Last Update 03 Feb 26

Fair value Increased 2.22%IREN: AI Power Capacity Expansion Will Drive Transformative Multi Year Contract Upside

Narrative Update on IREN

The analyst price target in our framework has shifted to align more closely with the recent Street move toward $80, with a modest fair value adjustment to about $84.85 as analysts highlight IREN's large AI contract with Microsoft and its sizeable planned capacity buildout as key drivers in their updated views.

Analyst Commentary

Recent Street research on IREN has shifted meaningfully, with several bullish analysts now highlighting the AI contract pipeline and power capacity story, while earlier caution around execution and financing remains in the background. Here is how the commentary breaks down.

Bullish Takeaways

- Bullish analysts describe the coming period as potentially "transformative," citing IREN's positioning in AI infrastructure and high performance compute as a key driver behind their higher price targets near US$80.

- They point to IREN's AI contract with Microsoft as one of the largest AI deals among bitcoin miners, which they see as a support for revenue visibility and a reason to assign a higher fair value multiple.

- Some research calls out IREN's development pipeline of over 2 GW of incremental capacity expected to be fully energized by 2027, viewing this as meaningful growth optionality if projects are executed as planned.

- Coverage initiations with positive ratings reference "critically scarce" power supply for AI and GPU clusters, suggesting that tight supply and strong pricing in high performance compute could underpin the investment case for IREN's buildout.

Bearish Takeaways

- Bearish analysts have previously pointed to "underwhelming" fiscal Q1 results, arguing that near term financial performance does not yet match the longer term AI ambitions embedded in some valuation targets.

- There is concern around IREN's "lofty" AI cloud revenue guidance for 2026, with some viewing the current outlook as aggressive relative to the execution steps still required.

- Execution and financing risks are described as "quite high," reflecting the scale of the planned 2 GW capacity expansion and the capital required to bring that pipeline fully online.

- Some commentary highlights "significant risks" to IREN meeting its 2026 revenue outlook, which could pressure the stock's valuation if the company falls short of current expectations.

What's in the News

- Media coverage highlights IREN among bitcoin miners that are repurposing data centers for AI workloads, with AI contracts described as a new source of large customers as traditional mining activity faces cooler cryptocurrency pricing (Wall Street Journal).

- IREN completed a follow on equity offering of approximately US$1.63b, issuing 39,699,102 ordinary shares at a price of US$41.12 per share in a registered direct transaction.

- Prior to completion, IREN filed for a follow on equity offering of ordinary shares through a registered direct structure, signaling an intent to raise additional equity capital.

- KPMG LLP was appointed as IREN's independent registered public accounting firm on November 27, 2025, following a board approved recommendation by the Audit and Risk Committee. Prior auditor reports included a going concern explanatory paragraph for the fiscal year ended June 30, 2024.

- At the 2025 Annual General Meeting on November 19, 2025, shareholders approved multiple amendments to the company constitution. These included updated quorum requirements aligned with Nasdaq rules, annual director elections, a forum selection provision, and revised advance notice provisions for universal proxies.

Valuation Changes

- Fair Value: Adjusted slightly from US$83.00 to about US$84.85, reflecting a modest tweak in the model inputs rather than a wholesale shift in view.

- Discount Rate: Moved marginally from 8.11% to about 8.05%, a small change that slightly affects the present value of projected cash flows.

- Revenue Growth: Held effectively flat at about 73.81%, indicating no material change in the long term growth assumptions used in the model.

- Net Profit Margin: Inched up from roughly 17.32% to about 17.34%, signaling a very small adjustment in expected profitability over time.

- Future P/E: Ticked up from roughly 58.13x to about 59.25x, implying a slightly higher valuation multiple being used for IREN in future periods.

Key Takeaways

- Vertical integration and strategic partnerships strengthen IREN's growth in AI cloud and data center markets, supporting higher margins and future competitiveness.

- Flexible business model and efficient financing provide resilience, enabling shifts to higher-margin sectors and sustaining earnings amid industry changes.

- Heavy reliance on debt-funded expansion, volatile revenues, rising energy costs, competitive pressures, and regulatory risks threaten profitability, cash flow stability, and long-term growth.

Catalysts

About IREN- Operates in the integrated data center business.

- Rapid expansion into AI cloud services, fueled by IREN's vertical integration and direct-to-chip liquid cooling data centers, positions the company to capitalize on accelerating demand for AI infrastructure; this is expected to significantly boost long-term revenue growth and improve EBITDA margins due to recurring, high-margin AI cloud contracts.

- Secured expansion of grid-connected power and proprietary data centers (now at nearly 3GW and 810MW of operational capacity), enables IREN to serve both the digital currencies mining and AI compute sectors, offering flexibility to pivot toward higher-margin segments as market opportunities evolve; this bodes well for future revenue visibility and capital efficiency.

- Strengthened cost position through low all-in cash mining costs ($36,000/Bitcoin) and access to low-cost, renewable power ($0.035/kWh), puts IREN at an advantage in a consolidating industry, supporting robust net margins and sustainable earnings even as weaker miners exit post-halving.

- Strong institutional partnerships and designation as an NVIDIA preferred partner unlock access to next-generation GPU supply and broaden IREN's customer pipeline, positioning the company to benefit from greater institutional adoption of digital assets and advanced computing-supporting both topline growth and long-term competitiveness.

- Successful and capital-efficient financing strategies (e.g., 100% non-dilutive GPU financings at low rates, robust cash reserves), enable IREN to scale AI and data center business lines without undue leverage, securing the required capital for expansion and reducing future risk to net margins and cash flow.

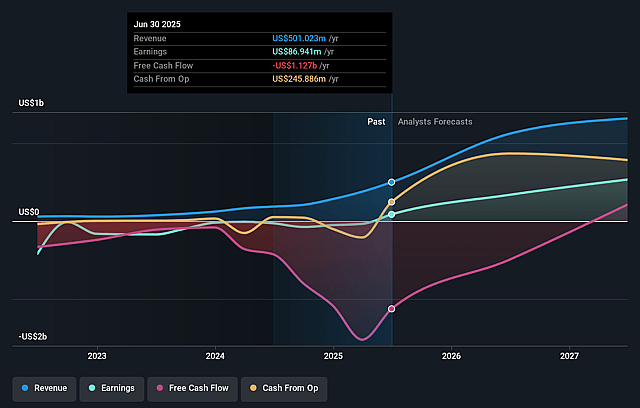

IREN Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming IREN's revenue will grow by 45.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 17.4% today to 66.6% in 3 years time.

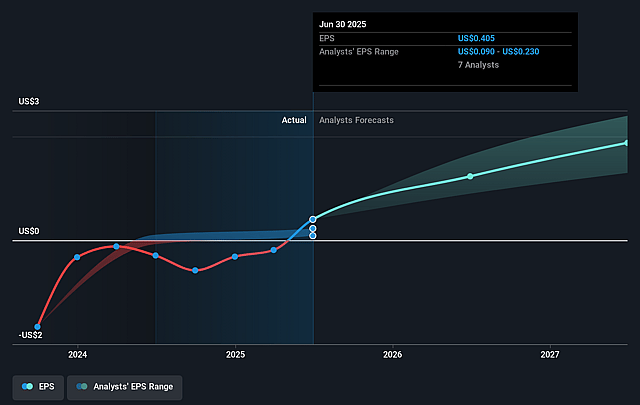

- Analysts expect earnings to reach $1.0 billion (and earnings per share of $3.31) by about September 2028, up from $86.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.8x on those 2028 earnings, down from 88.3x today. This future PE is lower than the current PE for the US Software industry at 36.6x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.22%, as per the Simply Wall St company report.

IREN Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- IREN's heavy capital expenditures for rapid data center and GPU expansion, funded by significant debt and lease financing, risk outpacing operating cash flows-potentially leading to higher leverage, reduced free cash flow, and downward pressure on net margins if market conditions become less favorable.

- The company's revenues remain highly reliant on Bitcoin mining and, increasingly, short-term AI cloud contracts; continued earnings stability may be threatened by Bitcoin price volatility, future block reward halvings, and the relatively short contract duration for AI compute services, impacting revenue predictability and long-term cash flow.

- Rising global energy prices and potential scarcity or cost volatility in key energy markets (e.g., West Texas and British Columbia) could drive higher operating expenses and erode IREN's low-cost advantage, negatively affecting gross and net margins over time.

- The introduction of new, more efficient GPUs and ASICs from competitors, coupled with increasing customer demand for more flexible or lower-density rack configurations, could materially shorten equipment life cycles and raise the ongoing capital intensity of IREN's infrastructure, pressuring profit margins and necessitating continual high investment.

- The rapid scaling and geographic concentration of data center assets increase exposure to regulatory, environmental, and permitting risks (including ESG pressures on energy use and emissions), which may result in added compliance costs or restrictions-ultimately reducing profitability and increasing execution risk on planned expansions.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $28.727 for IREN based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $41.0, and the most bearish reporting a price target of just $16.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.5 billion, earnings will come to $1.0 billion, and it would be trading on a PE ratio of 11.8x, assuming you use a discount rate of 8.2%.

- Given the current share price of $28.21, the analyst price target of $28.73 is 1.8% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on IREN?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.