Key Takeaways

- Immediate fulfillment of large defense and commercial contracts, along with onshoring and vertical integration, could drive outsized revenue growth and margin expansion.

- Investment in proprietary tech and platform capabilities positions the company to capitalize on secular growth markets and secure high-margin, service-based revenue streams.

- Exposure to regulatory risks, overdependence on government contracts, operational pressures, margin compression, and supply chain vulnerabilities threaten revenue stability and profitability.

Catalysts

About Unusual Machines- Engages in the commercial drone industry.

- Analyst consensus expects Unusual Machines to benefit from significant U.S. government orders, but this may understate the scale and speed of demand; the company's readiness to immediately fulfill large, multi-customer contracts, as multiple defense clients pursue urgent drone buildouts, could deliver a step function increase in quarterly revenue and put Unusual Machines years ahead of consensus growth curves.

- While analysts broadly anticipate gross margin expansion from new domestic manufacturing, they may be underestimating margin upside from rapid production ramping and onshoring; with vertical integration and next-gen U.S. facilities, Unusual Machines could see gross margins push above 40 percent by mid-2026 as scale unlocks both operational leverage and premium pricing for NDAA-compliant components.

- The accelerating adoption of drones and robotics in logistics, critical infrastructure, and smart agriculture-which outpaces prior growth estimates and is now being driven by labor shortages and real-time data needs-positions Unusual Machines to capture vastly higher recurring hardware and analytics revenue across multiple secular growth industries.

- Recent investment in proprietary platforms, advanced sensor technology, and strategic R&D enables Unusual Machines to rapidly expand its addressable market into adjacent autonomous systems and secure licensing deals, paving the way for high-margin, service-based revenue streams and long-term earnings outperformance.

- Unusual Machines' strong balance sheet and unique ability to pre-build inventory ahead of competitors-as well as its agility in serving both rapid DoD surges and longer-term commercial contracts-supports potential for both industry consolidation through accretive M&A and above-peer return on equity, further compressing its undervaluation.

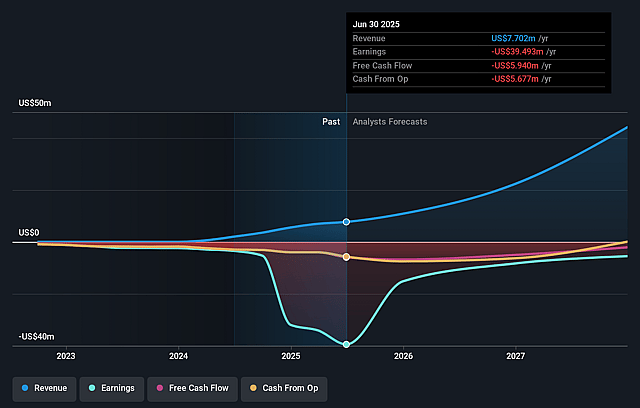

Unusual Machines Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Unusual Machines compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Unusual Machines's revenue will grow by 93.6% annually over the next 3 years.

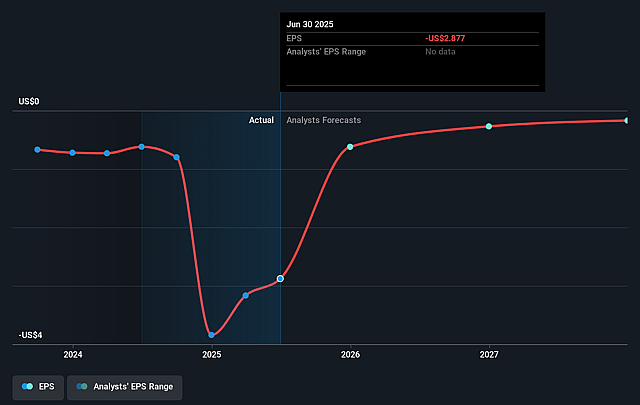

- Even the bullish analysts are not forecasting that Unusual Machines will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Unusual Machines's profit margin will increase from -512.8% to the average US Electronic industry of 9.0% in 3 years.

- If Unusual Machines's profit margin were to converge on the industry average, you could expect earnings to reach $5.1 million (and earnings per share of $0.13) by about September 2028, up from $-39.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 194.8x on those 2028 earnings, up from -7.6x today. This future PE is greater than the current PE for the US Electronic industry at 23.1x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.07%, as per the Simply Wall St company report.

Unusual Machines Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Increased regulatory scrutiny, changing tariffs, and uncertainties relating to privacy and potential new drone legislation could restrict the deployment and usage of Unusual Machines' products, creating unexpected obstacles to market access and reducing future revenues.

- Heavy reliance on anticipated government contracts and a narrow band of enterprise customers exposes the company to significant revenue volatility if orders are delayed, fail to materialize, or if customer demand shifts, which could cause sudden revenue shortfalls and earnings losses.

- The rapid scale-up in production, workforce, and capital expenditure increases operational risk, and if demand or government orders underperform expectations, Unusual Machines could face excess capacity, compressed net margins, and long-term earnings pressure.

- The electronics industry's trend toward commoditization and rapidly falling selling prices may erode Unusual Machines' gross margins over time, especially if it struggles to continuously differentiate its products in a crowded and aggressively competitive sector.

- Persistent supply chain challenges-including dependence on specialized components such as rare earth magnets-leave the company vulnerable to geopolitical disruptions, trade restrictions, and input cost increases, which could constrain production volumes and negatively impact future profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Unusual Machines is $20.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Unusual Machines's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $20.0, and the most bearish reporting a price target of just $15.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $55.9 million, earnings will come to $5.1 million, and it would be trading on a PE ratio of 194.8x, assuming you use a discount rate of 8.1%.

- Given the current share price of $9.27, the bullish analyst price target of $20.0 is 53.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.