- United States

- /

- Auto Components

- /

- NYSE:MOD

3 Value Stock Picks Including Laureate Education For Estimated Undervaluation

Reviewed by Simply Wall St

As the United States stock market experiences a surge in optimism due to potential resolutions to the government shutdown, major indices like the Nasdaq, S&P 500, and Dow Jones have posted significant gains. In this environment of renewed investor confidence, identifying undervalued stocks can be particularly advantageous as they may offer opportunities for growth amidst market fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Old National Bancorp (ONB) | $21.03 | $41.03 | 48.7% |

| Nicolet Bankshares (NIC) | $125.39 | $242.17 | 48.2% |

| Huntington Bancshares (HBAN) | $15.81 | $31.03 | 49.1% |

| Genius Sports (GENI) | $10.40 | $20.64 | 49.6% |

| First Busey (BUSE) | $22.92 | $45.34 | 49.4% |

| Fifth Third Bancorp (FITB) | $43.13 | $83.26 | 48.2% |

| CNB Financial (CCNE) | $24.89 | $49.42 | 49.6% |

| Caris Life Sciences (CAI) | $24.80 | $47.93 | 48.3% |

| Byrna Technologies (BYRN) | $18.26 | $35.57 | 48.7% |

| AbbVie (ABBV) | $218.71 | $434.42 | 49.7% |

Let's review some notable picks from our screened stocks.

Laureate Education (LAUR)

Overview: Laureate Education, Inc. provides higher education programs and services through its network of universities and institutions, with a market cap of approximately $4.48 billion.

Operations: Laureate Education generates revenue primarily from its operations in Peru ($756.18 million) and Mexico ($827.52 million).

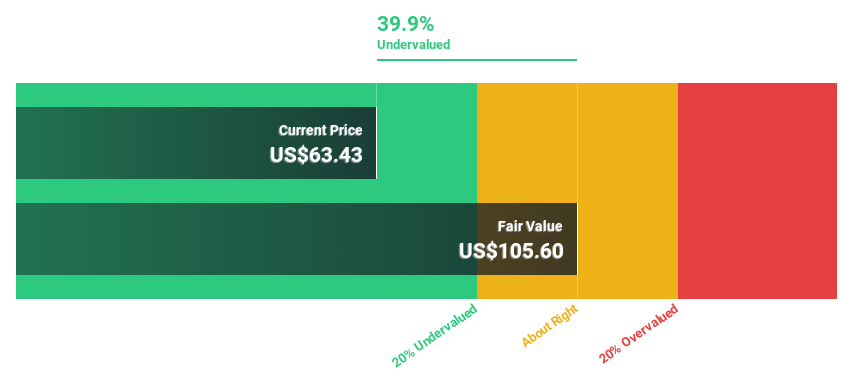

Estimated Discount To Fair Value: 43.7%

Laureate Education appears undervalued with its current stock price of US$31.15 trading significantly below the estimated fair value of US$55.36, suggesting a discount based on discounted cash flow analysis. Despite slower revenue growth forecasts (9.8% annually), earnings are expected to grow at a robust 23% per year, outpacing the broader U.S. market's growth rate. However, recent insider selling and decreased net income highlight potential concerns amidst positive long-term earnings projections and an expanded buyback plan worth US$250 million.

- Our comprehensive growth report raises the possibility that Laureate Education is poised for substantial financial growth.

- Take a closer look at Laureate Education's balance sheet health here in our report.

Dutch Bros (BROS)

Overview: Dutch Bros Inc. operates and franchises drive-thru coffee shops in the United States, with a market cap of approximately $9.48 billion.

Operations: The company's revenue is primarily derived from its company-operated shops, contributing $1.41 billion, and franchising activities, which add $123.40 million.

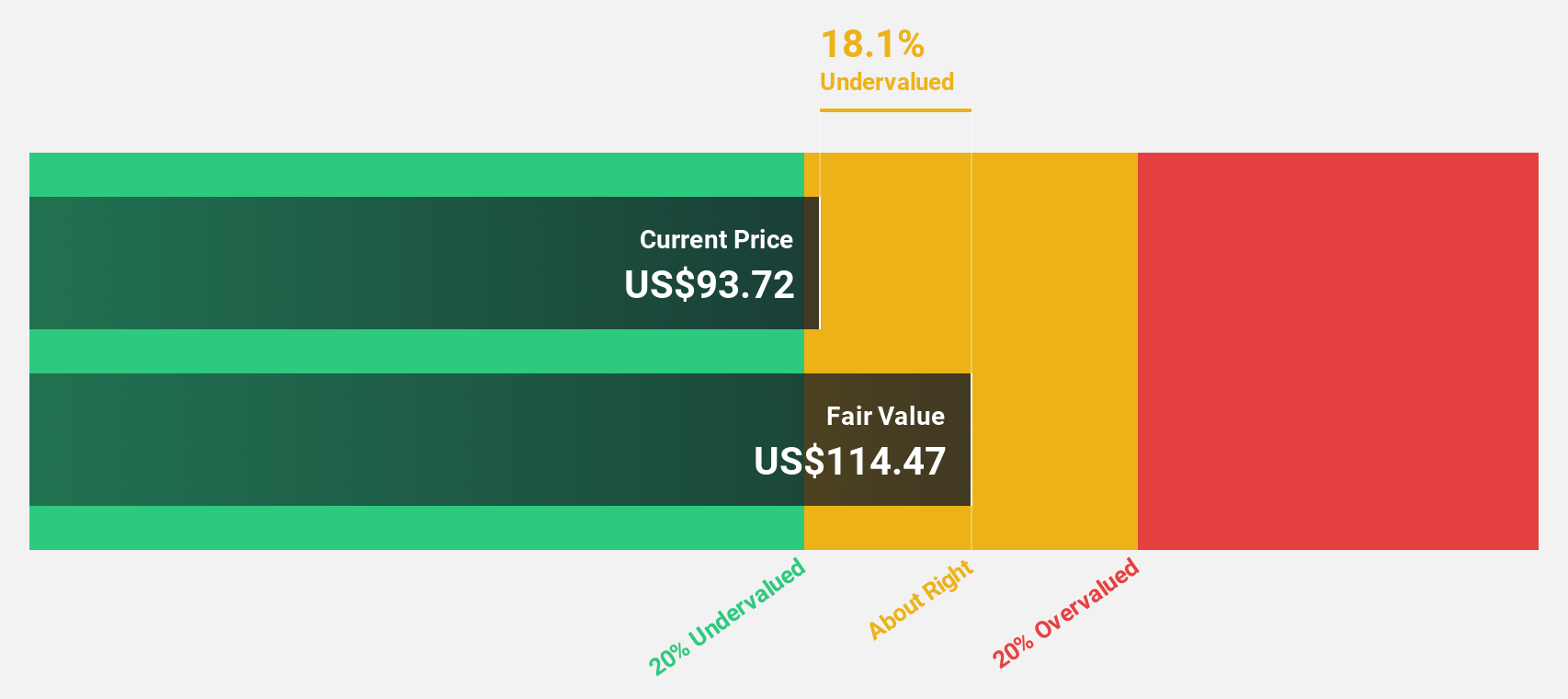

Estimated Discount To Fair Value: 12.5%

Dutch Bros is trading at US$56.68, below its estimated fair value of US$64.74, indicating it is undervalued based on cash flows. The company reported strong Q3 2025 results, with revenue rising to US$423.58 million from US$338.21 million a year ago and net income increasing to US$17.5 million from US$12.64 million. Despite significant insider selling recently, Dutch Bros' expansion plans and raised earnings guidance reflect confidence in future growth prospects.

- Our earnings growth report unveils the potential for significant increases in Dutch Bros' future results.

- Get an in-depth perspective on Dutch Bros' balance sheet by reading our health report here.

Modine Manufacturing (MOD)

Overview: Modine Manufacturing Company designs, engineers, tests, manufactures, and sells mission-critical thermal solutions globally, with a market cap of $8.23 billion.

Operations: Modine's revenue is primarily generated from its Climate Solutions segment at $1.57 billion and Performance Technologies segment at $1.13 billion.

Estimated Discount To Fair Value: 24.5%

Modine Manufacturing is trading at US$159.74, significantly below its estimated fair value of US$211.6, suggesting it is undervalued based on cash flows. The company reported Q2 2025 sales of US$738.9 million, up from the previous year, though net income slightly decreased to US$44.4 million from US$46.1 million a year ago. Despite recent insider selling, Modine's raised financial guidance and strategic expansions in data center cooling products underscore its growth potential amidst robust demand projections.

- In light of our recent growth report, it seems possible that Modine Manufacturing's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Modine Manufacturing's balance sheet health report.

Summing It All Up

- Click here to access our complete index of 180 Undervalued US Stocks Based On Cash Flows.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MOD

Modine Manufacturing

Designs, engineers, tests, manufactures, and sells mission-critical thermal solutions in the United States, Canada, Italy, Hungary, the United Kingdom, China, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives