- United Arab Emirates

- /

- Banks

- /

- ADX:BOS

3 Middle Eastern Penny Stocks With Market Caps Up To US$2B

Reviewed by Simply Wall St

The Middle Eastern stock markets have recently experienced some easing, with most Gulf indices reflecting economic uncertainty and geopolitical tensions. Despite these challenges, the region continues to present unique investment opportunities, particularly in the realm of penny stocks. Although considered an outdated term, penny stocks still represent smaller or newer companies that can offer significant growth potential when backed by strong financials and clear strategies.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Maharah for Human Resources (SASE:1831) | SAR4.85 | SAR2.18B | ✅ 2 ⚠️ 3 View Analysis > |

| Thob Al Aseel (SASE:4012) | SAR3.79 | SAR1.52B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪4.83 | ₪343.95M | ✅ 3 ⚠️ 1 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.07 | AED2.14B | ✅ 5 ⚠️ 3 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.49 | AED225M | ✅ 2 ⚠️ 3 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.30 | AED683.1M | ✅ 2 ⚠️ 3 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED2.98 | AED344.19M | ✅ 2 ⚠️ 5 View Analysis > |

| Union Properties (DFM:UPP) | AED0.836 | AED3.59B | ✅ 3 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.83 | AED504.85M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.79 | ₪219.01M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 80 stocks from our Middle Eastern Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Bank Of Sharjah P.J.S.C (ADX:BOS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Bank Of Sharjah P.J.S.C., along with its subsidiaries, offers commercial and investment banking products and services in the United Arab Emirates with a market capitalization of AED4.32 billion.

Operations: The company's revenue is derived from two main segments: Commercial Banking, contributing AED373.76 million, and Investment and Treasury, generating AED342.43 million.

Market Cap: AED4.32B

Bank Of Sharjah P.J.S.C. has shown significant earnings growth, with net income rising from AED 90.87 million to AED 152.63 million year-over-year in the second quarter of 2025, although this was partly due to a large one-off gain of AED99.3 million. The bank's price-to-earnings ratio is below the market average, potentially indicating value for investors interested in penny stocks. However, it faces challenges such as high non-performing loans at 6.6% and relatively low return on equity at 11.7%. Recent executive changes aim to enhance compliance standards amid a volatile share price environment.

- Click here to discover the nuances of Bank Of Sharjah P.J.S.C with our detailed analytical financial health report.

- Review our historical performance report to gain insights into Bank Of Sharjah P.J.S.C's track record.

Amanat Holdings PJSC (DFM:AMANAT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Amanat Holdings PJSC, along with its subsidiaries, invests in education and healthcare companies in the UAE and internationally, with a market capitalization of AED2.80 billion.

Operations: The company's revenue is derived from two main segments: Education, contributing AED485.25 million, and Healthcare, contributing AED365.18 million.

Market Cap: AED2.8B

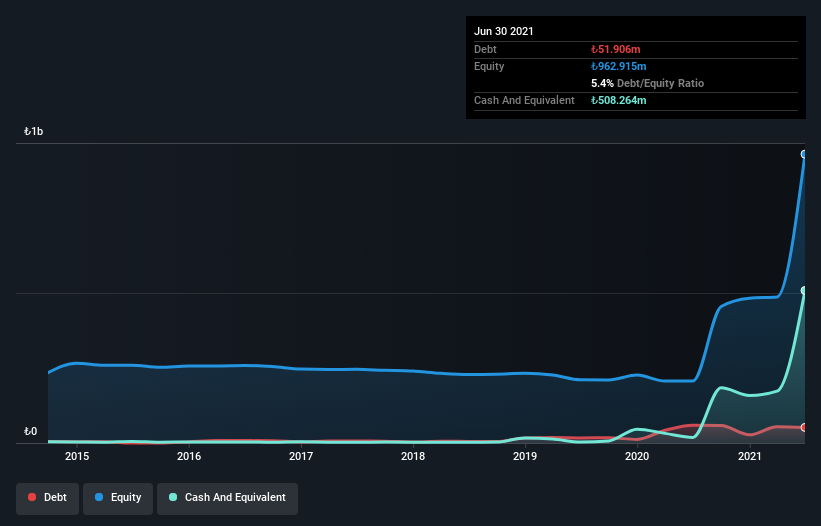

Amanat Holdings PJSC demonstrates a stable financial position, with short-term assets of AED814.9 million surpassing both its short and long-term liabilities. Recent earnings growth is impressive, with net income increasing to AED47.36 million in Q2 2025 from AED40.43 million the previous year, driven by strong performance in education and healthcare segments. Despite a low return on equity at 6.2%, the company maintains high-quality earnings and has not diluted shareholders recently. However, its dividend yield of 4.07% is not fully covered by free cash flows, indicating potential sustainability concerns for income-focused investors.

- Jump into the full analysis health report here for a deeper understanding of Amanat Holdings PJSC.

- Gain insights into Amanat Holdings PJSC's historical outcomes by reviewing our past performance report.

Ihlas Yayin Holding (IBSE:IHYAY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ihlas Yayin Holding A.S. operates in the media, publishing, and advertising sectors in Turkey through its subsidiaries and has a market capitalization of TRY1.14 billion.

Operations: The company's revenue is primarily generated from its Journalism and Printing Works segment, which accounts for TRY1.79 billion, followed by News Agencies at TRY398.31 million and TV Services and Other at TRY274.53 million.

Market Cap: TRY1.14B

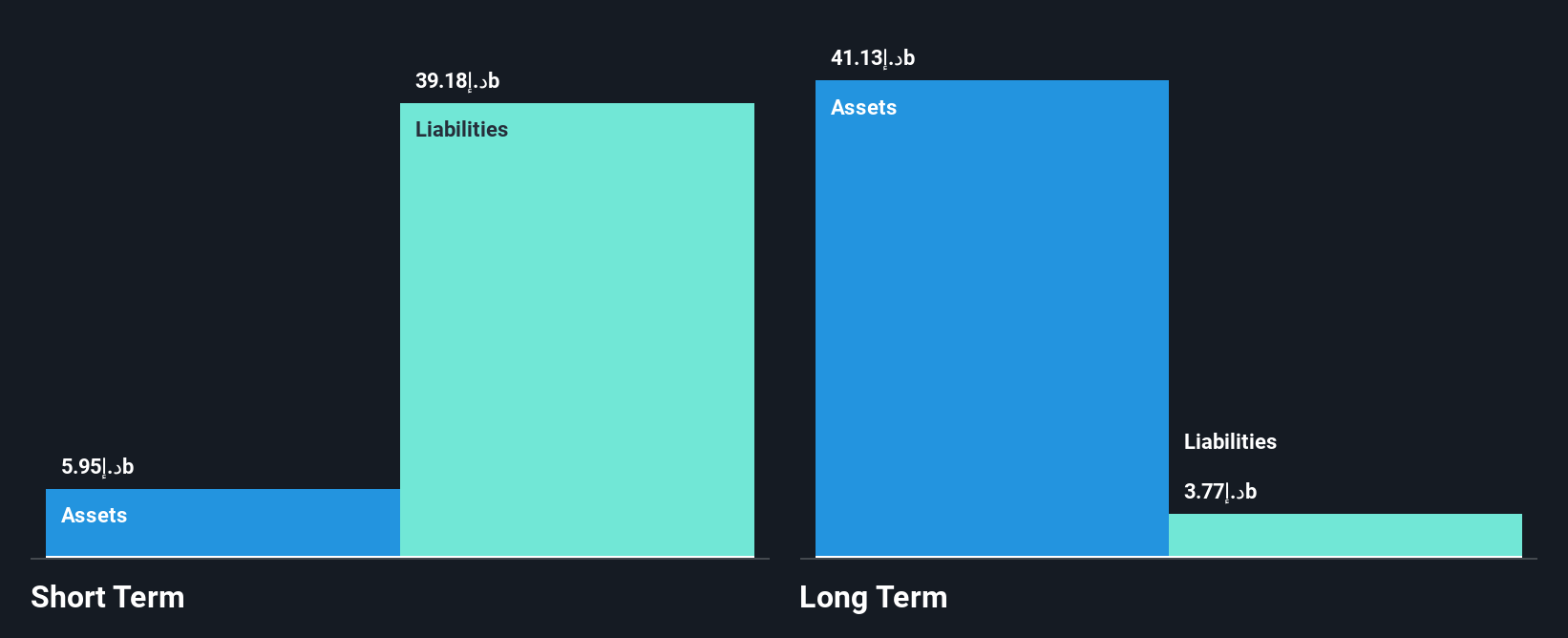

Ihlas Yayin Holding A.S. has shown resilience in managing its financial structure despite ongoing unprofitability, with short-term assets of TRY1.2 billion exceeding short-term liabilities of TRY915.8 million and a reduced debt-to-equity ratio from 28.8% to 1.1% over five years. However, the company faces challenges with a net loss increasing to TRY236.49 million for the first half of 2025 and earnings declining by an average of 55.8% annually over the past five years, suggesting limited cash runway if free cash flow continues to diminish at historical rates, which could impact future operational stability without strategic adjustments.

- Get an in-depth perspective on Ihlas Yayin Holding's performance by reading our balance sheet health report here.

- Explore historical data to track Ihlas Yayin Holding's performance over time in our past results report.

Next Steps

- Investigate our full lineup of 80 Middle Eastern Penny Stocks right here.

- Ready To Venture Into Other Investment Styles? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank Of Sharjah P.J.S.C might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:BOS

Bank Of Sharjah P.J.S.C

Provides commercial and investment banking products and services in the United Arab Emirates.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives