- United States

- /

- Hospitality

- /

- NasdaqGS:SRAD

3 Stocks Estimated To Be Up To 34.7% Below Their Intrinsic Value

Reviewed by Simply Wall St

As major stock indexes in the United States continue to set fresh records, buoyed by optimism surrounding U.S.-China trade talks and anticipated Federal Reserve rate cuts, investors are keenly watching for opportunities that may still offer substantial value. In this environment of soaring indices, identifying stocks that are potentially undervalued can be crucial for those looking to maximize their investment potential.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Udemy (UDMY) | $6.92 | $13.53 | 48.9% |

| ImmunityBio (IBRX) | $2.66 | $5.09 | 47.8% |

| First Busey (BUSE) | $23.20 | $45.91 | 49.5% |

| First Advantage (FA) | $14.22 | $27.26 | 47.8% |

| Fifth Third Bancorp (FITB) | $42.45 | $82.75 | 48.7% |

| e.l.f. Beauty (ELF) | $126.18 | $252.06 | 49.9% |

| Corpay (CPAY) | $284.24 | $545.71 | 47.9% |

| Constellium (CSTM) | $16.85 | $32.34 | 47.9% |

| Ategrity Specialty Insurance Company Holdings (ASIC) | $19.54 | $38.00 | 48.6% |

| ASP Isotopes (ASPI) | $10.09 | $19.57 | 48.5% |

We're going to check out a few of the best picks from our screener tool.

Global-E Online (GLBE)

Overview: Global-E Online Ltd. operates a direct-to-consumer cross-border e-commerce platform across Israel, the United Kingdom, the United States, and other international markets with a market cap of approximately $5.88 billion.

Operations: The company generates revenue of $843.64 million from its Internet Information Providers segment.

Estimated Discount To Fair Value: 34.7%

Global-E Online is trading at US$34.81, significantly below its estimated fair value of US$53.29, highlighting potential undervaluation based on cash flows. Recent earnings show a turnaround with net income of US$10.49 million compared to a prior loss, and sales growth from US$168 million to US$214.88 million year-over-year. The company has announced a $200 million share repurchase program funded by existing and future cash flows, reinforcing its strong cash position and operational growth prospects.

- Insights from our recent growth report point to a promising forecast for Global-E Online's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Global-E Online.

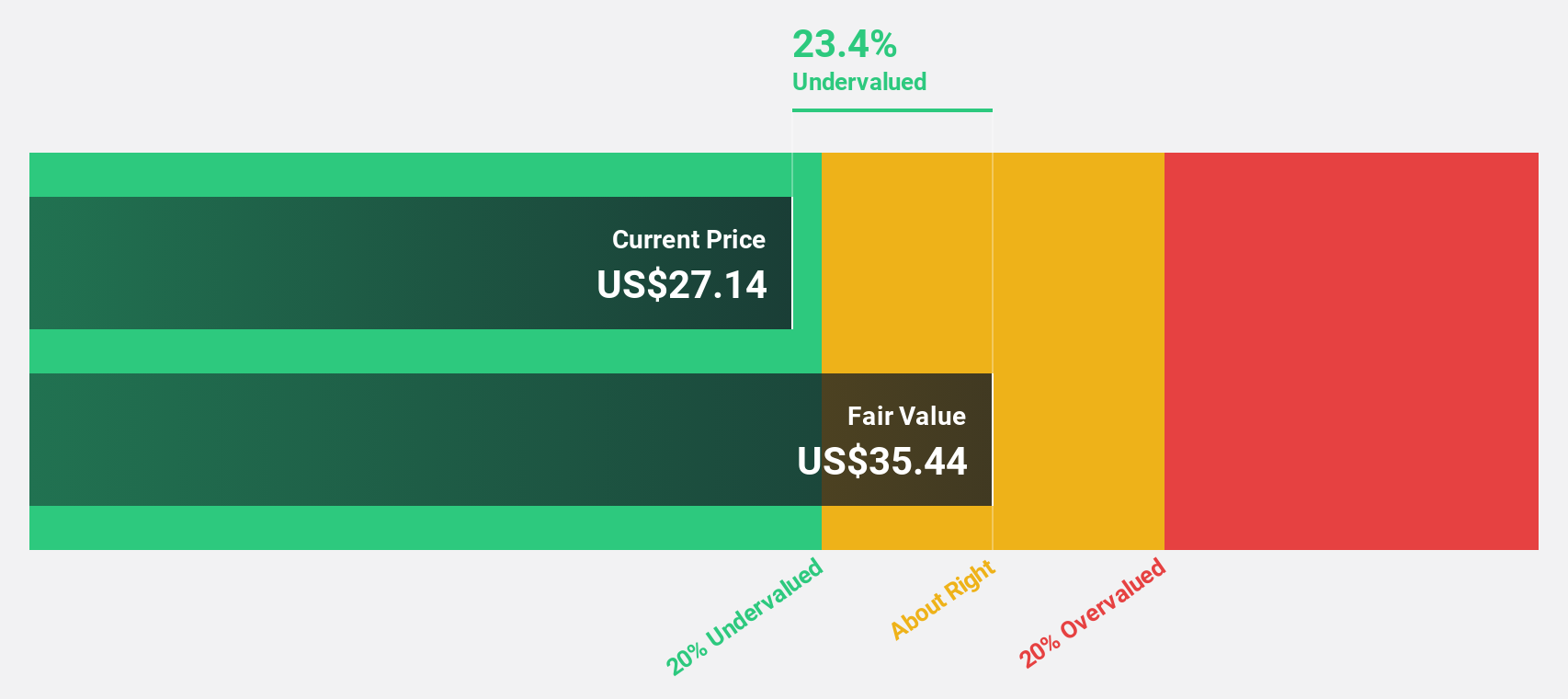

Sportradar Group (SRAD)

Overview: Sportradar Group AG offers sports data services to the sports betting and media industries across various regions worldwide, with a market cap of $8.08 billion.

Operations: The company's revenue from Data Processing services amounts to €1.19 billion.

Estimated Discount To Fair Value: 34.4%

Sportradar Group is trading at US$27.11, well below its estimated fair value of US$41.32, suggesting it may be undervalued based on cash flows. The company reported a strong earnings turnaround with net income of €49.25 million for Q2 2025, compared to a loss the previous year. It has also completed share buybacks totaling $86 million, reflecting robust cash flow management and enhancing shareholder value while projecting significant annual earnings growth of 24.7%.

- The growth report we've compiled suggests that Sportradar Group's future prospects could be on the up.

- Take a closer look at Sportradar Group's balance sheet health here in our report.

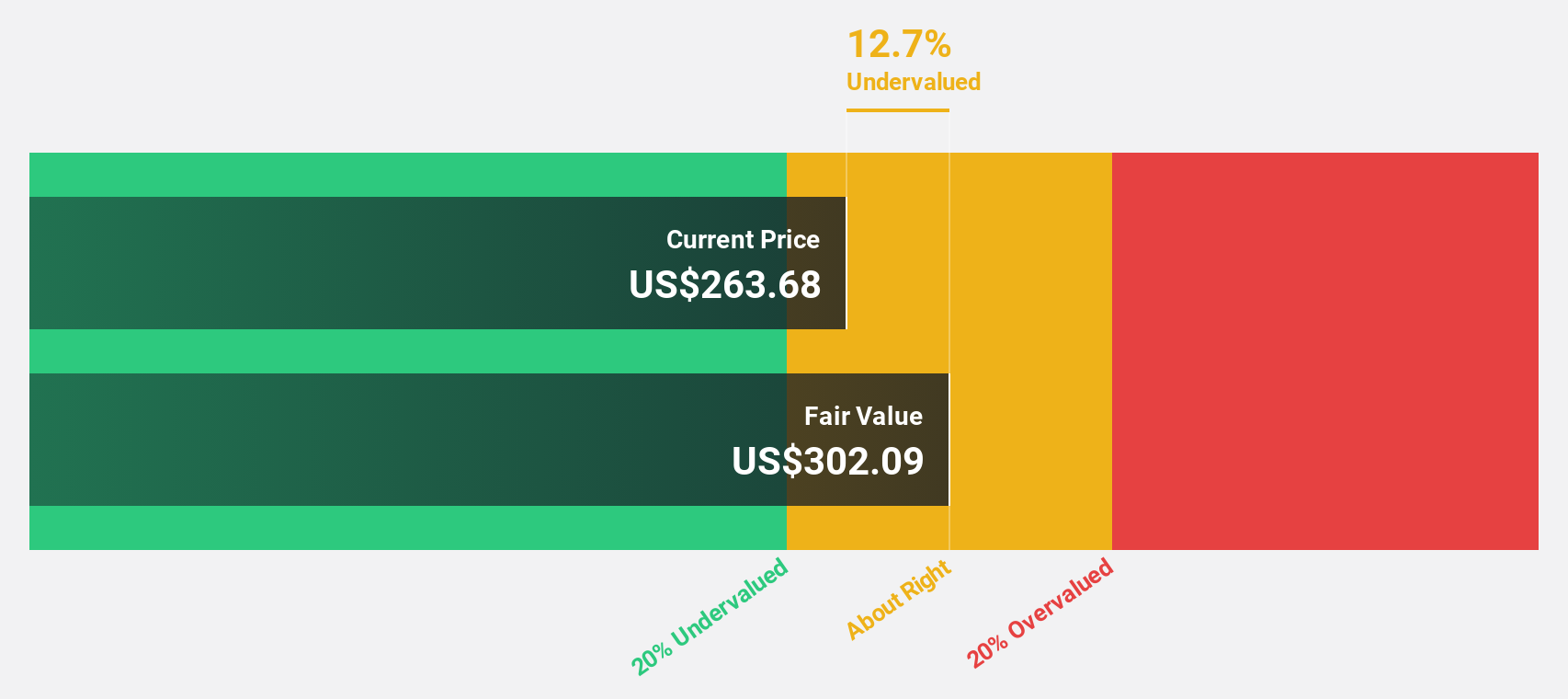

Burlington Stores (BURL)

Overview: Burlington Stores, Inc. operates as a retailer of branded merchandise in the United States and Puerto Rico, with a market cap of approximately $16.74 billion.

Operations: The company's revenue primarily comes from its retail segment focused on apparel, generating approximately $11.01 billion.

Estimated Discount To Fair Value: 15.4%

Burlington Stores, trading at US$271.09, is below its fair value estimate of US$320.59, reflecting potential undervaluation based on cash flows. Recent earnings show net income growth to US$94.19 million for Q2 2025 from US$73.76 million a year ago, with earnings per share rising to US$1.47 from US$1.15. Despite high debt levels and non-cash earnings, the company completed a significant buyback of shares worth $368.34 million, indicating strong cash flow management and enhancing shareholder value.

- In light of our recent growth report, it seems possible that Burlington Stores' financial performance will exceed current levels.

- Get an in-depth perspective on Burlington Stores' balance sheet by reading our health report here.

Turning Ideas Into Actions

- Take a closer look at our Undervalued US Stocks Based On Cash Flows list of 183 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SRAD

Sportradar Group

Provides sports data services for the sports betting and media industries in Switzerland, the United States, North America, Africa, the Asia Pacific, the Middle East, Europe, Latin America, and the Caribbean.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives