- United Kingdom

- /

- Oil and Gas

- /

- AIM:NWF

3 UK Dividend Stocks Yielding Up To 4.5%

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index recently experienced a downturn, influenced by weak trade data from China, which has struggled to recover post-pandemic. In such uncertain market conditions, dividend stocks can offer stability and income potential, making them an attractive choice for investors seeking reliable returns amidst global economic fluctuations.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Seplat Energy (LSE:SEPL) | 5.37% | ★★★★★☆ |

| RS Group (LSE:RS1) | 3.97% | ★★★★★☆ |

| Pets at Home Group (LSE:PETS) | 6.37% | ★★★★★★ |

| OSB Group (LSE:OSB) | 6.07% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.59% | ★★★★★☆ |

| MONY Group (LSE:MONY) | 6.24% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.36% | ★★★★★☆ |

| IG Group Holdings (LSE:IGG) | 4.44% | ★★★★★☆ |

| Halyk Bank of Kazakhstan (LSE:HSBK) | 8.16% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 5.38% | ★★★★★★ |

Click here to see the full list of 50 stocks from our Top UK Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

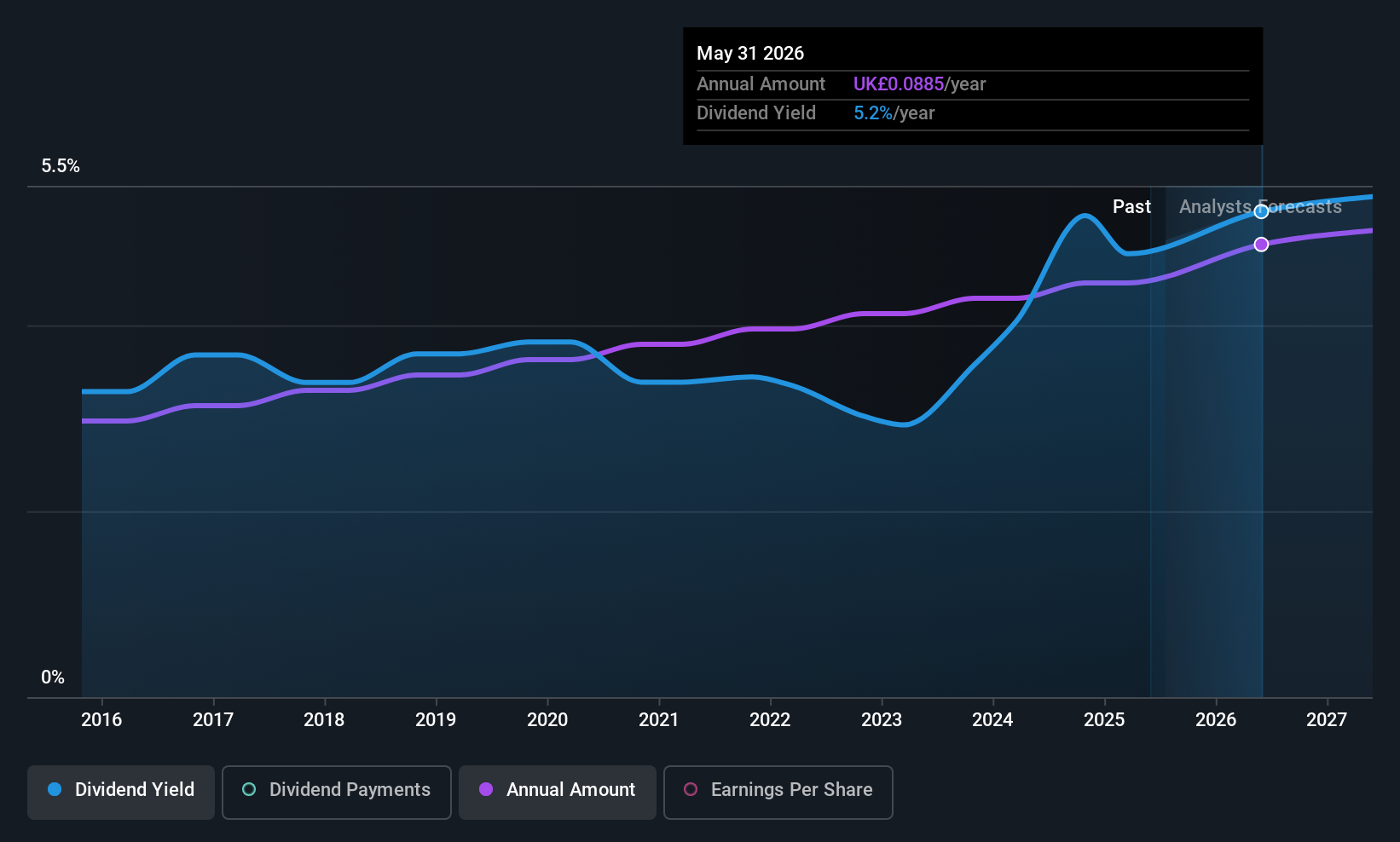

NWF Group (AIM:NWF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: NWF Group plc, with a market cap of £90.75 million, operates in the United Kingdom through its subsidiaries by engaging in the sale and distribution of fuel oils.

Operations: NWF Group plc generates its revenue through three main segments: Food (£86.30 million), Feeds (£204.60 million), and Fuels (£620.40 million).

Dividend Yield: 4.6%

NWF Group offers a stable dividend history with payments well-covered by earnings and cash flows, maintaining a consistent increase over the past decade. Despite a lower yield of 4.59% compared to top-tier UK dividend stocks, its payout ratio of 67% suggests sustainability. Recent financials show decreased sales and net income, yet strategic acquisitions in fuel distribution and food sectors signal growth ambitions. The proposed final dividend increase reflects ongoing commitment to shareholder returns.

- Click to explore a detailed breakdown of our findings in NWF Group's dividend report.

- According our valuation report, there's an indication that NWF Group's share price might be on the expensive side.

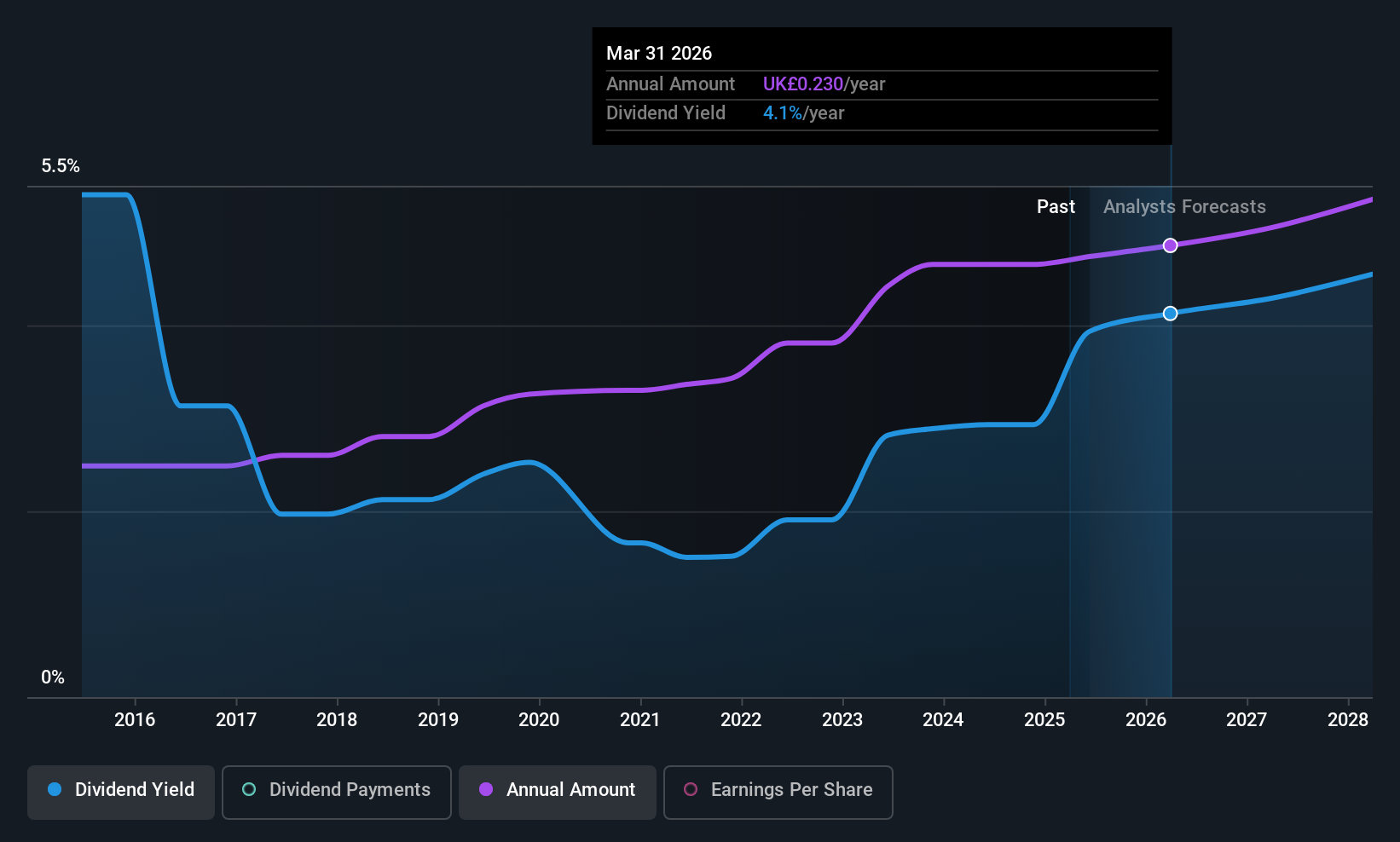

Drax Group (LSE:DRX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Drax Group plc, with a market cap of £2.49 billion, is involved in renewable power generation in the United Kingdom through its subsidiaries.

Operations: Drax Group's revenue is derived from several segments: Energy Solutions (£3.14 billion), Pellet Production (£948.80 million), Biomass Generation (£4.58 billion), and Flexible Generation (£191.10 million).

Dividend Yield: 3.8%

Drax Group's dividend payments are well-covered by earnings and cash flows, with a low payout ratio of 24.7%. Despite a recent increase in dividends to 29 pence per share, the yield remains below top-tier UK stocks. The company completed significant share buybacks worth £290.5 million, enhancing shareholder value despite declining sales and net income. However, Drax's dividend history shows volatility over the past decade, raising concerns about reliability despite current financial coverage.

- Click here to discover the nuances of Drax Group with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Drax Group's share price might be too pessimistic.

RS Group (LSE:RS1)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: RS Group plc operates as a distributor of maintenance, repair, and operations products and service solutions across the UK, US, France, Mexico, Germany, Italy, Switzerland and internationally with a market cap of approximately £2.64 billion.

Operations: RS Group plc generates revenue primarily from Other Product and Service Solutions, amounting to £2.50 billion, and Own-Brand Product and Service Solutions, contributing £400.40 million.

Dividend Yield: 4%

RS Group's dividend payments are well-supported by earnings, with a payout ratio of 69%, and by cash flows at 50%. The company has consistently increased its dividends over the past decade, though its yield of 3.97% is lower than the top UK dividend payers. Recent leadership changes in RS South Africa could bolster growth prospects, despite RS Group's removal from the FTSE All-World Index, which may affect investor sentiment.

- Unlock comprehensive insights into our analysis of RS Group stock in this dividend report.

- The analysis detailed in our RS Group valuation report hints at an deflated share price compared to its estimated value.

Where To Now?

- Navigate through the entire inventory of 50 Top UK Dividend Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if NWF Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:NWF

NWF Group

Engages in the sale and distribution of fuel oils in the United Kingdom.

6 star dividend payer with excellent balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)