Last Update 03 Dec 25

SHAK: Margin Expansion And Development Pipeline Will Drive Long Term Earnings Upside

Analysts have modestly lowered their price target on Shake Shack, reflecting concerns about softer near term demand and traffic in a challenging environment, even as they highlight the company’s compelling same store sales trajectory, margin expansion, and development pipeline.

Analyst Commentary

Recent research notes reflect a mixed but constructive stance on Shake Shack, with modestly reduced price targets alongside acknowledgement of a healthier long term growth profile and improved risk reward following the recent share price pullback.

Bullish Takeaways

- Bullish analysts highlight a compelling same store sales trajectory and margin expansion opportunity, supporting the view that earnings power can grow faster than current valuation implies.

- Acceleration in unit development is seen as a key driver of multi year revenue growth. The current multiple is viewed as attractive relative to the company’s long term expansion runway.

- Increased marketing spend is viewed as an effective tool to stabilize traffic in a softer demand backdrop, helping execution and providing a bridge to stronger macro conditions.

- Some analysts see expectations as appropriately reset after the recent selloff, leaving a more balanced risk reward skew that could allow for upside if operating trends stabilize or improve.

Bearish Takeaways

- Bearish analysts remain cautious on near term demand, citing visible slowing in September and broader softness across fast casual and quick service that could pressure sales momentum.

- Risks to near term same store sales are viewed as a constraint on multiple expansion. Investors are described as reluctant to pay a premium valuation until traffic trends show more consistency.

- The need for elevated marketing to support traffic underscores the challenging operating environment and raises questions about sustainability of margin gains if demand does not improve.

- Lowered price targets reflect concerns that, despite a solid long term story, execution will need to be closely managed to meet growth expectations in a choppy consumer landscape.

What's in the News

- President Trump is expected to sign an order cutting tariffs on key food imports, including beef and coffee, which could lower Shake Shack's input costs and support margins in coming quarters (Bloomberg).

- Truist lowered its price target on Shake Shack shares to $146 from $156 while reiterating a Buy rating. The firm cited a compelling same store sales and margin expansion story despite near term demand headwinds (Truist research note).

- Shake Shack announced that Chief Financial Officer Katherine Fogertey will step down effective March 4, 2026, with an Office of the CFO established and a search for her successor underway to ensure continuity across financial functions.

- The company reiterated and detailed guidance for Q4 and full year 2025, projecting approximately $1.45 billion in revenue, low single digit same Shack sales growth, and restaurant level profit margins in the 22.7% to 23% range.

- Shake Shack is expanding its footprint and brand reach through a new Hawaii partnership with Union MAK Corporation, planning its first Oahu location in 2027, and through autonomous delivery pilots in Chicago via Coco Robotics on Uber Eats.

Valuation Changes

- Fair Value Estimate is unchanged at approximately $114.36 per share, indicating no adjustment to the intrinsic value assessment.

- The discount rate has risen slightly from 8.81% to about 8.88%, reflecting a marginally higher required return on equity risk.

- Revenue growth is effectively unchanged at roughly 14.88% annually, suggesting consistent expectations for top line expansion.

- Net profit margin is effectively unchanged at about 5.41%, indicating stable assumptions for long term profitability.

- Future P/E has risen slightly from 52.33x to about 52.43x, implying a modest increase in the forward valuation multiple applied to earnings.

Key Takeaways

- Menu innovation, digital upgrades, and targeted marketing are fueling stronger sales growth, brand equity, and improved guest experiences, boosting margins and long-term earnings power.

- Strategic expansion into urban, international, and experiential formats, alongside operational improvements and sustainability efforts, positions Shake Shack for sustained, system-wide revenue and margin gains.

- Rising input costs, mixed traffic growth, elevated investments, operational complexity, and geographic concentration all threaten long-term profitability and sustainable growth.

Catalysts

About Shake Shack- Owns, operates, and licenses Shake Shack restaurants (Shacks) in the United States and internationally.

- Shake Shack is making significant investments in menu innovation and a robust culinary calendar, introducing new premium offerings (e.g., limited-time Dubai Shake, expanded menu for local tastes internationally) and leveraging paid media for the first time to drive higher guest frequency and attract new customers; this is poised to accelerate comp sales growth and support higher revenue and earnings power than currently captured in estimates.

- The company's strategic focus on urban expansion and accelerated domestic and international store openings-especially in untapped markets and through new formats such as drive-thru and licensed partnerships (e.g., casinos, Panama)-directly taps into growing urbanization and demand for experiential fast-casual dining, supporting long-term, system-wide revenue growth.

- Enhanced digital capabilities (including app-focused promotions and omni-channel marketing platforms) and the adoption of smarter operational tools (e.g., labor scheduling, digital kiosks, kitchen prototyping) are improving efficiency, guest experience, and speed of service, which is already translating into higher restaurant-level margins and should further boost net margins over time.

- Operational discipline via a standardized performance scorecard, leadership development, and supply chain optimization has delivered material improvements in labor productivity and cost control, helping to offset inflationary pressures on input costs-a structural margin tailwind that seems underappreciated and should help drive sustainable earnings growth.

- The shift to omnichannel sales and a culture of brand responsibility and sustainability (e.g., community engagement, eco-friendly packaging), combined with stepped-up top-of-funnel marketing, enhances Shake Shack's ability to capture incremental sales, build brand equity with younger, urban-centric consumers, and consolidate share as weaker competitors exit, supporting long-term revenue and margin expansion.

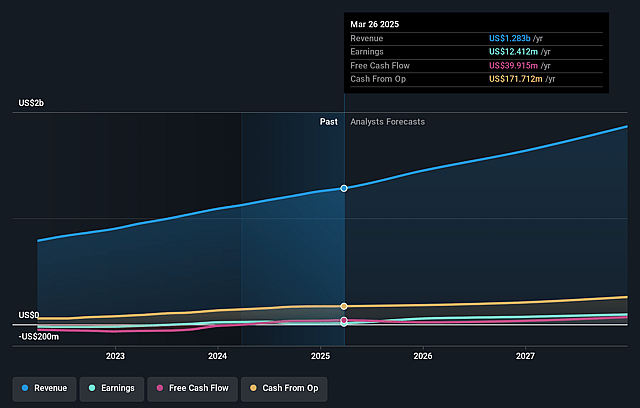

Shake Shack Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Shake Shack's revenue will grow by 14.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 1.5% today to 5.4% in 3 years time.

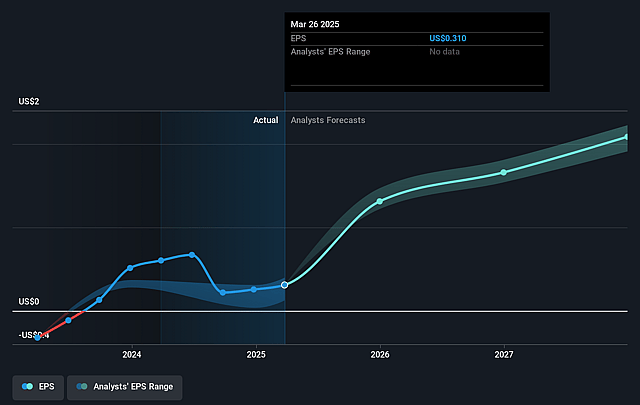

- Analysts expect earnings to reach $107.9 million (and earnings per share of $2.38) by about September 2028, up from $19.9 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 69.8x on those 2028 earnings, down from 199.0x today. This future PE is greater than the current PE for the US Hospitality industry at 23.9x.

- Analysts expect the number of shares outstanding to grow by 0.55% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.95%, as per the Simply Wall St company report.

Shake Shack Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rising beef and commodity costs (with beef inflation in the mid

- to high-single digits) may not be fully offset by operational efficiencies or supply chain optimizations, potentially pressuring net margins and earnings over time.

- Despite positive same-store sales, traffic was down year-over-year for part of the year and only turned positive after heavy promotional activity, suggesting underlying demand or competitive pressures could limit sustainable revenue growth and impact future comp sales.

- Heavy investments in marketing, technology, and accelerated store builds increase G&A and CapEx as a percentage of revenue, which, if not matched by higher-than-expected sales and margin leverage, could weigh on free cash flow and profitability.

- Menu innovation and increased operational complexity risk slowing throughput or impacting guest experience if not perfectly executed, which could dampen frequency or lower average check, risking both revenue and restaurant-level margins.

- Geographic concentration risks remain, as New York City and the Northeast, while high-margin, are underperforming in comp contribution relative to other markets, exposing Shake Shack to regional economic or demographic downturns that could negatively impact overall earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $135.476 for Shake Shack based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $162.0, and the most bearish reporting a price target of just $110.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.0 billion, earnings will come to $107.9 million, and it would be trading on a PE ratio of 69.8x, assuming you use a discount rate of 8.9%.

- Given the current share price of $98.33, the analyst price target of $135.48 is 27.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Shake Shack?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.