Key Takeaways

- Rapid innovation in operations, marketing, and new format adoption is driving outsized margin gains and expanding Shake Shack's addressable market well beyond expectations.

- Accelerated unit expansion, strong licensing partnerships, and improved organizational discipline are setting up long-term revenue growth and margin stability.

- Rising costs, evolving consumer preferences, aggressive expansion, and intensifying competition threaten Shake Shack's profitability, growth potential, and ability to diversify internationally.

Catalysts

About Shake Shack- Owns, operates, and licenses Shake Shack restaurants (Shacks) in the United States and internationally.

- Analyst consensus expects steady improvement in profit margins, but current execution is driving margin expansion at a much faster pace, with labor initiatives, kitchen innovations, and supply chain optimization yielding nearly 200 basis points of margin expansion year-over-year-the company is now tracking well above guided levels, setting up potential upside to long-term net margins and earnings.

- While analysts broadly see limited, steady comp and unit growth, Shake Shack's accelerated cadence of new Shack openings is outpacing prior expectations, backed by a pipeline and organizational infrastructure that supports system-wide unit growth in the mid-teens annually; with compounding global licensing partnerships and asset-light models, this unlocks greater revenue and accelerated cash generation than modeled.

- The move to a robust paid media and marketing strategy is in its infancy, yet initial results from targeted campaigns have exceeded internal expectations and are not factored into current sales or margin guidance-consistent, disciplined advertising could drive sustained traffic growth, premium product mix, and higher brand awareness among Gen Z and millennial consumers, materially boosting revenue and operating leverage over time.

- Strategic investments in leadership, performance management, and operational discipline-such as standardized scorecards and team development-are building an executional muscle that allows Shake Shack to open more units rapidly without compromising guest experience or margins, dramatically lowering execution risk and enhancing long-term margin stability as the brand scales.

- Shake Shack's early adoption of high-margin, premium innovation in beverages, dayparts (like breakfast in Asia), and omnichannel formats (drive-thru, app, third-party delivery) positions the brand to capture outsized share of urban, convenience-focused dining occasions, expanding its total addressable market and diversifying revenue streams at a time when consumer secular trends increasingly favor high-quality, digital-forward fast-casual experiences-setting up significant long-term upside for both top line and profitability.

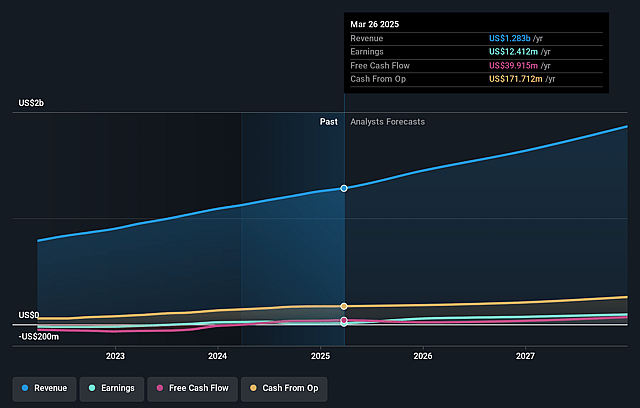

Shake Shack Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Shake Shack compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Shake Shack's revenue will grow by 16.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 1.5% today to 5.7% in 3 years time.

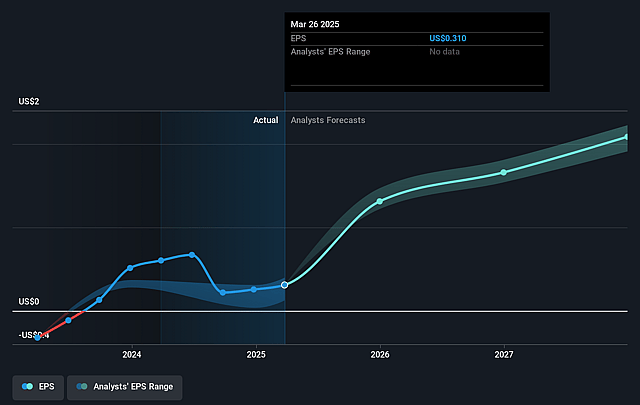

- The bullish analysts expect earnings to reach $118.2 million (and earnings per share of $2.76) by about September 2028, up from $19.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 76.2x on those 2028 earnings, down from 199.0x today. This future PE is greater than the current PE for the US Hospitality industry at 23.9x.

- Analysts expect the number of shares outstanding to grow by 0.55% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.95%, as per the Simply Wall St company report.

Shake Shack Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heightened consumer focus on health and wellness, as well as the shift toward plant-based and alternative proteins, could reduce demand for Shake Shack's core burger and shake products, posing a long-term risk to revenue growth if the company does not successfully adapt its menu.

- Continued inflation in beef and other key ingredients, alongside rising labor and occupancy costs in urban markets, threatens to shrink net margins and earnings, especially in a competitive landscape where price increases alone are unsustainable.

- The company's aggressive expansion strategy, including opening the largest class of new Shacks in its history and focusing on new formats such as drive-throughs and international locations, introduces risks of slower same-store sales growth and potential market saturation, which would directly impact top-line revenue growth.

- The international licensed business, while showing improvement in regions like China, still wrestles with limited brand awareness and operational hurdles abroad, putting constraints on global revenue diversification and the ability to generate consistent earnings from overseas markets.

- Increasing competition from both fast-casual upstarts and established quick-service chains with premium offerings, coupled with persistent pressure to invest in digital transformation and comply with regulatory mandates (such as food safety and labor practices), could siphon market share, elevate costs, and burden net margins as capital requirements escalate.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Shake Shack is $162.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Shake Shack's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $162.0, and the most bearish reporting a price target of just $110.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $2.1 billion, earnings will come to $118.2 million, and it would be trading on a PE ratio of 76.2x, assuming you use a discount rate of 8.9%.

- Given the current share price of $98.33, the bullish analyst price target of $162.0 is 39.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.