Key Takeaways

- Expansion of physical locations and private label offerings, along with supply chain investments, will drive sustained revenue growth, efficiency, and long-term market share gains.

- Strengthening digital engagement and rising member loyalty, particularly among younger customers, will accelerate e-commerce impact and recurring high-margin fee income.

- Heavy dependence on membership renewal, regulatory changes, e-commerce competition, and supply chain risks threaten Costco's margin stability and long-term revenue growth.

Catalysts

About Costco Wholesale- Engages in the operation of membership warehouses in the United States, Puerto Rico, Canada, Mexico, Japan, the United Kingdom, Korea, Australia, Taiwan, China, Spain, France, Iceland, New Zealand, and Sweden.

- While analyst consensus recognizes network expansion will add to revenue, the pace and scale of global urbanization and value-seeking consumer behavior may drive even stronger-than-expected traffic, same-store sales, and membership penetration, especially as new locations cannibalize and unlock additional capacity in overcrowded U.S. markets-implying sustained double-digit revenue growth and higher-than-anticipated membership fee income over the next several years.

- Analyst consensus highlights digital and e-commerce growth, but with digital engagement and mobile app adoption still at an early stage and personalizing omnichannel experiences improving quarterly, Costco is positioned to accelerate e-commerce's share of total sales at a faster trajectory, leading to significant scale leverage and net margin uplift as digital becomes a robust incremental contributor to both U.S. and international earnings.

- The rapid expansion of Costco's Kirkland Signature and organic/private label offerings in response to demand for healthier, sustainable products will meaningfully grow the company's total addressable market, increasing long-term market share in key grocery and nonfood categories-which is likely to structurally raise both gross margins and customer lifetime value.

- Costco's investments in supply chain technology, automation, and localized sourcing, combined with leading scale, will allow it to both absorb external cost shocks (such as potential future tariffs or supply disruptions) and structurally lower SG&A and cost of goods sold, supporting higher EBIT margins than currently modeled by the market.

- Increasing member loyalty, particularly among younger and digitally-acquired customers, coupled with expansion of Executive Memberships globally, will drive long-term recurring high-margin fee growth; this can provide a stable, compounding base for earnings even in adverse macro environments, which is underappreciated in current valuation multiples.

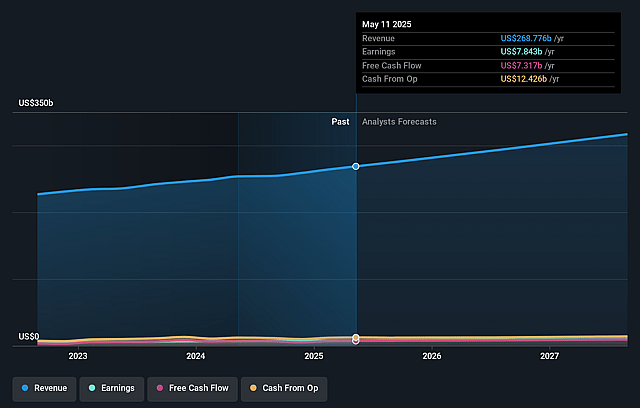

Costco Wholesale Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Costco Wholesale compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Costco Wholesale's revenue will grow by 8.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 2.9% today to 3.4% in 3 years time.

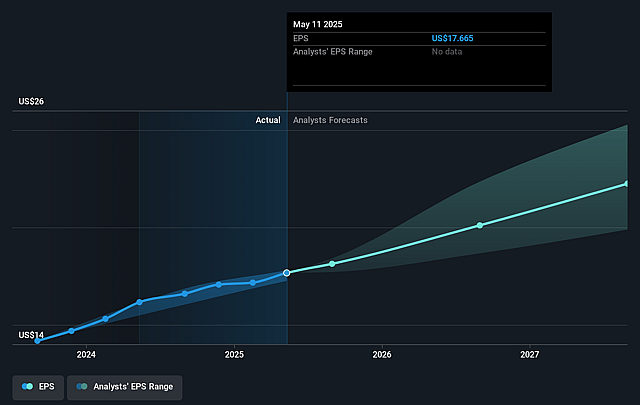

- The bullish analysts expect earnings to reach $11.9 billion (and earnings per share of $26.87) by about September 2028, up from $7.8 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 55.8x on those 2028 earnings, up from 55.4x today. This future PE is greater than the current PE for the US Consumer Retailing industry at 21.7x.

- Analysts expect the number of shares outstanding to grow by 0.09% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Costco Wholesale Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The aging population and declining birth rates in developed markets may slow long-term demand growth and limit Costco's ability to expand its membership base, constraining top line revenue growth over time.

- Costco's heavy reliance on annual membership fees exposes it to risk if renewal rates or pricing power decline, particularly as digital signups and international members-both of which currently renew at lower rates-grow as a proportion of the base, which could negatively impact recurring revenue and net margins.

- The continued growth and innovation of e-commerce rivals may erode Costco's traditional warehouse traffic and put pressure on margins if Costco cannot match the scale and convenience of online-only competitors, potentially weakening earnings growth.

- Rising regulatory complexity, including potential changes to labor, environmental, and trade (tariff) regimes, creates operational headwinds and could drive up compliance costs globally, putting pressure on operating margins and profitability.

- High private label (Kirkland) penetration, while advantageous in the short term, increases Costco's vulnerability to supply chain disruptions, shifts in consumer preference, or competitive pricing changes, any of which could compress gross margins and affect overall earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Costco Wholesale is $1225.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Costco Wholesale's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $1225.0, and the most bearish reporting a price target of just $620.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $347.0 billion, earnings will come to $11.9 billion, and it would be trading on a PE ratio of 55.8x, assuming you use a discount rate of 6.8%.

- Given the current share price of $979.25, the bullish analyst price target of $1225.0 is 20.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.