- United States

- /

- Chemicals

- /

- NYSE:EMN

3 Reliable Dividend Stocks Yielding At Least 4.2%

Reviewed by Simply Wall St

As investors closely monitor trade talks and economic data, the U.S. stock market has seen fluctuations with indices like the Dow Jones Industrial Average inching higher amid ongoing budget bill deliberations. In this environment of uncertainty, dividend stocks yielding at least 4.2% can offer a reliable income stream, providing stability and potential for growth as part of a diversified investment strategy.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Valley National Bancorp (VLY) | 4.79% | ★★★★★☆ |

| Universal (UVV) | 5.71% | ★★★★★★ |

| Peoples Bancorp (PEBO) | 5.21% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.26% | ★★★★★★ |

| Ennis (EBF) | 5.41% | ★★★★★★ |

| Dillard's (DDS) | 5.77% | ★★★★★★ |

| Credicorp (BAP) | 4.92% | ★★★★★☆ |

| Columbia Banking System (COLB) | 5.88% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.74% | ★★★★★☆ |

| Chevron (CVX) | 4.70% | ★★★★★★ |

Click here to see the full list of 140 stocks from our Top US Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Kraft Heinz (KHC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Kraft Heinz Company, along with its subsidiaries, manufactures and markets food and beverage products both in North America and internationally, with a market cap of approximately $30.56 billion.

Operations: Kraft Heinz generates revenue from three main segments: North America ($19.20 billion), Emerging Markets ($2.73 billion), and International Developed Markets ($3.50 billion).

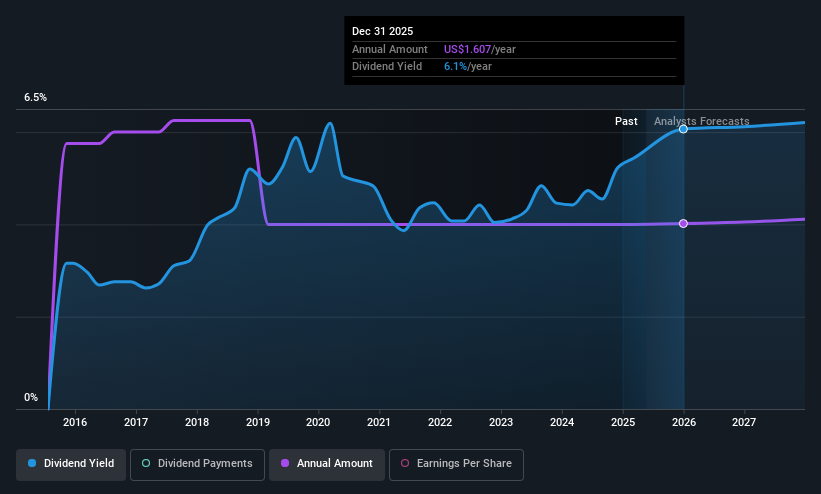

Dividend Yield: 6%

Kraft Heinz's dividend yield is among the top 25% in the US market, yet its dividend history reveals volatility and declining payments over the past decade. Despite this, dividends are currently covered by both earnings and cash flows with payout ratios of 72.6% and 62.6%, respectively. Recent index removals could signal shifting investor sentiment, although the stock trades significantly below estimated fair value, potentially offering a relative bargain for value-focused investors.

- Take a closer look at Kraft Heinz's potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Kraft Heinz is priced lower than what may be justified by its financials.

Eastman Chemical (EMN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Eastman Chemical Company is a specialty materials company with operations in the United States, China, and internationally, and has a market cap of approximately $8.62 billion.

Operations: Eastman Chemical Company's revenue is primarily derived from its Advanced Materials segment at $3.02 billion, Additives & Functional Products at $2.89 billion, Chemical Intermediates at $2.16 billion, and Fibers at $1.28 billion.

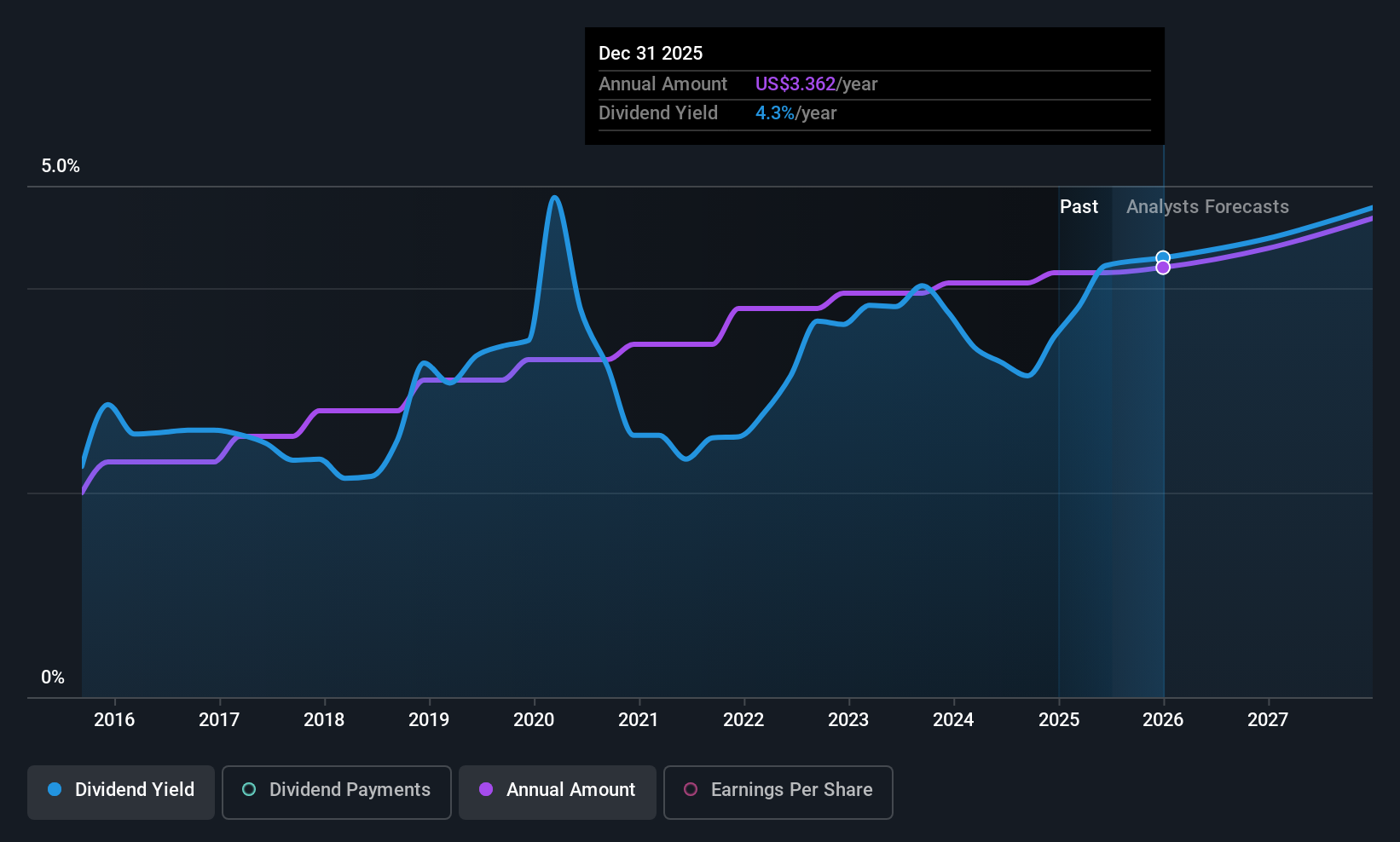

Dividend Yield: 4.2%

Eastman Chemical's dividend yield of 4.25% is reliable and well-covered by earnings (41.3% payout ratio) and cash flows (66.7% cash payout ratio). Despite not being in the top tier of US dividend payers, it offers stable payments with a decade-long growth history. Recent additions to multiple Russell indices may enhance visibility among value-focused investors, while trading below estimated fair value suggests potential for capital appreciation alongside its consistent dividend track record.

- Click here to discover the nuances of Eastman Chemical with our detailed analytical dividend report.

- Our valuation report here indicates Eastman Chemical may be undervalued.

Global Ship Lease (GSL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Global Ship Lease, Inc. owns and charters containerships under fixed-rate agreements to container shipping companies globally, with a market cap of approximately $936.97 million.

Operations: Global Ship Lease generates its revenue primarily from the transportation and shipping segment, amounting to $715.23 million.

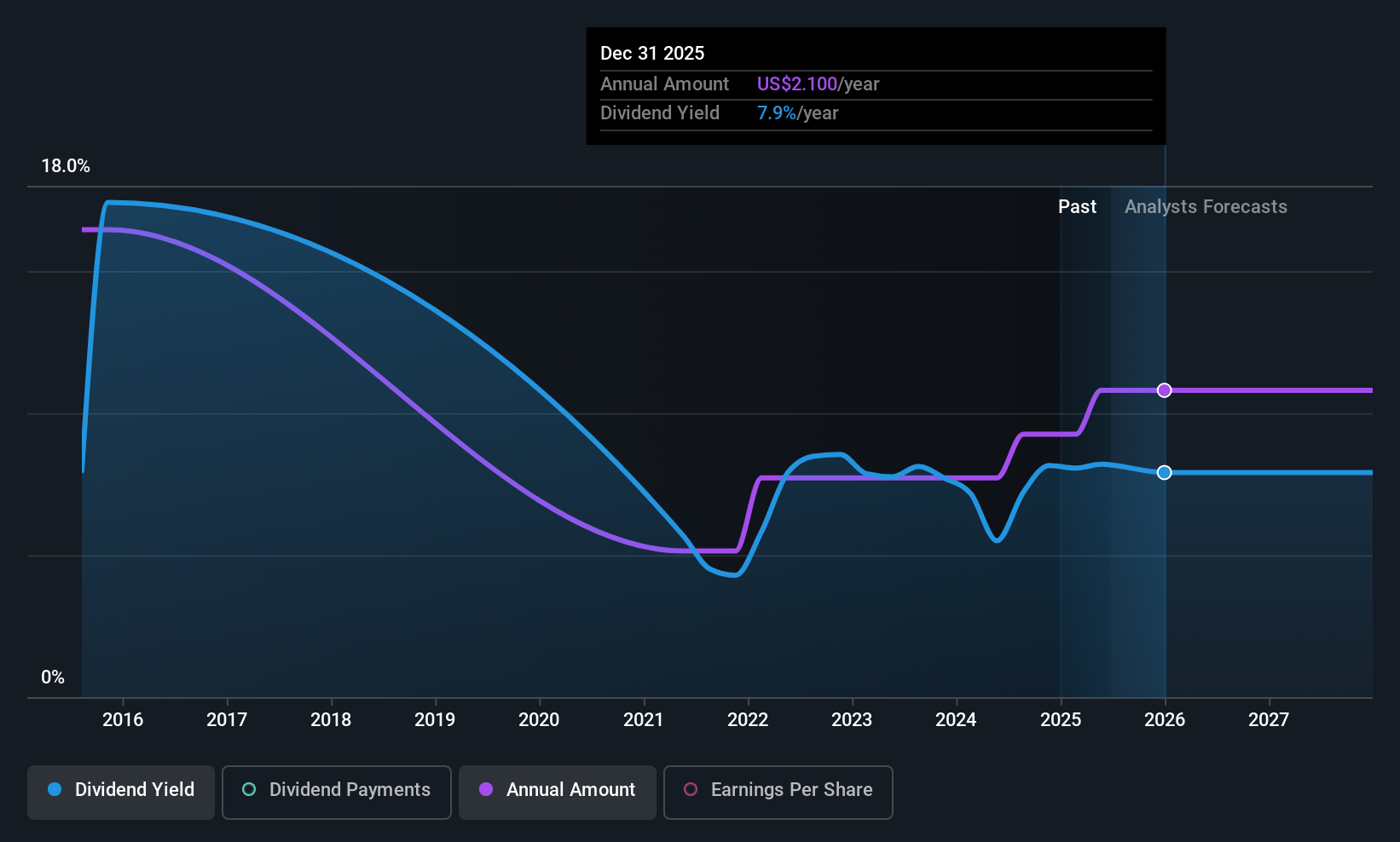

Dividend Yield: 8%

Global Ship Lease offers an 8.02% dividend yield, placing it in the top 25% of US dividend payers. Despite a volatile dividend history, current payouts are well-covered by earnings (17.7% payout ratio) and cash flows (59.3%). Recent earnings growth and a declared quarterly dividend of US$0.525 per share reflect financial strength, while trading at 80.8% below estimated fair value suggests potential upside for investors seeking both income and value opportunities.

- Delve into the full analysis dividend report here for a deeper understanding of Global Ship Lease.

- Insights from our recent valuation report point to the potential undervaluation of Global Ship Lease shares in the market.

Taking Advantage

- Reveal the 140 hidden gems among our Top US Dividend Stocks screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eastman Chemical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EMN

Eastman Chemical

Operates as a specialty materials company in the United States, China, and internationally.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives