- United States

- /

- Entertainment

- /

- NasdaqGS:WMG

3 Noteworthy Stocks Estimated To Be Trading At Discounts Of Up To 39.1% Below Intrinsic Value

Reviewed by Simply Wall St

As the U.S. stock market faces turbulence with regional bank shares plummeting and bond yields dropping to their lowest levels since April, investors are on the lookout for opportunities amidst uncertainty. In such volatile conditions, identifying undervalued stocks—those trading below their intrinsic value—can be a strategic approach to potentially capitalize on market inefficiencies and secure long-term gains.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wix.com (WIX) | $132.44 | $259.78 | 49% |

| Trade Desk (TTD) | $49.90 | $96.49 | 48.3% |

| TowneBank (TOWN) | $32.51 | $62.93 | 48.3% |

| Old National Bancorp (ONB) | $19.60 | $38.50 | 49.1% |

| Northwest Bancshares (NWBI) | $11.84 | $22.81 | 48.1% |

| NeuroPace (NPCE) | $10.64 | $20.24 | 47.4% |

| Midland States Bancorp (MSBI) | $15.61 | $30.63 | 49% |

| First Advantage (FA) | $14.06 | $27.21 | 48.3% |

| ChoiceOne Financial Services (COFS) | $26.29 | $51.66 | 49.1% |

| AGNC Investment (AGNC) | $9.92 | $19.51 | 49.2% |

Let's uncover some gems from our specialized screener.

Freshpet (FRPT)

Overview: Freshpet, Inc. manufactures, distributes, and markets natural fresh meals and treats for dogs and cats across the United States, Canada, and Europe with a market cap of approximately $2.51 billion.

Operations: The company's revenue is primarily derived from its pet food and pet treats segment for dogs and cats, totaling $1.04 billion.

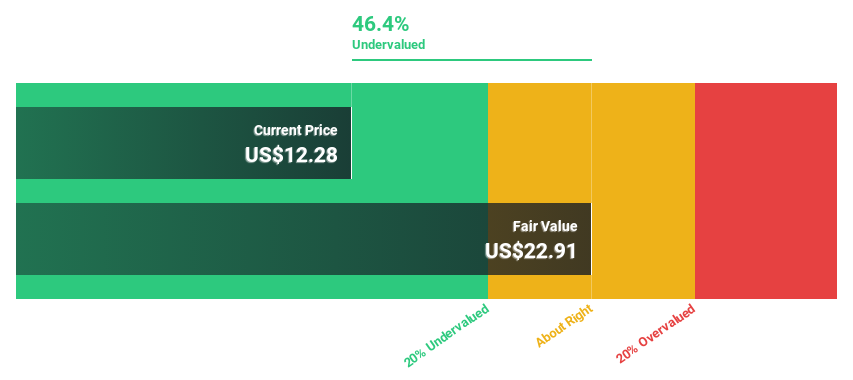

Estimated Discount To Fair Value: 39.1%

Freshpet is trading at US$53.65, significantly below its estimated fair value of US$88.07, suggesting it may be undervalued based on discounted cash flow analysis. Despite a recent CFO transition and revised guidance indicating slower growth, Freshpet's earnings are forecast to grow significantly at 31.6% annually over the next three years, outpacing the broader U.S. market's expected growth rate. Recent quarterly results showed improved profitability with net income of US$16.36 million compared to a loss previously reported.

- Our earnings growth report unveils the potential for significant increases in Freshpet's future results.

- Take a closer look at Freshpet's balance sheet health here in our report.

Sotera Health (SHC)

Overview: Sotera Health Company offers sterilization, lab testing, and advisory services for the healthcare industry across the United States, Canada, Europe, and internationally, with a market cap of approximately $4.62 billion.

Operations: The company's revenue is derived from three main segments: Nordion with $183.09 million, Nelson Labs contributing $221.92 million, and Sterigenics generating $719.53 million.

Estimated Discount To Fair Value: 30%

Sotera Health is trading at US$16.33, below its estimated fair value of US$23.32, highlighting potential undervaluation based on discounted cash flow analysis. Despite significant insider selling and interest payments not being well covered by earnings, the company forecasts substantial annual profit growth of 61.1%, surpassing the broader U.S. market's expectations. Recent equity offerings raised approximately US$307 million, while second-quarter revenue increased to US$294.34 million from last year's US$276.59 million.

- Upon reviewing our latest growth report, Sotera Health's projected financial performance appears quite optimistic.

- Navigate through the intricacies of Sotera Health with our comprehensive financial health report here.

Warner Music Group (WMG)

Overview: Warner Music Group Corp. is a music entertainment company operating in the United States, the United Kingdom, Germany, and internationally with a market cap of $16.90 billion.

Operations: The company generates revenue through its Recorded Music segment, which accounts for $5.21 billion, and its Music Publishing segment, contributing $1.26 billion.

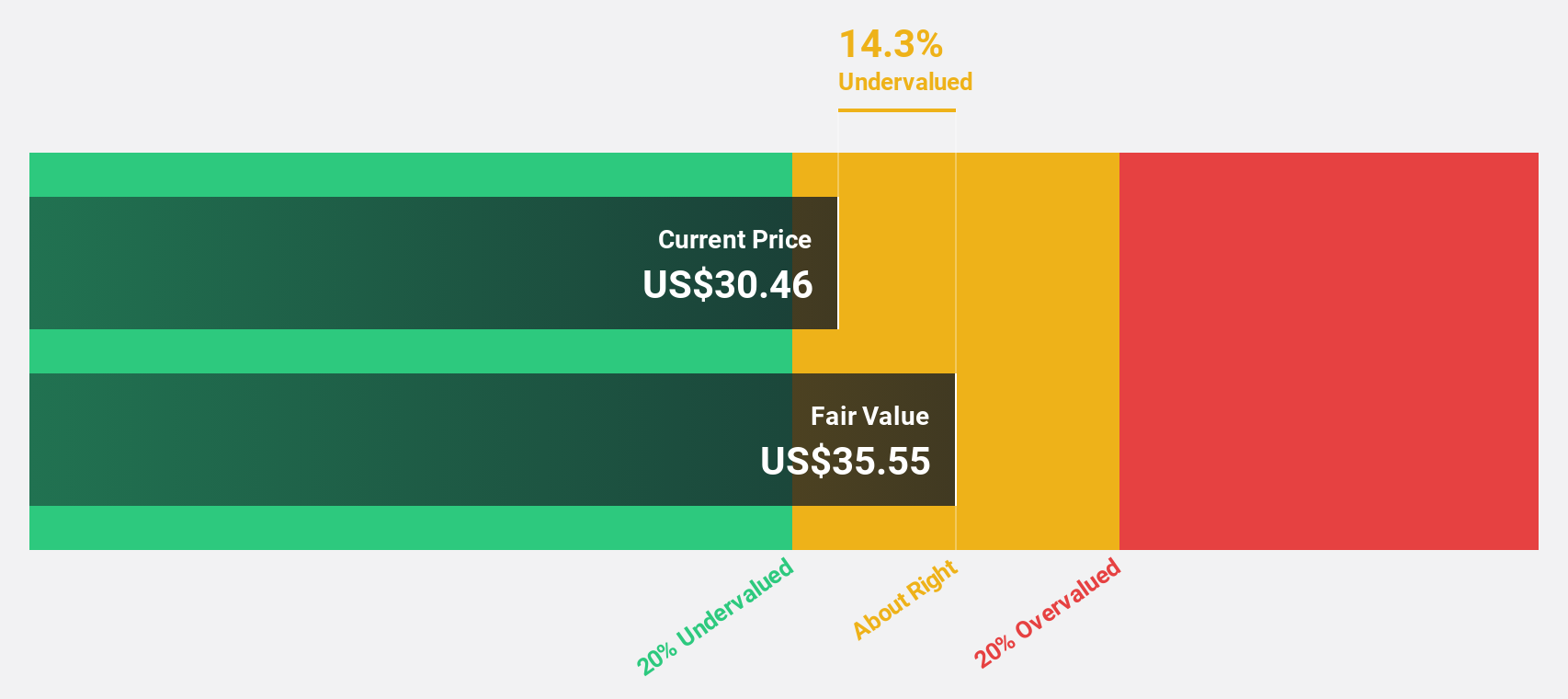

Estimated Discount To Fair Value: 10.5%

Warner Music Group, trading at US$32.48, is below its estimated fair value of US$36.3, suggesting potential undervaluation based on cash flows. However, its debt coverage by operating cash flow is weak. Despite this, earnings are expected to grow significantly over the next three years at 35.9% annually, outpacing the broader U.S. market's growth rate of 15.6%. Recent strategic alliances in AI technology could enhance future revenue streams and artist engagement initiatives.

- Our growth report here indicates Warner Music Group may be poised for an improving outlook.

- Click here to discover the nuances of Warner Music Group with our detailed financial health report.

Seize The Opportunity

- Reveal the 176 hidden gems among our Undervalued US Stocks Based On Cash Flows screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Warner Music Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WMG

Warner Music Group

Operates as a music entertainment company in the United States, the United Kingdom, Germany, and internationally.

Reasonable growth potential with slight risk.

Market Insights

Community Narratives