As the ASX 200 began the new financial year trading flat, with utilities leading sector gains and telecommunications lagging behind, investors are keeping a close eye on dividend stocks as a potential source of steady income. In an environment where certain sectors show resilience, identifying dividend stocks that offer attractive yields can be a prudent strategy for those seeking reliable returns amidst fluctuating market conditions.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Super Retail Group (ASX:SUL) | 8.30% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 8.20% | ★★★★★☆ |

| Ricegrowers (ASX:SGLLV) | 6.28% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 3.36% | ★★★★★☆ |

| Lycopodium (ASX:LYL) | 7.45% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 6.89% | ★★★★★☆ |

| IPH (ASX:IPH) | 7.59% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.60% | ★★★★★☆ |

| Bisalloy Steel Group (ASX:BIS) | 9.18% | ★★★★★☆ |

| Accent Group (ASX:AX1) | 9.22% | ★★★★★☆ |

Click here to see the full list of 28 stocks from our Top ASX Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

IVE Group (ASX:IGL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: IVE Group Limited operates in the marketing sector in Australia, with a market capitalization of A$439.42 million.

Operations: IVE Group Limited's revenue primarily comes from its advertising segment, which accounts for A$975.43 million.

Dividend Yield: 6.3%

IVE Group offers a compelling dividend yield of 6.32%, ranking in the top 25% among Australian dividend payers. Its dividends are well-supported by both earnings and cash flows, with payout ratios of 66.7% and 26.7%, respectively, suggesting sustainability despite its high debt levels. However, investors should note the company's volatile and unreliable dividend history over its nine-year record, which may raise concerns about future stability despite recent strong earnings growth of A$179 million last year.

- Click here to discover the nuances of IVE Group with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of IVE Group shares in the market.

Steadfast Group (ASX:SDF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Steadfast Group Limited operates as a general insurance brokerage firm across Australasia, Asia, and Europe with a market cap of A$6.61 billion.

Operations: Steadfast Group Limited generates revenue primarily from its Insurance Intermediary segment, which accounts for A$1.63 billion, and its Premium Funding segment, contributing A$120.20 million.

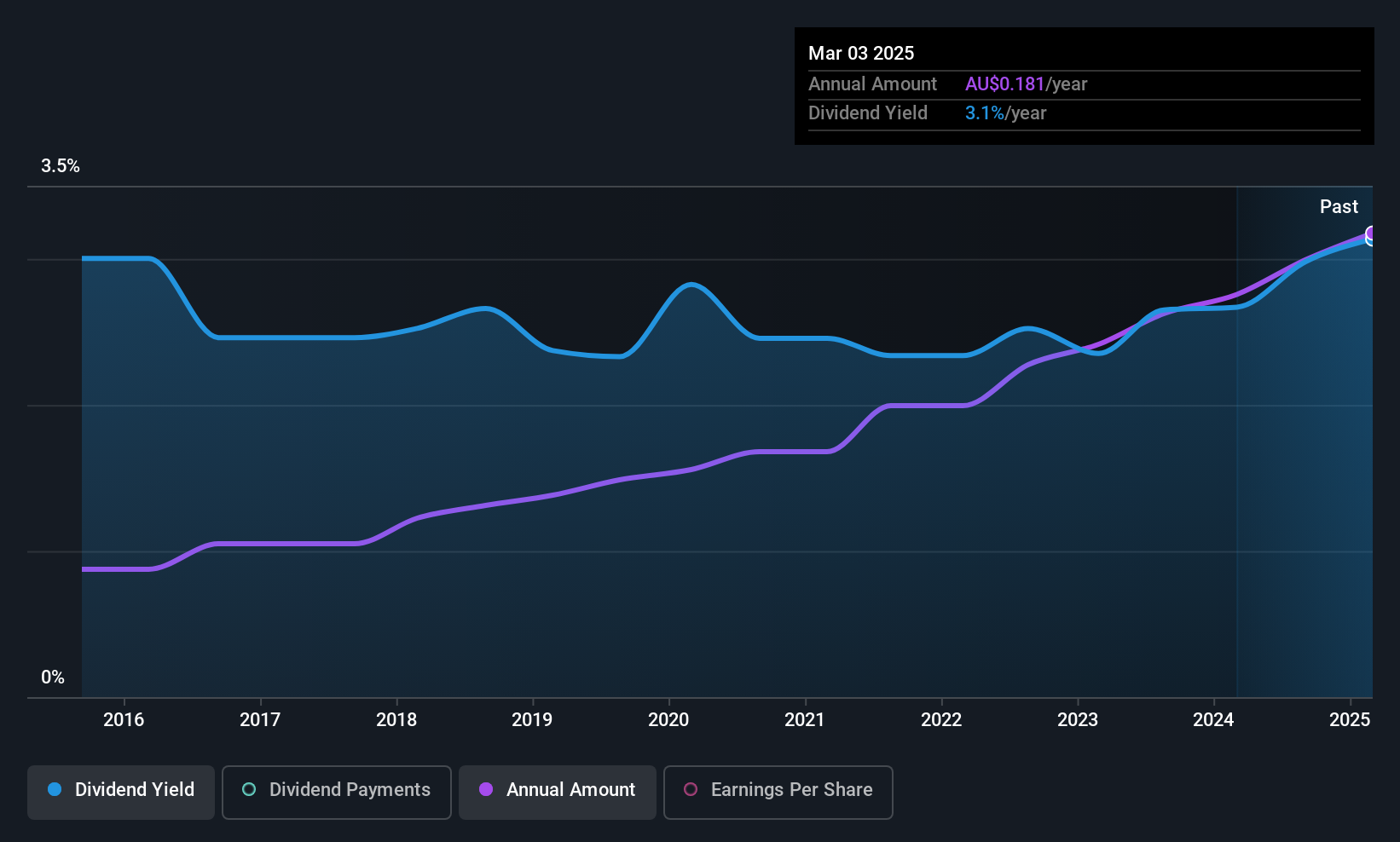

Dividend Yield: 3%

Steadfast Group's dividends are supported by earnings and cash flows, with payout ratios of 85.8% and 43.1%, respectively, indicating sustainability despite high debt levels and a volatile dividend history. Trading at A$4 billion, it offers a low yield of 3.03% compared to top-tier Australian dividend stocks but has shown substantial earnings growth of 33.9% annually over five years, although past dividend reliability remains a concern for investors.

- Unlock comprehensive insights into our analysis of Steadfast Group stock in this dividend report.

- According our valuation report, there's an indication that Steadfast Group's share price might be on the expensive side.

Ricegrowers (ASX:SGLLV)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ricegrowers Limited is a rice food company with operations across Australia, New Zealand, the Pacific Islands, Europe, the Middle East, Africa, Asia, and North America and has a market cap of A$671.48 million.

Operations: Ricegrowers Limited generates revenue through several segments, including Riviana (A$231.14 million), Cop Rice (A$250.64 million), Rice Food (A$132.53 million), Rice Pool (A$481.87 million), Corporate Segment (A$26.93 million), and International Rice (A$860.96 million).

Dividend Yield: 6.3%

Ricegrowers Limited offers a compelling dividend yield of 6.28%, ranking in the top 25% of Australian payers, with recent increases reflecting growth. Despite a history of volatility, dividends are currently sustainable with coverage by earnings and cash flows at payout ratios of 63.2% and 57.3%. Recent earnings report shows net income growth to A$68.41 million, supporting the dividend's stability amidst trading at significant value below its estimated fair value.

- Click here and access our complete dividend analysis report to understand the dynamics of Ricegrowers.

- The analysis detailed in our Ricegrowers valuation report hints at an deflated share price compared to its estimated value.

Summing It All Up

- Dive into all 28 of the Top ASX Dividend Stocks we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SDF

Steadfast Group

Provides general insurance brokerage services Australasia, Asia, and Europe.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion