- China

- /

- Retail Distributors

- /

- SHSE:600704

3 Global Dividend Stocks Yielding Over 3.3%

Reviewed by Simply Wall St

As global markets navigate a landscape marked by potential rate cuts and fluctuating economic indicators, investors are keenly observing how these dynamics impact various sectors. Amid these developments, dividend stocks yielding over 3.3% can offer an attractive opportunity for investors seeking income stability in a volatile environment.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Torigoe (TSE:2009) | 4.52% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 3.72% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.75% | ★★★★★★ |

| NCD (TSE:4783) | 4.67% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 3.96% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.28% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.46% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.78% | ★★★★★★ |

| Daicel (TSE:4202) | 4.41% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.75% | ★★★★★★ |

Click here to see the full list of 1335 stocks from our Top Global Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Wuchan Zhongda GroupLtd (SHSE:600704)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Wuchan Zhongda Group Co., Ltd. and its subsidiaries offer bulk commodity supply chain integration services both in China and internationally, with a market capitalization of CN¥29.79 billion.

Operations: Wuchan Zhongda Group Co., Ltd. generates revenue through its bulk commodity supply chain integration services, operating in both domestic and international markets.

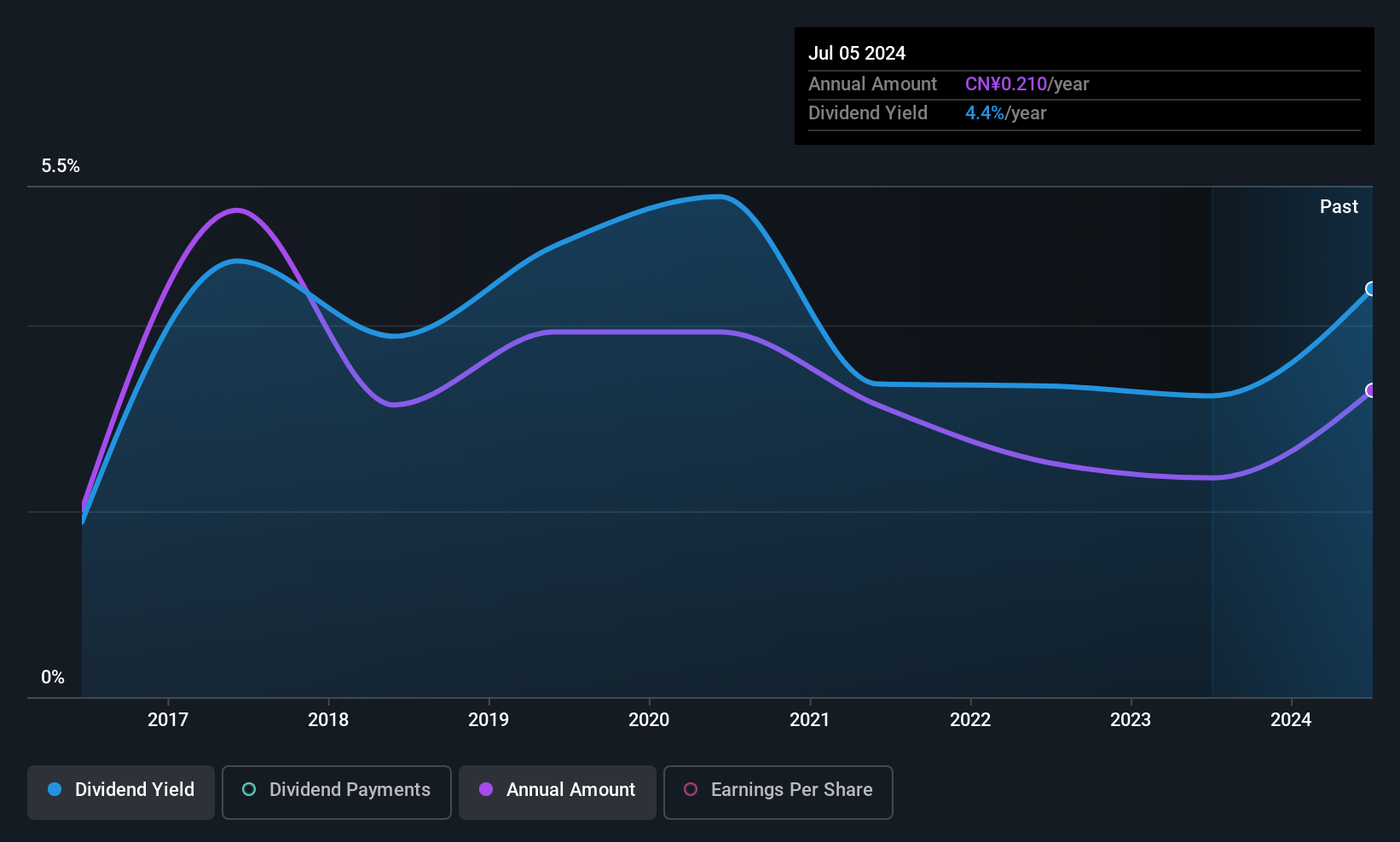

Dividend Yield: 3.3%

Wuchan Zhongda Group Ltd. reported a net income increase to CNY 2.04 billion for the first half of 2025, up from CNY 1.57 billion the previous year, indicating robust earnings growth despite a slight decline in sales. The company trades at a good value and its dividends are well-covered by both earnings and cash flows, with payout ratios of 30.9% and 23%, respectively. However, dividend reliability remains an issue due to historical volatility over the past decade.

- Click to explore a detailed breakdown of our findings in Wuchan Zhongda GroupLtd's dividend report.

- Our comprehensive valuation report raises the possibility that Wuchan Zhongda GroupLtd is priced lower than what may be justified by its financials.

37 Interactive Entertainment Network Technology Group (SZSE:002555)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: 37 Interactive Entertainment Network Technology Group Co., Ltd. develops, distributes, and operates online games in China with a market cap of CN¥38.81 billion.

Operations: 37 Interactive Entertainment Network Technology Group Co., Ltd. generates its revenue primarily through the development, distribution, and operation of online games in China.

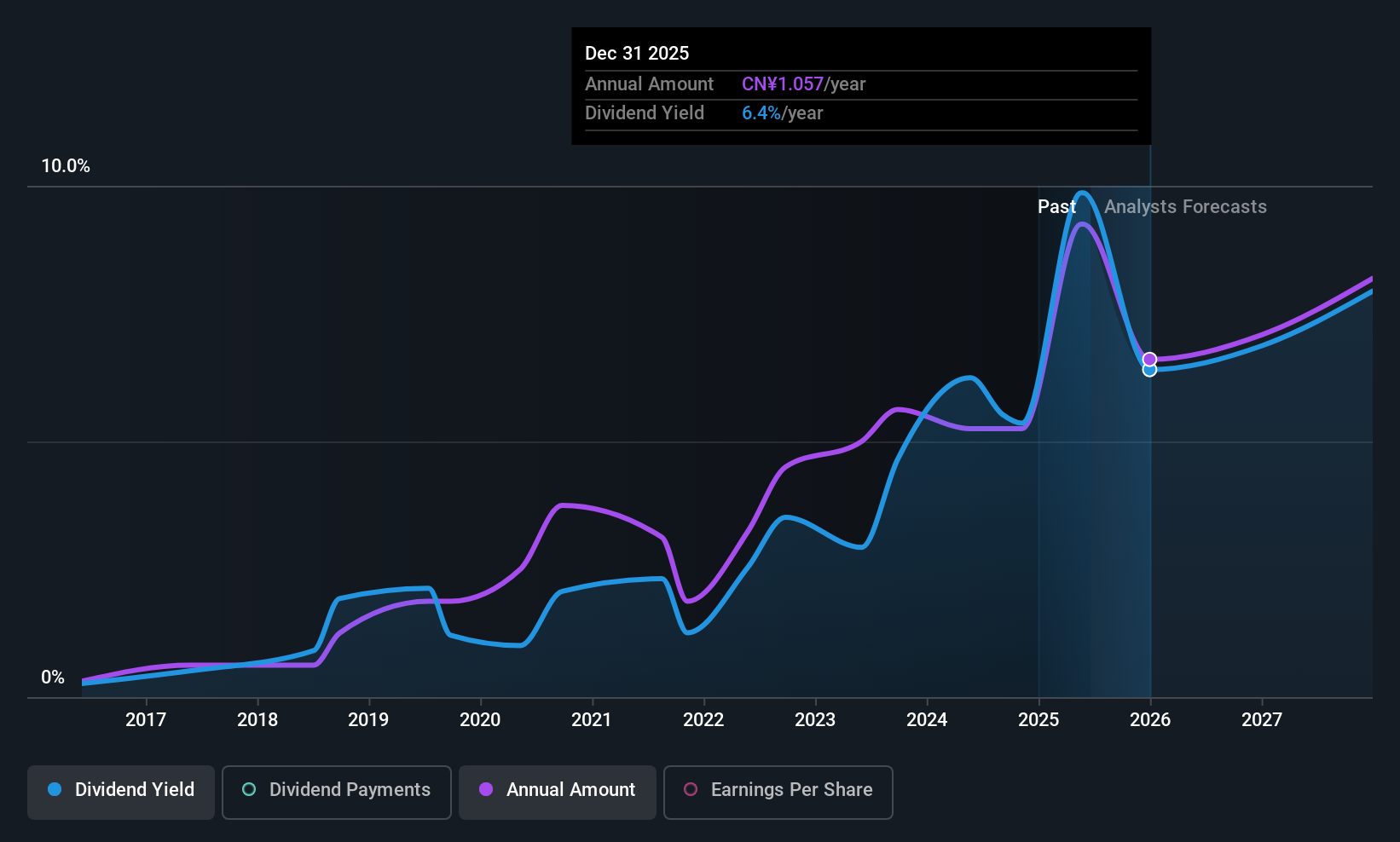

Dividend Yield: 7.6%

37 Interactive Entertainment Network Technology Group reported a net income increase to CNY 1.40 billion for the first half of 2025, despite a decline in sales. The dividend yield is high at 7.61%, placing it in the top 25% of CN market payers, yet it's not well covered by cash flows with a high payout ratio of 178.3%. While dividends have increased over the past decade, they remain unreliable and volatile, raising sustainability concerns.

- Unlock comprehensive insights into our analysis of 37 Interactive Entertainment Network Technology Group stock in this dividend report.

- Upon reviewing our latest valuation report, 37 Interactive Entertainment Network Technology Group's share price might be too pessimistic.

Hefei Meyer Optoelectronic Technology (SZSE:002690)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hefei Meyer Optoelectronic Technology Inc. operates in the field of optoelectronic technology, focusing on the development and production of intelligent sorting and inspection equipment, with a market cap of approximately CN¥15.67 billion.

Operations: Hefei Meyer Optoelectronic Technology Inc.'s revenue is primarily derived from its intelligent sorting and inspection equipment within the optoelectronic technology sector.

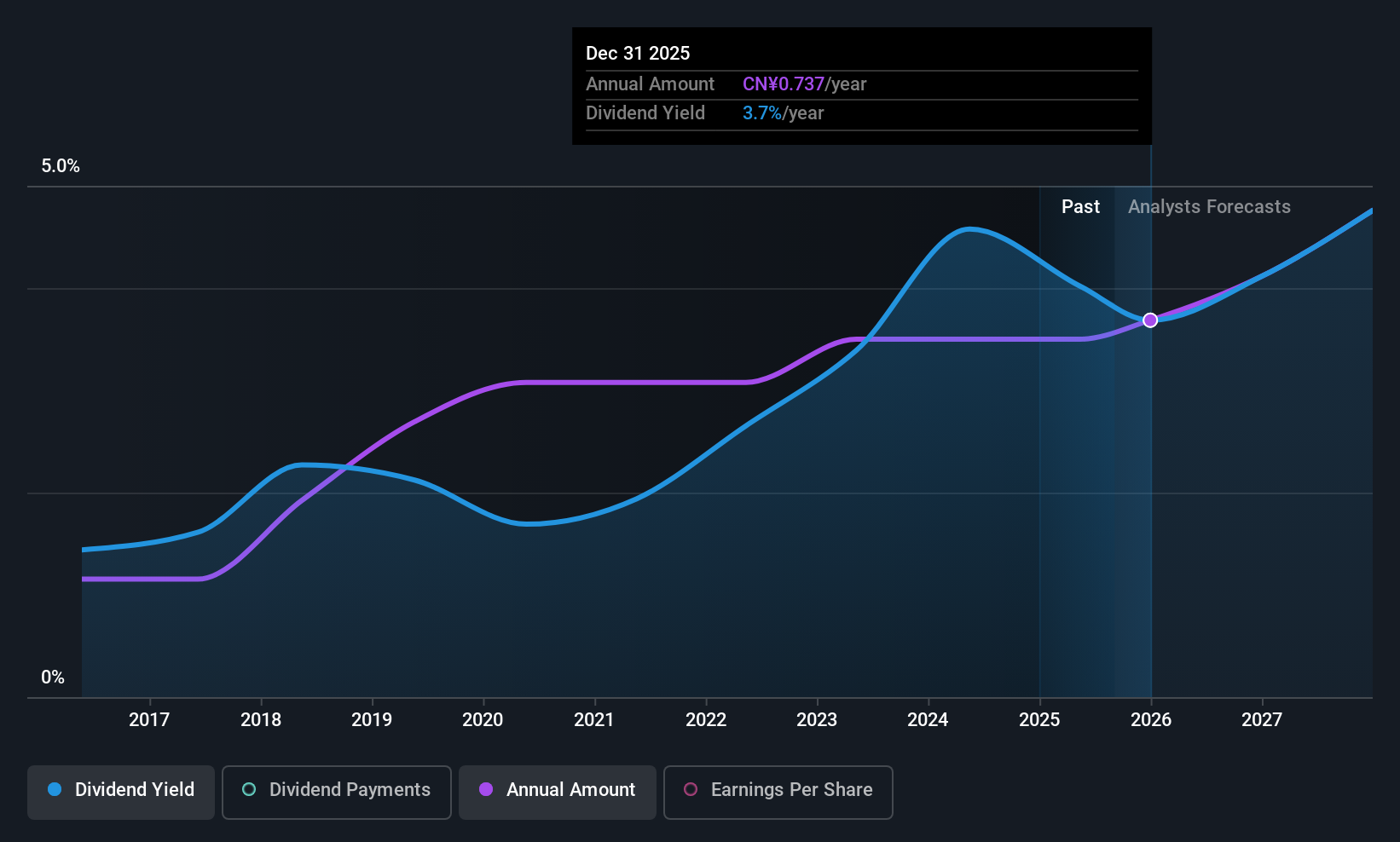

Dividend Yield: 3.6%

Hefei Meyer Optoelectronic Technology's dividend yield of 3.57% ranks in the top quartile of CN market payers, yet sustainability is questionable due to a high payout ratio (90.5%) that isn't supported by earnings. Though dividends have grown and remained stable over the past decade, recent earnings growth—evident in a rise to CNY 302.76 million net income for H1 2025—doesn't fully cover dividends, suggesting limited reliability in future payouts.

- Click here and access our complete dividend analysis report to understand the dynamics of Hefei Meyer Optoelectronic Technology.

- The valuation report we've compiled suggests that Hefei Meyer Optoelectronic Technology's current price could be quite moderate.

Key Takeaways

- Discover the full array of 1335 Top Global Dividend Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wuchan Zhongda GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600704

Wuchan Zhongda GroupLtd

Provides bulk commodity supply chain integration services in China and internationally.

Undervalued established dividend payer.

Market Insights

Community Narratives