As European markets experience a modest uptick, buoyed by a ceasefire in the Middle East and easing trade tensions, investors are eyeing dividend stocks as a potential source of steady income amidst economic uncertainty. In this environment, selecting dividend stocks with robust yields can offer an attractive balance between risk and reward, providing investors with regular income while navigating the fluctuating market landscape.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.43% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.39% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.59% | ★★★★★★ |

| Les Docks des Pétroles d'Ambès -SA (ENXTPA:DPAM) | 5.73% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.87% | ★★★★★★ |

| Holcim (SWX:HOLN) | 5.31% | ★★★★★★ |

| ERG (BIT:ERG) | 5.31% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 3.93% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.79% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.49% | ★★★★★★ |

Click here to see the full list of 237 stocks from our Top European Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

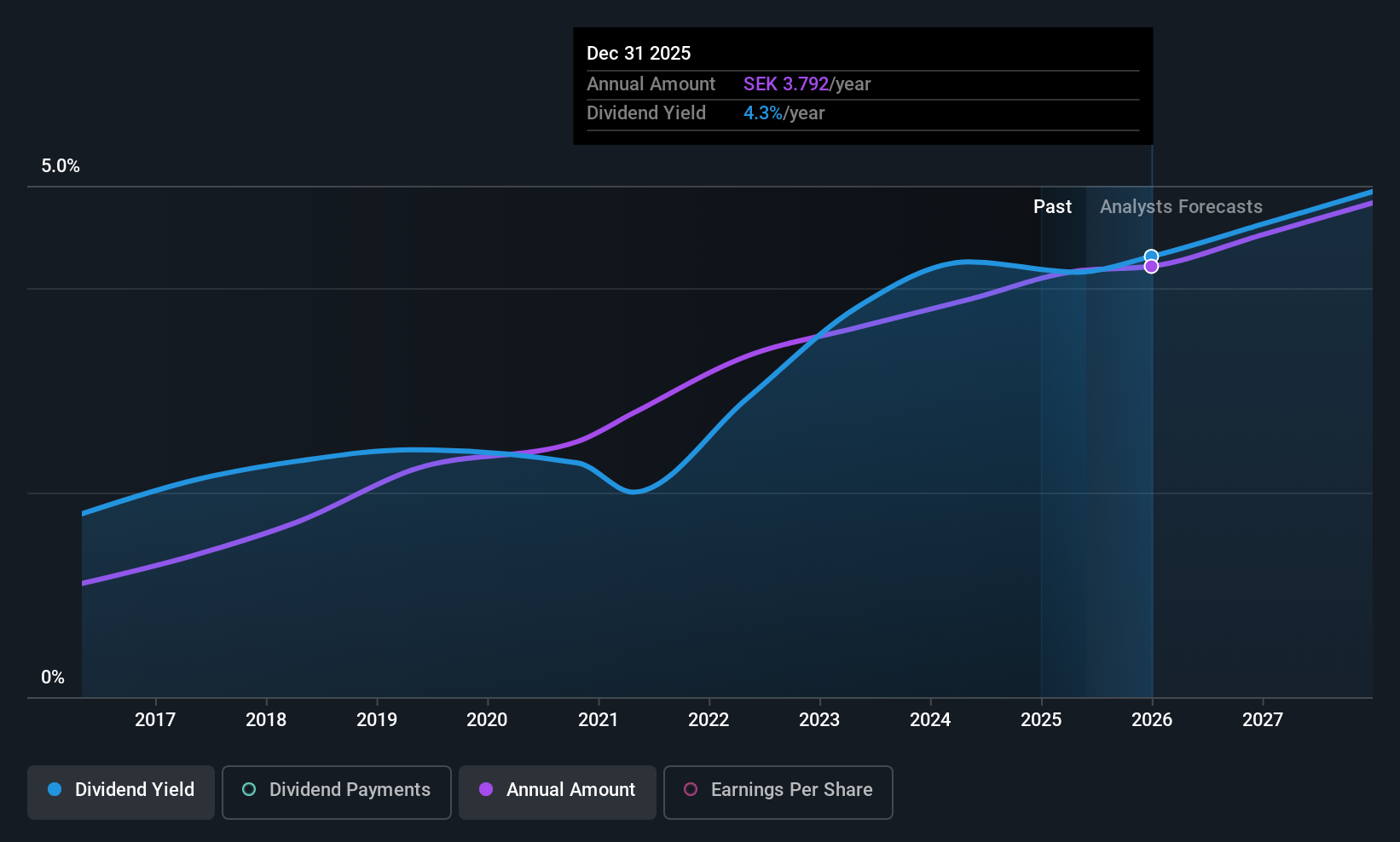

Bravida Holding (OM:BRAV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bravida Holding AB (publ) offers technical services and installations for buildings and industrial facilities across Sweden, Norway, Denmark, and Finland, with a market cap of SEK19.63 billion.

Operations: Bravida Holding AB (publ) generates revenue through its provision of technical services and installations for buildings and industrial facilities in Sweden, Norway, Denmark, and Finland.

Dividend Yield: 3.9%

Bravida Holding's dividends are well-supported by both earnings and cash flows, with a payout ratio of 70.8% and a cash payout ratio of 44.5%. Although the company has only paid dividends for nine years, they have been stable with minimal volatility. Recent Q1 results showed increased net income to SEK 227 million despite a slight sales decline. Additionally, Bravida's commitment to emission reduction targets aligns it with sustainability trends, potentially enhancing its long-term appeal to investors focused on environmental responsibility.

- Dive into the specifics of Bravida Holding here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Bravida Holding is trading behind its estimated value.

Bank Handlowy w Warszawie (WSE:BHW)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bank Handlowy w Warszawie S.A., along with its subsidiaries, offers a variety of banking services to individual and corporate clients both in Poland and internationally, with a market cap of PLN15.63 billion.

Operations: Bank Handlowy w Warszawie S.A. generates revenue through its Retail Banking segment, which accounts for PLN1.32 billion, and its Institutional Banking segment, contributing PLN3.16 billion.

Dividend Yield: 8.6%

Bank Handlowy w Warszawie offers a high dividend yield of 8.59%, ranking in the top 25% of Polish dividend payers, but its sustainability is questionable due to a payout ratio not forecasted to be covered by earnings in three years. The bank's dividends have been volatile and unreliable over the past decade, with recent decreases announced. Additionally, it faces challenges with high bad loans (2.4%) and low allowance coverage (90%), impacting financial stability.

- Get an in-depth perspective on Bank Handlowy w Warszawie's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Bank Handlowy w Warszawie's current price could be quite moderate.

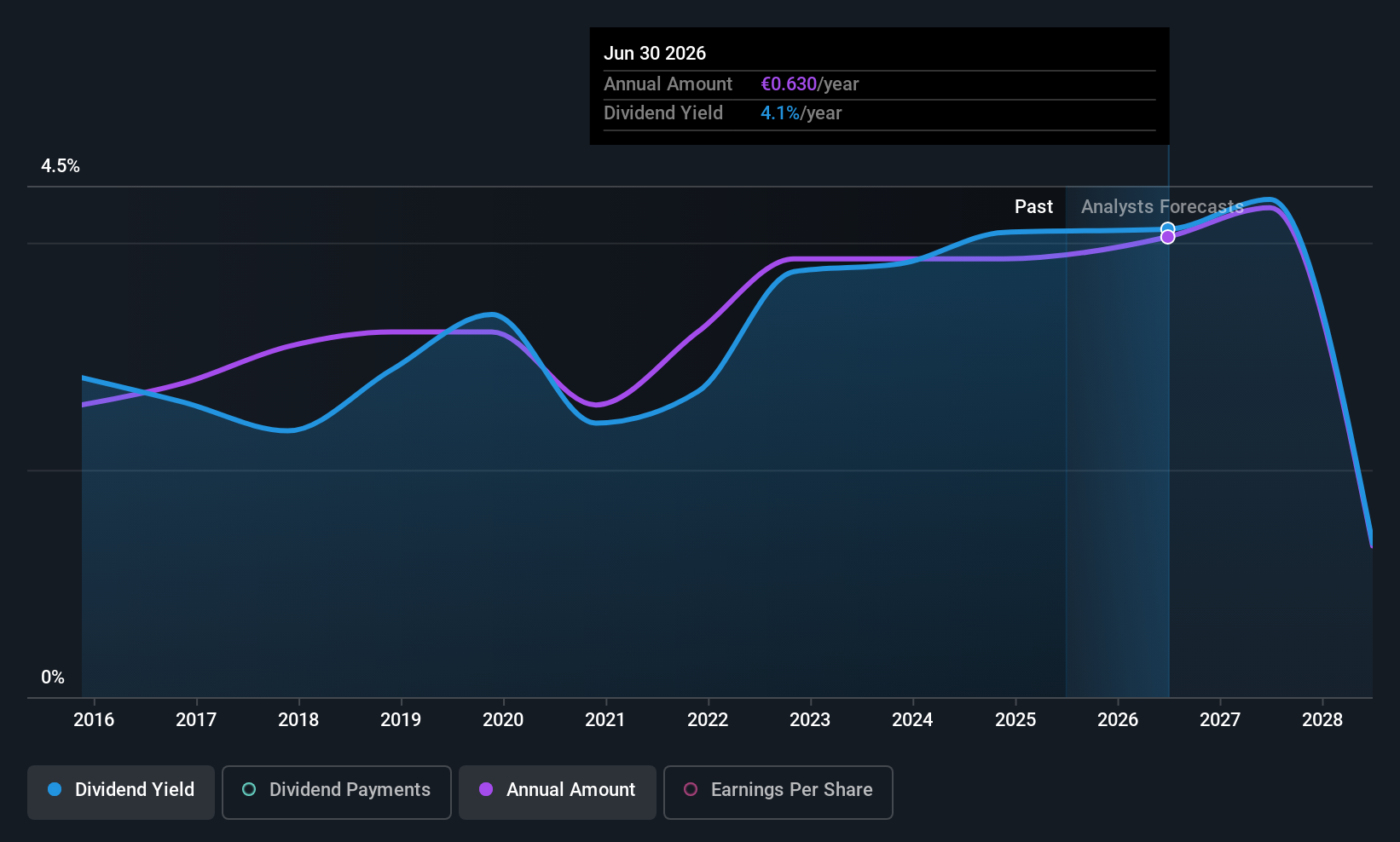

Schloss Wachenheim (XTRA:SWA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Schloss Wachenheim AG is a producer and distributor of sparkling and semi-sparkling wine products in Europe and internationally, with a market cap of €120.38 million.

Operations: Schloss Wachenheim AG generates revenue primarily from its Alcoholic Beverages segment, which amounts to €446.44 million.

Dividend Yield: 3.9%

Schloss Wachenheim AG provides a stable dividend of 3.95%, supported by a low payout ratio of 43.5% and a cash payout ratio of 33.9%, ensuring sustainability through earnings and cash flows. Despite recent quarterly net losses, the company has shown improved nine-month earnings, with net income rising to €7.6 million from €6.15 million year-over-year, enhancing its dividend reliability over the past decade with consistent growth and stability in payments.

- Click to explore a detailed breakdown of our findings in Schloss Wachenheim's dividend report.

- Our valuation report unveils the possibility Schloss Wachenheim's shares may be trading at a discount.

Where To Now?

- Click here to access our complete index of 237 Top European Dividend Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SWA

Schloss Wachenheim

Produces and distributes sparkling and semi-sparkling wine products in Europe and internationally.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives