Key Takeaways

- Emerging technologies and heightened competition risk eroding Amphenol's margins, pricing power, and sales growth across core legacy products.

- Regulatory, supply chain, and R&D pressures are expected to increase costs, straining profitability and free cash flow in the face of uncertain returns.

- Strong, diversified growth driven by secular tech trends, consistent margin expansion, strategic acquisitions, and global manufacturing strengths underpinning stable, long-term financial performance.

Catalysts

About Amphenol- Designs, manufactures, and markets electrical, electronic, and fiber optic connectors in the United States, China, and internationally.

- Rapid advances in wireless and contactless technologies are expected to erode long-term demand for traditional interconnect solutions, which could significantly dampen unit sales volumes and force Amphenol into lower-margin product categories in coming years, directly pressuring both revenue growth and gross margins.

- The accelerating reshoring and regionalization of supply chains, along with volatile trade policies and heightened geopolitical risk, will likely disrupt Amphenol's global manufacturing and supplier network, raising operating costs and hindering its ability to serve major customers efficiently, thereby negatively impacting net margins and overall earnings stability.

- Ongoing and intensifying regulatory demands regarding environmental impact and ESG compliance are poised to require expensive product redesigns, increased documentation, and greater capital outlays for Amphenol's legacy product lines, which will elevate overhead and reduce profitability, dragging on both net income and free cash flow.

- Continued margin compression from the commoditization of connectors and cables, coupled with aggressive price competition from emerging market manufacturers, threatens to sharply reduce Amphenol's pricing power and undermine its ability to generate high incremental margins, resulting in slower revenue growth and lower return on invested capital.

- The need for heavy, ongoing R&D and capital expenditures to keep pace with rapid technological change-especially as next-generation AI, datacenter, and connectivity demands accelerate-creates sustained pressure on free cash flow and earnings, with limited visibility on whether innovation will deliver the necessary growth to offset these rising costs over the medium and long term.

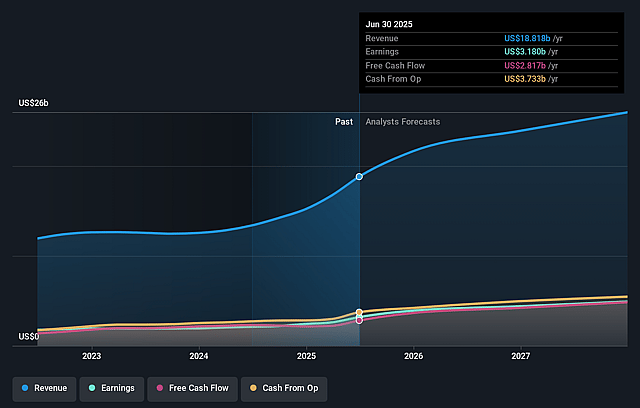

Amphenol Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Amphenol compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Amphenol's revenue will grow by 12.4% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 16.9% today to 19.3% in 3 years time.

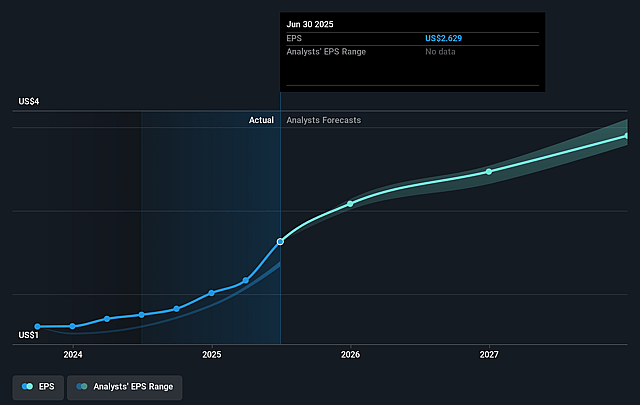

- The bearish analysts expect earnings to reach $5.1 billion (and earnings per share of $4.08) by about September 2028, up from $3.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 28.2x on those 2028 earnings, down from 45.7x today. This future PE is greater than the current PE for the US Electronic industry at 23.9x.

- Analysts expect the number of shares outstanding to grow by 1.27% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.3%, as per the Simply Wall St company report.

Amphenol Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Amphenol is experiencing exceptional growth in secular markets such as AI-enabled datacenter infrastructure, 5G, industrial automation, and electric vehicles, positioning it to ride long-term technology adoption cycles that should support robust revenue growth for years to come.

- The company has demonstrated the ability to consistently expand operating and adjusted margins, with management now targeting even higher conversion rates on incremental sales (approaching 30 percent), which directly supports strong improvements in net margins and earnings trajectory.

- Amphenol's diversified end-market exposure-including industrial, automotive, datacom, aerospace, defense, and communications-shields its revenue stream from cycles in any one sector and underpins long-term stability in both top-line and bottom-line performance.

- The company's highly successful acquisition strategy, including recent deals such as Narda-MITEQ, CIT, and ANDREW, is expanding its technology portfolio and product breadth, creating synergies that enhance revenue growth opportunities and profitability, as reflected in consistently strong cash flow.

- Amphenol's global manufacturing footprint and ability to localize supply chains in response to customer needs, combined with ongoing investment in high-value, next-generation products, make it a preferred supplier for leading OEMs, which should help defend or expand market share and drive sustained revenue, margin, and earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Amphenol is $89.94, which represents two standard deviations below the consensus price target of $116.19. This valuation is based on what can be assumed as the expectations of Amphenol's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $134.0, and the most bearish reporting a price target of just $85.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $26.7 billion, earnings will come to $5.1 billion, and it would be trading on a PE ratio of 28.2x, assuming you use a discount rate of 8.3%.

- Given the current share price of $119.09, the bearish analyst price target of $89.94 is 32.4% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Amphenol?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.