Last Update04 Sep 25Fair value Increased 0.70%

Analysts remain bullish on Amphenol due to accretive M&A activity, robust end-market diversification, and favorable industry trends, maintaining the consensus price target at $115.38.

Analyst Commentary

- Bullish analysts highlight that the acquisitions of Trexon and CommScope's Connectivity & Cables Solutions business are expected to be earnings accretive, expand Amphenol's product offering—particularly in fiber optics and defense—and represent a high-return use of capital.

- Several note that M&A continues to be a key growth driver for Amphenol, potentially adding $0.20–$0.25 EPS longer term and supporting an enhanced growth trajectory.

- Bullish analysts are raising price targets in anticipation of above-guidance results, supported by robust end-market diversification and limited direct tariff exposure.

- Some valuation increases are attributed to applying higher forward multiples to updated EPS estimates, reflecting improving financial outlooks.

- Broader industry tailwinds, including stronger-than-expected U.S. auto sales and more moderate tariffs, are viewed as supportive factors for Amphenol's business.

What's in the News

- Amphenol is finalizing a ~$10.5 billion deal (including debt) to acquire CommScope’s connectivity and cable unit (CCS), with an announcement expected soon; this follows CommScope exploring the sale of its largest division and prior Amphenol acquisitions from CommScope (Wall Street Journal, M&A Rumors and Discussions).

- From April 1 to July 22, 2025, Amphenol repurchased 2,445,700 shares for $199.6 million, completing a total of 12,069,970 shares repurchased for $844.15 million since April 2024 under its ongoing buyback program (Buyback Tranche Update).

- For Q3 2025, Amphenol projects sales between $5.4 billion and $5.5 billion, representing a year-over-year increase of 34% to 36% (Corporate Guidance).

- Amphenol was dropped from several major value-focused indexes, including the Russell 3000 Value, Russell 1000 Value, and Russell Top 200 Value indexes as of late June 2025 (Index Constituent Drops).

- Amphenol and CommScope have not commented publicly on the pending acquisition as of the last report; media sources are basing updates on information from people familiar with the matter (Wall Street Journal, Reuters).

Valuation Changes

Summary of Valuation Changes for Amphenol

- The Consensus Analyst Price Target remained effectively unchanged, at $115.38.

- The Discount Rate for Amphenol remained effectively unchanged, at 8.22%.

- The Net Profit Margin for Amphenol remained effectively unchanged, at 18.74%.

Key Takeaways

- Robust demand for high-speed interconnect solutions and diversified end markets strengthens revenue durability and reduces risk from economic cycles.

- Strategic acquisitions, innovation, and a premium product mix are enhancing margins, pricing power, and positioning versus competitors for secular growth.

- Heavy reliance on volatile tech markets, high capex, acquisition risks, and competitive pricing pressures threaten sustainable growth, margin stability, and free cash flow.

Catalysts

About Amphenol- Designs, manufactures, and markets electrical, electronic, and fiber optic connectors in the United States, China, and internationally.

- Accelerating global deployment of AI-driven data centers and adoption of next-generation IT architecture is driving strong, sustained demand for Amphenol's high-speed, high-value interconnect solutions, as evidenced by exceptional growth in IT datacom revenue and continued multi-quarter customer engagement; this is expected to support further top-line growth and maintain higher incremental margins.

- Increased electronic content and complexity across automotive, industrial, defense, and communications markets (including EVs, factory automation, and defense modernization) is expanding Amphenol's total addressable market, enabling diversified, resilient revenue streams and reducing cyclicality risk, which should underpin durability in both sales and earnings.

- Ongoing strategic acquisitions (e.g., ANDREW, CIT, Narda-MITEQ) are broadening product offerings in attractive, high-growth segments (AI, RF/microwave, aerospace/defense), creating further operating leverage and margin expansion opportunities through integration, as reflected in recent record operating margins and sequential improvement in profitability.

- Enhanced focus on high-technology, differentiated product mix-driven by customer demand for mission-critical, high-performance components-has strengthened pricing power and operating efficiency, resulting in structurally higher conversion and operating margins, with management now targeting 30% incremental margin conversion versus the historical 25%.

- Sustained investment in capacity and innovation (elevated CapEx to support datacom/AI growth, R&D for advanced connectors), paired with global supply chain agility and geographic diversification, positions Amphenol to out-execute competitors in capturing future secular growth, supporting robust free cash flow and long-term earnings per share growth.

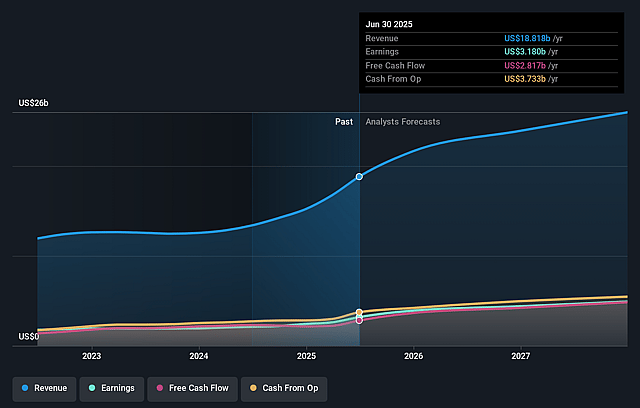

Amphenol Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Amphenol's revenue will grow by 12.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 16.9% today to 18.8% in 3 years time.

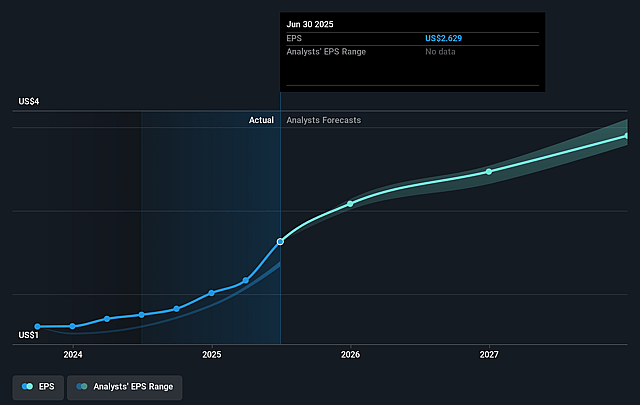

- Analysts expect earnings to reach $5.1 billion (and earnings per share of $4.04) by about September 2028, up from $3.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 37.0x on those 2028 earnings, down from 44.8x today. This future PE is greater than the current PE for the US Electronic industry at 23.9x.

- Analysts expect the number of shares outstanding to grow by 1.27% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.3%, as per the Simply Wall St company report.

Amphenol Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's unprecedented growth and robust results in the IT datacom and AI infrastructure markets may not be sustainable as sector demand can be volatile and "lumpy"-management specifically acknowledged recent outperformance involved "pulling forward" demand from future quarters, which could lead to short-term revenue declines or stagnation if customer investment moderates.

- Ongoing elevated capital expenditures, especially in support of the booming AI and datacenter demand, could pressure future free cash flow and operating margins if the anticipated growth doesn't persist or if project returns underperform expectations.

- The aggregate contribution to revenue growth from acquisitions is significant, and the text notes "the dilutive impact of acquisitions," as well as the risk that future deals may be less synergistic or harder to integrate, potentially reducing overall net margin improvement.

- Although management highlighted a diversified customer and market base, the results reveal growing exposure to cyclical and fast-evolving technology end markets (notably AI/data center infrastructure), which increases risk of customer concentration and unpredictable revenue/earnings swings as technology cycles or customer budgets shift.

- Intense focus on expanding sales in high-performance, high-margin segments creates challenges to sustain pricing power amid long-term industry trends toward commoditization and system integration, meaning downward pricing pressure or shifts in product mix could erode long-term revenue growth and net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $116.188 for Amphenol based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $134.0, and the most bearish reporting a price target of just $85.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $26.9 billion, earnings will come to $5.1 billion, and it would be trading on a PE ratio of 37.0x, assuming you use a discount rate of 8.3%.

- Given the current share price of $116.79, the analyst price target of $116.19 is 0.5% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.