- Australia

- /

- Commercial Services

- /

- ASX:MAD

3 ASX Stocks Estimated To Be Trading Up To 38% Below Intrinsic Value

Reviewed by Simply Wall St

As the Australian market remains relatively flat, hovering around the 8,542-point mark, and with Treasurer Jim Chalmers advocating for comprehensive tax reforms, investors are keenly observing sectors like IT and Industrials that have shown resilience. In this environment of cautious optimism and sector-specific movements, identifying stocks trading below their intrinsic value can present opportunities for investors seeking potential long-term gains.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Tasmea (ASX:TEA) | A$3.20 | A$6.04 | 47% |

| Ridley (ASX:RIC) | A$2.86 | A$5.64 | 49.3% |

| Praemium (ASX:PPS) | A$0.63 | A$1.16 | 45.6% |

| Polymetals Resources (ASX:POL) | A$0.885 | A$1.55 | 42.9% |

| PointsBet Holdings (ASX:PBH) | A$1.195 | A$2.03 | 41.1% |

| Nanosonics (ASX:NAN) | A$4.18 | A$6.94 | 39.8% |

| Infomedia (ASX:IFM) | A$1.155 | A$1.98 | 41.5% |

| Fenix Resources (ASX:FEX) | A$0.285 | A$0.47 | 39.3% |

| DroneShield (ASX:DRO) | A$1.845 | A$3.41 | 45.9% |

| Charter Hall Group (ASX:CHC) | A$19.06 | A$33.88 | 43.7% |

Let's review some notable picks from our screened stocks.

Mader Group (ASX:MAD)

Overview: Mader Group Limited is a contracting company that offers specialist technical services in the mining, energy, and industrial sectors both in Australia and internationally, with a market cap of A$1.22 billion.

Operations: The company's revenue is primarily derived from its Staffing & Outsourcing Services segment, which generated A$811.54 million.

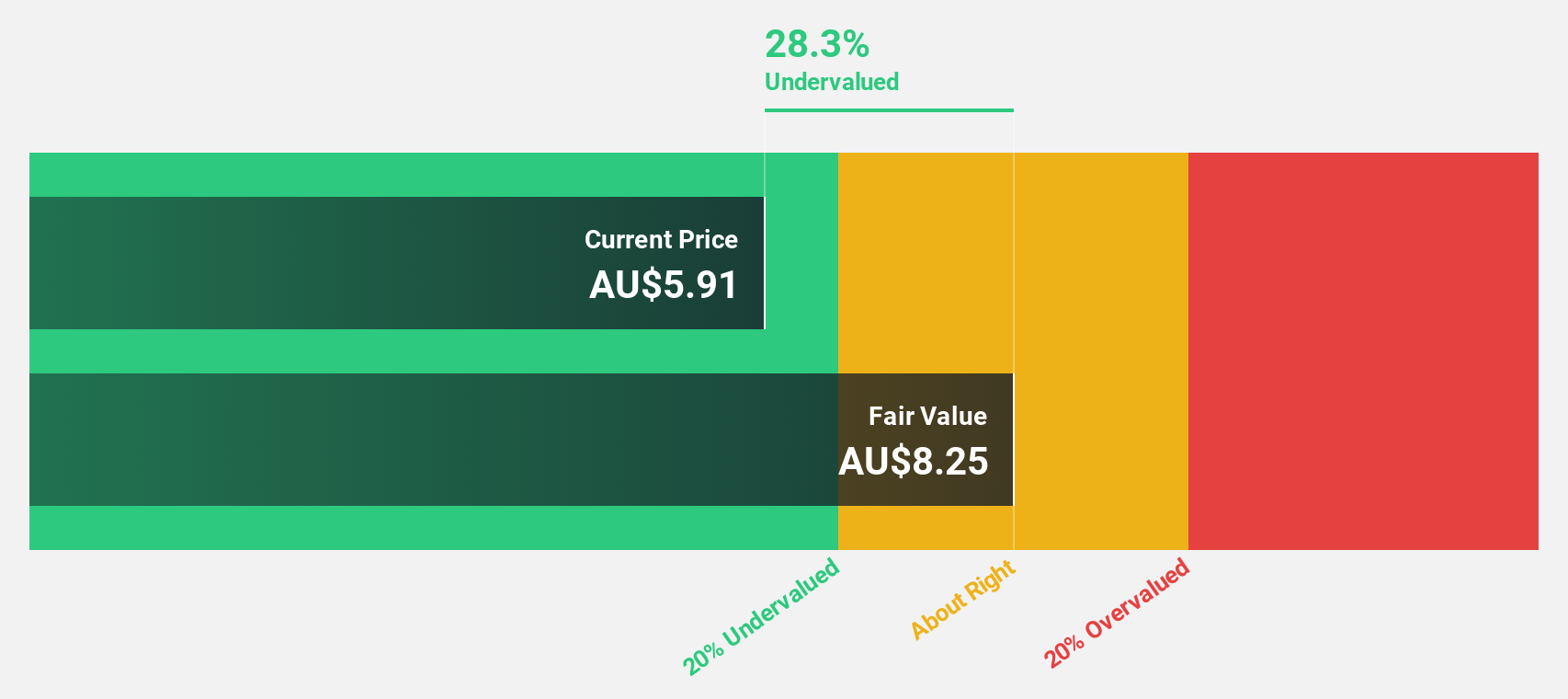

Estimated Discount To Fair Value: 26.5%

Mader Group is trading at A$6.06, significantly below its estimated fair value of A$8.25, indicating it may be undervalued based on cash flows. Despite forecasted revenue growth of 11.1% per year being slower than 20%, it surpasses the Australian market average of 5.6%. Earnings are expected to grow by 13.48% annually, outpacing the market's 11.6%. With a high future return on equity forecasted at 24.1%, Mader presents strong investment potential amidst current undervaluation.

