- France

- /

- Metals and Mining

- /

- ENXTPA:ERA

3 European Stocks Estimated To Be 14.2% To 48.9% Below Intrinsic Value

Reviewed by Simply Wall St

As the European market experiences modest gains, with the STOXX Europe 600 Index rising by 1.03% amid expectations of U.S. interest rate cuts, investors are keenly observing opportunities that may arise from shifting economic conditions and central bank policies. In this context, identifying undervalued stocks becomes crucial as they can offer potential value when markets stabilize or grow; these stocks are often priced below their intrinsic value due to temporary factors rather than fundamental weaknesses.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Truecaller (OM:TRUE B) | SEK43.04 | SEK85.80 | 49.8% |

| Rheinmetall (XTRA:RHM) | €1950.00 | €3819.19 | 48.9% |

| Micro Systemation (OM:MSAB B) | SEK63.00 | SEK122.75 | 48.7% |

| DSV (CPSE:DSV) | DKK1371.00 | DKK2694.66 | 49.1% |

| Digital Workforce Services Oyj (HLSE:DWF) | €3.41 | €6.82 | 50% |

| Brockhaus Technologies (XTRA:BKHT) | €9.92 | €19.22 | 48.4% |

| ATON Green Storage (BIT:ATON) | €2.09 | €4.09 | 48.9% |

| Atea (OB:ATEA) | NOK142.00 | NOK280.67 | 49.4% |

| Alfio Bardolla Training Group (BIT:ABTG) | €1.96 | €3.79 | 48.3% |

| adidas (XTRA:ADS) | €178.30 | €350.73 | 49.2% |

Let's explore several standout options from the results in the screener.

ERAMET (ENXTPA:ERA)

Overview: ERAMET S.A. is a company engaged in the production and sale of manganese and nickel across various global markets including France, Europe, North America, China, and other regions, with a market cap of €1.48 billion.

Operations: The company's revenue segments include Manganese at €1.98 billion, Mineral Sands at €305 million, Nickel at €151 million, and SLN at €52 million.

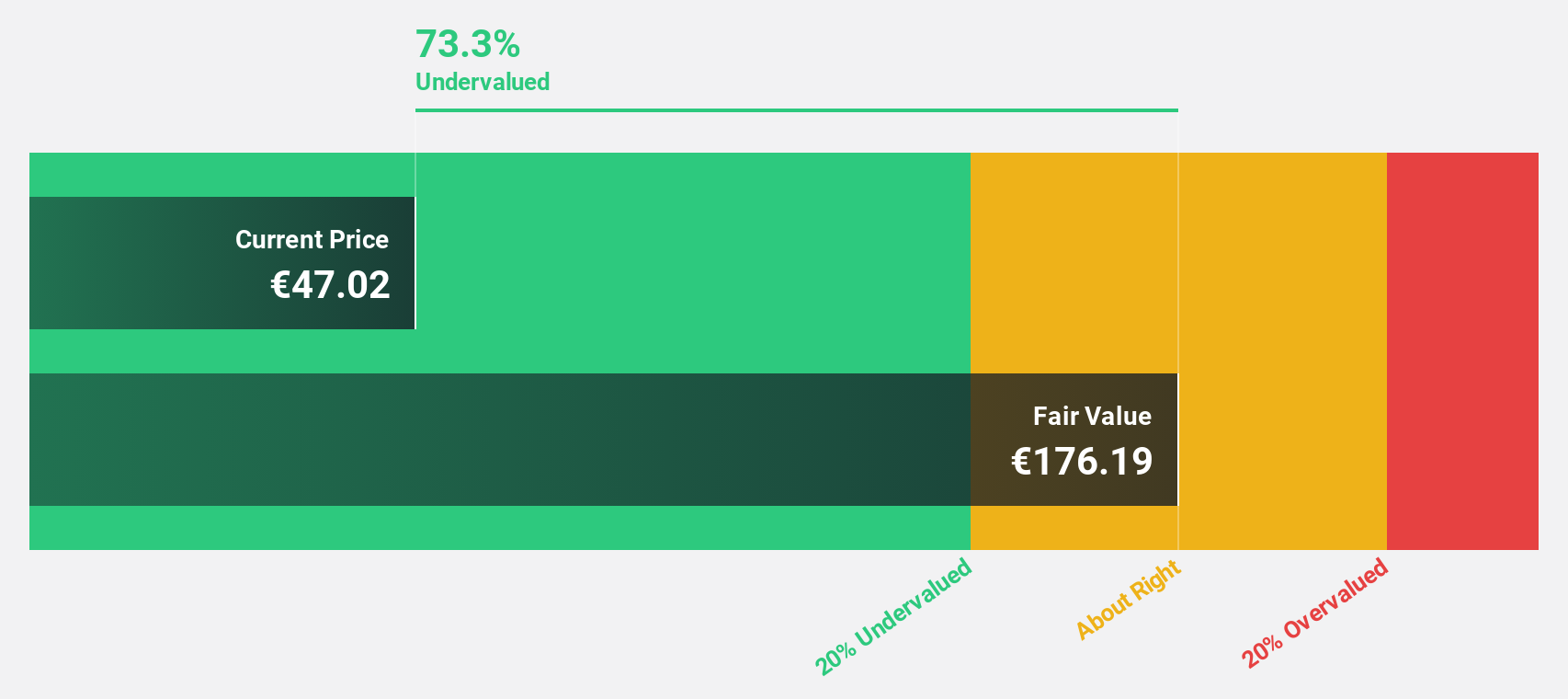

Estimated Discount To Fair Value: 14.2%

ERAMET is trading at €51.85, approximately 14.2% below its estimated fair value of €60.44, suggesting it may be undervalued based on cash flows. Despite a reported net loss of €152 million for H1 2025, the company is expected to become profitable within three years with earnings growth forecasted at over 110% annually. However, its dividend yield remains unsustainable due to poor coverage by earnings and cash flows, and debt levels are not well-supported by operating cash flow.

- Our earnings growth report unveils the potential for significant increases in ERAMET's future results.

- Get an in-depth perspective on ERAMET's balance sheet by reading our health report here.

AutoStore Holdings (OB:AUTO)

Overview: AutoStore Holdings Ltd. is a company that offers robotic and software technology solutions across Norway, Germany, Europe, the United States, Asia, and other international markets with a market cap of NOK31.72 billion.

Operations: AutoStore Holdings Ltd. generates revenue of $529 million from its Industrial Automation & Controls segment.

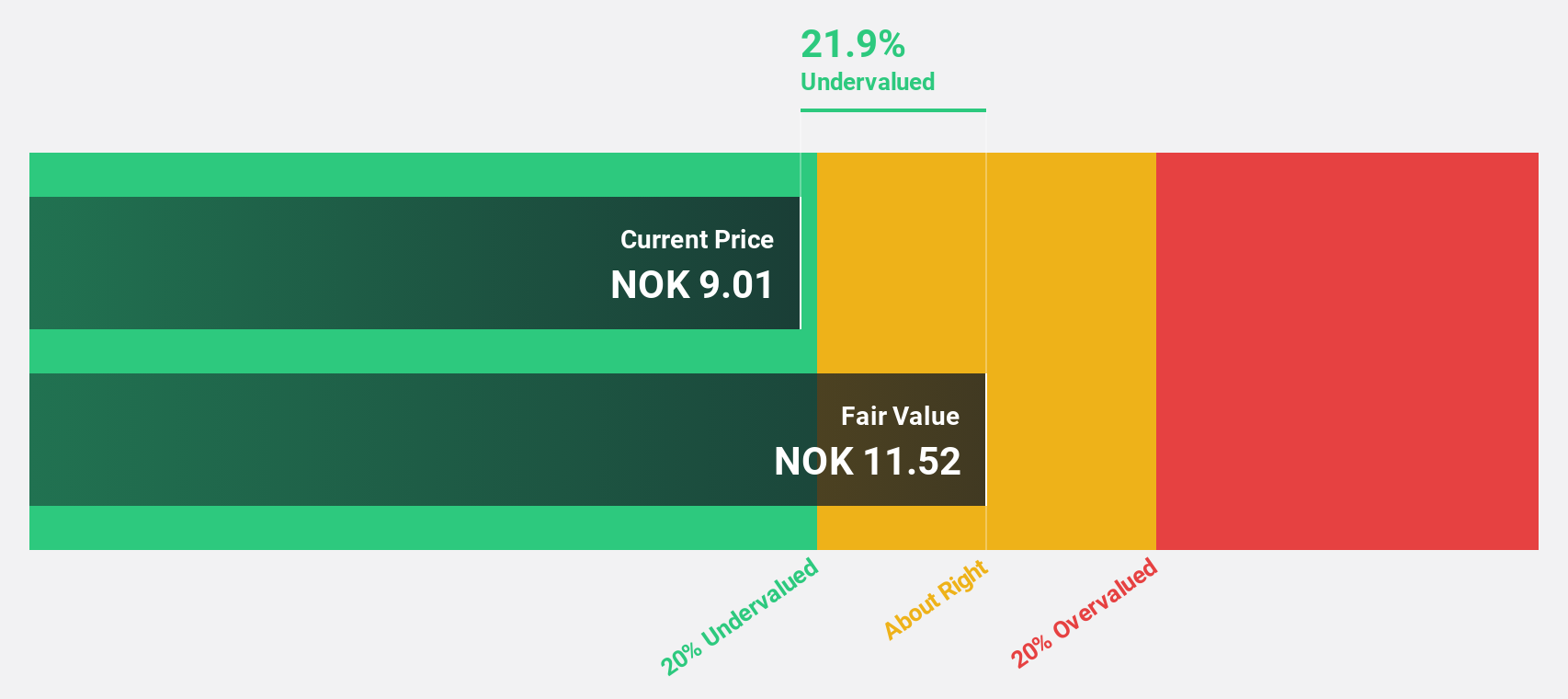

Estimated Discount To Fair Value: 14.7%

AutoStore Holdings is trading at NOK9.44, approximately 14.7% below its estimated fair value of NOK11.06, reflecting potential undervaluation based on cash flows despite recent earnings declines. Revenue growth is expected to outpace the Norwegian market at 10% annually, with significant earnings growth forecasted over the next three years. The strategic partnership with Rehrig Pacific enhances AutoStore's position in warehouse automation, potentially boosting future revenue streams and operational efficiency amidst a volatile share price environment.

- Our comprehensive growth report raises the possibility that AutoStore Holdings is poised for substantial financial growth.

- Navigate through the intricacies of AutoStore Holdings with our comprehensive financial health report here.

Rheinmetall (XTRA:RHM)

Overview: Rheinmetall AG is a company that offers mobility and security technologies across Germany, Europe, the Americas, Asia, and globally, with a market cap of €89.47 billion.

Operations: The company's revenue is primarily derived from its Vehicle Systems segment at €4.39 billion, Weapon and Ammunition at €3.05 billion, Electronic Solutions at €2.02 billion, and Power Systems at €1.97 billion.

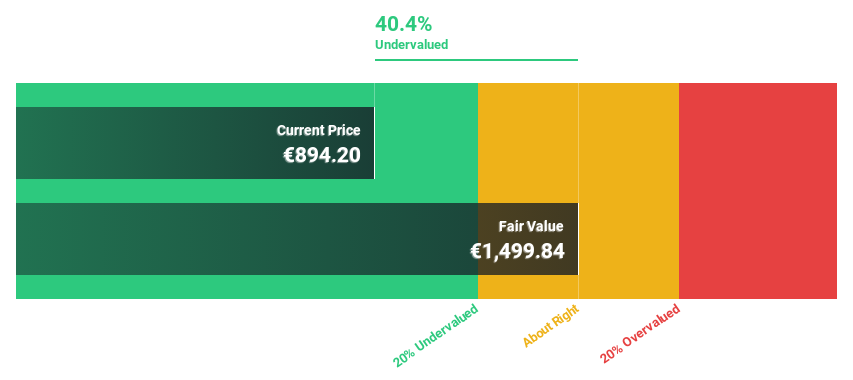

Estimated Discount To Fair Value: 48.9%

Rheinmetall is trading at €1,950, significantly below its estimated fair value of €3,819.19, suggesting undervaluation based on cash flows. Earnings are projected to grow substantially over the next three years at 33.34% annually, outpacing the German market. Recent initiatives include divesting civilian businesses and expanding into shipbuilding to enhance its defense offerings across land, sea, and air sectors. This strategic shift aims to capitalize on Europe's increasing defense requirements while potentially improving future cash flows.

- Upon reviewing our latest growth report, Rheinmetall's projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of Rheinmetall.

Taking Advantage

- Delve into our full catalog of 211 Undervalued European Stocks Based On Cash Flows here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ERAMET might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ERA

ERAMET

Produces and sells manganese and nickel in France, Europe, North America, China, Other Asia, Oceania, Africa, South America, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives