- United States

- /

- Capital Markets

- /

- NYSE:APAM

3 Reliable Dividend Stocks Yielding Up To 7.4%

Reviewed by Simply Wall St

The market has been flat over the last week but has risen 12% in the past 12 months, with earnings forecast to grow by 15% annually. In this environment, selecting reliable dividend stocks can provide a steady income stream and potential for growth, making them an attractive option for investors seeking stability and returns.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Universal (UVV) | 5.68% | ★★★★★★ |

| Southside Bancshares (SBSI) | 4.64% | ★★★★★☆ |

| Huntington Bancshares (HBAN) | 3.56% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.03% | ★★★★★★ |

| Ennis (EBF) | 5.41% | ★★★★★★ |

| Douglas Dynamics (PLOW) | 3.81% | ★★★★★☆ |

| Dillard's (DDS) | 5.99% | ★★★★★★ |

| CompX International (CIX) | 4.62% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.74% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.57% | ★★★★★☆ |

Click here to see the full list of 137 stocks from our Top US Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

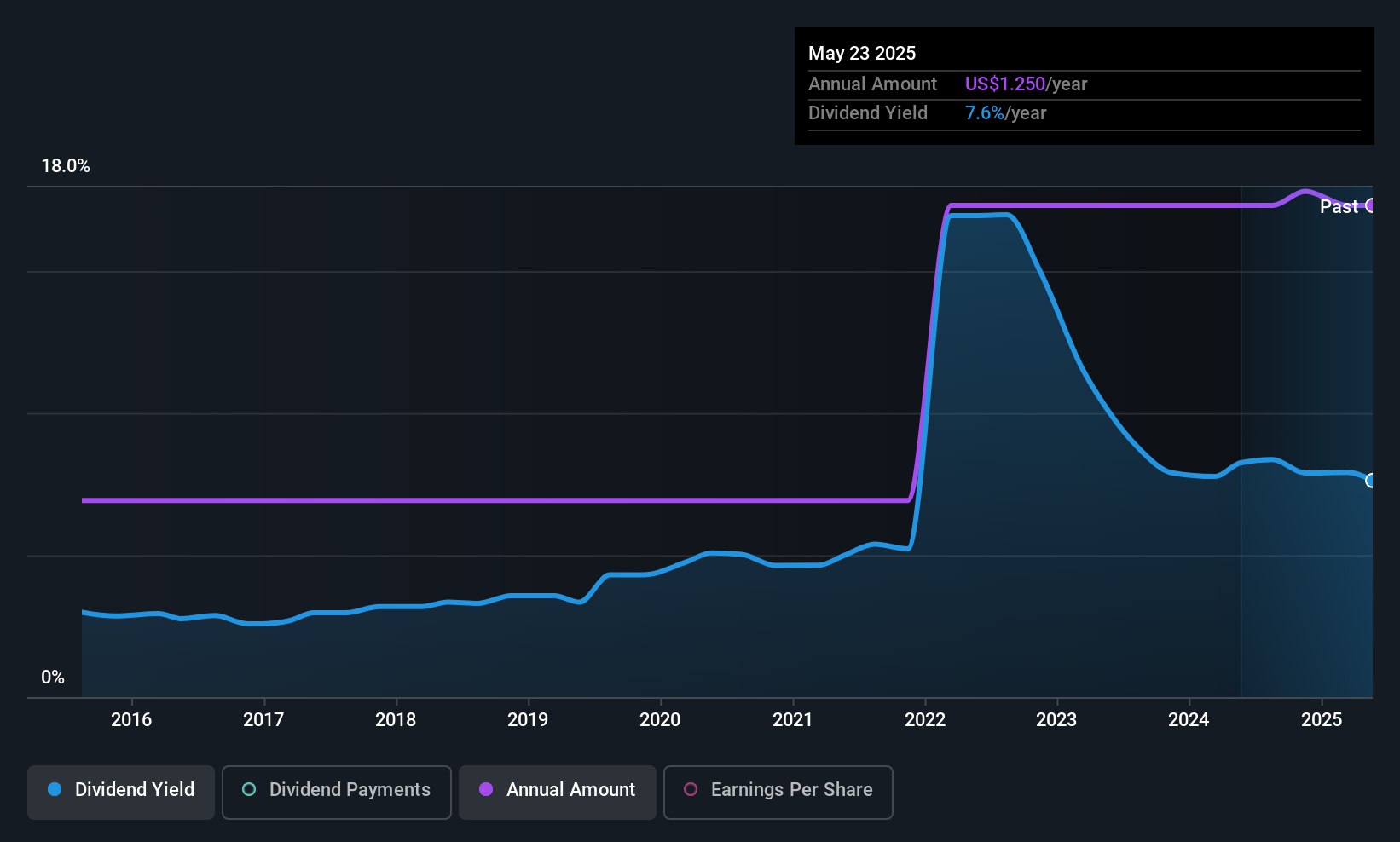

Spok Holdings (SPOK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Spok Holdings, Inc., through its subsidiary Spok, Inc., offers healthcare communication solutions across various regions including the United States, Europe, and Asia, with a market cap of $372.77 million.

Operations: Spok Holdings, Inc. generates revenue of $139.04 million from its Clinical Communication and Collaboration Business segment.

Dividend Yield: 6.9%

Spok Holdings offers a high dividend yield of 6.89%, placing it in the top 25% of US dividend payers, and has maintained stable and growing dividends over the past decade. However, its dividends are not well covered by earnings or free cash flows, with a payout ratio of 159.4% and a cash payout ratio of 98.5%. Recent events include being dropped from the Russell 2000 Dynamic Index, which may impact investor perception.

- Navigate through the intricacies of Spok Holdings with our comprehensive dividend report here.

- According our valuation report, there's an indication that Spok Holdings' share price might be on the expensive side.

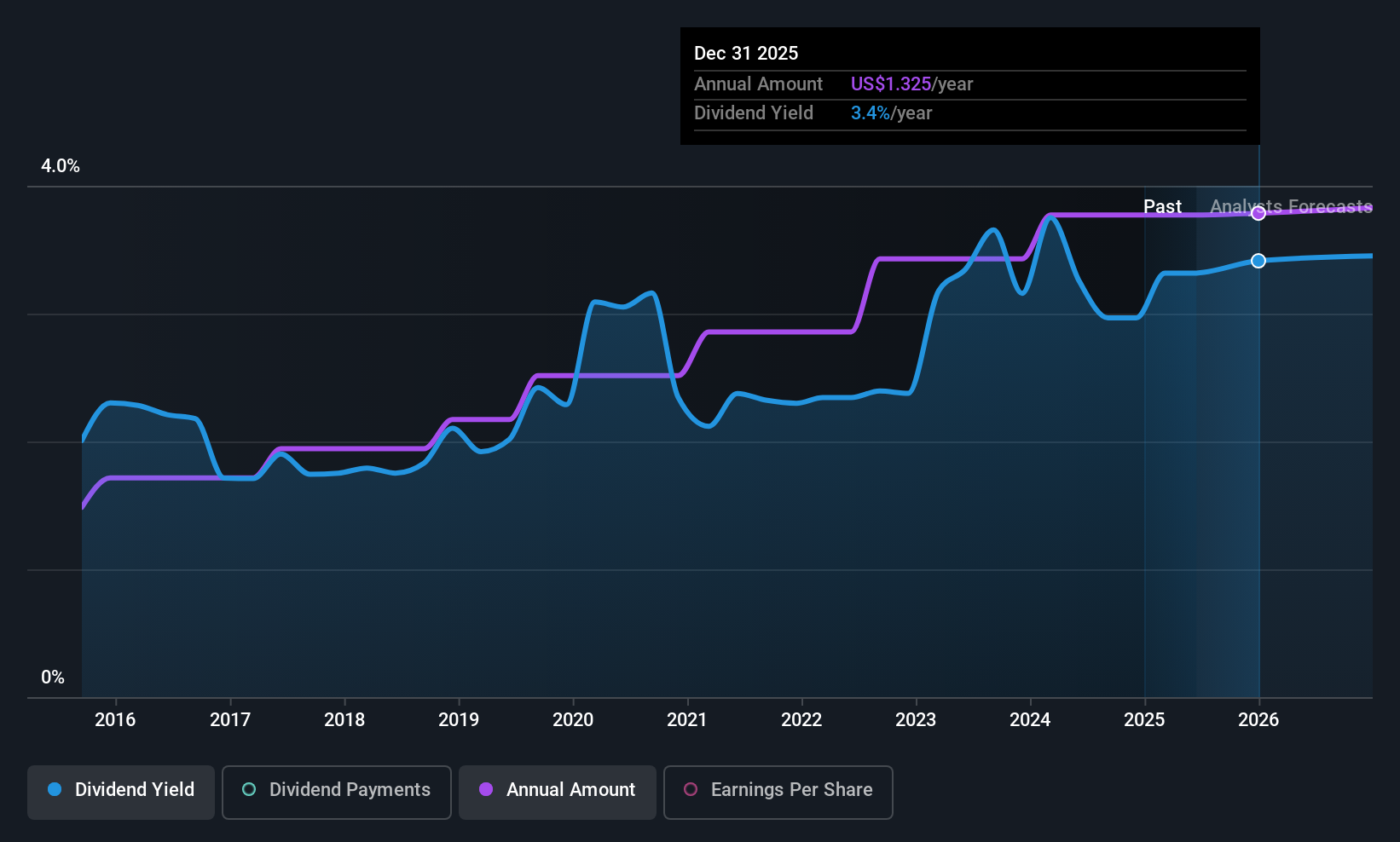

TriCo Bancshares (TCBK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TriCo Bancshares is a bank holding company for Tri Counties Bank, offering commercial banking services to individual and corporate customers, with a market cap of approximately $1.40 billion.

Operations: TriCo Bancshares generates revenue primarily through its Community Banking segment, which accounted for $389.80 million.

Dividend Yield: 3.1%

TriCo Bancshares provides a reliable dividend yield of 3.08%, though it falls short of the top 25% in the US market. The company has maintained stable and growing dividends over the past decade, supported by a low payout ratio of 38.4%. Recent developments include a quarterly dividend affirmation at $0.33 per share and an auditor change to Baker Tilly US, LLP following the merger with Moss Adams LLP, which does not affect financial reporting stability.

- Unlock comprehensive insights into our analysis of TriCo Bancshares stock in this dividend report.

- The valuation report we've compiled suggests that TriCo Bancshares' current price could be quite moderate.

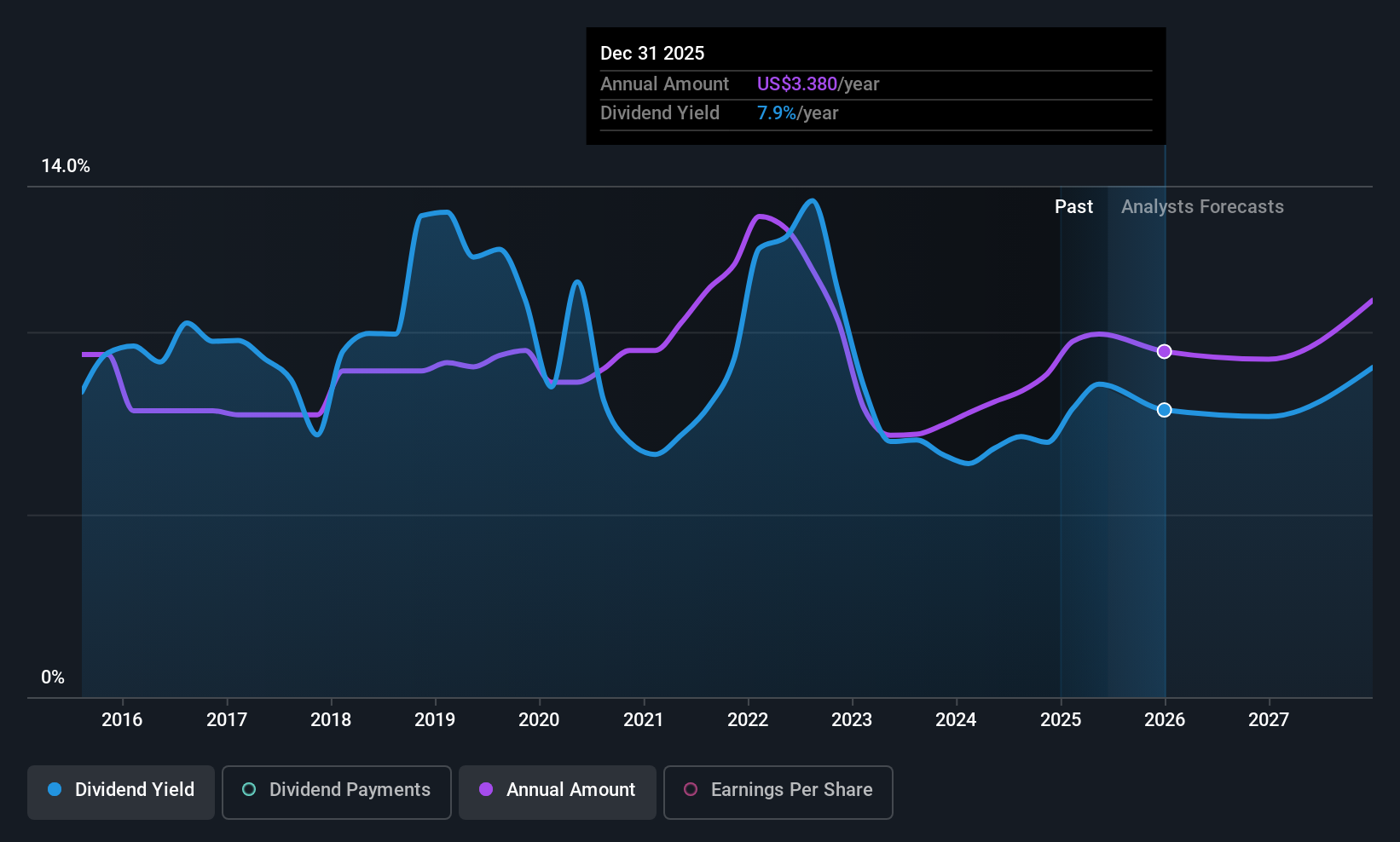

Artisan Partners Asset Management (APAM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Artisan Partners Asset Management Inc. is a publicly owned investment manager with a market cap of approximately $3.76 billion.

Operations: Artisan Partners Asset Management Inc. generates its revenue primarily from the Investment Management Industry, amounting to $1.12 billion.

Dividend Yield: 7.5%

Artisan Partners Asset Management offers a dividend yield of 7.5%, placing it in the top 25% of US dividend payers, though its dividends have been volatile over the past decade. The company's recent inclusion in multiple Russell indices may enhance visibility among investors. Despite a sustainable payout ratio supported by cash flows and earnings, recent executive changes and insider selling could raise concerns about stability. Revenue and earnings showed modest growth, but future declines are expected.

- Click here to discover the nuances of Artisan Partners Asset Management with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Artisan Partners Asset Management is priced lower than what may be justified by its financials.

Key Takeaways

- Get an in-depth perspective on all 137 Top US Dividend Stocks by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APAM

Artisan Partners Asset Management

Artisan Partners Asset Management Inc. is publicly owned investment manager.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives