As European markets navigate a landscape of easing inflation and potential interest rate cuts, investors are keenly observing the pan-European STOXX Europe 600 Index, which recently edged higher amid trade negotiations with the U.S. In such an environment, dividend stocks can offer a stable income stream and potential for growth, making them an attractive consideration for those looking to balance their portfolios against market volatility.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.37% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 3.93% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 6.99% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.95% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.70% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.58% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.20% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.20% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.71% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.36% | ★★★★★★ |

Click here to see the full list of 231 stocks from our Top European Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

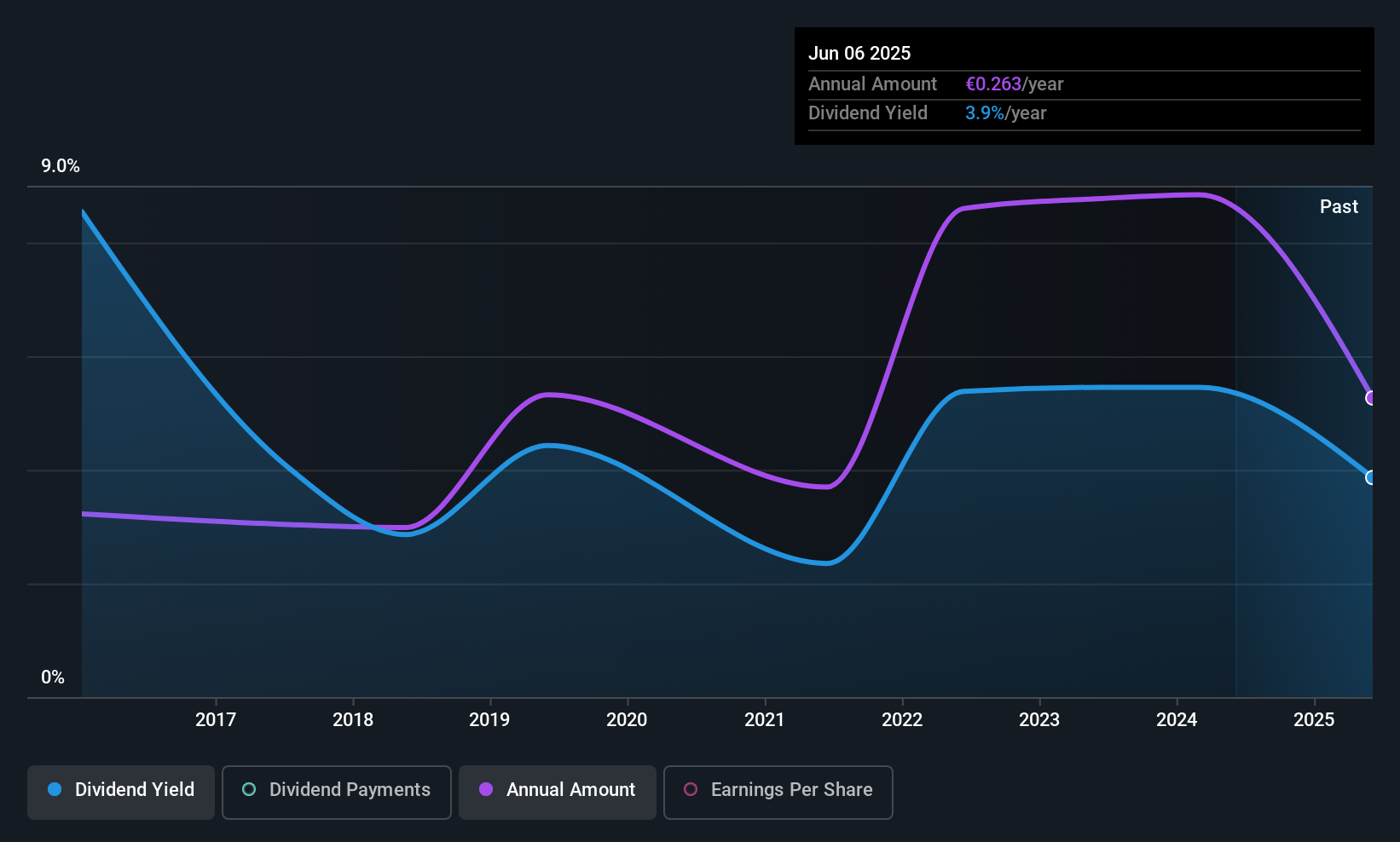

Payton Planar Magnetics (ENXTBR:PAY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Payton Planar Magnetics Ltd., along with its subsidiaries, develops, manufactures, and markets planar and conventional transformers globally, with a market cap of €123.70 million.

Operations: Payton Planar Magnetics Ltd. generates revenue of $49.83 million from its transformer segment.

Dividend Yield: 3.8%

Payton Planar Magnetics offers a covered dividend with a payout ratio of 39.8% and a cash payout ratio of 54.6%, ensuring sustainability through earnings and cash flows. However, its 3.76% yield is below the top tier in Belgium, and its dividend history is marked by volatility despite growth over the past decade. Recent earnings show decreased sales and net income, potentially impacting future dividends but not immediately threatening current payouts.

- Get an in-depth perspective on Payton Planar Magnetics' performance by reading our dividend report here.

- The valuation report we've compiled suggests that Payton Planar Magnetics' current price could be inflated.

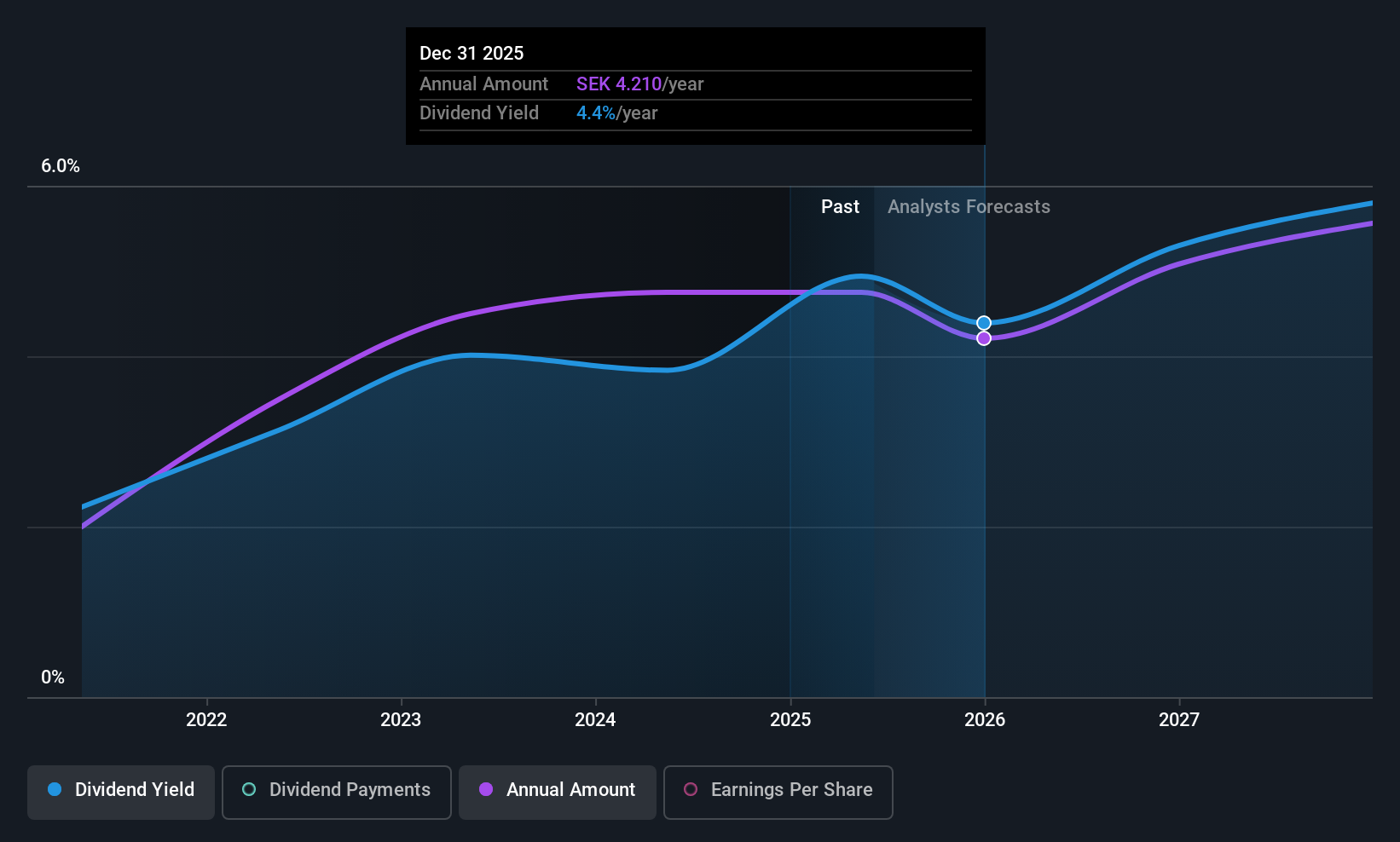

NCC (OM:NCC B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NCC AB (publ) is a construction company operating in Sweden, Norway, Denmark, and Finland with a market cap of approximately SEK18.60 billion.

Operations: NCC AB (publ) generates revenue through its segments: NCC Industry (SEK12.66 billion), NCC Infrastructure (SEK18.27 billion), NCC Building Sweden (SEK13.78 billion), NCC Building Nordics (SEK13.92 billion), and NCC Property Development (SEK4.31 billion).

Dividend Yield: 4.7%

NCC's dividend is well-covered, with a payout ratio of 57.6% and a cash payout ratio of 25.8%, but its reliability is questionable due to volatility over the past decade. Despite this, it offers a competitive yield in Sweden's market. Recent projects, such as expansions in Finland and road maintenance contracts in Sweden and Norway, highlight NCC's ongoing business activities that may support future earnings stability despite recent quarterly losses impacting short-term outlooks.

- Delve into the full analysis dividend report here for a deeper understanding of NCC.

- According our valuation report, there's an indication that NCC's share price might be on the cheaper side.

Prevas (OM:PREV B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Prevas AB is a technical consultancy services provider operating in Sweden and internationally, with a market cap of SEK1.21 billion.

Operations: Prevas AB generates revenue from its operations in Sweden (SEK1.28 billion) and Denmark (SEK164.26 million).

Dividend Yield: 5.1%

Prevas AB's dividend is supported by a payout ratio of 75% and a cash payout ratio of 45.9%, indicating solid coverage. The proposed SEK 4.75 per share dividend is set for distribution on May 21, 2025. While dividends have grown steadily, they have only been paid for four years. Despite lower profit margins this year, Prevas trades at a significant discount to its estimated fair value and offers one of the top yields in Sweden's market at 5.05%.

- Take a closer look at Prevas' potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Prevas is trading behind its estimated value.

Key Takeaways

- Click this link to deep-dive into the 231 companies within our Top European Dividend Stocks screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:PREV B

Prevas

Provides technical solutions in Sweden, Denmark, Finland, and internationally.

Good value with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)