Last Update 10 Jan 26

Fair value Decreased 0.019%EH: Slower Regulatory Progress Will Still Support Future Low Altitude Upside

Analysts have trimmed their price target on EHang Holdings to reflect a relatively flat fair value estimate, along with expectations for a more gradual commercialization phase over the next 12 to 24 months, following recent research pointing to slower regulatory progress in the eVTOL sector and China's low altitude economy plan.

Analyst Commentary

Bullish and bearish analysts are reacting differently to the latest update on EHang Holdings, and that split view is feeding directly into how they think about valuation, commercialization timing, and execution risk over the next 12 to 24 months.

Bullish Takeaways

- Bullish analysts still view electric vertical take off and landing aircraft as a potential global megatrend, which supports the idea that EHang could remain part of a long term growth story even with slower near term commercialization.

- China's low altitude economy plan is seen as an important structural tailwind, giving EHang a defined policy framework that could support future demand, infrastructure, and use cases as regulations evolve.

- The more gradual commercialization phase over 12 to 24 months is interpreted by some as allowing management time to refine operations, address regulatory conditions, and prepare for scaled deployment rather than pushing for aggressive, higher risk rollouts.

- Even with a lower price target, bullish analysts may see room for upside if regulatory milestones or commercialization progress unfold more smoothly than currently reflected in the updated fair value assumptions.

Bearish Takeaways

- Bearish analysts are focused on the slower and more conditional regulatory pathway, which they see as adding uncertainty to the timing of meaningful revenue scaling and thus capping near term valuation.

- The cut in the price target to US$13 from US$21 at JPMorgan reflects a more cautious stance on the pace of commercialization, with the revised target aligning closer to what they view as a relatively flat fair value profile in the near term.

- Findings from the Guangzhou immersion tour and related discussions are interpreted as signs that execution may be more complex than initially expected, which could weigh on investor confidence around EHang's ability to hit earlier commercialization expectations.

- With the rating move to Neutral, more cautious analysts see a less compelling risk reward trade off in the short to medium term, as regulatory and commercialization milestones are now thought to take longer to potentially translate into financial results.

What's in the News

- EHang maintained its annual revenue guidance for fiscal 2025 at approximately RMB 500 million, citing foreseeable market demand, a diversified product portfolio, commercial readiness, and global progress as the basis for this outlook (Corporate guidance).

- The company launched urban human carrying flight events in Bangkok under Thailand's AAM Sandbox Initiative. The head of the Civil Aviation Authority of Thailand personally flew in the pilotless EH216-S, supporting regulatory trust and future commercial routes in locations such as Pattaya, Phuket, and Koh Samui (Product announcement, Thailand).

- EHang completed a series of pilotless EH216-S trial air taxi flights in central Doha, described as the first urban flights of a pilotless eVTOL in the Middle East, under operational authorization from Qatar's aviation authorities and in cooperation with Qatar's Ministry of Transport (Product announcement, Qatar).

- The company introduced the VT35, a new generation long range pilotless eVTOL with an approximately 200 kilometer design range and compatibility with existing EH216-S vertiports. It is aimed at medium to long range use cases such as intercity and cross sea routes, supported by purchase and cooperation agreements with partners in Zhejiang, Hainan, and Hefei (Product announcement, VT35).

- A proposed class action settlement related to purchasers of EHang ADSs between March 29, 2022 and November 6, 2023 is set for a court hearing on January 9, 2026, with a proposed Settlement Amount of US$1,985,000 and a plan for attorneys' fees, expenses, and administration costs subject to court approval (Legal update).

Valuation Changes

- Fair Value Estimate: Adjusted slightly from 22.456043 to 22.451778, indicating a very small change in the modelled fair value per unit used in the analysis.

- Discount Rate: Refined from 8.321668% to 8.299686%, a modest shift that points to only a minor change in the assumed risk profile or required return in the model.

- Revenue Growth: Held effectively steady at 71.025317% versus 71.0253167907575%, suggesting no meaningful revision to the long term top line growth assumption.

- Net Profit Margin: Kept almost unchanged at 16.90868% compared with 16.90867978275698%, showing that profitability expectations within the model remain consistent.

- Future P/E: Adjusted slightly from 44.558573x to 44.31467494272611x, indicating a small tweak to the multiple applied to projected earnings in the updated valuation work.

Key Takeaways

- Expansion into urban air mobility and strong government partnerships enhance regulatory acceptance, infrastructure integration, and long-term revenue growth potential.

- Innovations in battery technology and a dual business model foster market differentiation, recurring revenue, and margin improvement through operational services and proven safety records.

- Heavy reliance on China, rising costs, and certification delays pose risks to growth and profitability as EHang prioritizes operational stability over aggressive expansion.

Catalysts

About EHang Holdings- Operates as an urban air mobility (UAM) technology platform company in the People’s Republic of China, East Asia, West Asia, North America, South America, West Africa, and Europe.

- The ongoing expansion of urban air mobility use cases-especially driven by government initiatives in smart cities, emergency response, and low-altitude economic ecosystems-positions EHang's autonomous aerial vehicles as foundational infrastructure, which is likely to sustain robust long-term demand and revenue growth as cities increasingly adopt eVTOL solutions.

- The company's deepening partnerships with municipal governments (such as Hefei's RMB 500 million support for the VT35 hub) and involvement in setting regulatory and safety standards enhances regulatory acceptance and ecosystem integration, supporting wider market entry, improved top-line growth, and improved long-term earnings visibility.

- Significant advancements in battery R&D-including solid-state battery integration and partnerships aimed at improving flight range, safety, and eco-friendliness-strengthen EHang's differentiation in green air mobility; this aligns with growing regulatory and societal demands for carbon reduction, which should drive both sales volumes and the ability to command higher margins due to performance leadership.

- Transitioning to a dual business model that combines eVTOL manufacturing with high-value operational services (maintenance, software, training, and operations management) is expected to unlock recurring revenue streams and meaningfully improve overall net margins and earnings resilience as the installed base scales.

- EHang's first-mover advantage in passenger-carrying pilotless eVTOL commercialization, validated by a proven safety record and accelerating order conversion, underpins sustained pricing power, competitive differentiation, and high customer switching costs, which should contribute to long-term margin expansion and earnings growth as volumes ramp.

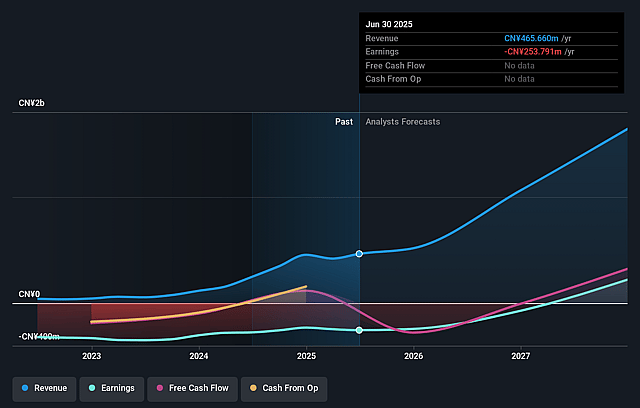

EHang Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming EHang Holdings's revenue will grow by 63.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from -54.5% today to 15.5% in 3 years time.

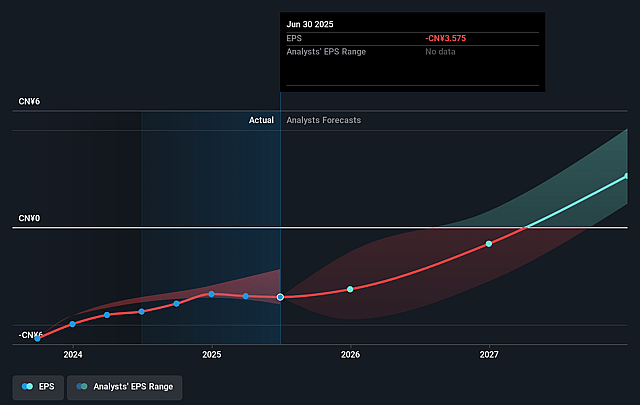

- Analysts expect earnings to reach CN¥314.3 million (and earnings per share of CN¥3.82) by about September 2028, up from CN¥-253.8 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as CN¥99.4 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 56.8x on those 2028 earnings, up from -32.2x today. This future PE is greater than the current PE for the US Aerospace & Defense industry at 34.4x.

- Analysts expect the number of shares outstanding to grow by 5.03% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.29%, as per the Simply Wall St company report.

EHang Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- EHang's lowered revenue guidance for 2025 and its strategy to moderate the pace of order deliveries in favor of focusing on operational readiness and safety signal that the company is prioritizing long-term stability over short-term sales growth; this transition may lead to slower revenue growth and increases the risk that scaling will be delayed, impacting near-future top-line revenues.

- International expansion remains in early stages, with 90% of current sales and backlog concentrated in China; limited overseas certification and very modest overseas deliveries so far raise concerns about the company's ability to diversify revenue and increase its addressable market, making future earnings vulnerable to domestic regulatory or economic headwinds.

- EHang's continued high operating expenses-largely due to accelerated R&D investment and workforce expansion-are outpacing gross profit growth, which could put persistent pressure on net margins and profitability, particularly if operational ramp-up or commercial adoption is slower than anticipated.

- Heightened competition from larger, global aerospace and eVTOL players with more resources could erode EHang's technological lead, dampen pricing power, and compress both revenues and margins if multinational rivals gain certifications or market traction faster, both domestically and internationally.

- Delays or stricter standards in achieving large-scale regulatory certifications for new aircraft models, batteries, and international operations could impede commercial deployments, slow revenue recognition, and limit market expansion-exposing EHang's long-term growth to regulatory and operational execution risks.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $23.713 for EHang Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $27.77, and the most bearish reporting a price target of just $19.04.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CN¥2.0 billion, earnings will come to CN¥314.3 million, and it would be trading on a PE ratio of 56.8x, assuming you use a discount rate of 8.3%.

- Given the current share price of $15.91, the analyst price target of $23.71 is 32.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on EHang Holdings?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.