- According our earnings growth report, there's an indication that Mader Group might be ready to expand.

- Click here to discover the nuances of Mader Group with our detailed financial health report.

Nick Scali (ASX:NCK)

Overview: Nick Scali Limited, with a market cap of A$1.59 billion, is involved in the sourcing and retailing of household furniture and related accessories across Australia, the United Kingdom, and New Zealand.

Operations: The company's revenue primarily comes from its furniture retailing segment, generating A$492.63 million.

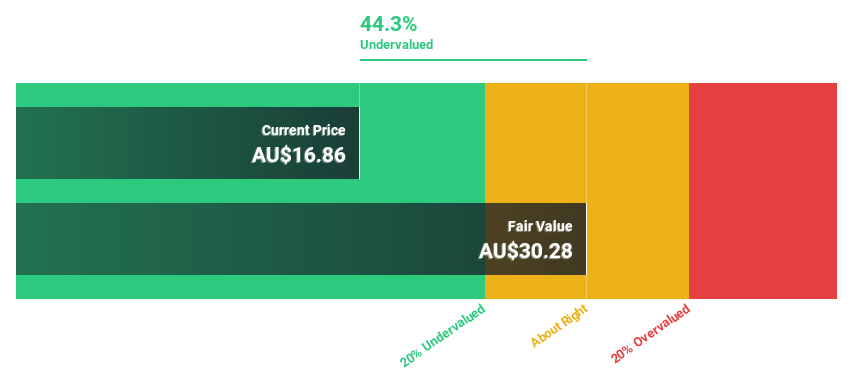

Estimated Discount To Fair Value: 33.6%

Nick Scali, trading at A$18.56, is considerably below its estimated fair value of A$27.93, highlighting potential undervaluation based on cash flows. Its revenue growth forecast of 8.4% annually exceeds the Australian market average of 5.6%, while earnings are expected to rise by 12.42% per year, surpassing the market's 11.6%. The company anticipates a high future return on equity at 28.3%. Recent CFO transition plans ensure continued strategic financial leadership amidst expansion efforts.

- Our earnings growth report unveils the potential for significant increases in Nick Scali's future results.

- Dive into the specifics of Nick Scali here with our thorough financial health report.

Pantoro Gold (ASX:PNR)

Overview: Pantoro Gold Limited, with a market cap of A$1.34 billion, is involved in gold mining, processing, and exploration activities in Western Australia.

Operations: The company generates revenue from its Norseman Gold Project, amounting to A$289.11 million.

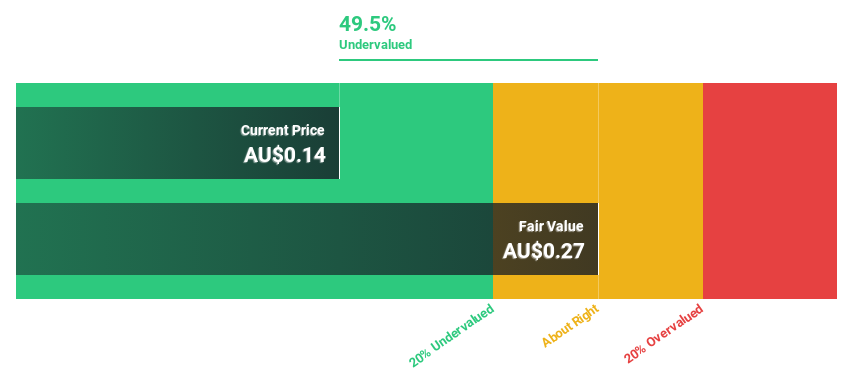

Estimated Discount To Fair Value: 38%

Pantoro Gold, currently trading at A$3.4, is significantly undervalued compared to its fair value estimate of A$5.48. With earnings projected to grow 57.28% annually and anticipated profitability within three years, it presents a compelling growth story. The company's revenue growth forecast of 19.5% per year surpasses the Australian market average of 5.6%. Recent drilling results at the OK Underground Mine support potential ore reserve upgrades, enhancing future cash flow prospects amid strategic expansion efforts.

- The growth report we've compiled suggests that Pantoro Gold's future prospects could be on the up.

- Navigate through the intricacies of Pantoro Gold with our comprehensive financial health report here.

Make It Happen

- Embark on your investment journey to our 34 Undervalued ASX Stocks Based On Cash Flows selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MAD

Mader Group

A contracting company, provides specialist technical services in the mining, energy, and industrial sectors in Australia, North America, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion