- China

- /

- Electronic Equipment and Components

- /

- SZSE:002388

3 Promising Penny Stocks In Global With Market Caps Below US$2B

Reviewed by Simply Wall St

Amidst speculation of a potential rate cut by the Federal Reserve, global markets have seen a surge in U.S. equities, with small-cap stocks leading the charge. As investors navigate these shifting economic landscapes, penny stocks—despite their somewhat outdated moniker—continue to capture attention for their potential value and growth opportunities. These smaller or newer companies can offer affordability and substantial upside when backed by solid financials, making them an intriguing option for those seeking hidden gems in today's market.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.44 | A$117.93M | ✅ 4 ⚠️ 3 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.55 | HK$977.26M | ✅ 4 ⚠️ 1 View Analysis > |

| GTN (ASX:GTN) | A$0.40 | A$77.22M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.625 | SGD255.33M | ✅ 4 ⚠️ 2 View Analysis > |

| MGB Berhad (KLSE:MGB) | MYR0.505 | MYR295.83M | ✅ 5 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.87 | SGD11.33B | ✅ 5 ⚠️ 1 View Analysis > |

| Zetrix AI Berhad (KLSE:ZETRIX) | MYR0.895 | MYR6.92B | ✅ 5 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.16 | £184.37M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.95 | €32.04M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 3,774 stocks from our Global Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Hubei Mailyard ShareLtd (SHSE:600107)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hubei Mailyard Share Co., Ltd, with a market cap of CN¥1.64 billion, is involved in the manufacture, processing, and sale of clothes, apparel, textiles, and accessories both in China and internationally.

Operations: Hubei Mailyard Share Co., Ltd has not reported any specific revenue segments.

Market Cap: CN¥1.64B

Hubei Mailyard Share Co., Ltd, with a market cap of CN¥1.64 billion, is currently unprofitable but has a stable financial position with short-term assets of CN¥668.4 million exceeding both its short and long-term liabilities. The company has more cash than total debt and maintains a sufficient cash runway for over three years, even if free cash flow reduces at historical rates. Despite increasing losses over the past five years, the management team and board are experienced, with average tenures of 2.7 and 3.4 years respectively, providing some stability amidst financial challenges.

- Click here and access our complete financial health analysis report to understand the dynamics of Hubei Mailyard ShareLtd.

- Gain insights into Hubei Mailyard ShareLtd's past trends and performance with our report on the company's historical track record.

Fujian Start GroupLtd (SHSE:600734)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Fujian Start Group Co.Ltd, with a market cap of CN¥8.65 billion, specializes in providing anti-intrusion detection systems in China.

Operations: Fujian Start Group Co.Ltd has not reported any specific revenue segments.

Market Cap: CN¥8.65B

Fujian Start Group Co.Ltd, with a market cap of CN¥8.65 billion, is currently unprofitable and possibly pre-revenue. The company has improved its financial position over the past five years by reducing losses at a significant rate and turning negative shareholder equity positive. Short-term assets of CN¥564.3 million cover both short and long-term liabilities, indicating a stable balance sheet despite the lack of profitability. While the board is experienced with an average tenure of 3.4 years, the management team is relatively new with only 1.5 years on average, suggesting potential for strategic shifts in operations or focus areas moving forward.

- Take a closer look at Fujian Start GroupLtd's potential here in our financial health report.

- Assess Fujian Start GroupLtd's previous results with our detailed historical performance reports.

Sunyes Manufacturing (Zhejiang) Holding (SZSE:002388)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sunyes Manufacturing (Zhejiang) Holding Co., Ltd. operates in the manufacturing industry and has a market cap of approximately CN¥2.47 billion.

Operations: Sunyes Manufacturing (Zhejiang) Holding Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥2.47B

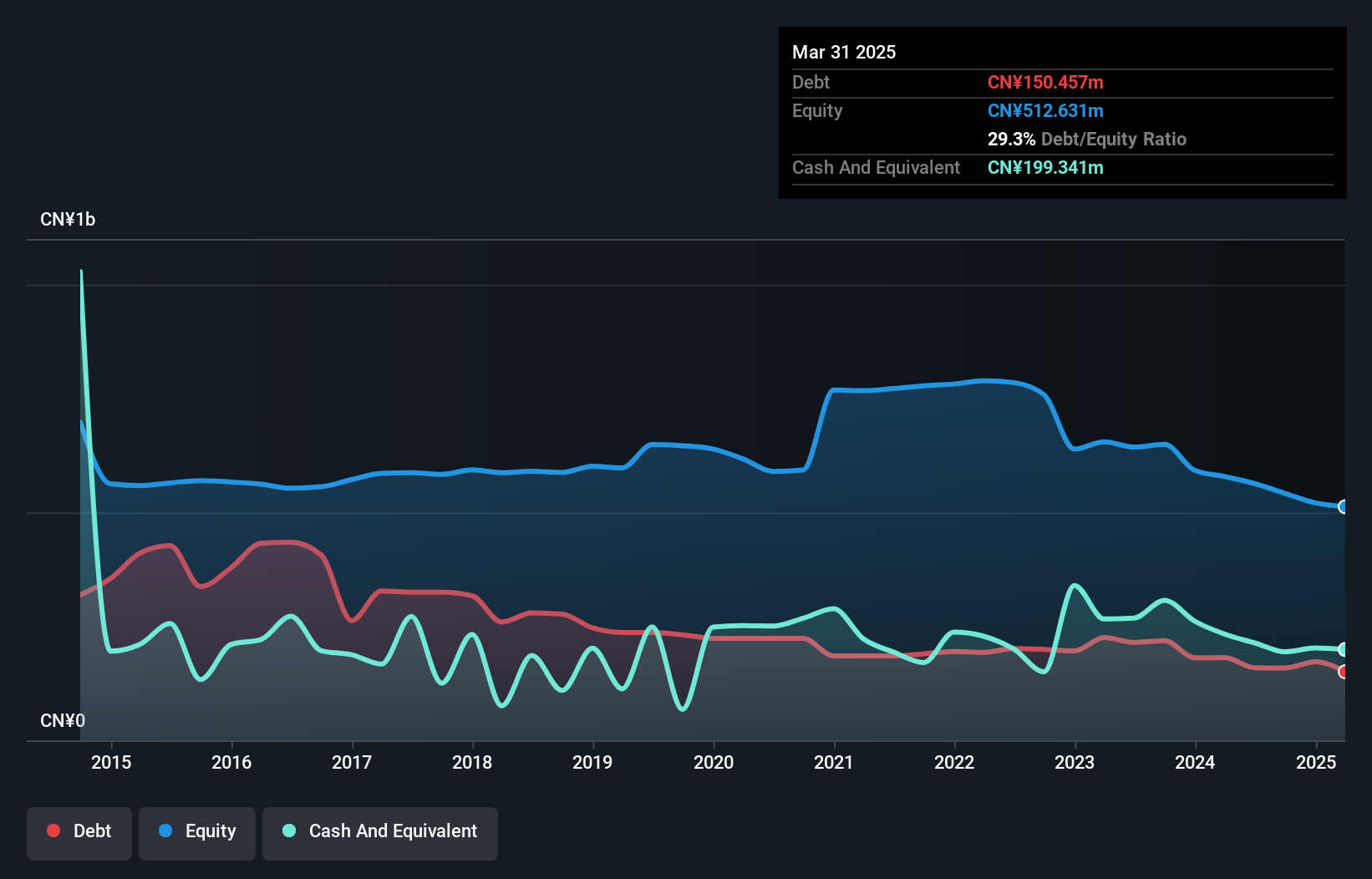

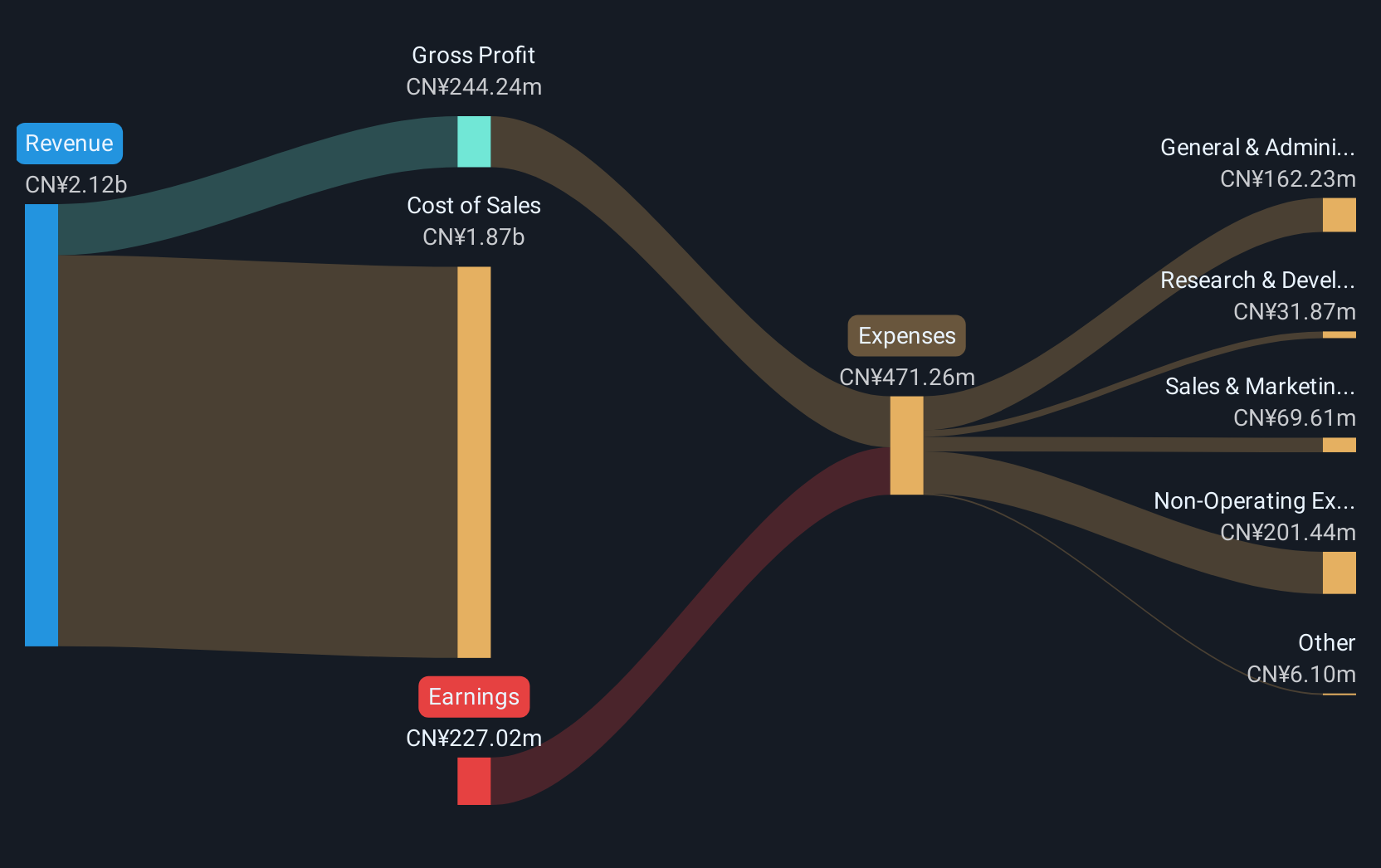

Sunyes Manufacturing (Zhejiang) Holding Co., Ltd., with a market cap of CN¥2.47 billion, is pre-revenue and unprofitable, facing increased losses over the past five years. Despite this, its financial position shows short-term assets of CN¥1.9 billion exceeding both short and long-term liabilities, alongside a satisfactory net debt to equity ratio of 35.7%. The management team is experienced with an average tenure of 2.5 years; however, the board lacks such experience. Recent shareholder meetings have focused on repurchasing restricted stocks and amending company bylaws, indicating strategic adjustments in governance and capital structure.

- Click to explore a detailed breakdown of our findings in Sunyes Manufacturing (Zhejiang) Holding's financial health report.

- Explore historical data to track Sunyes Manufacturing (Zhejiang) Holding's performance over time in our past results report.

Next Steps

- Jump into our full catalog of 3,774 Global Penny Stocks here.

- Searching for a Fresh Perspective? These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002388

Sunyes Manufacturing (Zhejiang) Holding

Sunyes Manufacturing (Zhejiang) Holding Co., Ltd.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives