- Australia

- /

- Oil and Gas

- /

- ASX:YAL

3 ASX Dividend Stocks Yielding Up To 9.8%

Reviewed by Simply Wall St

As the ASX200 flirts with record highs, investors are navigating a landscape marked by sector volatility and economic caution, underscored by recent fluctuations in tech and healthcare stocks. In such an environment, dividend stocks offer a compelling proposition for those seeking stable income streams amid market turbulence.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Super Retail Group (ASX:SUL) | 8.28% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 8.45% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 3.13% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.71% | ★★★★★☆ |

| Lycopodium (ASX:LYL) | 7.21% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 6.85% | ★★★★★☆ |

| IPH (ASX:IPH) | 7.32% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.39% | ★★★★★☆ |

| Bisalloy Steel Group (ASX:BIS) | 9.31% | ★★★★★☆ |

| Accent Group (ASX:AX1) | 6.93% | ★★★★★☆ |

Click here to see the full list of 28 stocks from our Top ASX Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Accent Group (ASX:AX1)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Accent Group Limited operates in the retail, distribution, and franchise sectors for lifestyle footwear, apparel, and accessories across Australia and New Zealand with a market cap of A$1.13 billion.

Operations: Accent Group Limited generates its revenue primarily through Retail at A$1.30 billion and Wholesale at A$475.92 million.

Dividend Yield: 6.9%

Accent Group's dividend yield of 6.93% places it among the top 25% of Australian dividend payers, although its payments have been volatile over the past decade. Despite this volatility, dividends are well-covered by both earnings (payout ratio: 87.5%) and cash flows (cash payout ratio: 40.5%). Recent strategic agreements with Frasers Group, including a significant equity offering raising A$60.45 million, aim to bolster growth through expanded retail operations in Australasia and enhance future revenue streams.

- Get an in-depth perspective on Accent Group's performance by reading our dividend report here.

- According our valuation report, there's an indication that Accent Group's share price might be on the cheaper side.

NRW Holdings (ASX:NWH)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NRW Holdings Limited operates through its subsidiaries to offer diversified contract services in the resources and infrastructure sectors across Australia, with a market capitalization of A$1.30 billion.

Operations: NRW Holdings Limited generates revenue through its key segments: MET (A$853.22 million), Civil (A$776.06 million), and Mining (A$1.56 billion).

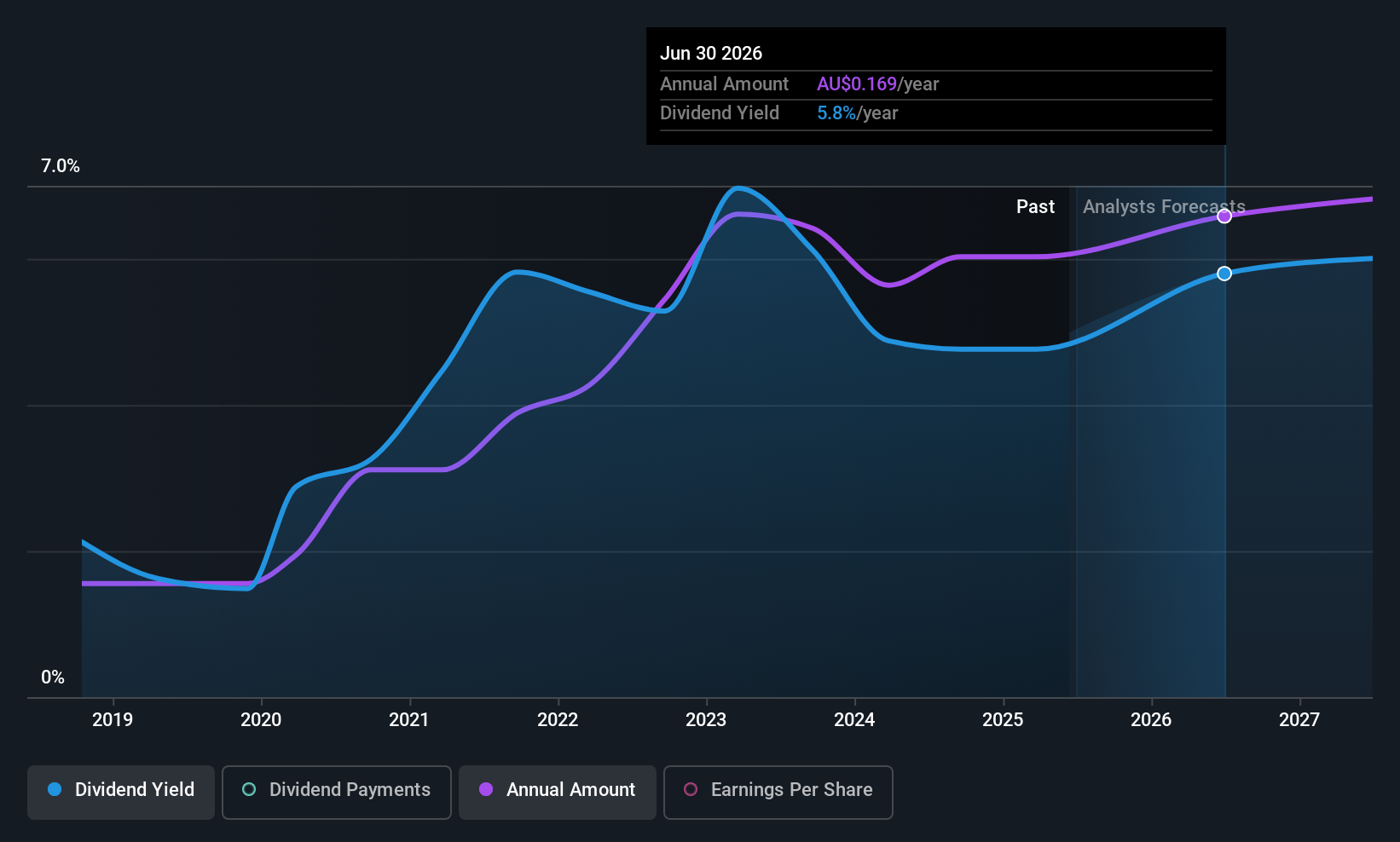

Dividend Yield: 5.4%

NRW Holdings offers a dividend yield of 5.44%, lower than the top 25% in Australia, with dividends covered by earnings (63.4% payout ratio) and cash flows (55.3% cash payout ratio). Despite a history of unstable payments, dividends have grown over the past decade. Trading at 41.1% below estimated fair value, it presents good relative value compared to peers. The recent appointment of CFO Peter Bryant may impact financial strategy positively given his extensive industry experience.

- Dive into the specifics of NRW Holdings here with our thorough dividend report.

- The valuation report we've compiled suggests that NRW Holdings' current price could be quite moderate.

Yancoal Australia (ASX:YAL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yancoal Australia Ltd is involved in the exploration, development, production, and marketing of metallurgical and thermal coal across multiple countries including Australia and several in Asia and Europe, with a market cap of A$6.96 billion.

Operations: Yancoal Australia's revenue segments consist of A$6.18 billion from Coal Mining in NSW and A$584 million from Coal Mining in QLD.

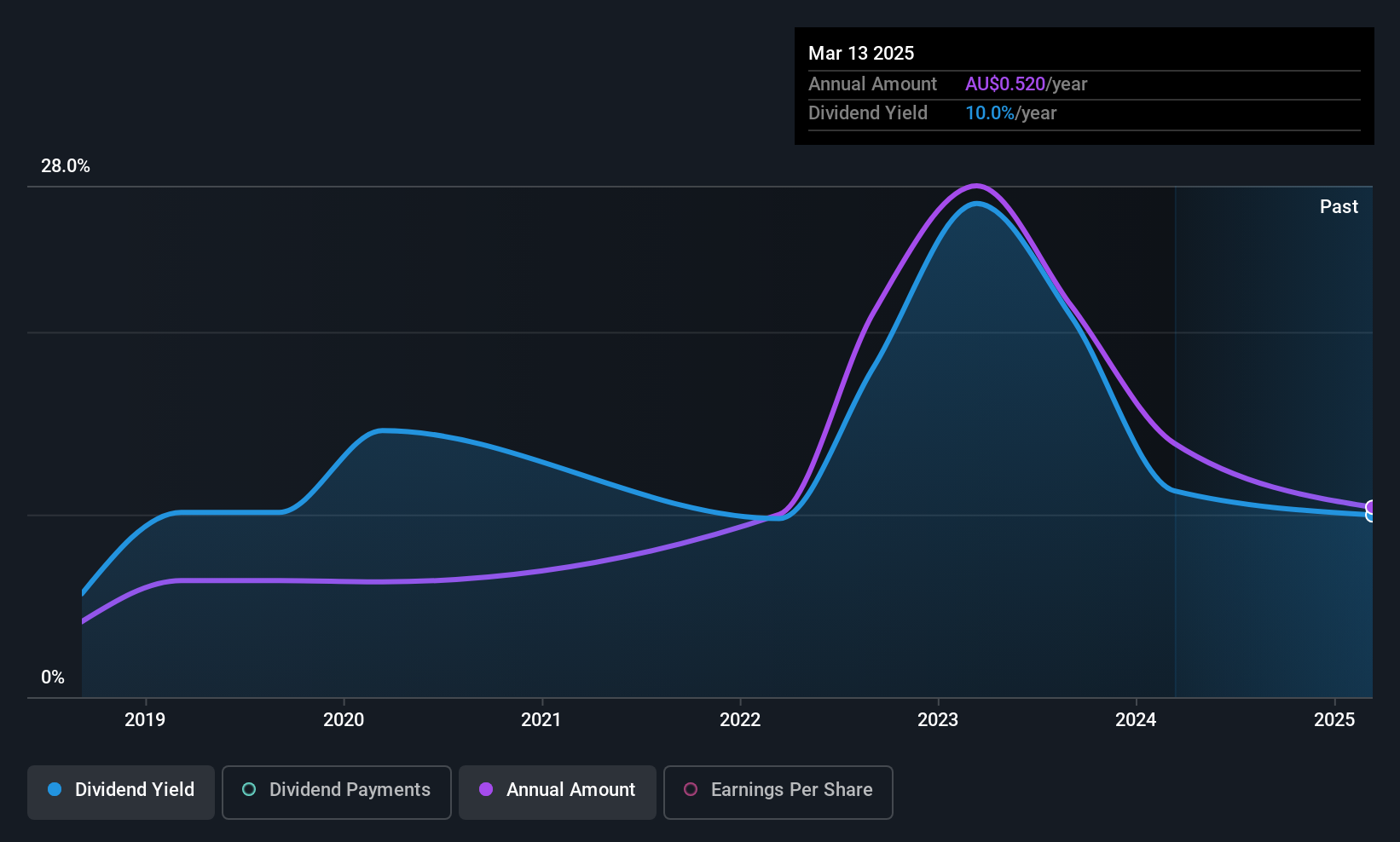

Dividend Yield: 9.9%

Yancoal Australia's dividend yield of 9.87% places it in the top 25% of Australian dividend payers, with dividends covered by earnings (56.3% payout ratio) and cash flows (48.1% cash payout ratio). However, its dividend history is less stable, with volatility over the past seven years despite recent increases. The company trades at a favorable price-to-earnings ratio of 5.7x compared to the market's 17.9x, though future earnings are expected to decline by an average of 5.5% annually over three years. Recent production results showed growth in ROM coal and saleable coal outputs compared to last year.

- Navigate through the intricacies of Yancoal Australia with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Yancoal Australia's share price might be too pessimistic.

Summing It All Up

- Explore the 28 names from our Top ASX Dividend Stocks screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:YAL

Yancoal Australia

Engages in the exploration, development, production, and marketing of metallurgical and thermal coal in Australia, China, Japan, Taiwan, South Korea, Thailand, Vietnam, Malaysia, India, Europe, Israel, Chile, Indonesia, Cambodia, and Bangladesh.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives