Key Takeaways

- AT&T is emerging from an unstable phase with questionable performance and a large debt burden.

- Sentiment will pick up as the company demonstrates fundamental improvements and recapitalizes its structure.

- The company will gain on fiber network expansion, bundled offerings, and ongoing cost optimization to drive future growth

- Emerging technologies like satellite internet pose a threat of disruption, while the long-term value of 5G investments remains unclear

- AT&T is in a much better position to maintain its dividend, at the current pace it will take 10.75 years to double an investment from the dividend yield

- The company’s cost savings program will benefit from replacing traditional infrastructure with fiber, which has a lower cost to maintain in the future.

Catalysts

Connecting Families With All-In-One Bundles Is Providing A Stable Customer Base

AT&T is maintaining a wireless (mobile phone communication) market share lead over peers driven by their strategy of offering all-in-one packages “converged connectivity” to higher value customers. The company isn’t focused on having the cheapest offering, but on providing the highest value relative to price.

This approach reduces risk on both sides, as customers gain an integrated solution for wireless and broadband, while the company gains a stable revenue stream from connected and higher-value customers.

Let’s break down why.

Saturated Customer Population Limits Growth, Companies Innovate On Services In Order To Take Market Share

The telecom wireless sector has been saturated for some time in the U.S. with the market share being split between three main competitors: AT&T, Verizon, and T-Mobile.

Statista: portion of wireless subscriptions by carrier

In Q4 2023, AT&T had the largest share with 241.5M U.S. wireless subscribers, followed by Verizon with 144.8M, and T-Mobile with 119.7M. The total number of subscriptions is 518.2M, amounting to roughly 1.5 subscriptions per person. It is evident that there is little room to grow the core service by acquiring new customers, instead, the race revolves around taking market share from other competitors by offering better services i.e. strengthening and expanding the coverage infrastructure; or competing on price.

Converged Connectivity Attracts Higher-Value Customers And Reduces Risk

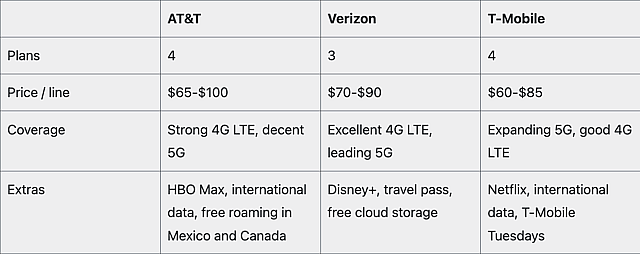

The three competitors have a relatively similar offering for customers. All have unlimited plans, with the highest price range going to AT&T, and the lowest to T-Mobile. Extras are an interesting approach, and their structure may change over time as the streaming wars unfold.

Table 1: Rough comparison between the key players in wireless telecom in February 2024

AT&T’s strategy revolves around service quality, compared to competing on price – this way they are acquiring and retaining higher paying customers, while peers with cheaper initial offerings tend to acquire a type of customer that may not be sustainable.

SEC: AT&T’s Wireless Subscriber Composition

Drilling-down on the wireless segment, we can see that while the number of prepaid customers remained flat, postpaid customers increased the most with 3.3% YoY, indicating that AT&T has a higher selling proposition within this service. The company also showed growth in their connected devices, which were up by 20M. This is in-line with AT&T’s strategy to position as a converged connectivity provider, enticing customers to move towards all-in-one packages for mobile and internet by offering better value as they increase their bundles.

Optimizing The Business Will Lead To Higher Earnings

Most of the company’s revenues (67%) come from mobile wireless services, while consumer and business broadband together accounts for 28% of revenues. All of these are supported by AT&T’s fiber network, which is their core product that differentiates by access point types – cable, wireless.

Simply Wall St: AT&T’s revenue and expense structure breakdown

I expect competition to keep AT&T on their toes, and force them to optimize their products and cost structure. As growth runs out the companies will focus inwards and increase the bottom-line for investors allowing them to reduce financing risk and prepare for large CapEx investments in new technologies.

Further Cost Cutting Will Lift Profitability

AT&T already executed on cumulative cost savings of $6B in 2023 and is on track to gain $2B more in savings by mid-2026, which I expect will produce lasting benefits to the bottom line.

This will be done in multiple ways, the company is replacing copper wire with fiber-optic cable, which is cheaper to maintain and more durable. Next, the current mid-band 5G wireless network now covers >210M people, and I expect CapEx to slow down as the company recalibrates the ROI on the technology. AT&T’s fiber network is the largest in the U.S. with 26+ million locations, targeting 30 million by the end of 2025. I expect fiber CapEx to persist given that the company is positioning as a provider for both internet and wireless services.

Broadbandnow: AT&T’s fiber-optic availability map

As we can see from the fiber coverage map above, it is clear that AT&T is covering densely populated areas, with a long road to expansion should management decide to keep going in that direction.

With this in mind, it is understandable to see allocated CapEx of $21.5B for 2024 indicating that the company will keep replacing its old infrastructure with fiber, which is cheaper and more durable. By reducing its costs, AT&T will unlock around $2B to its current operating income of $27.7B.

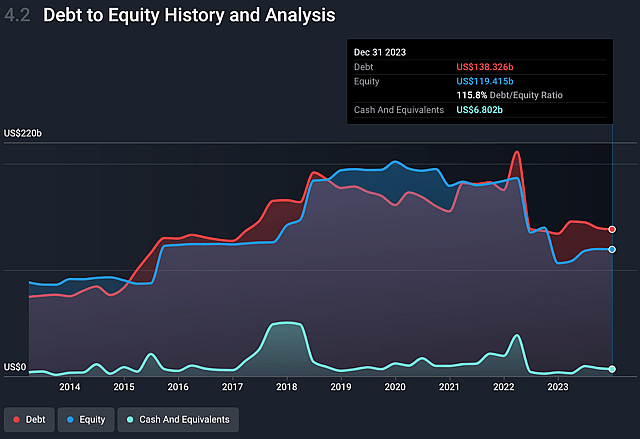

AT&T’s Capital Structure Leaves No Margin Of Safety

AT&T is aiming to drive down its net debt to adjusted EBITDA ratio from 2.8x to 2.5x, this assumes EBITDA growth of 3% p.a., resulting in $47.8B for 1H '25 and their current net debt of $129B. By applying the target 2.5x ratio, we see that AT&T is aiming for a $10B reduction in net debt to $119B. Paying down gross debt from $155B (including $17.6B operating lease obligations) to $145B results in a debt to capital ratio of 55%, which can rack up fixed interest payment costs with little tax benefits to shareholders. I also think that the company is holding too much cash, as debt maturity schedules may force AT&T to refinance at higher rates.

Simply Wall St: AT&T’s key historical balance sheet metrics

While telecom has been historically considered a safe industry, and one can argue that despite a large debt load, AT&T is optimally capitalized, management shouldn’t get too comfortable and start erring in the direction of safety. Traditionally, it was considered that the older a company is, the safer it becomes, and that becomes part of their financial decision-making. However, the situation has changed in the past decade, and older companies are top candidates for being disrupted by emerging technologies, in this sense AT&T’s profitability is a prime target for competitors and regulators.

Finally, despite being well capitalized, AT&T’s investors may perceive it as being risky, which has the effect of pressuring the share price, resulting in an even higher cost of financing from equity investors. While management may think that the company is not reliant on equity investors, it may find it difficult to find and retain talent – while at the same-time facing union renegotiations which may be more aggressive due to the change in cost of living over the past few years. Making use of incentive-based compensation may offset these risks, which is why I think that management should increase its focus on equity investors.

I discuss the more potential risks to the business in the risk section below.

Analyzing The Three Competitors Together Reduces The Need To Pick A Winner

Many investors are concerned over picking one telecom stock over the other. However, given that the industry is growth-constrained, a simple way to mitigate risk is to see if the combined largest market-share companies are reasonably valued and reduce competition risk by equally weighting the three stocks.

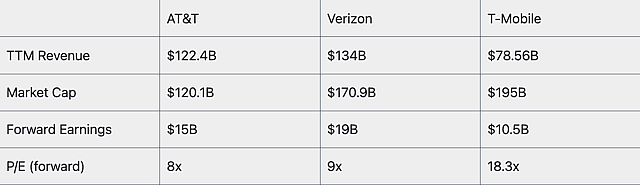

Table 2: Comparing the market cap to forward earnings of the three key player in telecom

By aggregating the forward earnings of the three companies, I came up with a value of $44.5B – likewise, we take their market cap, which adds up to around $486B, and we find that in total we would be paying an aggregated forward PE of 10.9x. This looks to be around a fair value equivalent for the stocks. Conversely, we can see that the earnings yield comes up to 9% (44.5/486=9%).

In other words, for an aggregated market cap $486B investors are getting a 9% yield, which is great because it means that the dividends of both AT&T and Verizon are sustainable as they produce 6.5% and 6.6% yields respectively – offsetting the 1.6% from T-Mobile. Note, if we consider buybacks as a form of capital return, then the combined yield of dividends and buybacks (p. 44) for T-Mobile is 7%.

This means that in aggregate, the companies produce enough earnings to allocate for dividends and have a portion of earnings left over to optimize operations or stabilize their capital structure.

Assumptions

Growth: I assume a low 2% revenue CAGR going to 2029, converging on $135B. Revenue growth will be limited by the already saturated market, but still driven by an expansion in fiber and wireless package bundles.

Profitability: I expect the company to implement further cost savings and stabilize operating margins around 24%. I believe that AT&T will continue to operate with high leverage, and will find it difficult to pay down debt as unexpected CapEx requirements become necessary in order to stay on par with competitors. For this reason, I expect the net income margin to converge on 15% in 2029, resulting in $20B earnings or an EPS of $2.83 given that the company doesn’t pursue a buyback policy and will likely keep its share count around 7.15B.

Valuation multiple: I believe that AT&T will gradually re-rate from a PE of 8.4x to 15.5x as their operations stabilize, demonstrate a secure dividend, and EBITDA increases to meet their 2.5x leverage target.

Risks

- Wage contract renegotiations: AT&T may need to sit down at the union negotiating table as two major contracts covering 25,000 employees expire in 2024. Cost of living increases in the past two years have driven double-digit wage growth in delivery and airlines. There is a possibility that AT&T may need to budget for more wages in the following years, affecting operating margins.

- Additional lead cable replacement opex: AT&T may need to spend an additional $2B to $4B in order to replace 60,000 miles of old cable infrastructure, per Goldman estimates. The company is in a good position to finance these expenses, but it will show up as a temporary drag on gross margins.

- Oligopoly barriers to entry may start coming down: Compared to places like Western Europe, AT&T’s pricing is high, indicating that there is plenty of room for competitors should regulators decide to open the floodgates.

- The sector is not immune to disruption: Google Fiber launched in 2010, and while the project saw relatively low success, just the prospect of a new high-tech competitor entering the space managed to awaken telecom companies from their stupor and embark on massive spending programs to deliver >1 GBit internet to homes in the U.S. This shock to the system may be repeated once again with technological breakthroughs like low-orbit satellite internet.

- Internet from space: Musk’s Starlink and Amazon’s Kuiper are bent on using low-orbit satellites to deliver high speed internet to homes. SpaceX is in the lead and already offers internet plans, while Amazon is close behind – promoting a more affordable option. All three companies are in the game as T-Mobile is in partnership with SpaceX to boost coverage via satellite, and Verizon is talking to Amazon, AT&T is partnering with AST SpaceMobile. However, ultimately companies that have the satellite infrastructure don’t need a middle-man and can function as separate internet service providers. Should the technology advance and is proven stable, it can mark a new era in communications. Musk is already teasing the use of the technology for mobile phones. Initially this technology will limit growth for traditional telecom in rural areas, however it will be increasingly adopted in cities as it becomes more affordable.

- 5G lacks a popular use case: the move to install 5G infrastructure is predicated on the optionality that a 5G super app that everyone needs will eventually show up. That hasn’t happened so far. Further, advancements in edge infrastructure and software are optimizing bandwidth for apps, games, and HD streaming (both conference and entertainment) can easily be done with 4G LTE. While some analysts estimate that a 5G super app can add $5-$10 on monthly plans, the ROI on 5G becomes questionable when we take into account the billions in CapEx spent to put the infrastructure in place.

Have other thoughts on AT&T?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

Simply Wall St analyst Goran_Damchevski holds no position in NYSE:T. Simply Wall St has no position in any companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.