Last Update 05 Nov 25

Fair value Increased 1.14%The analyst price target for Global Payments has increased from $103.18 to $104.36. Analysts point to improving revenue growth, expanding profit margins, and positive momentum in merchant business trends as key drivers of the upward revision.

Analyst Commentary

Recent Street research highlights a generally constructive view on Global Payments, with analysts focusing on both opportunities and risks tied to valuation, execution, and sector outlook.

Bullish Takeaways- Bullish analysts see improving organic growth prospects, driven in part by anticipated synergies from recent acquisitions such as WorldPay.

- Several view the stock as attractively valued at current levels and suggest potential upside from current share prices.

- Underlying Merchant business trends remain solid, even in mixed macroeconomic conditions. This supports expectations of continued top-line momentum.

- Execution in expanding technology rollouts, such as the Genius platform in new geographies, is gaining traction and is viewed as a positive catalyst for future growth.

- Bearish analysts caution that the broader Payments sector has experienced significant investor rotation toward AI-centric stocks, which is weighing on sentiment.

- Instances of uneven execution across the sector continue to keep some investors cautious regarding the ability to consistently deliver on growth targets.

- The macro environment remains characterized as "choppy," which could temper revenue and margin expansion if conditions worsen.

What's in the News

- Global Payments announced a new multi-year global partnership with Harris Blitzer Sports & Entertainment, becoming the Official Payment Technology Provider for the Prudential Center, the New Jersey Devils, and the Philadelphia 76ers. The partnership includes the rollout of Global Payments' point-of-sale technology and ticketing payment solutions across these venues and teams. (Client Announcement)

- The company introduced its Genius unified point-of-sale (POS) solution for higher education institutions in the U.S. and Canada, aiming to streamline campus commerce operations, improve transaction visibility, and enhance compliance for universities and colleges. (Product Announcement)

- Global Payments appointed Patricia 'Patty' Watson and Archana 'Archie' Deskus as independent Board directors in collaboration with Elliott Investment Management, with plans to appoint an additional director by or after the 2026 annual meeting. The Board will expand to 12 directors as a result. (Investor Activism, Agreement Related)

- The Genius enterprise POS platform is now available for both U.S. and UK quick service restaurant and fast casual markets, as well as enterprise foodservice environments, offering features such as real-time data sync, integrated payments, kitchen management, and digital signage. (Product Announcement)

- The Tampa Bay Lightning selected Global Payments as its payments provider for food, beverage, retail, and ticketing at AMALIE Arena, continuing a trend of major sports partnerships for the company. (Client Announcement)

Valuation Changes

- Consensus Analyst Price Target has risen slightly, moving from $103.18 to $104.36.

- Discount Rate has fallen moderately, decreasing from 9.16 percent to 8.91 percent.

- Revenue Growth assumptions have increased, rising from 7.02 percent to 8.47 percent.

- Net Profit Margin estimates have grown significantly, up from 13.81 percent to 19.99 percent.

- Future P/E ratio has dropped substantially, falling from 16.54x to 9.96x.

Key Takeaways

- Integrated platforms, strategic acquisitions, and tech investments are enhancing Global Payments' growth, margin expansion, and competitive positioning in digital and cross-border payments.

- Strong demand from small and mid-sized businesses and operational transformations are expected to drive recurring revenues, improved client retention, and expanded market share.

- Ongoing divestitures, integration risks, and rising competition threaten revenue stability, margin expansion, and the company's ability to adapt amid regulatory and technological disruption.

Catalysts

About Global Payments- Provides payment technology and software solutions for card, check, and digital-based payments in the Americas, Europe, and the Asia-Pacific.

- The expanding rollout of the Genius integrated POS platform across the US and international markets positions Global Payments to capitalize on the ongoing movement from cash to digital payments and e-commerce growth, likely supporting accelerating revenues and new market share wins.

- Robust demand for integrated payment and software bundles, especially for small and mid-sized businesses (SMBs), is expected to drive higher recurring SaaS-like revenue streams and improved net margins through operating leverage, as evidenced by increased sales productivity and strong ISV partner growth.

- Cross-border payment capabilities are being enhanced through acquisitions (e.g., APAC-focused digital wallet/QR software) and expanded international distribution, enabling Global Payments to address the rising need for real-time, frictionless payments in global trade-supporting future transaction volume and revenue growth.

- The Worldpay acquisition and operational transformation program are creating scale benefits, cost efficiencies, and significant cross-selling opportunities (e.g., selling Genius into Worldpay's merchant base); these are expected to boost earnings growth and margin expansion after integration.

- Investments in cloud-based infrastructure, AI-powered fraud prevention, marketing automation, and streamlined customer onboarding are reducing churn, improving client stickiness, and enabling faster product launches, which will likely aid both revenue growth and net margin improvement over the next several years.

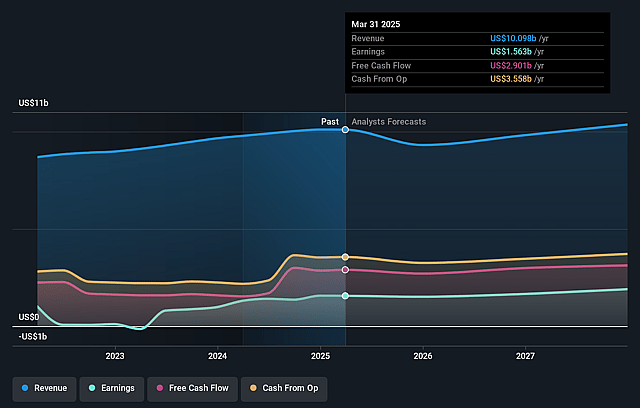

Global Payments Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Global Payments's revenue will grow by 7.0% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 14.6% today to 13.8% in 3 years time.

- Analysts expect earnings to reach $1.7 billion (and earnings per share of $8.47) by about September 2028, up from $1.5 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $1.3 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.5x on those 2028 earnings, up from 14.3x today. This future PE is about the same as the current PE for the US Diversified Financial industry at 16.5x.

- Analysts expect the number of shares outstanding to decline by 4.67% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.16%, as per the Simply Wall St company report.

Global Payments Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy reliance on large-scale acquisitions like Worldpay, along with portfolio divestitures (e.g., payroll and issuer solutions), heightens integration and execution risk, which could potentially lead to operational disruption, integration challenges, and possible goodwill impairment-negatively impacting both revenue stability and long-term earnings growth.

- Increasing adoption of alternative, decentralized payment solutions and the rise of embedded finance models could erode merchant reliance on third-party payment processors, structurally compressing industry-wide fees and threatening future revenue and margin expansion.

- Margin pressures could intensify over time due to increased competition from fintech upstarts, legacy banks, and direct merchant network connections, particularly as merchants focus on optimizing payment acceptance costs, which may reduce net margins.

- Ongoing global regulatory changes and data privacy requirements across jurisdictions (such as strengthening data protection acts and emerging CBDCs/digital rails) could drive higher compliance costs and introduce uncertainty that would compress earnings and complicate international expansion.

- Sustained divestitures (over $550 million annualized revenue already divested and the potential for more post-Worldpay) and portfolio shifts may thin the company's long-term revenue base, lessen diversification, and increase exposure to secular risk in key verticals, challenging the company's ability to grow and maintain resilient free cash flow.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $103.182 for Global Payments based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $194.0, and the most bearish reporting a price target of just $65.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $12.3 billion, earnings will come to $1.7 billion, and it would be trading on a PE ratio of 16.5x, assuming you use a discount rate of 9.2%.

- Given the current share price of $86.91, the analyst price target of $103.18 is 15.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.