- Japan

- /

- Semiconductors

- /

- TSE:6723

3 Global Stocks Estimated To Be Priced Up To 38.8% Below Intrinsic Value

Reviewed by Simply Wall St

In recent weeks, global markets have been buoyed by favorable trade deal news, with indices like the S&P 500 and Nasdaq Composite reaching record highs. Amidst this optimistic environment, value stocks have shown resilience, outpacing growth counterparts as investors seek opportunities that may be undervalued in the current economic landscape. Identifying stocks priced below their intrinsic value can offer potential for gains, especially when market conditions are favorable and supportive of such investments.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Talenom Oyj (HLSE:TNOM) | €3.50 | €6.97 | 49.8% |

| Surgical Science Sweden (OM:SUS) | SEK148.00 | SEK295.09 | 49.8% |

| Shenzhen KSTAR Science and Technology (SZSE:002518) | CN¥23.28 | CN¥46.06 | 49.5% |

| Sheng Siong Group (SGX:OV8) | SGD2.10 | SGD4.16 | 49.5% |

| Nan Ya Printed Circuit Board (TWSE:8046) | NT$176.50 | NT$349.10 | 49.4% |

| Lectra (ENXTPA:LSS) | €24.45 | €48.67 | 49.8% |

| JOST Werke (XTRA:JST) | €51.70 | €102.66 | 49.6% |

| IDEC (TSE:6652) | ¥2349.00 | ¥4676.69 | 49.8% |

| Figeac Aero Société Anonyme (ENXTPA:FGA) | €10.30 | €20.43 | 49.6% |

| Atea (OB:ATEA) | NOK142.80 | NOK283.14 | 49.6% |

Let's dive into some prime choices out of the screener.

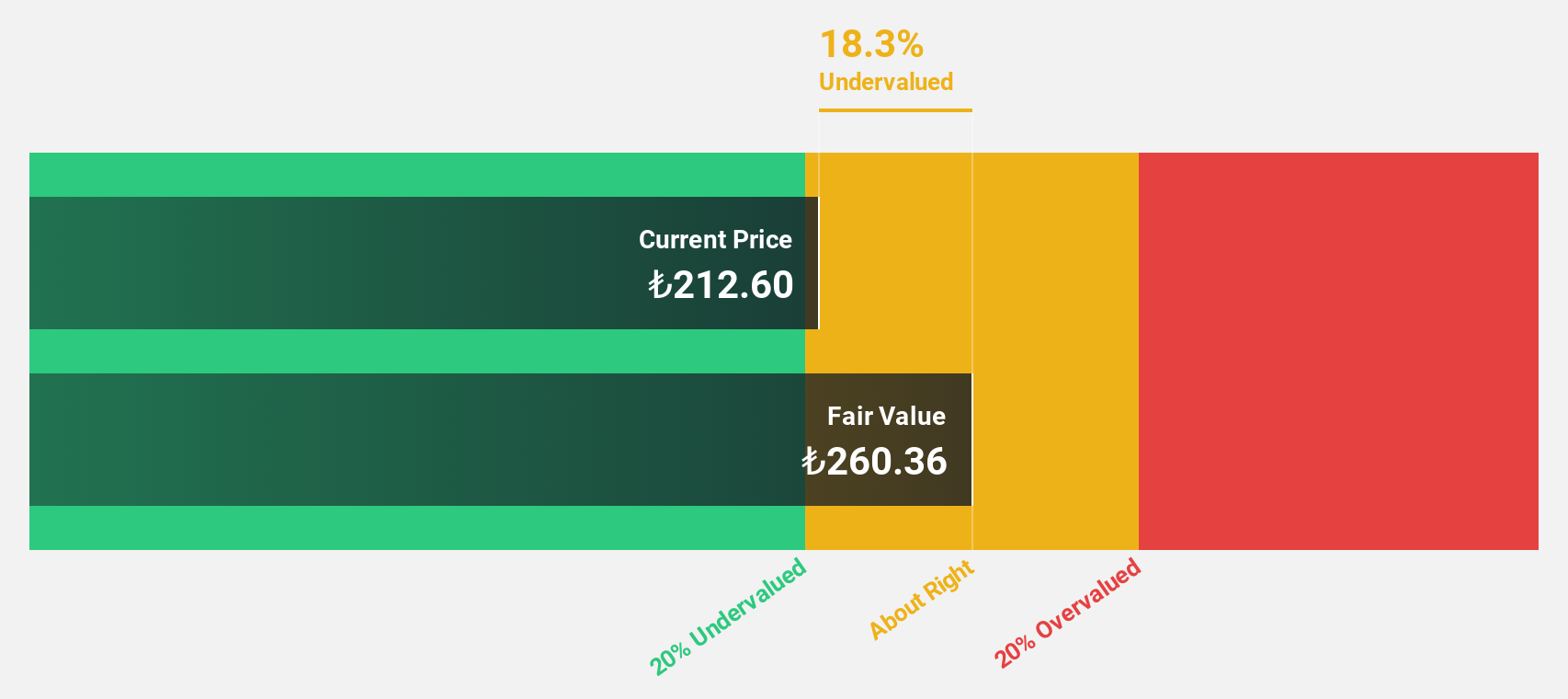

Tofas Türk Otomobil Fabrikasi Anonim Sirketi (IBSE:TOASO)

Overview: Tofas Türk Otomobil Fabrikasi Anonim Sirketi manufactures and sells passenger cars and light commercial vehicles in Turkey, with a market cap of TRY115.40 billion.

Operations: The company generates revenue from consumer financing (TRY9.29 billion) and trading of spare parts and automobiles (TRY97.99 billion).

Estimated Discount To Fair Value: 11.4%

Tofas Türk Otomobil Fabrikasi Anonim Sirketi is trading at TRY230.8, below its estimated fair value of TRY260.36, indicating it may be undervalued based on cash flows. However, its dividend yield of 5.2% isn't well covered by earnings or free cash flows, and profit margins have decreased to 1.1% from last year's 11.4%. Despite this, the company's earnings and revenue are expected to grow significantly above market rates over the next three years.

- Insights from our recent growth report point to a promising forecast for Tofas Türk Otomobil Fabrikasi Anonim Sirketi's business outlook.

- Delve into the full analysis health report here for a deeper understanding of Tofas Türk Otomobil Fabrikasi Anonim Sirketi.

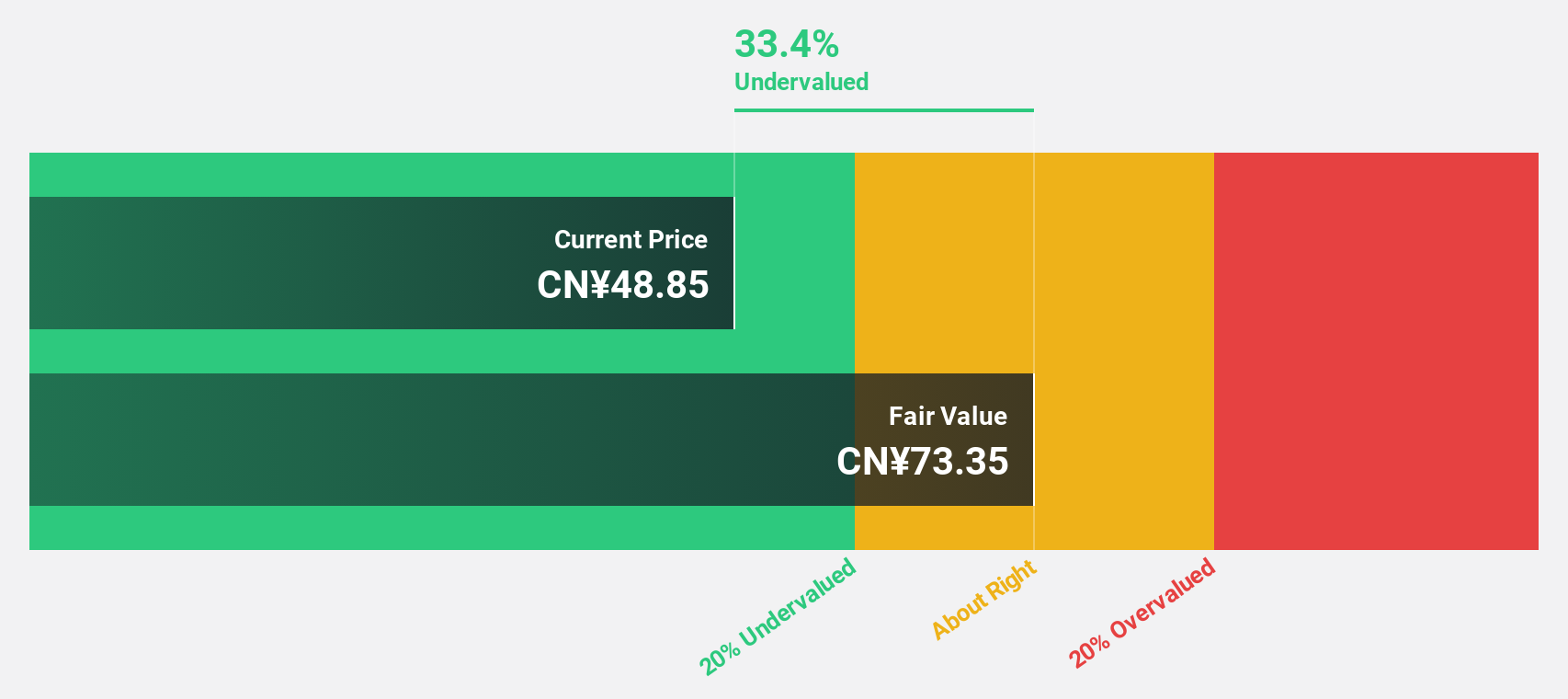

Zhejiang Sanmei Chemical IndustryLtd (SHSE:603379)

Overview: Zhejiang Sanmei Chemical Industry Co., Ltd. operates in the chemical industry and has a market cap of CN¥29.07 billion.

Operations: The company's revenue segments are not provided in the text.

Estimated Discount To Fair Value: 33.2%

Zhejiang Sanmei Chemical Industry Ltd. trades at CN¥48.85, below its fair value estimate of CN¥73.15, reflecting a potential undervaluation based on cash flows. Despite high non-cash earnings and a dividend yield of 0.92% not fully covered by free cash flows, the company shows robust earnings growth forecasted at 22.88% annually over three years, although slightly trailing the Chinese market's expected growth rate of 23.6%. Recent legal settlements have been resolved without impacting current financials significantly.

- Our comprehensive growth report raises the possibility that Zhejiang Sanmei Chemical IndustryLtd is poised for substantial financial growth.

- Dive into the specifics of Zhejiang Sanmei Chemical IndustryLtd here with our thorough financial health report.

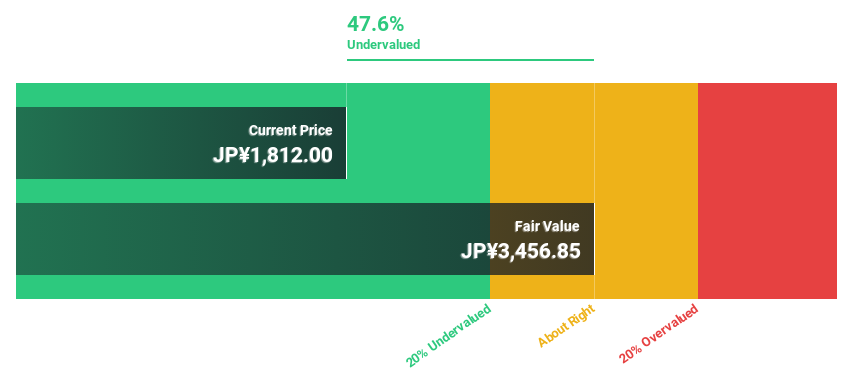

Renesas Electronics (TSE:6723)

Overview: Renesas Electronics Corporation is a global company that engages in the research, development, design, manufacturing, sales, and servicing of semiconductors across various regions including Japan, China, the rest of Asia, Europe, and North America with a market cap of ¥3.38 trillion.

Operations: The company's revenue segments consist of Automotive, generating ¥651.39 billion, and Industrial/Infrastructure/IoT, contributing ¥611.09 billion.

Estimated Discount To Fair Value: 38.8%

Renesas Electronics trades at ¥1,840.5, significantly below its estimated fair value of ¥3,008.93, highlighting potential undervaluation based on cash flows. Despite recent losses and high volatility in share price, revenue is expected to grow 8.5% annually—outpacing the Japanese market's forecasted growth rate of 4.3%. However, interest payments remain poorly covered by earnings and return on equity is projected to be low at 12.5% in three years.

- The growth report we've compiled suggests that Renesas Electronics' future prospects could be on the up.

- Unlock comprehensive insights into our analysis of Renesas Electronics stock in this financial health report.

Seize The Opportunity

- Take a closer look at our Undervalued Global Stocks Based On Cash Flows list of 486 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6723

Renesas Electronics

Researches, develops, designs, manufactures, sells, and services semiconductors in Japan, China, rest of Asia, Europe, North America, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives