3 Asian Stocks Estimated To Be Up To 48.5% Below Intrinsic Value

Reviewed by Simply Wall St

Amid the backdrop of significant trade developments and economic shifts, Asian markets have shown resilience with notable gains in key indices. As global investors navigate these evolving conditions, identifying undervalued stocks becomes crucial; such stocks often present opportunities when their market price is perceived to be below their intrinsic value due to temporary factors or broader market trends.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zhuhai CosMX Battery (SHSE:688772) | CN¥14.07 | CN¥27.82 | 49.4% |

| SpiderPlus (TSE:4192) | ¥498.00 | ¥993.27 | 49.9% |

| Shenzhen Envicool Technology (SZSE:002837) | CN¥31.65 | CN¥62.15 | 49.1% |

| Range Intelligent Computing Technology Group (SZSE:300442) | CN¥51.51 | CN¥101.65 | 49.3% |

| Polaris Holdings (TSE:3010) | ¥221.00 | ¥433.68 | 49% |

| HL Holdings (KOSE:A060980) | ₩40950.00 | ₩81254.09 | 49.6% |

| HDC Hyundai Development (KOSE:A294870) | ₩23000.00 | ₩45711.05 | 49.7% |

| GEM (SZSE:002340) | CN¥6.68 | CN¥13.13 | 49.1% |

| Forum Engineering (TSE:7088) | ¥1206.00 | ¥2404.26 | 49.8% |

| cottaLTD (TSE:3359) | ¥433.00 | ¥851.54 | 49.2% |

Let's dive into some prime choices out of the screener.

Simcere Pharmaceutical Group (SEHK:2096)

Overview: Simcere Pharmaceutical Group Limited is an investment holding company that focuses on the research, development, manufacture, and sale of pharmaceutical products in China with a market cap of approximately HK$30.54 billion.

Operations: The company generates revenue primarily through its pharmaceuticals segment, which accounts for CN¥6.64 billion.

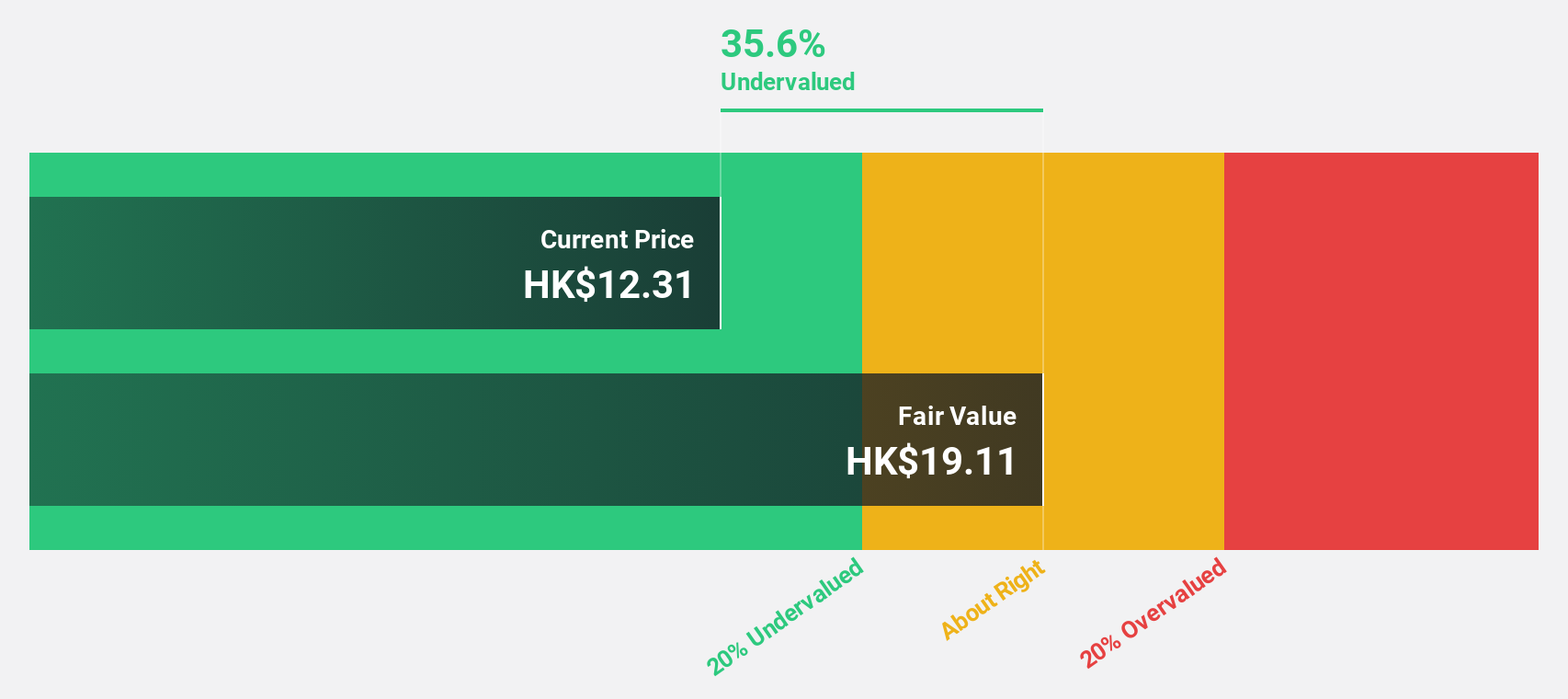

Estimated Discount To Fair Value: 35.6%

Simcere Pharmaceutical Group is trading at a significant discount to its estimated fair value, with shares priced at HK$12.34 compared to a fair value estimate of HK$19.16. Recent product approvals and partnerships, such as the NDA acceptance for Rademikibart and approval of ENZESHU®?, highlight potential revenue growth opportunities. Despite low forecasted return on equity, earnings are expected to grow significantly at 22.87% annually, outpacing the Hong Kong market's average growth rate.

- Our growth report here indicates Simcere Pharmaceutical Group may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Simcere Pharmaceutical Group's balance sheet health report.

Chugai Pharmaceutical (TSE:4519)

Overview: Chugai Pharmaceutical Co., Ltd. is involved in the research, development, manufacture, sale, importation, and exportation of pharmaceuticals both in Japan and internationally, with a market cap of ¥12.08 trillion.

Operations: The company generates revenue primarily from its pharmaceuticals segment, amounting to ¥1.20 trillion.

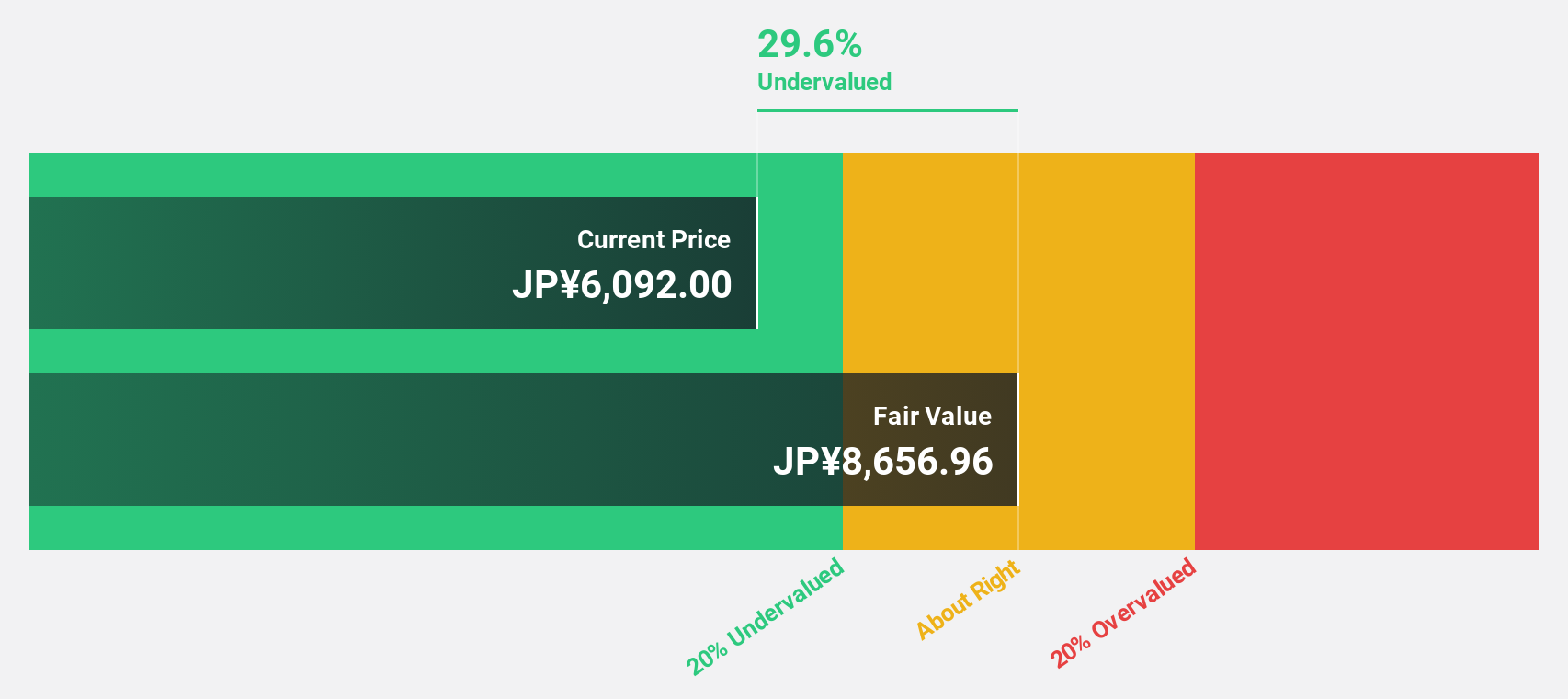

Estimated Discount To Fair Value: 14.0%

Chugai Pharmaceutical is trading at ¥7,341, below its fair value estimate of ¥8,539.88. Earnings are projected to grow 8.17% annually, outpacing the Japanese market's average growth rate. Recent strategic alliances, including a collaboration with Gero PTE for age-related therapies and a research agreement with Rani Therapeutics Holdings for drug delivery innovations, underscore potential future revenue streams despite recent share price volatility and moderate profit growth forecasts.

- The analysis detailed in our Chugai Pharmaceutical growth report hints at robust future financial performance.

- Dive into the specifics of Chugai Pharmaceutical here with our thorough financial health report.

Nan Ya Printed Circuit Board (TWSE:8046)

Overview: Nan Ya Printed Circuit Board Corporation manufactures and sells printed circuit boards (PCBs) across Taiwan, the United States, Mainland China, Korea, and internationally, with a market cap of approximately NT$116.63 billion.

Operations: The company's revenue is primarily derived from its operations in Asia (NT$14.61 billion) and domestic sales (NT$23.26 billion), with a smaller contribution from America (NT$31.62 million).

Estimated Discount To Fair Value: 48.5%

Nan Ya Printed Circuit Board is trading at NT$180.5, significantly below its estimated fair value of NT$350.42, highlighting potential undervaluation based on cash flows. Earnings are expected to grow substantially at 62.4% annually, surpassing Taiwan's market average growth rate of 13.1%. Despite recent executive changes and a dividend decrease to TWD 1 per share, the company reported improved Q1 earnings with sales reaching TWD 8.46 billion and net income of TWD 207.47 million compared to a previous loss.

- In light of our recent growth report, it seems possible that Nan Ya Printed Circuit Board's financial performance will exceed current levels.

- Click here to discover the nuances of Nan Ya Printed Circuit Board with our detailed financial health report.

Where To Now?

- Unlock our comprehensive list of 263 Undervalued Asian Stocks Based On Cash Flows by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2096

Simcere Pharmaceutical Group

An investment holding company, engages in the research, development, manufacture, and sale of pharmaceutical products to distributors, pharmacy chains, and other pharmaceutical manufacturers in China.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives