- Australia

- /

- Consumer Durables

- /

- ASX:FWD

3 Top ASX Dividend Stocks To Consider

Reviewed by Simply Wall St

The Australian market has recently experienced significant fluctuations, with profit-taking in Commonwealth Bank impacting the ASX200, while a rotation into materials has seen BHP Limited and other resource stocks gain ground. Amidst these shifts, investors are increasingly looking towards dividend stocks as a means of securing steady income in uncertain times. A good dividend stock typically offers consistent payouts and resilience against market volatility, making it an attractive option for those navigating the current economic landscape.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Sugar Terminals (NSX:SUG) | 8.12% | ★★★★★☆ |

| Ricegrowers (ASX:SGLLV) | 6.29% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 3.30% | ★★★★★☆ |

| New Hope (ASX:NHC) | 9.56% | ★★★★★☆ |

| Lycopodium (ASX:LYL) | 7.10% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 7.03% | ★★★★★☆ |

| IPH (ASX:IPH) | 7.42% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.55% | ★★★★★☆ |

| Bisalloy Steel Group (ASX:BIS) | 8.67% | ★★★★★☆ |

| Accent Group (ASX:AX1) | 9.22% | ★★★★★☆ |

Click here to see the full list of 29 stocks from our Top ASX Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Fleetwood (ASX:FWD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fleetwood Limited, with a market cap of A$234.53 million, operates in Australia and New Zealand by designing, manufacturing, selling, and installing modular accommodation and buildings.

Operations: Fleetwood Limited generates revenue through three main segments: RV Solutions (A$71.51 million), Building Solutions (A$340.12 million), and Community Solutions (A$50.02 million).

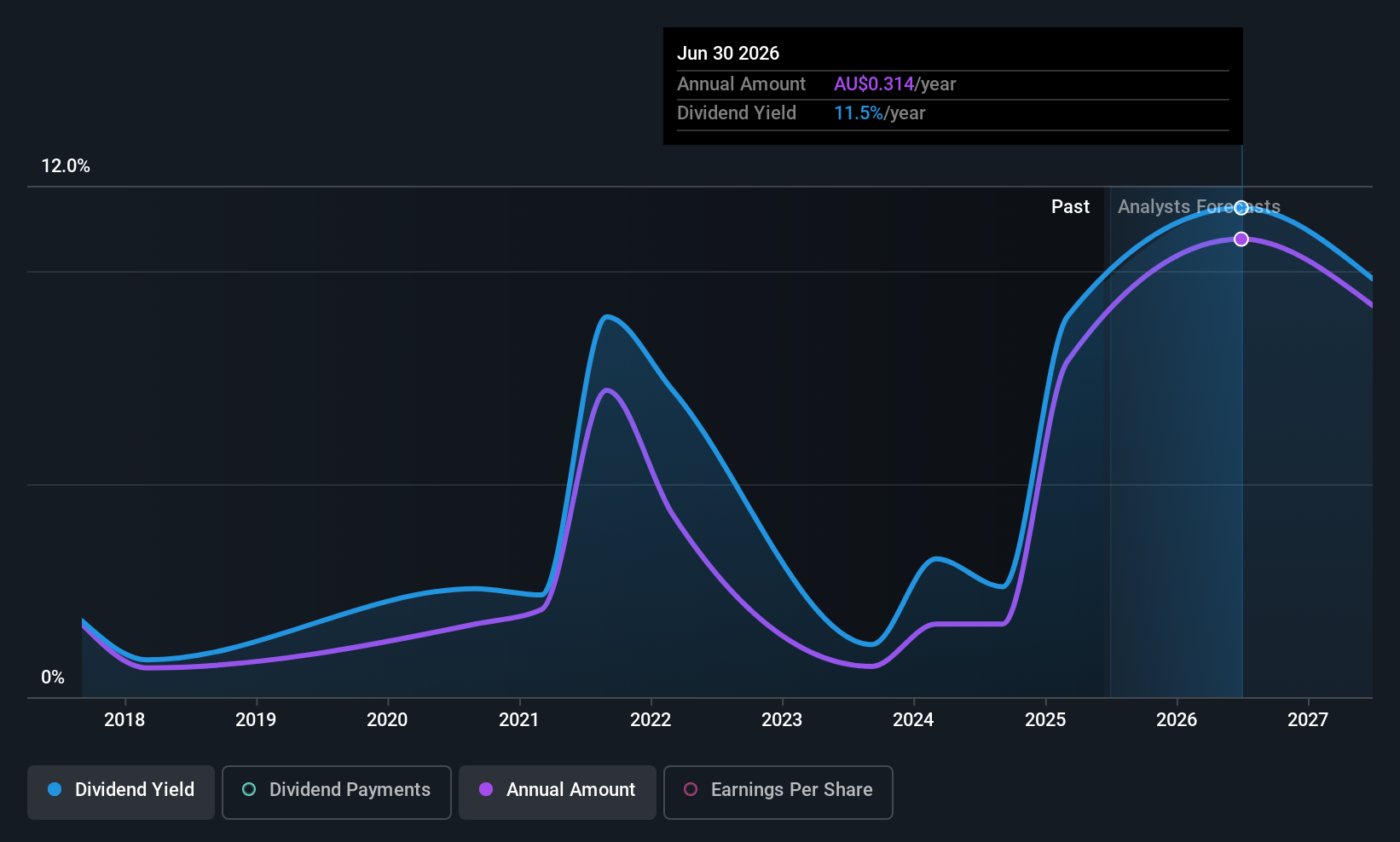

Dividend Yield: 9.1%

Fleetwood's dividend yield of 9.06% places it among the top 25% of Australian dividend payers, yet its dividends have been volatile over the past decade and are not well covered by earnings due to a high payout ratio of 286.1%. Despite this, cash flows do cover dividends with a cash payout ratio of 56.9%. The company recently completed a share buyback program, repurchasing shares worth A$2.02 million, which may impact future dividend sustainability.

- Click here to discover the nuances of Fleetwood with our detailed analytical dividend report.

- Our valuation report unveils the possibility Fleetwood's shares may be trading at a premium.

MFF Capital Investments (ASX:MFF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: MFF Capital Investments Limited is an investment firm manager with a market capitalization of approximately A$2.59 billion.

Operations: MFF Capital Investments Limited generates its revenue primarily from equity investments, amounting to A$1.01 billion.

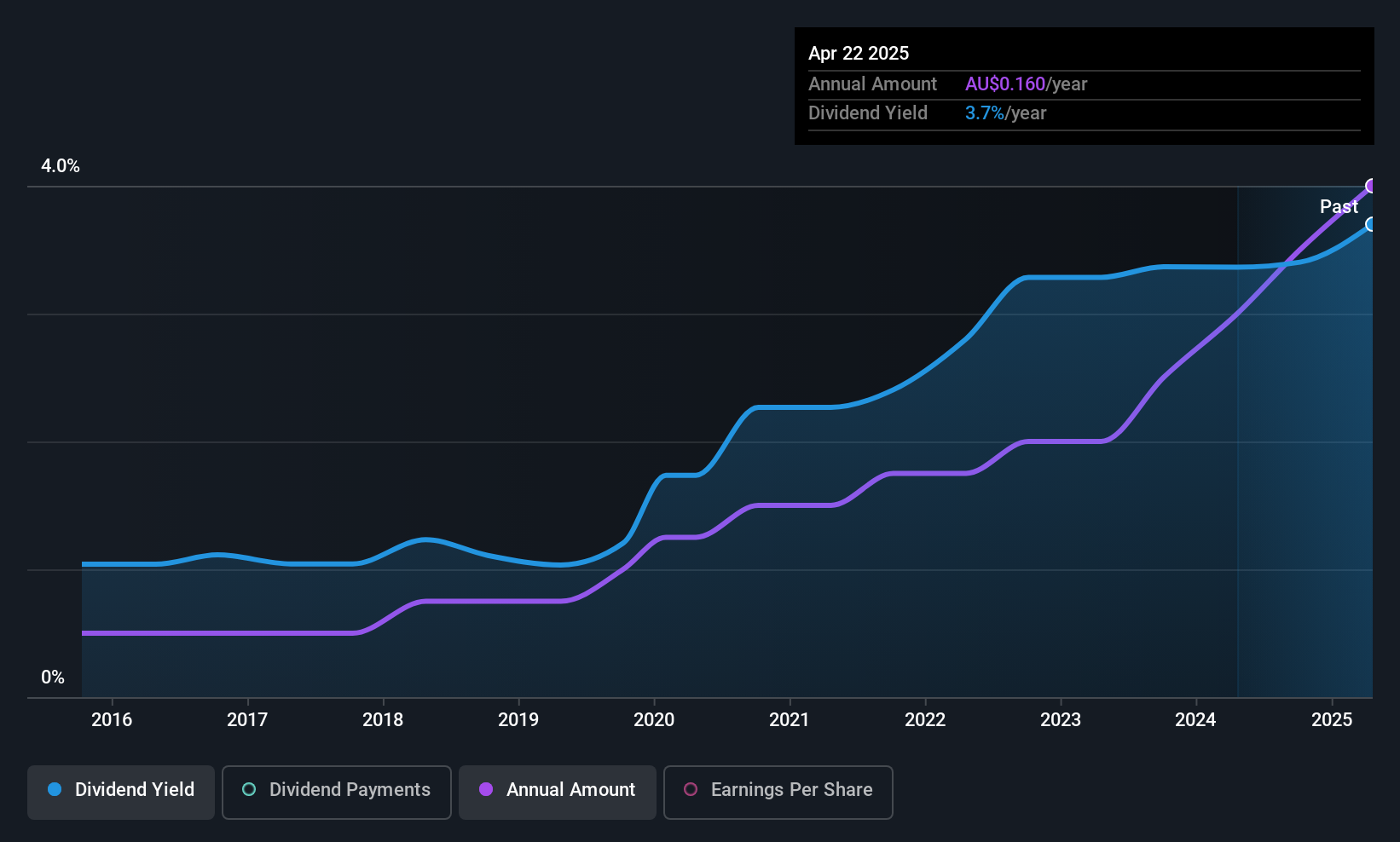

Dividend Yield: 3.6%

MFF Capital Investments offers a dividend yield of 3.62%, which is below the top quartile in Australia, but its dividends are well-supported by earnings and cash flows with payout ratios of 12.7% and 22.9%, respectively. Over the past decade, MFF's dividends have been stable and growing, reflecting reliability without volatility. Additionally, MFF appears undervalued, trading at 43.1% below its estimated fair value, potentially enhancing its appeal to dividend investors seeking growth potential.

- Dive into the specifics of MFF Capital Investments here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of MFF Capital Investments shares in the market.

Perenti (ASX:PRN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Perenti Limited is a global mining services company with a market capitalization of A$1.53 billion.

Operations: Perenti Limited generates revenue through its Drilling Services (A$750.65 million), Contract Mining Services (A$2.50 billion), and Mining Services and Idoba (A$229.77 million) segments.

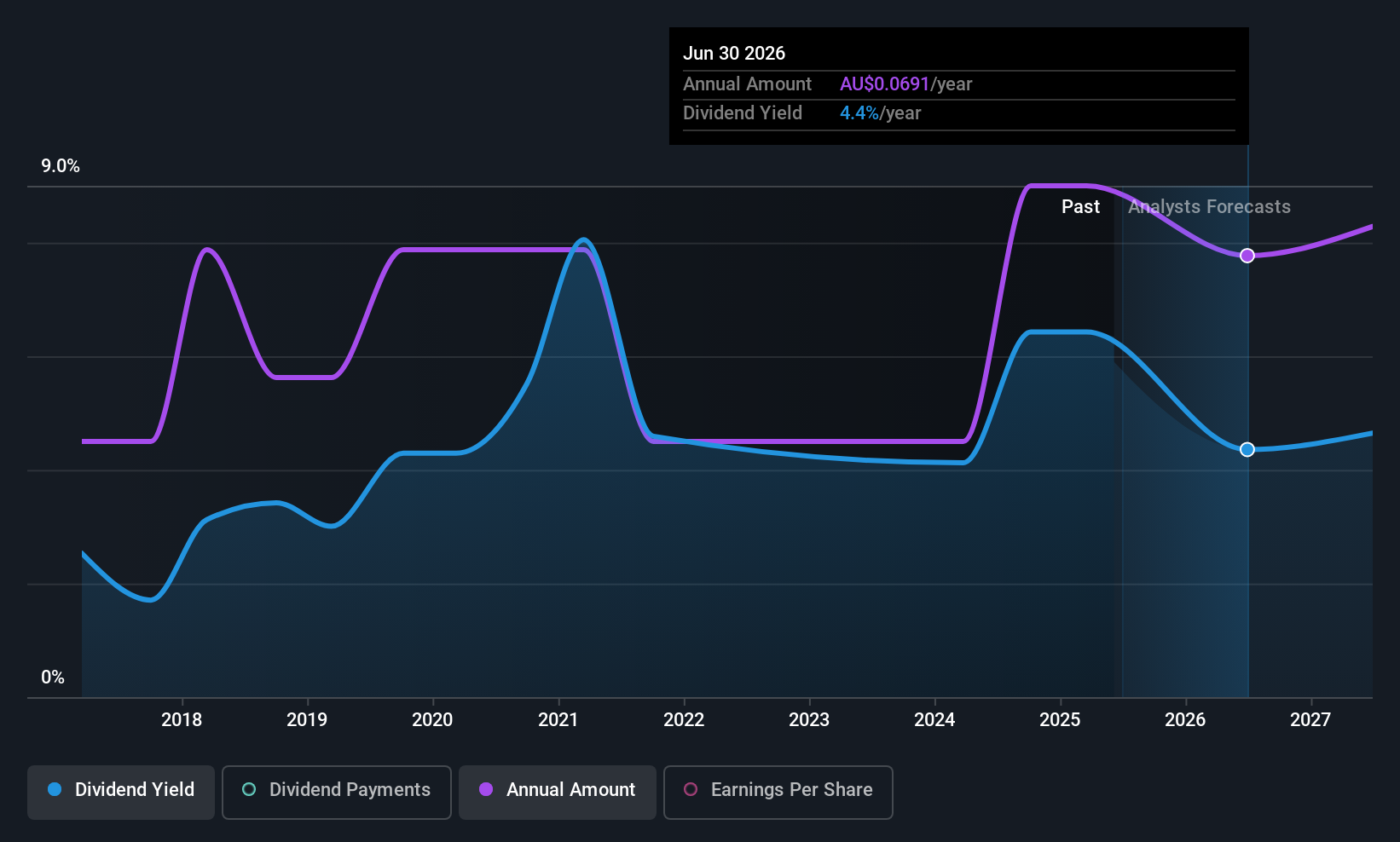

Dividend Yield: 4.9%

Perenti's dividend yield of 4.86% trails the top Australian payers, but its dividends are well-covered by earnings and cash flows with payout ratios of 76% and 46.4%, respectively. Despite a volatile dividend history over the past decade, recent increases suggest potential growth. Trading at A$1 billion below estimated fair value, Perenti may attract investors seeking undervalued opportunities, though its profit margins have declined from last year’s figures.

- Click to explore a detailed breakdown of our findings in Perenti's dividend report.

- Our valuation report unveils the possibility Perenti's shares may be trading at a discount.

Taking Advantage

- Delve into our full catalog of 29 Top ASX Dividend Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:FWD

Fleetwood

Engages in the design, manufacture, sale, and installation of modular accommodation and buildings in Australia and New Zealand.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives