- Canada

- /

- Construction

- /

- TSX:ATRL

3 TSX Stocks Estimated To Be Trading At Discounts Of Up To 48.3%

Reviewed by Simply Wall St

As the Canadian market navigates through a period of trade negotiations and economic uncertainties, investors are keenly observing opportunities that arise from recent market volatility. In this context, identifying undervalued stocks becomes crucial as they may offer attractive entry points for those looking to diversify their portfolios amidst fluctuating valuations and economic shifts.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Trisura Group (TSX:TSU) | CA$44.28 | CA$85.65 | 48.3% |

| Timbercreek Financial (TSX:TF) | CA$7.60 | CA$10.91 | 30.3% |

| TerraVest Industries (TSX:TVK) | CA$169.10 | CA$315.95 | 46.5% |

| Magna Mining (TSXV:NICU) | CA$1.72 | CA$3.35 | 48.6% |

| Lithium Royalty (TSX:LIRC) | CA$5.06 | CA$8.88 | 43% |

| K92 Mining (TSX:KNT) | CA$15.36 | CA$21.56 | 28.8% |

| Journey Energy (TSX:JOY) | CA$1.90 | CA$2.93 | 35.2% |

| High Tide (TSXV:HITI) | CA$3.14 | CA$4.56 | 31.2% |

| Aris Mining (TSX:ARIS) | CA$9.17 | CA$13.25 | 30.8% |

| Alphamin Resources (TSXV:AFM) | CA$0.86 | CA$1.31 | 34.3% |

We'll examine a selection from our screener results.

AtkinsRéalis Group (TSX:ATRL)

Overview: AtkinsRéalis Group Inc. is a company that, along with its subsidiaries, offers professional services, project management, and capital investment services across the United Kingdom, Canada, the United States, Saudi Arabia, and internationally with a market cap of CA$16.57 billion.

Operations: The company's revenue segments include Linxon (CA$900.71 million), Capital (CA$133.33 million), Nuclear (CA$1.73 billion), LSTK Projects (CA$200.97 million), Engineering Services - UKI (CA$2.53 billion), Engineering Services - AMEA (CA$1.31 billion), Engineering Services - USLA (CA$1.72 billion), and Engineering Services - Canada (CA$1.42 billion).

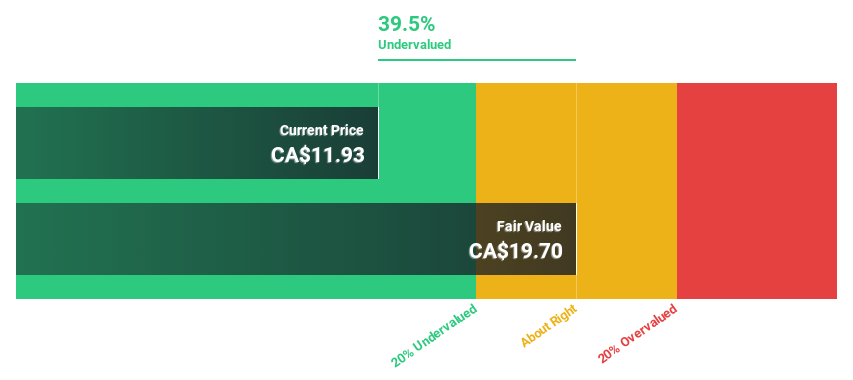

Estimated Discount To Fair Value: 14.8%

AtkinsRéalis Group is trading at CA$95.51, below its estimated fair value of CA$112.16, indicating potential undervaluation based on cash flows. While revenue growth is moderate at 7% per year, earnings are expected to grow significantly at 23.1% annually, outpacing the Canadian market's average growth rate. Recent strategic alliances and leadership changes aim to bolster operational execution and global expansion efforts, potentially enhancing cash flow generation in the future.

- Our earnings growth report unveils the potential for significant increases in AtkinsRéalis Group's future results.

- Get an in-depth perspective on AtkinsRéalis Group's balance sheet by reading our health report here.

K92 Mining (TSX:KNT)

Overview: K92 Mining Inc. is involved in the exploration and development of mineral deposits in Papua New Guinea, with a market cap of CA$3.70 billion.

Operations: The company's revenue primarily comes from the Kainantu Project, generating $435.43 million.

Estimated Discount To Fair Value: 28.8%

K92 Mining, trading at CA$15.36, is undervalued compared to its estimated fair value of CA$21.56. Recent earnings surged with a net income of US$70.24 million for Q1 2025, up from US$3.07 million the previous year, highlighting strong cash flow potential. The company’s ongoing expansions and high-grade drilling results at Kainantu Gold Mine bolster future growth prospects despite insider selling concerns over the past quarter and reliance on non-cash earnings components.

- The analysis detailed in our K92 Mining growth report hints at robust future financial performance.

- Click here to discover the nuances of K92 Mining with our detailed financial health report.

Trisura Group (TSX:TSU)

Overview: Trisura Group Ltd. is a specialty insurance company engaged in surety, risk solutions, corporate insurance, and reinsurance across Canada, the United States, and internationally with a market cap of CA$2.10 billion.

Operations: The company's revenue segments include Trisura Specialty with CA$1.04 billion and Trisura US Programs with CA$2.16 billion.

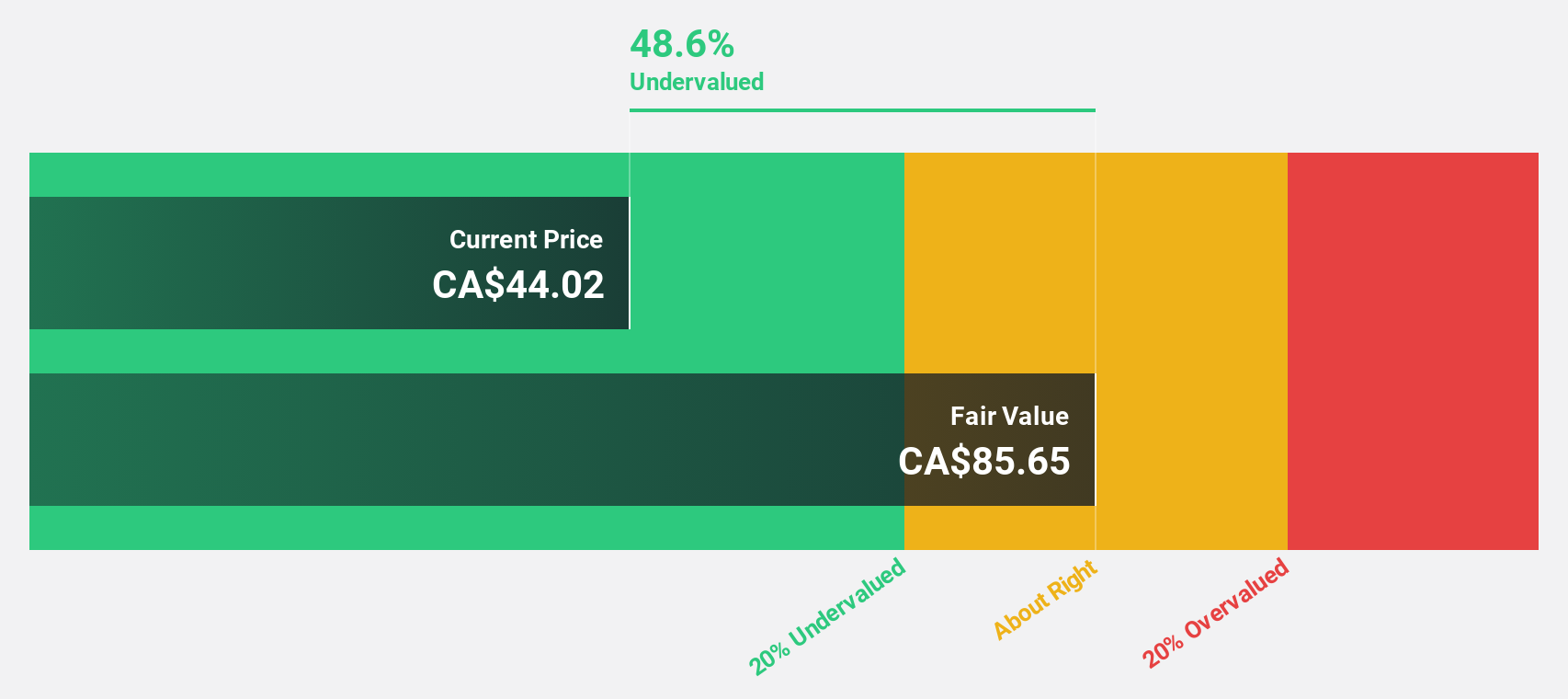

Estimated Discount To Fair Value: 48.3%

Trisura Group, priced at CA$44.28, is significantly undervalued compared to its fair value estimate of CA$85.65, trading 48.3% below this benchmark. Despite a decrease in net income to CA$28.99 million for Q1 2025 from the previous year's CA$36.43 million, the company shows strong potential with earnings forecasted to grow significantly over the next three years and revenue growth expected to outpace the Canadian market average by nearly double.

- Our expertly prepared growth report on Trisura Group implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Trisura Group's balance sheet health report.

Summing It All Up

- Click this link to deep-dive into the 24 companies within our Undervalued TSX Stocks Based On Cash Flows screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ATRL

AtkinsRéalis Group

Provides professional services and project management, and capital investment services in United Kingdom, Canada, the United States, Saudi Arabia, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives