Key Takeaways

- Amphenol's leadership in next-gen infrastructure, broad customer base, and strong AI adoption position it for multi-year revenue and earnings growth above current expectations.

- Diversified end markets, operational agility, and disciplined execution are driving higher margins, robust cash flow, and further accretive M&A beyond market assumptions.

- Shifts in technology, trade policies, and customer pricing power, alongside rising costs and end-market cyclicality, heighten risks to Amphenol's margins, growth, and long-term profitability.

Catalysts

About Amphenol- Designs, manufactures, and markets electrical, electronic, and fiber optic connectors in the United States, China, and internationally.

- Analyst consensus views the AI-driven datacom surge as a key driver, but this could be understated as management highlights that Amphenol's leading role in next-gen infrastructure is just beginning, with a broad and deep customer base and early innings of AI adoption, suggesting continued outsized revenue growth and multi-year earnings upside.

- While the consensus expects margin improvements due to high-value products and operational leverage, management now targets incremental operating income conversion rates close to 30%-well above previous 25% targets-and sees further room for expansion as high-technology content and disciplined execution drive a structural shift higher in net margins.

- The explosive acceleration and recovery in segments like industrial and automotive, supported by surging demand for connected devices, automation, medical, and EV applications, position Amphenol for sustained above-market long-term organic sales growth, with diversification insulating revenues from end-market volatility.

- Amphenol's uniquely agile global footprint, rapid facility expansion, and nimble operational culture have enabled it to out-execute competitors, capitalize immediately on market shifts, and convert execution into strong cash flow, signaling ongoing improvements in operating leverage and free cash generation beyond current analyst forecasts.

- The powerful combination of robust free cash flow and an expanding, active acquisition pipeline-including both transformative deals (CommScope, CIT) and strategic bolt-ons (Narda-MITEQ)-sets the stage for continued accretive M&A, accelerating both revenue growth and EPS well beyond what is currently priced in by the market.

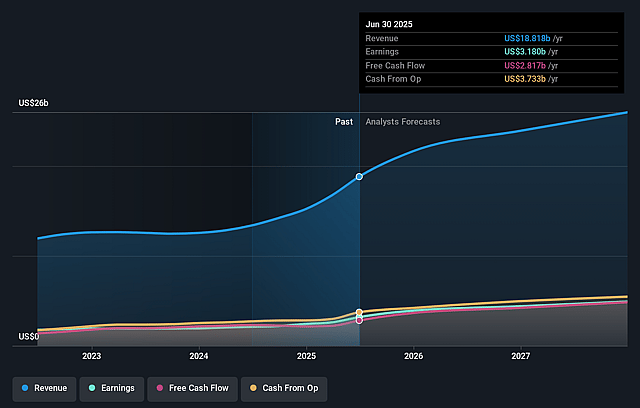

Amphenol Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Amphenol compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Amphenol's revenue will grow by 15.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 16.9% today to 19.8% in 3 years time.

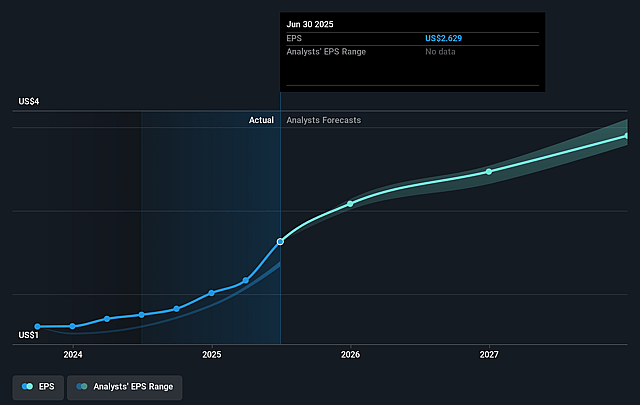

- The bullish analysts expect earnings to reach $5.7 billion (and earnings per share of $4.54) by about September 2028, up from $3.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 37.5x on those 2028 earnings, down from 44.8x today. This future PE is greater than the current PE for the US Electronic industry at 23.9x.

- Analysts expect the number of shares outstanding to grow by 1.27% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.3%, as per the Simply Wall St company report.

Amphenol Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rising protectionist policies and trade barriers, as alluded to in the mention of ongoing diversification of manufacturing footprints to manage tariffs and trade volatility, could increase supply chain costs, introduce demand unpredictability, and ultimately pressure Amphenol's net income and revenue growth.

- The acceleration of software-defined solutions and wireless technologies threatens to gradually shrink the physical connector market, which risks eroding Amphenol's addressable market and long-term organic sales growth.

- Amphenol's exposure to cyclical end-markets such as automotive and industrial, highlighted by management's comments about ongoing areas of uncertainty and moderation in these areas, increases the risk of greater earnings volatility and potential pressure on long-term valuation and profitability.

- Intensifying pricing pressure from large customers-given Amphenol's emphasis on broad representation across industry giants and OEMs-may lead to margin erosion as these buyers consolidate and leverage their purchasing power, negatively impacting gross margins.

- Rising R&D and capital expenditures, particularly with elevated investment needed to keep pace with AI and other technology trends, may eventually outstrip the company's capacity for efficient innovation, leading to declining returns on invested capital, reduced profitability, and increased strain on future free cash flow.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Amphenol is $134.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Amphenol's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $134.0, and the most bearish reporting a price target of just $85.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $29.0 billion, earnings will come to $5.7 billion, and it would be trading on a PE ratio of 37.5x, assuming you use a discount rate of 8.3%.

- Given the current share price of $116.79, the bullish analyst price target of $134.0 is 12.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Amphenol?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.