- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:241

3 Promising Asian Penny Stocks With A Market Cap Below US$10B

Reviewed by Simply Wall St

Amidst the backdrop of global market volatility, with Asian markets navigating their own set of challenges and opportunities, investors are increasingly exploring diverse investment avenues. Penny stocks, though an older term in the investment lexicon, continue to capture interest due to their potential for significant growth at a relatively low cost. These stocks often represent smaller or emerging companies that can offer substantial value when supported by strong financial health and strategic growth plans.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Asia Medical and Agricultural Laboratory and Research Center (SET:AMARC) | THB1.79 | THB751.8M | ✅ 3 ⚠️ 3 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.425 | SGD172.25M | ✅ 4 ⚠️ 3 View Analysis > |

| YKGI (Catalist:YK9) | SGD0.096 | SGD40.8M | ✅ 2 ⚠️ 3 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.179 | SGD35.66M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.09 | SGD8.23B | ✅ 5 ⚠️ 0 View Analysis > |

| Ever Sunshine Services Group (SEHK:1995) | HK$1.93 | HK$3.34B | ✅ 5 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.50 | HK$51.52B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.19 | HK$750.83M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.27 | HK$2.12B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$1.95 | HK$1.62B | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,157 stocks from our Asian Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Shanghai Fudan-Zhangjiang Bio-PharmaceuticalLtd (SEHK:1349)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Shanghai Fudan-Zhangjiang Bio-Pharmaceutical Co., Ltd. focuses on the research, development, manufacture, and sale of bio-pharmaceutical products in China, with a market cap of approximately HK$7.48 billion.

Operations: Shanghai Fudan-Zhangjiang Bio-Pharmaceutical Co., Ltd. has not reported specific revenue segments.

Market Cap: HK$7.48B

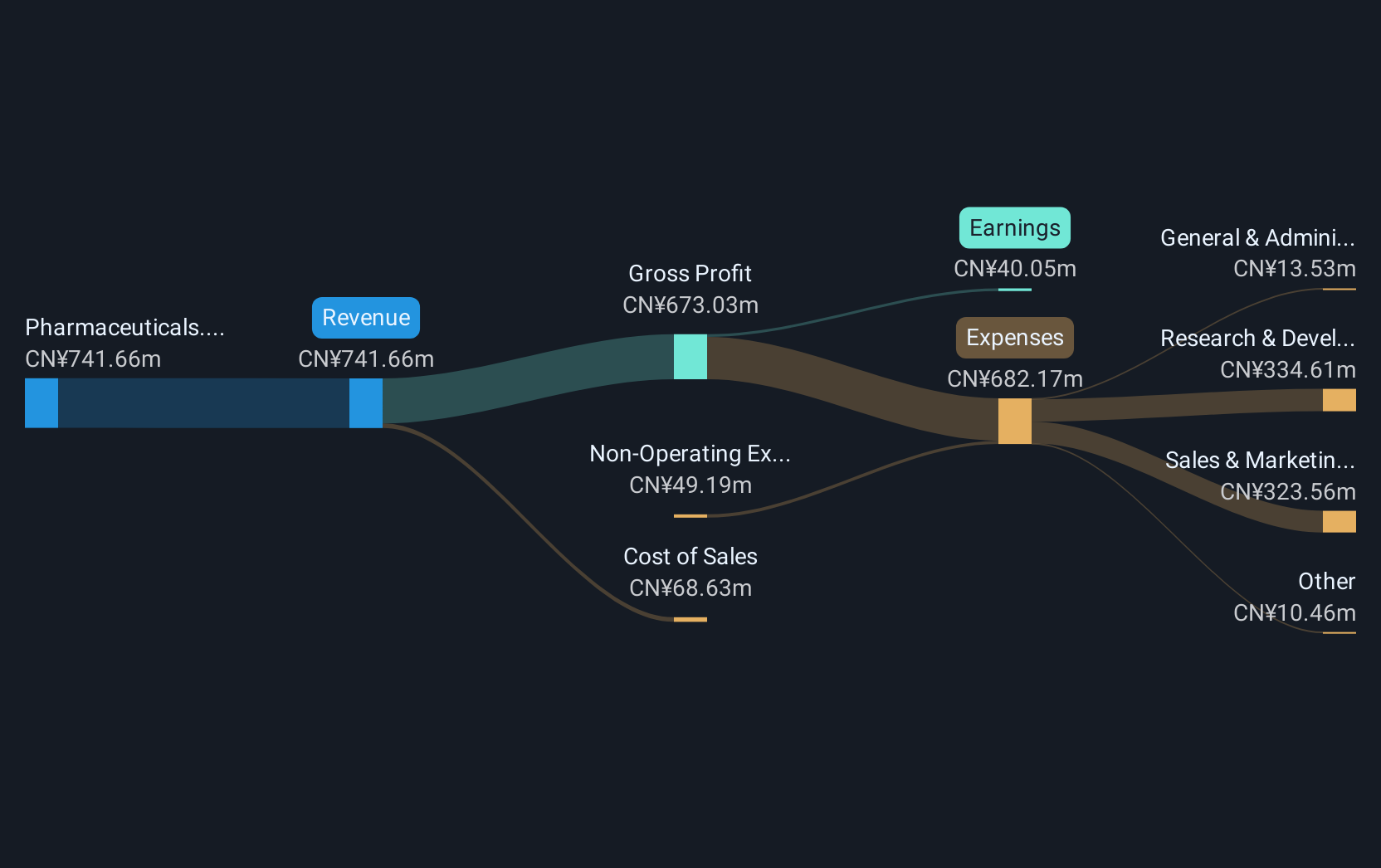

Shanghai Fudan-Zhangjiang Bio-Pharmaceutical Co., Ltd. has shown recent sales growth, reporting CNY 179.91 million in the first quarter of 2025, up from CNY 147.65 million a year ago, though its net profit margins have decreased to 5.4% from last year's 12.6%. The company maintains strong short-term financial health with assets of CN¥1.6 billion exceeding liabilities significantly and has reduced its debt-to-equity ratio over five years to a minimal level of 0.2%. However, earnings have been volatile with negative growth trends and significant one-off gains impacting results, indicating potential risks for investors in this penny stock space.

- Get an in-depth perspective on Shanghai Fudan-Zhangjiang Bio-PharmaceuticalLtd's performance by reading our balance sheet health report here.

- Explore historical data to track Shanghai Fudan-Zhangjiang Bio-PharmaceuticalLtd's performance over time in our past results report.

Alibaba Health Information Technology (SEHK:241)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Alibaba Health Information Technology Limited operates in pharmaceutical direct sales, a pharmaceutical e-commerce platform, and healthcare and digital services in Mainland China and Hong Kong, with a market cap of HK$75.59 billion.

Operations: The company's revenue from the distribution and development of pharmaceutical and healthcare products is CN¥30.60 billion.

Market Cap: HK$75.59B

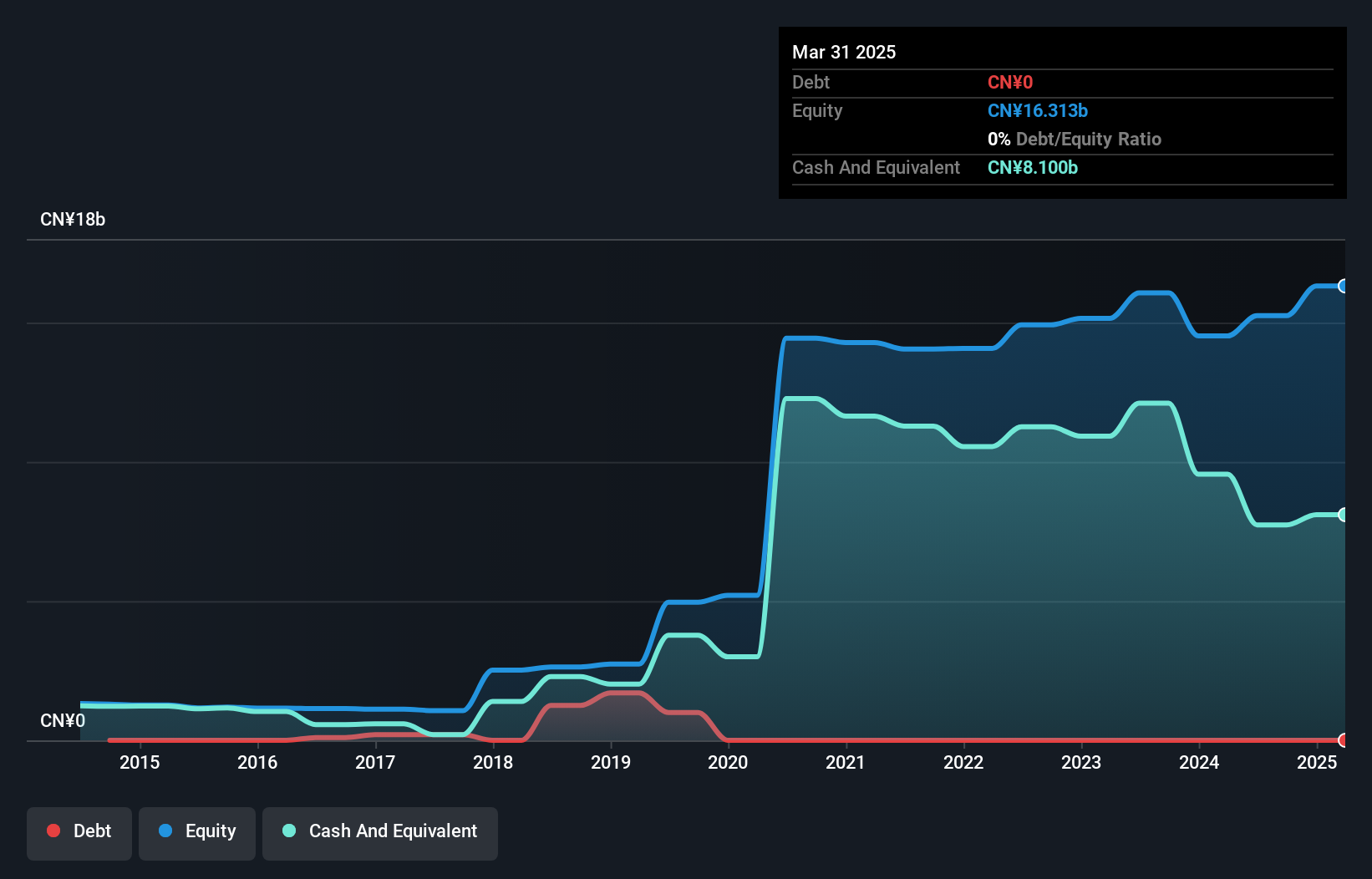

Alibaba Health Information Technology Limited has demonstrated robust financial growth, with earnings increasing by 62.1% over the past year and revenue reaching CN¥30.60 billion. The company benefits from a strong balance sheet, with short-term assets of CN¥12.3 billion comfortably exceeding both short and long-term liabilities, while maintaining a debt-free status that alleviates concerns about interest coverage or cash flow constraints. Despite a large one-off loss impacting recent results, net profit margins have improved to 4.7%. However, the relatively inexperienced board could pose governance challenges for this rapidly growing entity in the penny stock market segment.

- Click to explore a detailed breakdown of our findings in Alibaba Health Information Technology's financial health report.

- Examine Alibaba Health Information Technology's earnings growth report to understand how analysts expect it to perform.

Shanghai Trendzone Holdings GroupLtd (SHSE:603030)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Shanghai Trendzone Holdings Group Co., Ltd, with a market cap of CN¥3.63 billion, offers integrated solutions in design, construction, production, and services both within China and internationally.

Operations: Shanghai Trendzone Holdings Group Co., Ltd has not reported any specific revenue segments.

Market Cap: CN¥3.63B

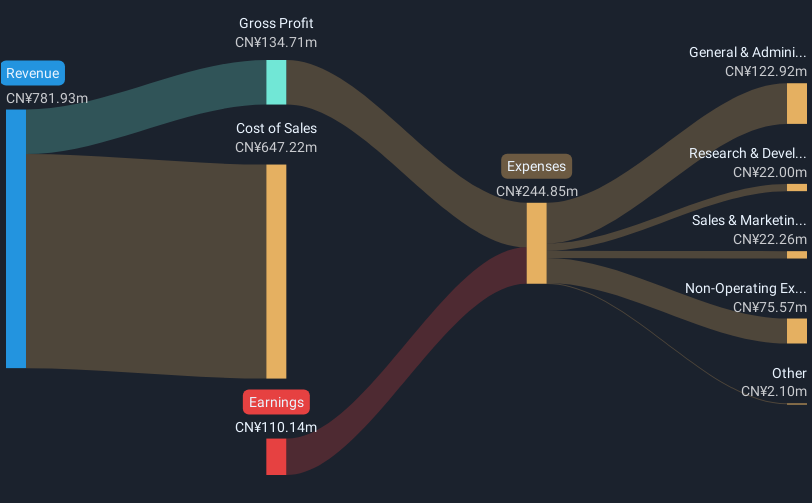

Shanghai Trendzone Holdings Group Co., Ltd, with a market cap of CN¥3.63 billion, has shown some positive financial movements despite ongoing challenges. The company's debt to equity ratio has improved from 54% to 42.5% over five years, and short-term assets of CN¥1.3 billion exceed both short and long-term liabilities, indicating solid asset management. However, the company remains unprofitable with a net loss of CN¥19.16 million for Q1 2025 and volatile share prices persistently high compared to peers in China. Although revenue increased slightly year-over-year for Q1 2025, earnings have declined by 4% annually over the past five years.

- Click here to discover the nuances of Shanghai Trendzone Holdings GroupLtd with our detailed analytical financial health report.

- Understand Shanghai Trendzone Holdings GroupLtd's track record by examining our performance history report.

Seize The Opportunity

- Unlock more gems! Our Asian Penny Stocks screener has unearthed 1,154 more companies for you to explore.Click here to unveil our expertly curated list of 1,157 Asian Penny Stocks.

- Want To Explore Some Alternatives? Rare earth metals are the new gold rush. Find out which 23 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:241

Alibaba Health Information Technology

An investment holding company, engages in the pharmaceutical direct sales, pharmaceutical e-commerce platform, and healthcare and digital services businesses in Mainland China and Hong Kong.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives