Last Update 31 Oct 25

Fair value Increased 8.93%Analysts have raised their fair value estimate for Unusual Machines from $18.67 to $20.33, citing strengthening U.S. demand for compliant drone components and the company’s position to benefit from a shift toward a domestic supply chain.

Analyst Commentary

Recent street research highlights a growing consensus among market observers regarding Unusual Machines’ prospects, particularly as the U.S. accelerates efforts to secure a domestic supply chain for drone technology. Several themes have emerged in the latest round of analysis.

Bullish Takeaways- Bullish analysts point to an emerging investment cycle in small, low-cost Unmanned Aircraft Systems. This is expected to drive significant demand for compliant components.

- Unusual Machines' domestic production capabilities and alignment with U.S. national security priorities position the company to capture substantial share as government and defense customers shift away from foreign supply chains.

- The strategic focus on NDAA-compliant parts for intelligence, surveillance, and reconnaissance applications boosts growth prospects and supports a favorable valuation outlook.

- Reshoring trends and heightened demand for “first person view” and attack drone components are expected to generate sustained long-term revenue streams for the company.

- Bearish analysts caution that the company’s growth projections may rely heavily on policy tailwinds and continued legislative emphasis on domestic sourcing.

- There are concerns around execution risk, particularly the company's ability to rapidly scale production in response to surging demand and security requirements.

- The competitive landscape remains dynamic, with other domestic suppliers seeking to enter or expand within the NDAA-compliant ecosystem. This could potentially pressure margins.

What's in the News

- Unusual Machines has won its largest-ever contract from the U.S. Department of Defense, with the Pentagon commissioning the company to produce 3,500 drone motors and additional parts. There is also a potential follow-on order for 20,000 more components in 2026 (Financial Times).

- The Financial Times reports that Unusual Machines received the Pentagon contract as a company in which Donald Trump Jr. has held a $4 million stake (Financial Times).

- Unusual Machines was recently added to the S&P Global BMI Index, marking a significant milestone for the company’s visibility and credibility in the market (Key Developments).

- The company has executed a memorandum of understanding with Safe Pro Group to integrate artificial intelligence-powered threat detection into its drone platforms for enhanced battlefield and disaster zone intelligence (Key Developments).

Valuation Changes

- Fair Value Estimate: Increased from $18.67 to $20.33, reflecting analysts’ higher confidence in Unusual Machines’ outlook.

- Discount Rate: Risen slightly from 8.22% to 8.25%, suggesting a modest uptick in perceived risk or required return.

- Revenue Growth: Remained stable at approximately 102.37%. This indicates analysts see little change in the company’s growth trajectory.

- Net Profit Margin: Declined slightly from 8.71% to 8.53%. This points to marginally lower profitability expectations.

- Future Price to Earnings Ratio (P/E): Increased from 157.43x to 175.31x. This signals higher anticipated valuations for the company’s future earnings.

Key Takeaways

- Growing government investment and policy changes in the U.S. drone sector will drive rising demand, with Unusual Machines well-placed to capitalize through new contracts and scaled domestic production.

- Focus on advanced manufacturing, acquisition opportunities, and higher-margin enterprise and government sales positions the company for sustainable margin expansion and long-term growth beyond core drone markets.

- Heavy dependence on volatile government demand and expansion amid regulatory, operational, and supply chain risks threaten both revenue stability and sustained profitability.

Catalysts

About Unusual Machines- Engages in the commercial drone industry.

- Significant government policy changes and increasing U.S. federal investment in drone technology are set to unlock material new demand for domestically sourced drone components; Unusual Machines' expectation of imminent and sizable government orders-including multiple customers vying for contracts like the $500 million PBAS program-positions the company to capture a large share of a rapidly expanding market, which is likely to drive sequential revenue growth over the next several quarters.

- The buildout of new domestic manufacturing capacity for motors and headsets, alongside the ability to scale production to tens of thousands of units monthly with further ramp potential, will enable Unusual Machines to quickly fulfill large, near-term orders and provide reliable, onshore supply to B2B and government customers, supporting both revenue acceleration and gross margin expansion as supply chains become more efficient.

- The accelerating adoption of automation, robotics, and IoT-combined with the explosion of the U.S. drone market and increased demand for advanced, NDAA-compliant components-expands Unusual Machines' long-term addressable market beyond just drones to broader smart hardware and embedded electronics, positioning the company for durable, above-market revenue growth well into the future.

- A strengthened balance sheet, with over $80 million in cash and no debt, allows Unusual Machines to aggressively pursue strategic acquisitions, vertical integration, and investments in production scaling and proprietary IP-each of which has the potential to improve net margins and enhance earnings growth through both operational leverage and increased differentiation versus lower-cost commodity competitors.

- The company's proactive move toward U.S.-based, tariff-advantaged production, combined with a focus on higher-margin enterprise and government sales (with enterprise already exceeding 30% of sales and a long-term target of 50%+), is expected to boost blended gross margins (targeting 35-50%) and shorten the path to cash flow positivity in 2026, positively impacting net margins and earnings.

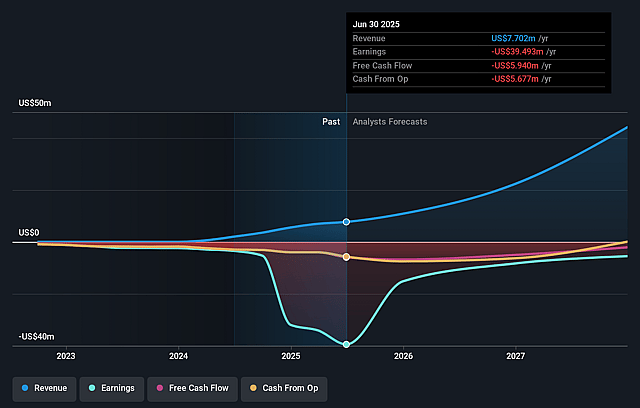

Unusual Machines Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Unusual Machines's revenue will grow by 92.8% annually over the next 3 years.

- Analysts are not forecasting that Unusual Machines will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Unusual Machines's profit margin will increase from -512.8% to the average US Electronic industry of 9.0% in 3 years.

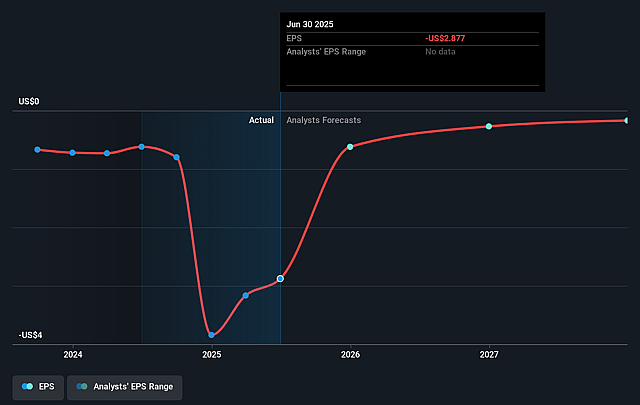

- If Unusual Machines's profit margin were to converge on the industry average, you could expect earnings to reach $5.0 million (and earnings per share of $0.13) by about September 2028, up from $-39.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 167.6x on those 2028 earnings, up from -7.4x today. This future PE is greater than the current PE for the US Electronic industry at 23.1x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.06%, as per the Simply Wall St company report.

Unusual Machines Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Unusual Machines' significant revenue growth and scale-up plans are heavily dependent on large and rapid increases in U.S. government orders, which creates risk if policy priorities or budget allocations change, leading to volatile or disappointing revenue realization.

- The company's aggressive expansion-including factory build-outs, new product lines, and workforce scaling-poses execution risks relating to operational efficiency, quality control in new manufacturing lines, and the ability to realize planned margin improvements, which may weigh on both net margins and earnings if poorly managed.

- The current strength in gross margins is partly attributed to tariffs on imported products, but increasing regulatory volatility, ongoing tariff policy changes, and potential shifts in trade relations may either pressure input costs or erode Unusual Machines' price competitiveness, directly impacting margins and profitability.

- A reliance on a handful of government-driven projects and a primarily domestic customer base heightens revenue concentration risk; failure to win key contracts or delays in government purchasing processes could cause significant earnings swings and impair revenue stability.

- The rapid pace of technological change in the drone and electronics sector, combined with supply chain vulnerabilities (e.g., 6-month lead times on magnets), exposes Unusual Machines to risks of inventory obsolescence and potential cost spikes, possibly requiring high ongoing R&D investment and reducing both short

- and long-term profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $17.0 for Unusual Machines based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $20.0, and the most bearish reporting a price target of just $15.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $55.2 million, earnings will come to $5.0 million, and it would be trading on a PE ratio of 167.6x, assuming you use a discount rate of 8.1%.

- Given the current share price of $9.02, the analyst price target of $17.0 is 46.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.