- Italy

- /

- Consumer Durables

- /

- BIT:PWS

3 European Stocks Estimated To Be Trading At A Discount Of Up To 29.9%

Reviewed by Simply Wall St

As European markets show signs of optimism with easing trade tensions and the potential for U.S. interest rate cuts, major stock indexes have experienced gains, including a 1.18% rise in the STOXX Europe 600 Index. In this environment, identifying undervalued stocks can be particularly appealing as investors seek opportunities that may benefit from improving economic sentiments and market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sparebank 68° Nord (OB:SB68) | NOK183.40 | NOK359.64 | 49% |

| InPost (ENXTAM:INPST) | €13.36 | €26.57 | 49.7% |

| IDI (ENXTPA:IDIP) | €79.40 | €157.98 | 49.7% |

| Echo Investment (WSE:ECH) | PLN5.38 | PLN10.71 | 49.7% |

| DO & CO (WBAG:DOC) | €235.00 | €461.46 | 49.1% |

| ATON Green Storage (BIT:ATON) | €2.09 | €4.09 | 48.9% |

| Atea (OB:ATEA) | NOK142.40 | NOK283.91 | 49.8% |

| Aquila Part Prod Com (BVB:AQ) | RON1.46 | RON2.86 | 49% |

| Alfio Bardolla Training Group (BIT:ABTG) | €1.855 | €3.66 | 49.3% |

| Absolent Air Care Group (OM:ABSO) | SEK254.00 | SEK506.58 | 49.9% |

We'll examine a selection from our screener results.

Powersoft (BIT:PWS)

Overview: Powersoft S.p.A. designs, produces, and markets power amplifiers, loudspeaker components, and software both in Italy and internationally, with a market cap of €269.74 million.

Operations: The company's revenue primarily comes from its Audio Amplifiers for Professional Applications segment, generating €71.50 million.

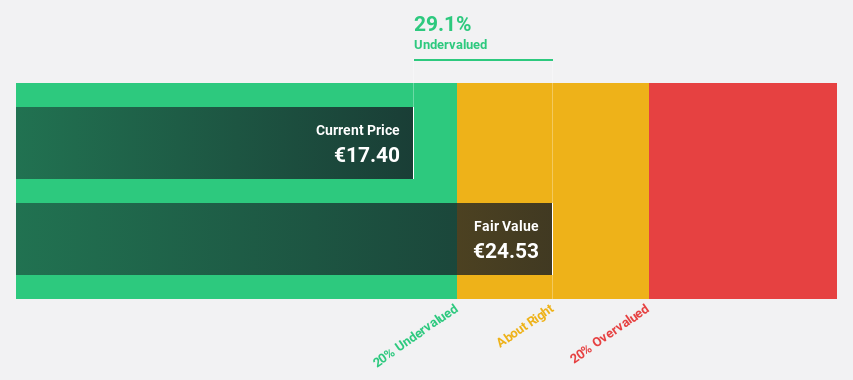

Estimated Discount To Fair Value: 17%

Powersoft is trading at €21, below its estimated fair value of €25.3, presenting a potential opportunity for investors focused on cash flow valuation. Despite its earnings growth of 2.4% last year, future earnings are expected to grow at 18.9% annually, surpassing the Italian market's average growth rate. However, the dividend yield of 3.9% isn't well-supported by free cash flows, and high non-cash earnings should be considered when evaluating overall financial health.

- Insights from our recent growth report point to a promising forecast for Powersoft's business outlook.

- Take a closer look at Powersoft's balance sheet health here in our report.

BlueNord (OB:BNOR)

Overview: BlueNord ASA is an oil and gas company focused on producing and developing resources to aid the energy transition towards net zero in Norway, Denmark, the Netherlands, and the United Kingdom, with a market cap of NOK12.53 billion.

Operations: The company's revenue from its Oil & Gas - Exploration & Production segment is $794.30 million.

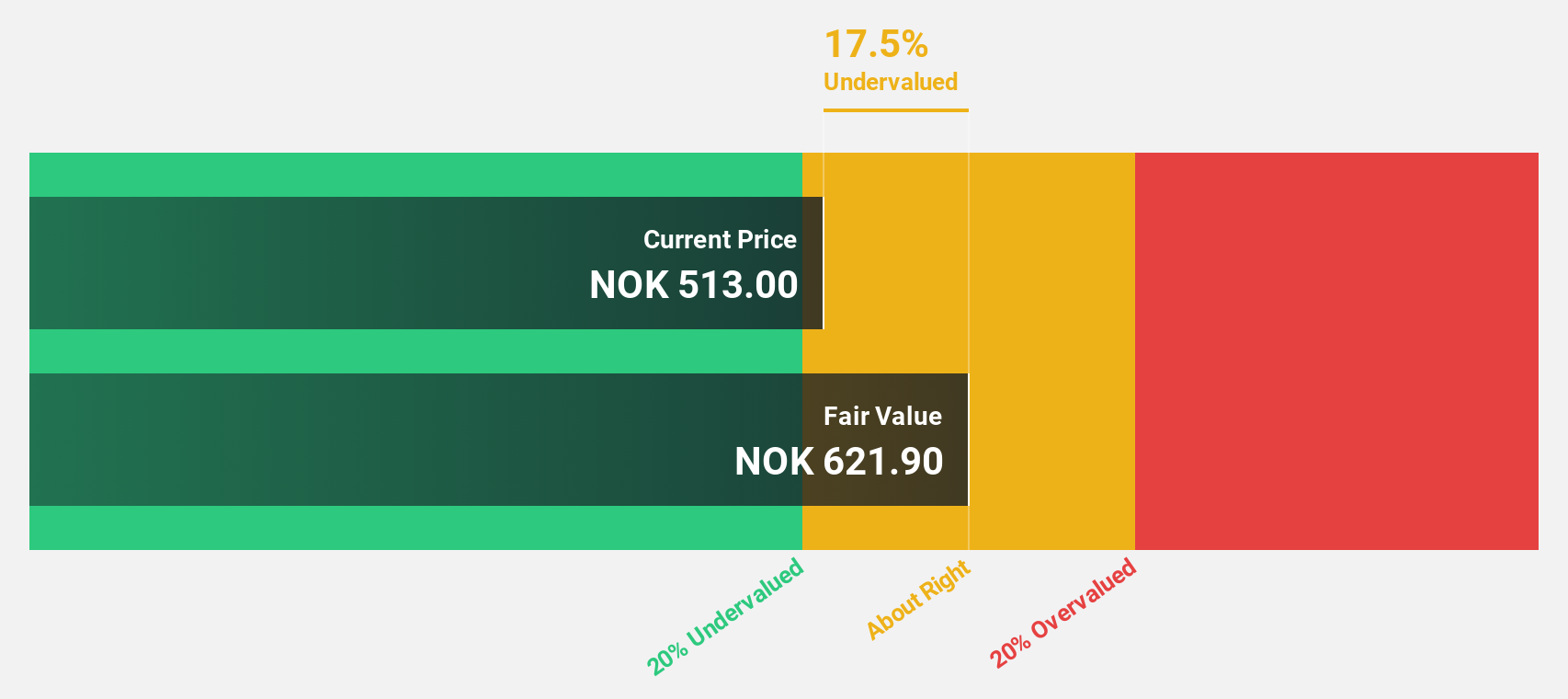

Estimated Discount To Fair Value: 29.9%

BlueNord ASA, trading at NOK491, is valued below its estimated fair value of NOK700.13, suggesting it could be undervalued based on cash flows. Forecasted revenue growth of 10.4% annually exceeds the Norwegian market average, and earnings are expected to grow significantly by 38.01% per year with profitability anticipated within three years. However, interest payments aren't well covered by earnings despite recent production challenges being resolved and a strong return on equity forecasted at 48.2%.

- The analysis detailed in our BlueNord growth report hints at robust future financial performance.

- Get an in-depth perspective on BlueNord's balance sheet by reading our health report here.

Mips (OM:MIPS)

Overview: Mips AB (publ) is a company that develops, manufactures, and sells helmet-based safety systems across North America, Europe, Sweden, Asia, and Australia with a market cap of SEK10.56 billion.

Operations: The company's revenue primarily comes from the Sporting Goods segment, which generated SEK518 million.

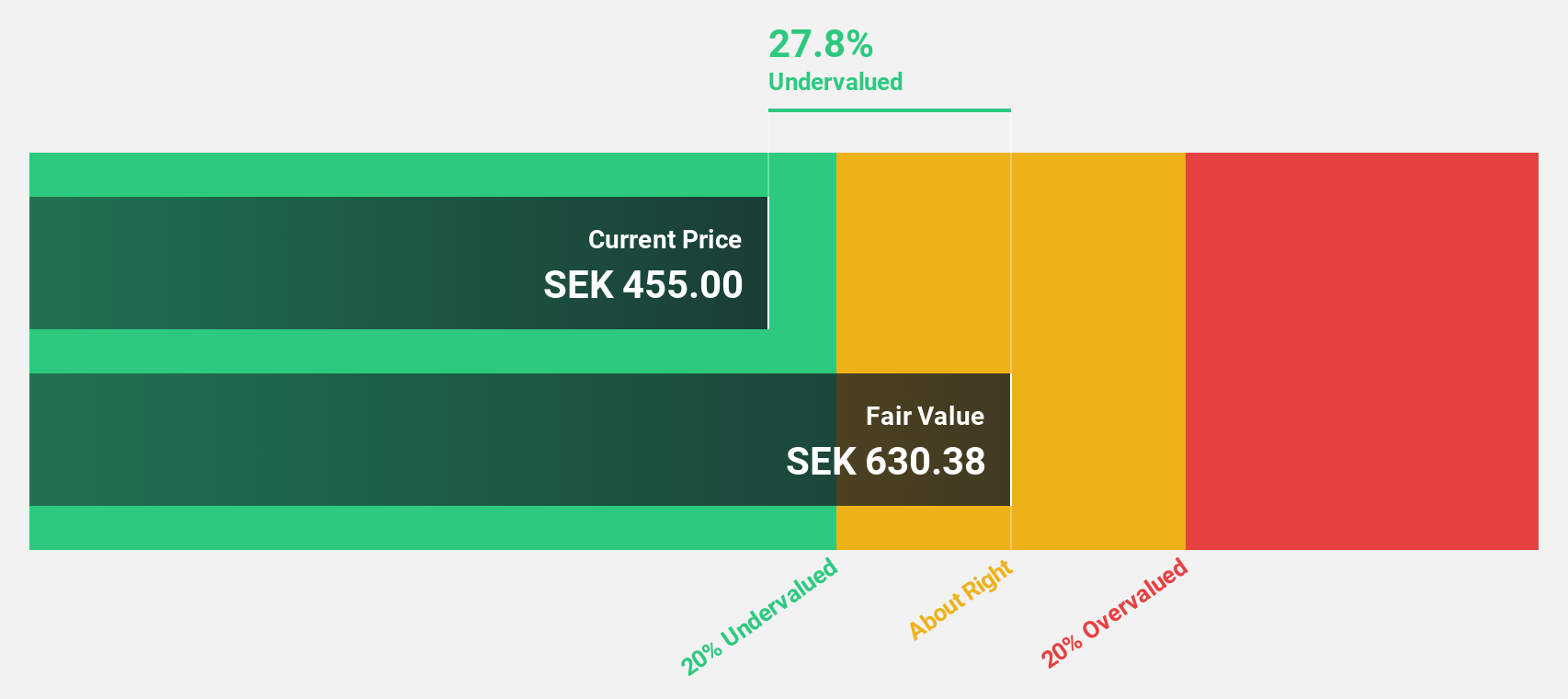

Estimated Discount To Fair Value: 29.3%

Mips AB, trading at SEK398.6, is valued below its estimated fair value of SEK563.65, indicating potential undervaluation based on cash flows. Recent earnings showed a slight decline in net income for Q2 2025 compared to the previous year despite increased sales. However, Mips's earnings and revenue are forecast to grow significantly faster than the Swedish market over the next three years, with a high return on equity anticipated at 41.9%.

- Our comprehensive growth report raises the possibility that Mips is poised for substantial financial growth.

- Navigate through the intricacies of Mips with our comprehensive financial health report here.

Turning Ideas Into Actions

- Unlock our comprehensive list of 215 Undervalued European Stocks Based On Cash Flows by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:PWS

Powersoft

Engages in the design, production, and marketing of power amplifiers, loudspeaker components, and software in Italy and internationally.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives