- United States

- /

- Specialized REITs

- /

- NYSE:VICI

3 Dividend Stocks Yielding Between 3% And 8.2%

Reviewed by Simply Wall St

The market in the United States has remained flat over the past week, though it has experienced a 10% increase over the last year, with earnings expected to grow by 15% annually. In this environment, dividend stocks yielding between 3% and 8.2% can offer investors a blend of income and potential growth, making them an attractive option for those seeking stability alongside capital appreciation.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Universal (UVV) | 5.98% | ★★★★★★ |

| Southside Bancshares (SBSI) | 4.76% | ★★★★★☆ |

| Peoples Bancorp (PEBO) | 5.28% | ★★★★★☆ |

| Huntington Bancshares (HBAN) | 3.74% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.27% | ★★★★★★ |

| Ennis (EBF) | 5.61% | ★★★★★★ |

| Dillard's (DDS) | 6.11% | ★★★★★★ |

| CompX International (CIX) | 4.64% | ★★★★★★ |

| Columbia Banking System (COLB) | 6.04% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.76% | ★★★★★☆ |

Click here to see the full list of 143 stocks from our Top US Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

CNB Financial (CCNE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CNB Financial Corporation, with a market cap of $506.58 million, operates as the bank holding company for CNB Bank, offering a range of banking products and services to individual, business, governmental, and institutional customers.

Operations: The primary revenue segment for CNB Financial Corporation is its Banking operations, generating $219.89 million.

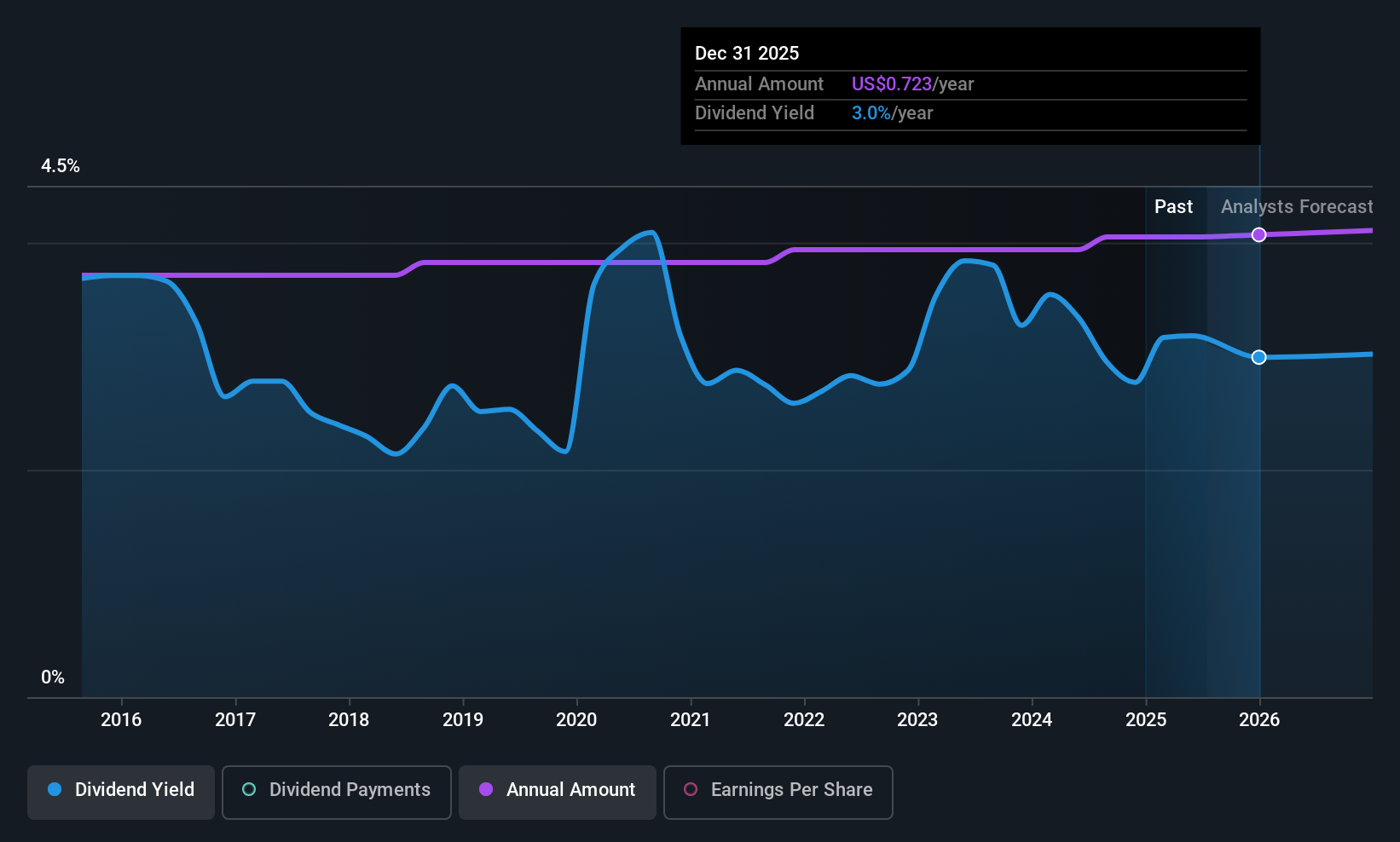

Dividend Yield: 3%

CNB Financial's dividend payments have been stable and reliable over the past decade, with a reasonably low payout ratio of 30.5%, indicating they are well covered by earnings. Although its current yield of 3.02% is below the top quartile in the US market, it remains attractive due to its consistent growth and stability. Recent announcements include a share repurchase program worth US$15 million, potentially enhancing shareholder value alongside regular dividend affirmations.

- Click to explore a detailed breakdown of our findings in CNB Financial's dividend report.

- In light of our recent valuation report, it seems possible that CNB Financial is trading behind its estimated value.

Buckle (BKE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Buckle, Inc. is a U.S.-based retailer specializing in casual apparel, footwear, and accessories for men, women, and kids under the Buckle and Buckle Youth brands, with a market cap of approximately $2.42 billion.

Operations: Buckle's revenue primarily comes from its sales of casual apparel, footwear, and accessories, totaling $1.23 billion.

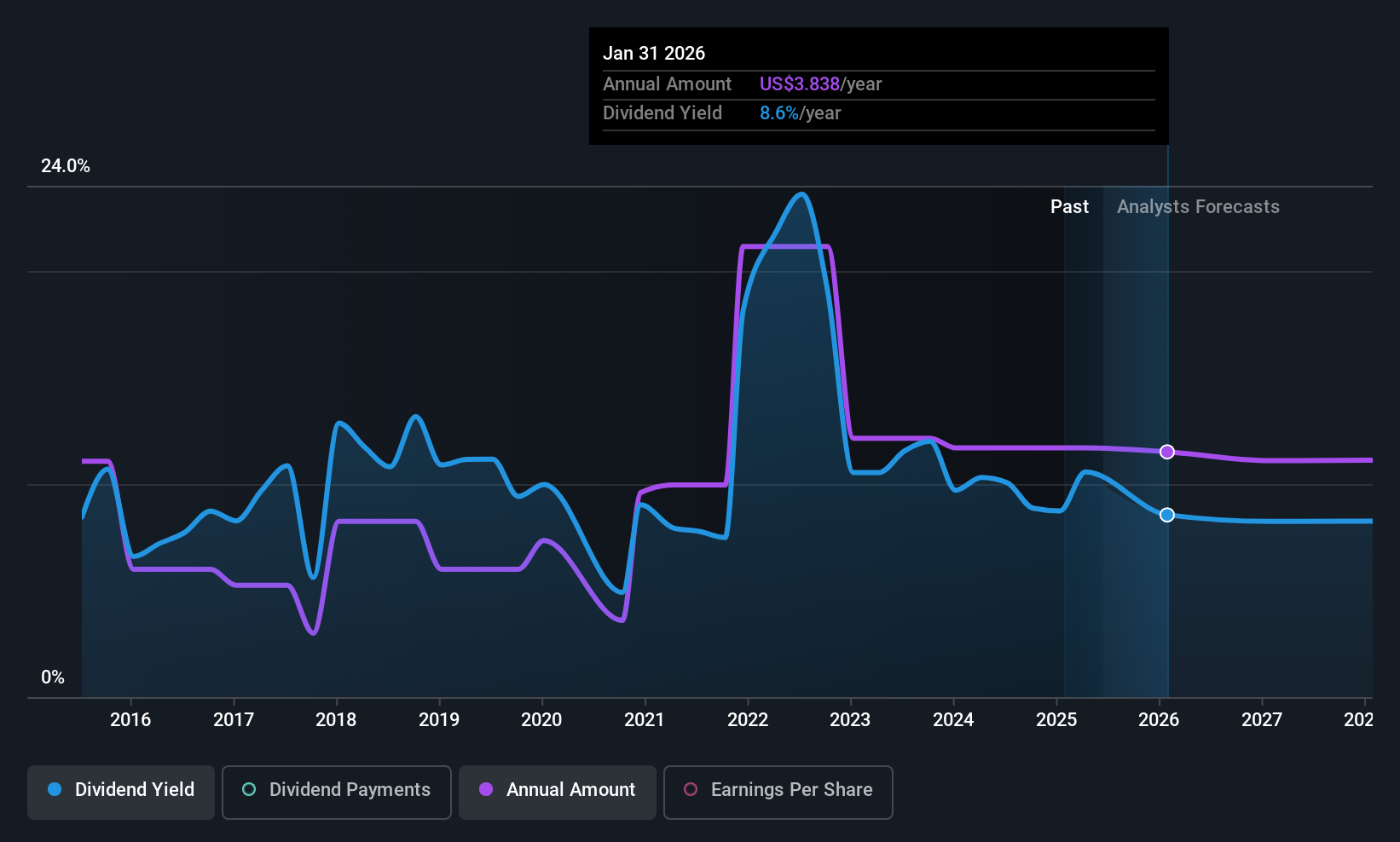

Dividend Yield: 8.3%

Buckle's dividend yield of 8.25% ranks in the top quartile among US payers, yet its sustainability is questionable due to a high cash payout ratio of 97.8%, indicating dividends aren't covered by free cash flow. Despite volatility over the past decade, dividends have grown. Recent sales growth and inclusion in multiple Russell indices highlight market recognition, though earnings coverage remains stronger than cash flow support for dividends.

- Navigate through the intricacies of Buckle with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Buckle is priced lower than what may be justified by its financials.

VICI Properties (VICI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: VICI Properties Inc. is an S&P 500 experiential real estate investment trust with a market cap of approximately $35.51 billion, owning a significant portfolio of gaming, hospitality, wellness, entertainment and leisure destinations including iconic venues like Caesars Palace Las Vegas and the Venetian Resort Las Vegas.

Operations: VICI Properties Inc. generates revenue primarily from its Real Property and Real Estate Lending Activities, totaling approximately $3.88 billion.

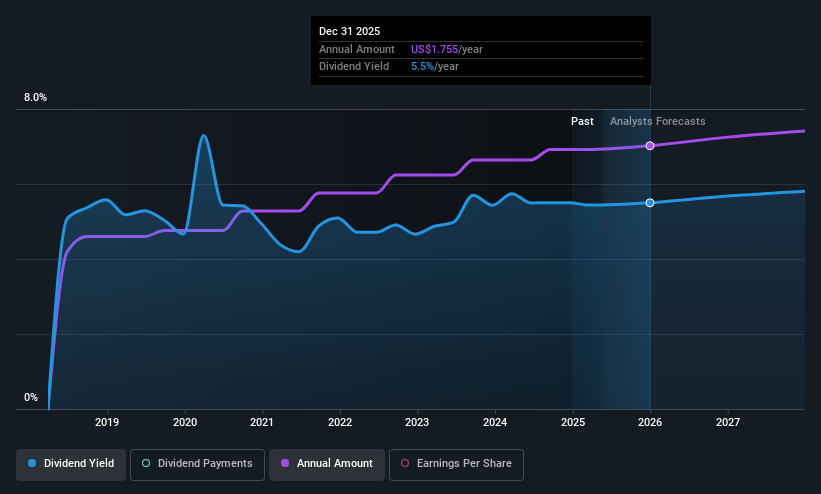

Dividend Yield: 5.2%

VICI Properties offers a compelling dividend yield of 5.23%, placing it in the top quartile among US dividend payers, with dividends covered by earnings (67.5% payout ratio) and cash flows (75.2% cash payout ratio). While dividends have been stable and growing over its seven-year history, the company faces challenges with debt coverage by operating cash flow. Recent earnings show revenue growth to US$984.2 million, though net income declined compared to last year.

- Unlock comprehensive insights into our analysis of VICI Properties stock in this dividend report.

- According our valuation report, there's an indication that VICI Properties' share price might be on the cheaper side.

Seize The Opportunity

- Click through to start exploring the rest of the 140 Top US Dividend Stocks now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VICI

VICI Properties

An S&P 500 experiential real estate investment trust that owns one of the largest portfolios of market-leading gaming, hospitality, wellness, entertainment and leisure destinations, including Caesars Palace Las Vegas, MGM Grand and the Venetian Resort Las Vegas, three of the most iconic entertainment facilities on the Las Vegas Strip.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives