- Thailand

- /

- Marine and Shipping

- /

- SET:RCL

3 Asian Dividend Stocks Yielding Up To 8.6%

Reviewed by Simply Wall St

As global markets navigate a landscape marked by trade negotiations and economic data fluctuations, investors are increasingly turning their attention to Asian dividend stocks as a potential source of steady income. In this context, selecting dividend stocks that offer robust yields can be an attractive strategy for those looking to capitalize on the region's diverse economic backdrop while potentially benefiting from stable cash flows.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.48% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.21% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.36% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.37% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.39% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.52% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.31% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.46% | ★★★★★★ |

| Daicel (TSE:4202) | 4.86% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.12% | ★★★★★★ |

Click here to see the full list of 1198 stocks from our Top Asian Dividend Stocks screener.

We'll examine a selection from our screener results.

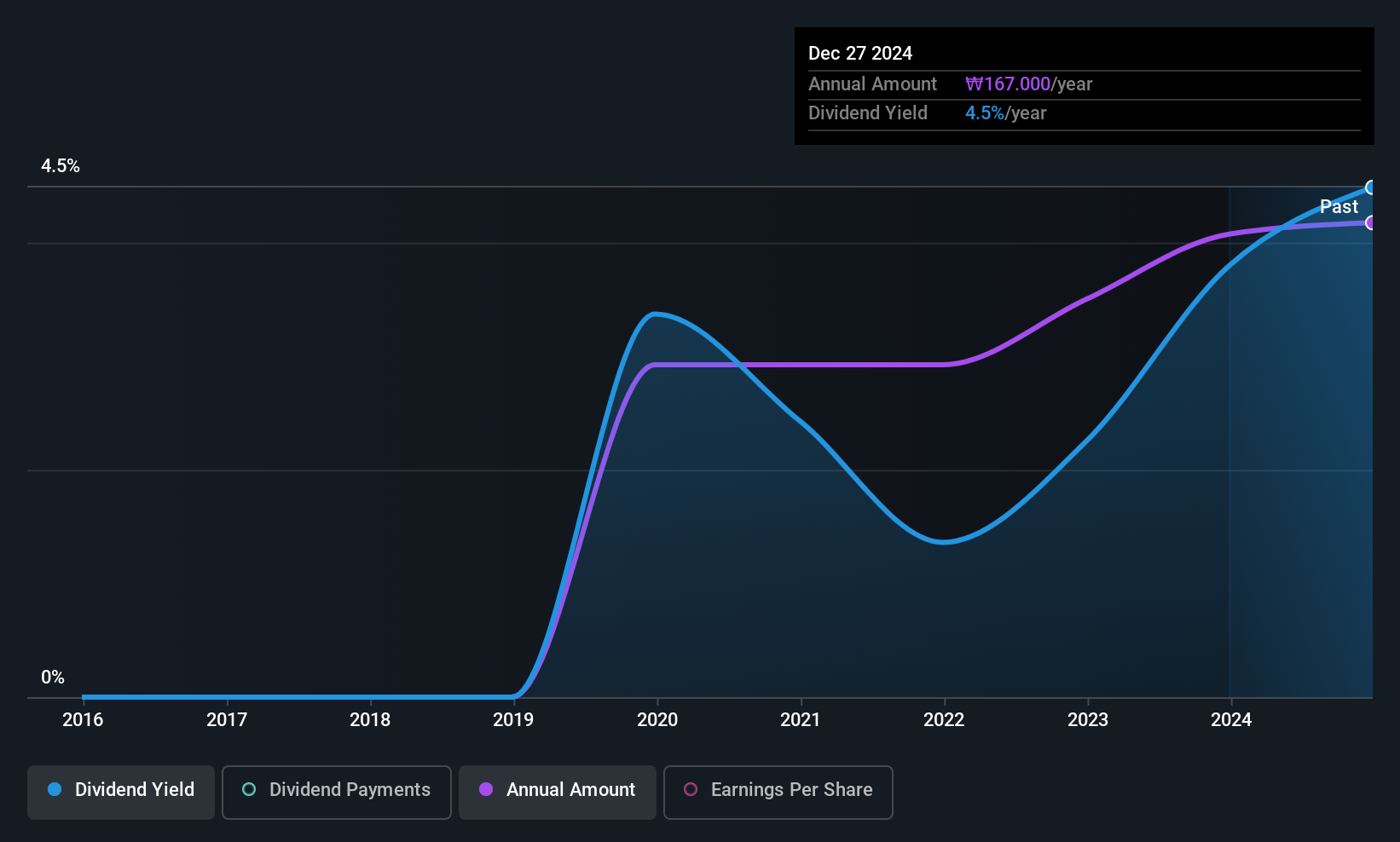

GOLFZON HOLDINGS (KOSDAQ:A121440)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: GOLFZON HOLDINGS Co., Ltd. operates in the golf, sports, health, and lifestyle sectors both in South Korea and internationally through its subsidiaries, with a market cap of approximately ₩255.79 billion.

Operations: GOLFZON HOLDINGS Co., Ltd.'s revenue primarily comes from its Distribution Business, generating approximately ₩320.69 billion, followed by Landlord activities at ₩62.40 billion and Golf Course Rental at ₩7.46 billion.

Dividend Yield: 3.9%

GOLFZON HOLDINGS offers a compelling dividend profile with payments covered by earnings (20.9% payout ratio) and cash flows (47.9% cash payout ratio). Despite having paid dividends for less than 10 years, the company maintains stable and reliable distributions, ranking in the top 25% of KR market dividend payers with a yield of 3.93%. Recent buybacks and significant earnings growth bolster its financial position, enhancing its appeal as a dividend stock in Asia.

- Navigate through the intricacies of GOLFZON HOLDINGS with our comprehensive dividend report here.

- The valuation report we've compiled suggests that GOLFZON HOLDINGS' current price could be quite moderate.

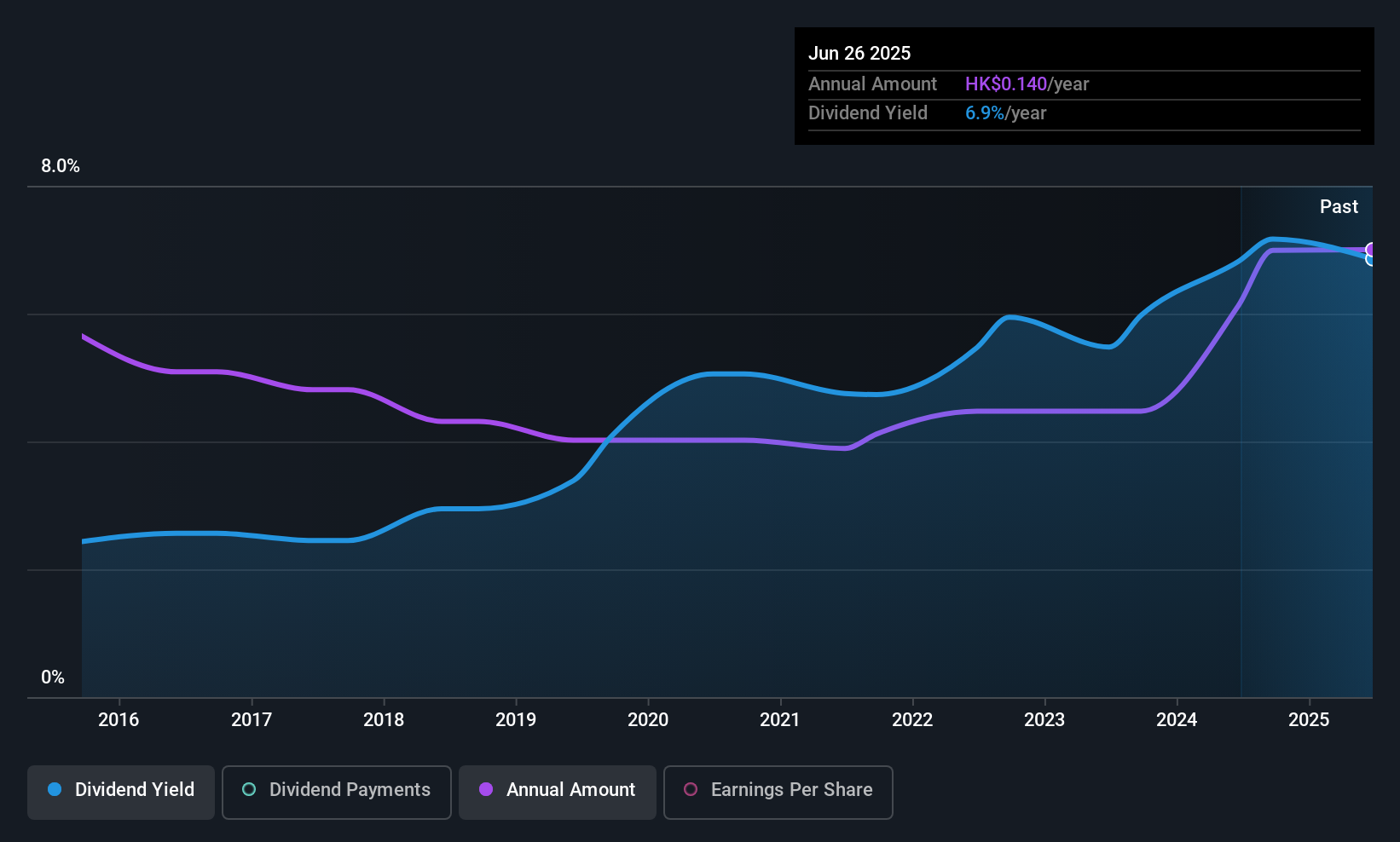

Tianjin Development Holdings (SEHK:882)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tianjin Development Holdings Limited, with a market cap of HK$2.53 billion, operates through its subsidiaries to supply water, heat, thermal power, and electricity to industrial, commercial, and residential customers in the People’s Republic of China.

Operations: Tianjin Development Holdings Limited generates revenue primarily from its Pharmaceutical segment (HK$1.61 billion), followed by Utilities (HK$1.44 billion), Electrical and Mechanical (HK$171.79 million), and Hotel operations (HK$134.23 million).

Dividend Yield: 5.9%

Tianjin Development Holdings declared a final dividend of HK$0.0882 per share for 2024, maintaining its reliable and stable 10-year dividend history. Despite a low payout ratio of 27.4%, the dividend yield of 5.93% falls short compared to Hong Kong's top payers at 7.11%. The dividends are not covered by free cash flows, raising sustainability concerns despite trading at a discount to fair value with large one-off items affecting earnings quality.

- Dive into the specifics of Tianjin Development Holdings here with our thorough dividend report.

- Our expertly prepared valuation report Tianjin Development Holdings implies its share price may be lower than expected.

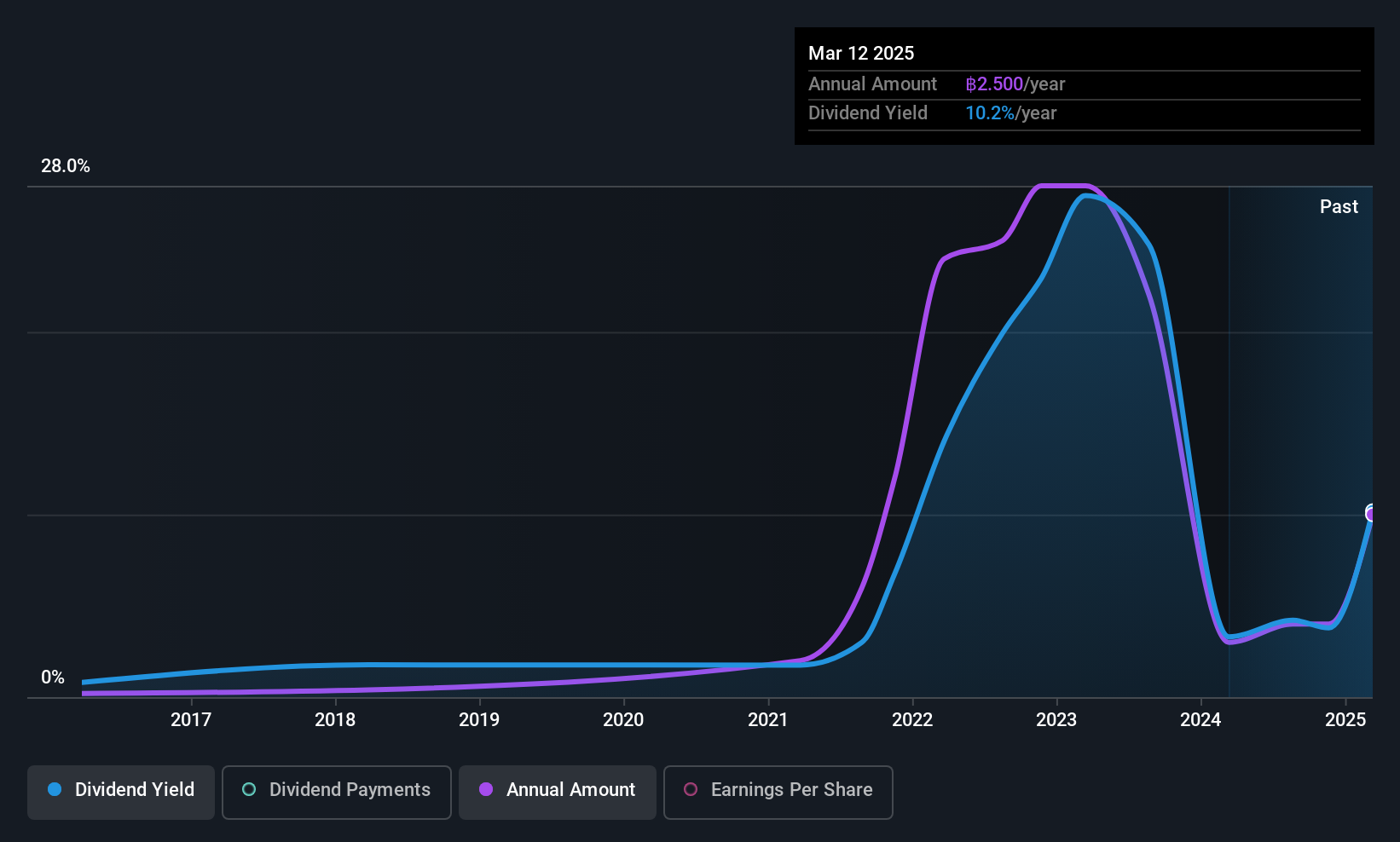

Regional Container Lines (SET:RCL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Regional Container Lines Public Company Limited operates feeder and vessel services across Thailand, Singapore, Hong Kong, China, Taiwan, and internationally with a market cap of THB24.03 billion.

Operations: Regional Container Lines generates revenue of THB37.62 billion from its feeder and vessel operations across multiple regions, including Thailand, Singapore, Hong Kong, China, and Taiwan.

Dividend Yield: 8.6%

Regional Container Lines' dividend yield of 8.62% ranks among the top in Thailand, though its sustainability is questioned due to lack of free cash flow coverage. Despite a low payout ratio of 19.5%, dividends have been volatile over the past decade, with inconsistent growth patterns. Recent financials show strong earnings growth, with net income rising to THB 2.06 billion for Q1 2025, yet high non-cash earnings may affect perceived quality and reliability of payouts.

- Delve into the full analysis dividend report here for a deeper understanding of Regional Container Lines.

- According our valuation report, there's an indication that Regional Container Lines' share price might be on the expensive side.

Taking Advantage

- Unlock our comprehensive list of 1198 Top Asian Dividend Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:RCL

Regional Container Lines

Engages in the feeder and vessel operations in Thailand, Singapore, Hong Kong, the People’s Republic of China, Taiwan, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives