- United States

- /

- Construction

- /

- NasdaqCM:LMB

3 Stocks That May Be Priced Below Their Estimated Worth In July 2025

Reviewed by Simply Wall St

As the U.S. stock market continues to reach new heights, with the S&P 500 and Nasdaq hitting record levels amid positive trade developments and strong corporate earnings, investors are keenly watching for opportunities that may be overlooked in this bullish environment. In such a thriving market, identifying stocks that are potentially undervalued requires careful analysis of their fundamentals and growth prospects relative to current economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| TowneBank (TOWN) | $35.61 | $69.58 | 48.8% |

| Sotera Health (SHC) | $12.30 | $24.38 | 49.5% |

| Semrush Holdings (SEMR) | $9.74 | $19.09 | 49% |

| Roku (ROKU) | $90.12 | $174.54 | 48.4% |

| Hims & Hers Health (HIMS) | $57.65 | $114.17 | 49.5% |

| Grindr (GRND) | $18.29 | $36.42 | 49.8% |

| Gold Royalty (GROY) | $2.72 | $5.42 | 49.8% |

| Globalstar (GSAT) | $24.57 | $47.68 | 48.5% |

| Carter Bankshares (CARE) | $18.10 | $35.83 | 49.5% |

| Acadia Realty Trust (AKR) | $18.77 | $36.63 | 48.8% |

Underneath we present a selection of stocks filtered out by our screen.

Limbach Holdings (LMB)

Overview: Limbach Holdings, Inc. operates as a building systems solution company in the United States with a market cap of $1.56 billion.

Operations: The company's revenue is derived from Owner Direct Relationships, contributing $361.64 million, and General Contractor Relationships, accounting for $171.28 million.

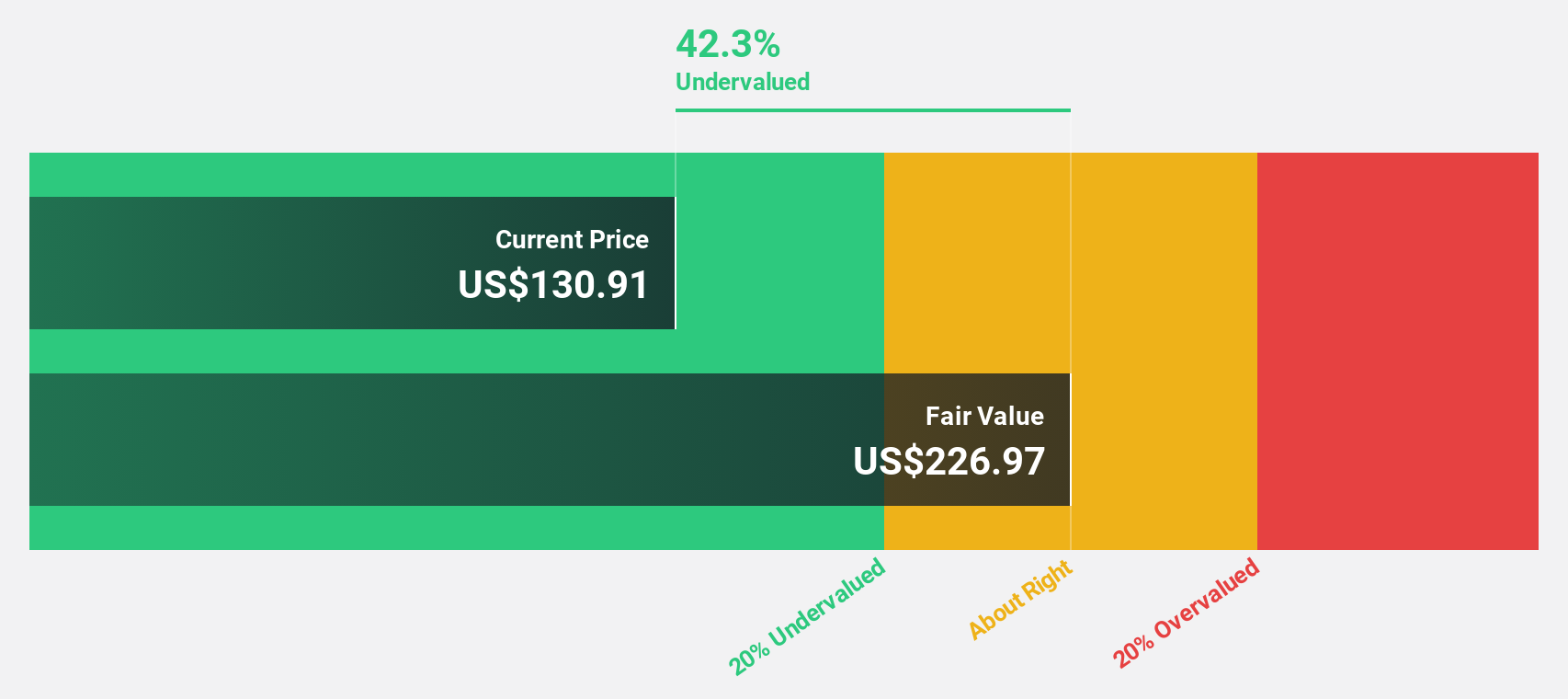

Estimated Discount To Fair Value: 38.2%

Limbach Holdings is trading at US$133.84, significantly below its estimated fair value of US$216.69, indicating potential undervaluation based on cash flows. The company's earnings are expected to grow at a robust 20.4% annually, outpacing the broader US market's growth rate of 14.9%. Recent amendments to their credit agreement have doubled their revolving credit facility to US$100 million, enhancing financial flexibility for strategic acquisitions and expansion initiatives in key metropolitan areas.

- According our earnings growth report, there's an indication that Limbach Holdings might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Limbach Holdings.

Casella Waste Systems (CWST)

Overview: Casella Waste Systems, Inc. operates as a vertically integrated solid waste services company in the United States with a market cap of approximately $6.92 billion.

Operations: The company's revenue segments include $526.04 million from the Eastern region, $258.99 million from the Mid-Atlantic region, $350.41 million from Resource Solutions, and $836.29 million from the Western (including Central) region.

Estimated Discount To Fair Value: 19.4%

Casella Waste Systems is trading at US$108.97, below its estimated fair value of US$135.13, suggesting potential undervaluation based on cash flows. Despite a net loss in Q1 2025, earnings are projected to grow significantly at 59.4% annually, surpassing the US market's growth rate of 14.9%. Recent investments in recycling facilities aim to enhance operational efficiency and sustainability initiatives but insider selling may warrant caution for investors seeking stability.

- The growth report we've compiled suggests that Casella Waste Systems' future prospects could be on the up.

- Take a closer look at Casella Waste Systems' balance sheet health here in our report.

Inspire Medical Systems (INSP)

Overview: Inspire Medical Systems, Inc. is a medical technology company that develops and commercializes minimally invasive solutions for obstructive sleep apnea (OSA) patients both in the United States and internationally, with a market cap of approximately $3.80 billion.

Operations: Inspire Medical Systems generates revenue primarily from its Patient Monitoring Equipment segment, which accounts for $840.11 million.

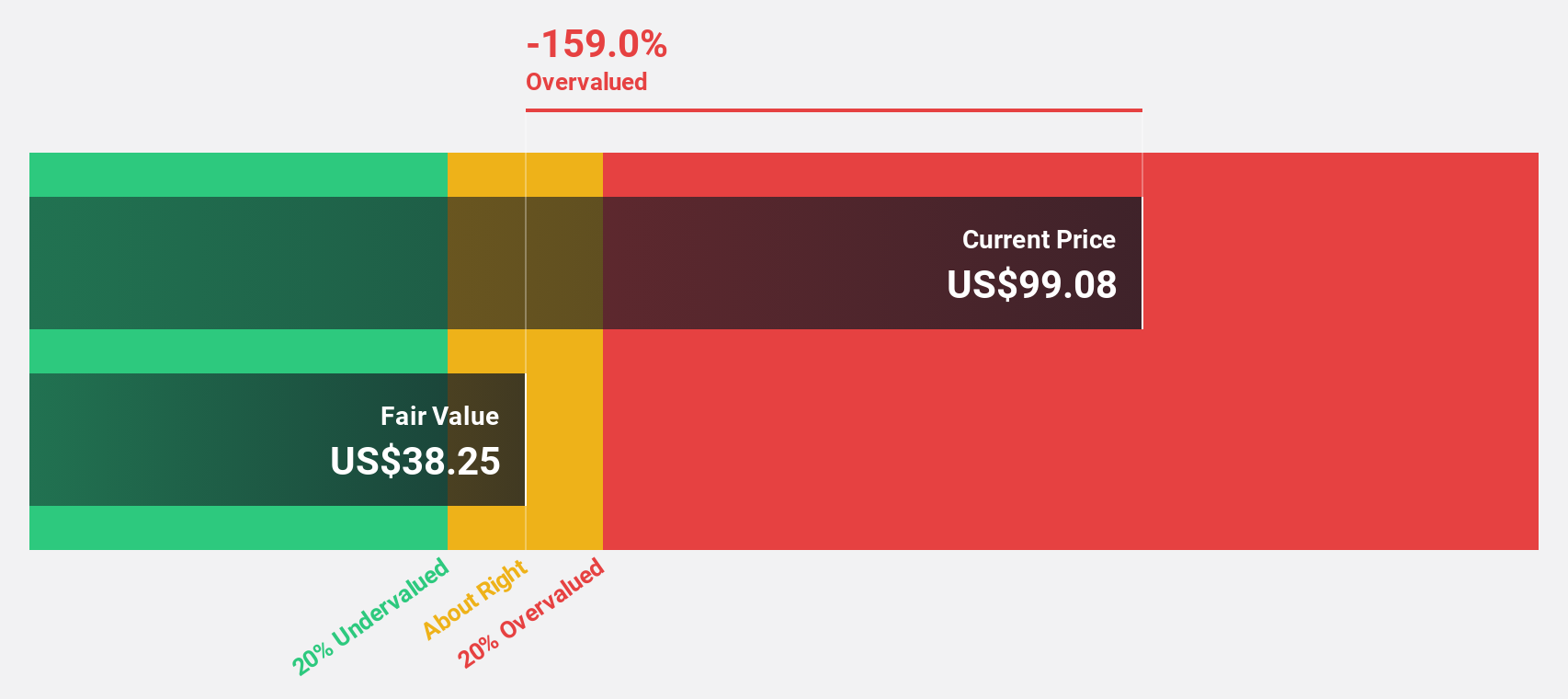

Estimated Discount To Fair Value: 47.1%

Inspire Medical Systems is trading at US$128.86, well below its estimated fair value of US$243.75, indicating potential undervaluation based on cash flows. The company became profitable this year and forecasts suggest earnings growth of 25.1% annually, outpacing the broader US market's growth rate of 14.9%. Recent financial guidance revision shows expected revenue between $940 million to $955 million for 2025, reflecting robust performance compared to last year's figures.

- Upon reviewing our latest growth report, Inspire Medical Systems' projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of Inspire Medical Systems.

Make It Happen

- Click through to start exploring the rest of the 165 Undervalued US Stocks Based On Cash Flows now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:LMB

Limbach Holdings

Operates as a building systems solution company in the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives