Key Takeaways

- Rapid scaling and reliance on government contracts expose the company to operational, supply chain, and forecasting risks, potentially delaying growth and pressuring margins.

- High expenses and limited brand recognition may hinder profitability and market share gains if revenue or innovation does not outpace established competitors.

- Heavy reliance on U.S. government contracts and domestic market advantages heightens vulnerability to regulatory shifts, execution challenges, and intense competition, risking growth and profitability.

Catalysts

About Unusual Machines- Engages in the commercial drone industry.

- Although Unusual Machines benefits from the rapid growth in automation, robotics, and government investment in drone technology, significant operational risks remain as the company attempts to scale production and workforce rapidly; any execution missteps in scaling manufacturing or unexpected supply chain disruptions could delay anticipated revenue growth and threaten future gross margins.

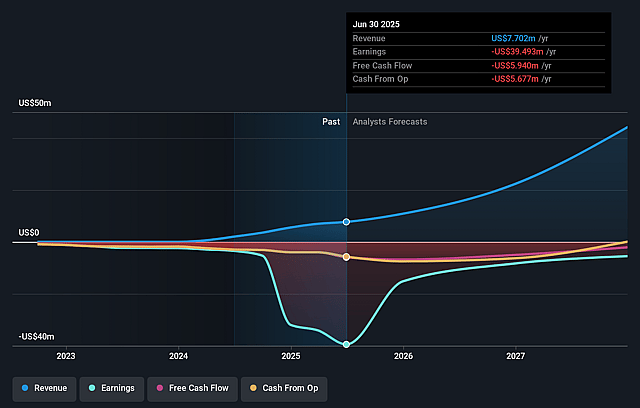

- Despite strong top-line momentum, with record revenues and gross margin improvements, the company still faces cash burn and losses from high operating expenses and substantial stock-based compensation; if revenue scale does not materialize as quickly as expected or if sustained gross margin expansion proves challenging, this could delay the timeline to achieving positive earnings or cash flow.

- While Unusual Machines is well capitalized and expects to benefit from regulatory and policy tailwinds, its heavy dependence on a timely and robust ramp in U.S. government orders introduces material forecasting uncertainty; bureaucratic delays or changes in government procurement priorities could leave the company with excess capacity, resulting in lower than expected revenues.

- Although the underlying trend of increased digitization, proliferation of IoT devices, and the shift to domestic/U.S.-based drone production plays to the firm's strengths, persistent risks of component shortages (e.g., magnets for motors) or sudden shifts in technology standards could force ongoing reinvestment, impacting EBITDA margins and necessitating more working capital.

- While Unusual Machines' expansion into new manufacturing lines and acquisitions positions it to address new verticals and higher-margin proprietary products, the company still lacks longstanding brand recognition and must compete against better-resourced incumbents; if its R&D spending fails to translate quickly into differentiated offerings or if vertical integration efforts stall, future market share expansion and sustainable margin gains could fall short of projections.

Unusual Machines Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Unusual Machines compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Unusual Machines's revenue will grow by 93.3% annually over the next 3 years.

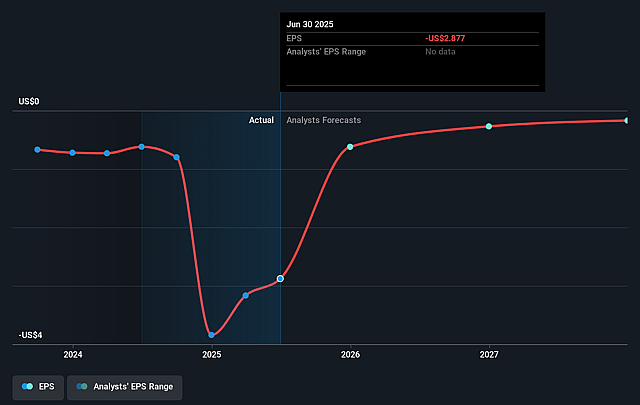

- The bearish analysts are not forecasting that Unusual Machines will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Unusual Machines's profit margin will increase from -512.8% to the average US Electronic industry of 9.0% in 3 years.

- If Unusual Machines's profit margin were to converge on the industry average, you could expect earnings to reach $5.0 million (and earnings per share of $0.13) by about August 2028, up from $-39.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 146.7x on those 2028 earnings, up from -7.9x today. This future PE is greater than the current PE for the US Electronic industry at 22.8x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.06%, as per the Simply Wall St company report.

Unusual Machines Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- A significant portion of Unusual Machines' near-term growth is predicated on pending U.S. government orders and mechanisms like the PBAS program; any delay, reduction, or failure in such contract awards would directly hurt revenues, cash flow, and growth expectations.

- Execution risk associated with scaling manufacturing-even with capital in hand-remains high, and setbacks in ramping up new facilities or integrating acquisitions like Rotor Lab could drive up operating expenses and delay path to positive net margins.

- The company's ability to maintain or improve gross margins depends on successfully passing through tariff and production cost increases to customers and achieving rapid learning curves for new product lines; a misstep here could compress margins and delay profitability.

- Intense competition both from larger incumbents as well as lower-cost international manufacturers, especially in an industry facing rapid technological change, could make it difficult for Unusual Machines to win and retain share, potentially flattening revenues and reducing pricing power.

- The company's current focus on the domestic market and reliance on U.S.-centric regulatory or geopolitical tailwinds may backfire if there is a shift in trade or drone regulations, reduced government spending, or slowing demand from U.S. enterprise and government channels, adversely affecting top-line growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Unusual Machines is $15.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Unusual Machines's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $20.0, and the most bearish reporting a price target of just $15.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $55.7 million, earnings will come to $5.0 million, and it would be trading on a PE ratio of 146.7x, assuming you use a discount rate of 8.1%.

- Given the current share price of $9.6, the bearish analyst price target of $15.0 is 36.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.