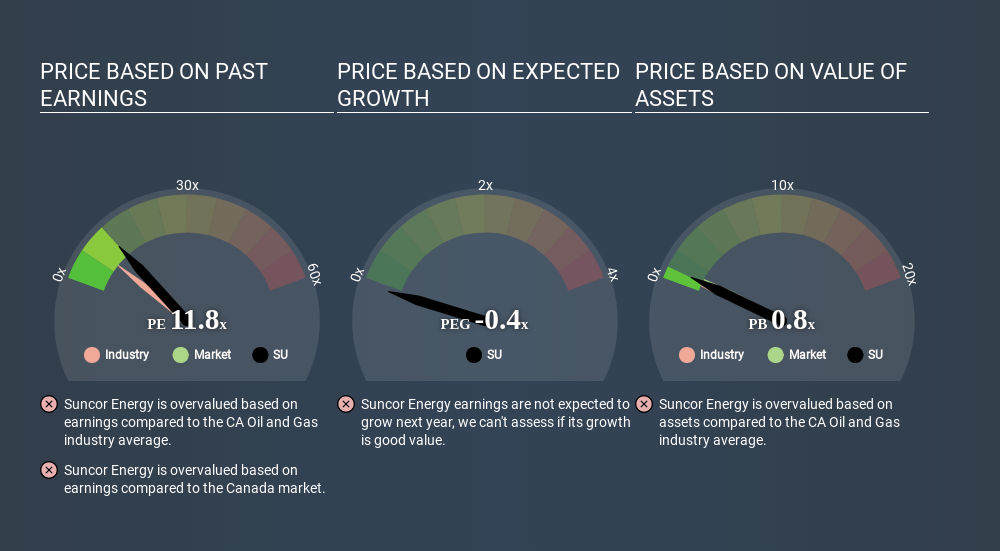

We can tell from its P/E ratio of 11.85 that there is some investor optimism about Suncor Energy. The image below shows that Suncor Energy has a higher P/E than the average (8.1) P/E for companies in the oil and gas industry.

That means that the market expects Suncor Energy will outperform other companies in its industry. The market is optimistic about the future, but that doesn't guarantee future growth. So further research is always essential. I often monitor director buying and selling.

How Growth Rates Impact P/E Ratios

Probably the most important factor in determining what P/E a company trades on is the earnings growth. That's because companies that grow earnings per share quickly will rapidly increase the 'E' in the equation. That means unless the share price increases, the P/E will reduce in a few years. Then, a lower P/E should attract more buyers, pushing the share price up.

Suncor Energy shrunk earnings per share by 8.4% last year. But over the longer term (3 years), earnings per share have increased by 90%.

A Limitation: P/E Ratios Ignore Debt and Cash In The Bank

One drawback of using a P/E ratio is that it considers market capitalization, but not the balance sheet. Thus, the metric does not reflect cash or debt held by the company. Hypothetically, a company could reduce its future P/E ratio by spending its cash (or taking on debt) to achieve higher earnings.

While growth expenditure doesn't always pay off, the point is that it is a good option to have; but one that the P/E ratio ignores.

So What Does Suncor Energy's Balance Sheet Tell Us?

Suncor Energy's net debt equates to 39% of its market capitalization. While that's enough to warrant consideration, it doesn't really concern us.

The Verdict On Suncor Energy's P/E Ratio

Suncor Energy trades on a P/E ratio of 11.8, which is fairly close to the CA market average of 11.8. Given it has some debt, but didn't grow last year, the P/E indicates the market is expecting higher profits ahead for the business. What we know for sure is that investors have become more excited about Suncor Energy recently, since they have pushed its P/E ratio from 8.8 to 11.8 over the last month. For those who prefer to invest with the flow of momentum, that might mean it's time to put the stock on a watchlist, or research it. But the contrarian may see it as a missed opportunity.

When the market is wrong about a stock, it gives savvy investors an opportunity. People often underestimate remarkable growth -- so investors can make money when fast growth is not fully appreciated. So this free report on the analyst consensus forecasts could help you make a master move on this stock.

But note: Suncor Energy may not be the best stock to buy. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20).

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:SU

Suncor Energy

Operates as an integrated energy company in Canada, the United States, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<html><head></head><body><div dir="auto">This is true here, but always true in the case of Alpha leaders. Often is takes a turn or two to get it right, like Gates to Nardella,  or Anton to Pinchar. This is when succession planning has failed or never happened. </div><div><br></div> </body></html>