Key Takeaways

- Costco may be overvalued, but its stable profitability indicates that it can catch-up in five years

- Growing the number of warehouses still makes sense, despite the lower returns

- Its own Kirkland brand, and eComm will contribute to margin expansion

- The special dividend is a working capital optimization tactic that also incentivizes investors to hold

- Membership fee increases may degrade loyalty, and act as a negative catalyst for the stock

Catalysts

Kirkland Signature's Growing Presence on Shelves Could Increase Margins

Costco is a customer-centric company, with a $300B market cap and $246B in annual revenue. Its substantial purchasing power allows it to negotiate favorable deals with suppliers, enabling it to pass on savings to its members. This bulk buying strategy is crucial in maintaining Costco's competitive edge, enabling it to offer consistently low prices across a wide range of products.

The difference between Costco and traditional retail is that the latter strives to maximize the margin on every product, while Costco strives to act as a procurement agent for customers that minimizes the profit margin on products while maintaining profitability from memberships.

Instead of offering more products, Costco holds a comparably lower number of product types per warehouse (around 4000, while peers such as Walmart tend to have around 15000). The lower selection allows Costco to focus on procuring quality stock for customers, which builds brand loyalty as customers know that they can get meaningfully better deals at Costco. The smaller selection of products is easier to manage, and has a high return on capital, enabling the company to operate profitably with lower gross margins. For comparison, while Costco has a gross margin of 12.4%, Walmart has 24.3%, Dollar General 30.6%, Target 26.8%, Home Depot 33.4%, Kroger 22%. In essence, Costco’s cheap bulk products are the value proposition for customers, and as long as it’s not losing money on turnover, it creates value from membership fees.

Costco is developing its store brand Kirkland Signature, centered on providing quality products (as opposed to a focus on cheap pricing). The company is leveraging its distribution network and customer loyalty to make Kirkland a recognised brand, and has found opportunities to replace branded products with Kirkland, which costs less to produce.

Costco: Kirkland Signature Landing Page

It seems that the approach is working, and management has noted that Kirkland is more profitable (p. 8) than comparable brand products. As a route to future profitability Costco may replace a number of branded products with their in-house brand, and cash in the margin difference.

High Membership Retention Will Lead To Predictable Profits

By charging an annual fee and retaining customer loyalty, Costco is able to ensure profitability despite economic downturns, so long as customers keep coming back and renewing. It is important to understand that the company is close to breakeven on product sales, but drives profitability from membership fees. Therefore, the key predictor to the company’s success is the number of memberships, and the resulting margin.

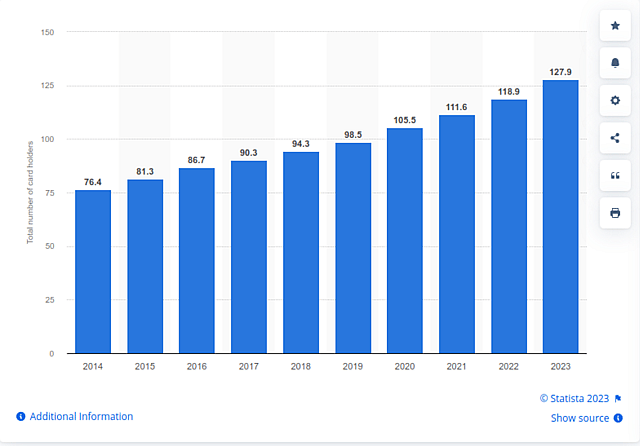

Statista: Costco’s Historical Card Holders

In Q1 ’24, membership fees brought in $1.082B, a 8.2% YoY increase from $1B in Q1 '23. Costco had a 1.56% operating margin from sales excluding memberships and a total operating margin of 3%. This means that memberships drive more than 50% of the operating profits.

In 2023 (p. 3) total memberships were 71M, bringing in $4.6B in revenue. Customers show a high level of satisfaction with the memberships, since Costco has a 90% yearly renewal rate.

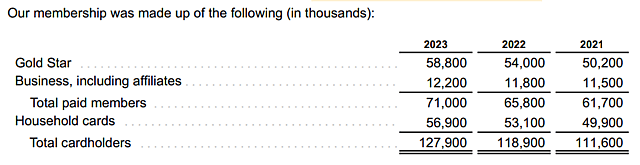

Costco: Customer Memberships Breakdown (p. 6)

There are three key membership types: Gold Star (individual or household) and Business (for business owners), both costing $60 per year. The third option is the Executive membership, costing $120 but with additional perks and discounts, such as a 2% reward on all purchases, and benefits for Costco Travel and Costco Insurance Services.

Membership Fee Increase Seems Likely

Costco investors and analysts have been speculating on a possible increase in membership fees as a way to drive profitability. This is not confirmed, but the existing priced-in enthusiasm may end up being a negative catalyst for the company. An increase in the membership fees would have a direct effect on operating profits and free cash flows.

While this is a possible scenario for 2024/25, there may be a few reasons why management may decide to refrain from increasing fees soon:

- The company just announced a special dividend, which is a signal that they have excess cash. Announcing a membership fee increase at this time would damage the brand as customers may feel that the company is starting a profitability squeeze.

- Costco may have the ability to develop two additional profitability avenues by developing their own Kirkland brand, and their eCommerce branch.

- Finally, managing to operate at such slim margins is Costco’s unique competitive advantage and their insurance policy against unpredictable competitors such as Amazon, and to a lesser extent Walmart.

White it may be inevitable that we see a fee increase, management may be staving off the decision in an attempt to build up the business, retain brand reputation, and put pressure on competitors.

A Special Dividend Encourages Investors To Hold

One of the ways Costco optimizes working capital is to delay paying a larger dividend at regular periods, employ the cash elsewhere, and pay a higher special dividend every few years. This approach also incentivises shareholders to keep the stock for longer with the built-in expectation for the dividend. This may have an effect on the stock’s resilience, as investors hold off on selling the stock.

In December 2023, Costco announced a special cash dividend of $15 per share, payable on January 12, 2024. This marked the company's fifth special dividend in the past 11 years, indicating its strong financial position and commitment to rewarding its shareholders.

With a stock price of around $680 the $15 special dividend yields 2.2%. Costco has around $17.9B in cash and an expected payout of $6.7B from the dividend, indicating that the dividend is affordable. For anyone who held the stock below $400, that special dividend alone is delivering a 3.75% yield (or higher the cheaper you bought).

Emerging Markets Are A High ROI Growth Avenue

Costco has several factors pointing towards sustained growth. The company's financial position allows it to seize opportunities in emerging markets and expand its e-commerce presence. Costco currently operates 871 warehouses, 600 of which are in the US. The company has also expanded into China, Japan, and South Korea where there was initial skepticism on the expansion, but the company quickly discovered a cultural fit with customers and their business grew.

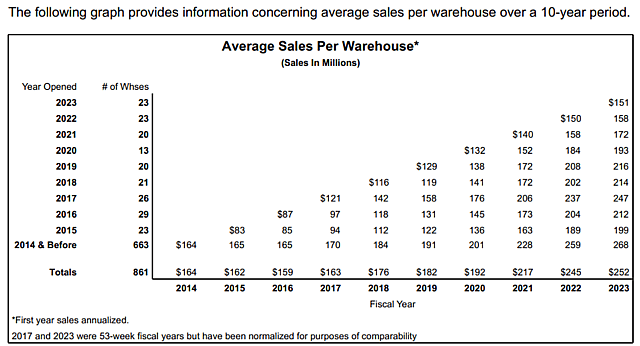

Costco is still opening warehouses, and we can see their performance in the chart below:

Costco: Average Sales Per Warehouse Since 2014 (p. 20)

The global average sales per warehouse has increased from $164M in 2014, to $252M in 2023. However, the average return per new store opened after 2014 is steadily decreasing from $268M in 2014 to $151M in 2023.

This poses the question, “given the slowdown in returns, should the company keep expanding physical stores?” My sense is yes, because Costco still produces a return on capital employed of 23.6%, indicating a productive growth strategy. The company is targeting to open 33 new warehouses, slightly higher than the 9-year average of 22, indicating that growth may accelerate in the coming years.

As high-return warehouse locations are becoming harder to acquire, Costco is left with expanding in highly competitive markets like Central Europe, or higher risk emerging markets. My estimate is that emerging markets are a better growth avenue for the company, and we’ll see more of those locations open up, especially in countries with low online shopping culture.

Costco’s High-Return Approach To Ecommerce Will Increase Profits

While Costco has been late (2017) to embrace eCommerce, the company is now pushing on online ordering and in-store pickup.

Costco is very disciplined at taking on projects with a high return on capital, this is why we see a lower number of offered items, a lower number of warehouses - 800+, vs. Walmart’s 10k+, and low employee turnover. Applying this approach means that Costco will develop eCommerce in areas where it’s the most valuable. This is why I expect the growth in eCommerce to be accompanied by an increase in profit margins.

In the latest earnings call, management noted a 6.1% growth in eComm sales, which were also driven by higher volume:

“Costco Logistics enjoyed record-breaking deliveries in the first quarter of fiscal '24,” added Galanti. “We completed over 800,000 deliveries, which were up 17% versus the comparable quarter last year.”

Costco also has a highly optimized supply chain that it will leverage for eCommerce. The company is able to ship directly from its established depots and partners, effectively cutting out the need to establish additional warehouses.

On the flip side, growing competition from Amazon, and rising eComm rivals like Walmart are a threat to Costco's physical business, as consumers increasingly turn to online shopping platforms.

Assumptions

- Business: Costco has grown revenues at around 11% per year over the last 5 years. I assume that it will grow sales slightly slower going forward at an average rate of 7% in the next 5 years, resulting in $345B of revenue in 2028. This will be driven by warehouse expansion, especially in emerging markets, execution on their in-house brand Kirkland, and an uptake in eCommerce.

- Margins: I assume that the increasing profitability of Kirkland, growth in eCommerce, and a possible increase in membership fees in the next three years will contribute to increased operating margins in the next five years. I estimate that Costco increases operating margins from 3.4% to 4.2%, reaching an EBIT of $14B in 2028.

- Projection: I expect the company to convert 65% of their operating profit to net profit (i.e. 35% of operating profit to be spent on interest and taxes), resulting in $9.1B.

- Outstanding shares: Costco’s number of diluted shares has been slightly increasing due to utilizing stock-based compensation. I expect this to be stable over the years, as I see Costco as a company focused on dividends and policies that cater to retail investors.

- Valuation Multiple: The stock currently trades at 45x earnings, and despite it being an incredibly high quality business, it is also a mature, low growth business. That is why I believe that the multiple investors are paying is too high, and I believe the multiple will re rate lower to around 30x earnings.

Risks

- The main risk to my narrative revolves around the fact that the valuation multiple may not lower due to multiple reasons.

- Costco’s investor mix (31% general public) may be incentivised to buy and hold the stock in anticipation of future special dividends and membership fee hikes.

- The current 46x PE ratio may be justified as a function of the low risk nature of the business and an expectation from investors of future margin expansion (and therefore higher future profits).

How well do narratives help inform your perspective?

Disclaimer

Simply Wall St analyst Goran_Damchevski holds no position in NasdaqGS:COST. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives