Last Update 05 Nov 24

Fair value Increased 14%Visa Posts Another Solid Quarter, Expects To Continue Growth

- Visa grew 10% in the last 12 months, slightly above my estimates.

- The company is facing a DOJ lawsuit because of its large market share and allegations of pressuring competitors.

- TTM net income grew 14% to 19.7B. With a 55% margin, Visa has shown resilience and is above my profitability estimate.

- I’m extending my 9.1% revenue CAGR and 50% net margin estimates to 2029.

- Despite trading at a premium, I think that Visa has the ability to grow into its fundamentals in the next few years.

Visa reported a Q4’24 net revenue growth of 12% to $9.6B YoY. The annual growth was $35.9B, slightly above my estimated 9% annual CAGR, and well underway to my 2028 target estimate of $48.3B. I will be extending my growth estimate to 2029, leading to an updated revenue target of $52.65B.

The key drivers for fiscal year growth were cross-border transactions, up by 15%, and payments volume, up by 8%.

Management issued guidance expecting high single, to low-double-digit revenue growth for FY’25, with incentives and cross-border payments being the key drivers.

Operating expenses are expected to track revenue growth, indicating that the company will maintain current levels of efficiency, despite wide AI adoption as noted in the earnings call.

Quarterly and FY net income rose 14% to $5.3B and $19.7B respectively. This is higher than my estimated $18.4B as Visa has shown resilience on their brand and pricing power.

My target margin of 50% is lower than Visa’s current 55% net margin, and I estimate that competition and regulation will slowly pressure the company’s margins in the next five years. I am maintaining my 5-year net profit margin estimate, which results in $26.3B for 2029.

In FY 2024, the company returned $16.6B via buybacks, and $4.22B in dividends, marking a total of $20.82B in returns to investors. Net of $850M in stock-based compensation, this represents a 3.7% adjusted yield. This indicates that despite growth, Visa’s is also generating a sizable cash return for investors.

DOJ Targets Visa On Antitrust

On September the 24th, the Department Of Justice (DOJ) filed an antitrust lawsuit against Visa. On the earnings call, Visa reiterated that they will fight the allegations. However, management’s tone on call resembled a willingness to work with the government. In my view, the payments landscape is clearly dominated by Visa and Mastercard, however this position is mostly earned, and there are plenty of well-funded competitors in the space. In this regard, I suspect there will be no clear case against Visa, and regardless of the election outcome, I suspect that the next administration will not have the political capital or willingness to keep pushing campaigns against large companies.

Valuation Update

Management’s guidance and the performance thus far is fairly consistent with my forward estimates. I expect this to continue in the next 5-years, which is why I am maintaining and extending my forward estimates to 2029.

Using my 22x PE and $27.8B earnings in 2029, I estimate Visa’s forward value to be around $611B. Discounted back using a 6.9% rate, I get a present value of $438B or $243 per share.

Relative to my narrative, it seems that the company continues to be traded at a premium, slightly below the 5-year forward value. Given Visa’s stable performance and continued growth expectations, investors may be able to justify the premium if the same assumptions hold in the future.

Key Takeaways

- Well-positioned to benefit from the continued growth of digital payments and the international market

- Investing heavily in B2B and cross border payments for new revenue growth

- Has a wide moat, and a large serviceable market, but investor expectations are already high

- Additionally the Credit Card Competition Act could be a major negative catalyst

- Risks to my narrative include stronger than expected US consumer, and increased use of Visa network from future Fintech.

Catalysts

The Benefits of Visa’s Global Reach

Visa processes more than $11.6 trillion in gross dollar volume (GDV), made up primarily of digital payments with the remainder being things like ATM withdrawals, B2B transactions, etc. Alongside Mastercard, which is en-route to process $9.2 trillion, this makes Visa one of the two largest payment processors in the world. The company evidently has a wide moat that is targeted by competitors and regulators.

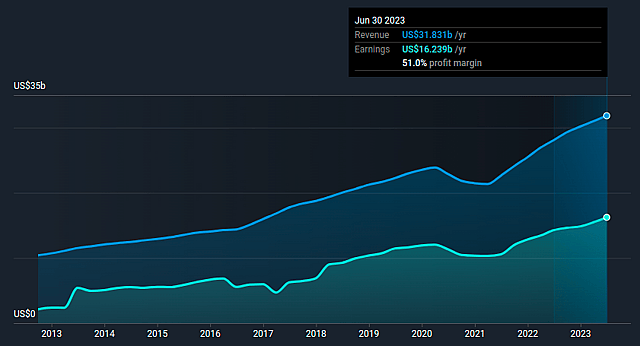

Simply Wall St: Visa’s historical revenue and earnings

While many competitors such as Block (SQ) and Paypal (PYPL) seek to penetrate the high-margin space, Visa is well-positioned to benefit from the continued growth of digital payments and serve as a foundation for digital transactions with a wide moat that can be difficult to substitute.

Digital payments, a core part of Visa’s transaction value, are estimated (2) to reach a $9.5 trillion GDV in 2023, and grow to $12 trillion in 2025.

The Credit Card Competition Act May Be A Major Negative Catalyst

Acknowledging that the passing of this act is not a given, investors may see a large portion of the profits of payment processors like Visa wiped out should this law pass. In its current proposition, the legislation would enable merchants to choose an alternative payment processor (one that isn’t Visa or Mastercard) to execute payments for their customers.

Merchants instead of customers are the ones covering payment processing fees, so they have a large incentive to route payments to the cheapest competitor. Inevitably, Visa will be forced to lower their payment fees to compete with these cheaper alternatives, thereby compromising a key income stream.

Large companies like Walmart and Amazon will especially benefit from this change as they stand to reduce the fees paid to processors like Visa and Mastercard.

I estimate that this bill or a compromised version of it will pass, and erode Visa’s oligopolistic moat, and therefore their margins and net profits.

Visa Will Only Capture 30% of Serviceable Addressable Market

In 2021, the US value of non-cash payments was estimated to be over $128.51 trillion

I estimate a Total Addressable Market (TAM) of $100 trillion to $150 trillion, based off data from the US plus the rest of the world.

But I think that a more realistic Serviceable Addressable Market (SAM - What Visa’s share of the TAM could be) for Visa is between $50 trillion and $75 trillion.

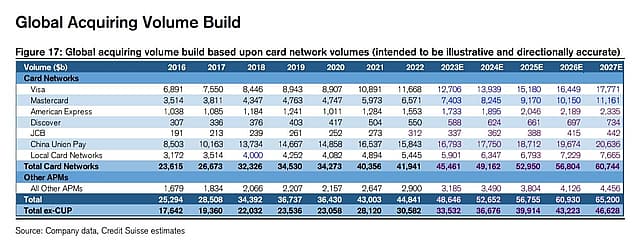

Alternative data: Global acquiring volume estimates (gross dollar value - GDV) for key peers

Alternative data estimates indicate that the global SAM for card networks will grow to $60 trillion in 2027. Of the SAM midpoint of $62.5 trillion by 2028, I estimate that Visa manages to capture 30% resulting in a GDV of $18.75 trillion.

Visa had a take rate of about 0.2247% for the last 9 months, up 9.4% YoY from 0.2054%. Assuming Visa captures my estimated GDV of $18.75 trillion, the revenue in 2028 comes up to $42.2 billion (5.8% CAGR revenue growth)

As most of the developed world already prefers cards, Visa will find it more difficult to open up international markets, so I expect the company to reach this high-point.

The International Segment Is A Primary Revenue & Growth Driver

Much of Visa’s growth comes from international markets, and there are two key verticals to watch for the company: e-commerce and B2B cross-border payments.

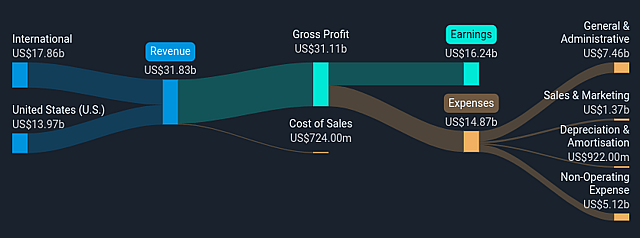

Simply Wall St: Visa’s revenue breakdown by segments

E-commerce is growing rapidly, and Visa is the leading payment processor for online transactions, making it well-positioned to capture this growing market.

Visa is also expanding into business-to-business (B2B) payments and cross-border payments. These markets have a lot of potential, and Visa is investing heavily to capitalize on these opportunities.

Assumptions

Revenue growth to slow slightly from 9.7% to 9% p.a.

- I expect revenues to grow at a 9% CAGR in the next five years, reaching $48.28 billion, due to the already high market share and difficulty in growing in emerging markets. For context, Visa’s 5-Year revenue CAGR is 9.7%, which I consider an upper limit given the already captured market share.

Regulatory and Competitive Headwinds to Pressure Margins

- I view negative regulatory and competitive headwinds pressuring profit margins, resulting in a stabilized margin of 50% in five years. This yields earnings of $24.14 billion.

Buybacks To Accelerate

- The company has reduced its share count by 2.2% on average in the last 2 years, and I expect that trend to accelerate to 2.5% p.a. by 2028, given that Visa has a combined payout ratio of dividends and buybacks of 85%. This results in a reduced share count to 1.8 billion.

Valuation Multiple to Re-rate Lower

- A high PE is indicative of growth, and I think that investors' sentiment will decline once they start viewing Visa as a maturing company. For this reason, I think Visa will re-rate to a lower PE of 22.2x in 2028.

Risks

Economic Resilience on US Consumer

- The U.S. consumer may prove more resilient than anticipated, and Visa may continue riding the growth wave in international markets, offsetting economic slumps.

Fintech Developers Use Visa Network More Than Expected

- Fintech companies are developing innovative payment solutions. However the Web-3 industry has been underwhelming in its attempt to replace traditional payment processors. Future FinTech developers may opt to use Visa’s infrastructure instead of trying to disrupt the widely established company.

Have other thoughts on Visa?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

Simply Wall St analyst Goran_Damchevski holds no position in NYSE:V. Simply Wall St has no position in any companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.