Key Takeaways

- Investment in U.S. facilities and advanced manufacturing could enhance operational efficiency, job growth, and revenue, improving margins and earnings.

- Sustainability goals and enhancements in services and product features might increase brand value, customer engagement, and high-margin revenue streams, supporting growth.

- Trade policy uncertainty, tariffs, and currency fluctuations could disrupt Apple's costs, margins, and revenue stability.

Catalysts

About Apple- Designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories worldwide.

- Apple's planned investment of $500 billion in the U.S. over the next four years, including the expansion of facilities and opening a new factory for advanced server manufacturing, could drive operational efficiencies and stimulate local job growth, potentially boosting revenues and improving net margins.

- The introduction of the iPhone 16e with an in-house C1 modem, and its focus on battery efficiency, presents opportunities for cost reductions and enhanced product differentiation, which could positively impact earnings through both higher sales and better margins.

- The expansion of Apple Intelligence features across languages and regions is likely to enhance customer engagement across the iPhone and iPad, potentially driving revenue growth through increased device sales and service subscriptions.

- Apple’s commitment to sustainability, with ambitious goals like carbon neutrality by 2030 and increased renewable energy usage, might improve its brand value and customer loyalty, subsequently supporting long-term revenue growth and net margins.

- Continued double-digit growth in Services revenue, bolstered by Apple TV+ content and new initiatives in sports and Apple Pay, could provide a higher-margin revenue stream, supporting future earnings growth and improving the overall company gross margin profile.

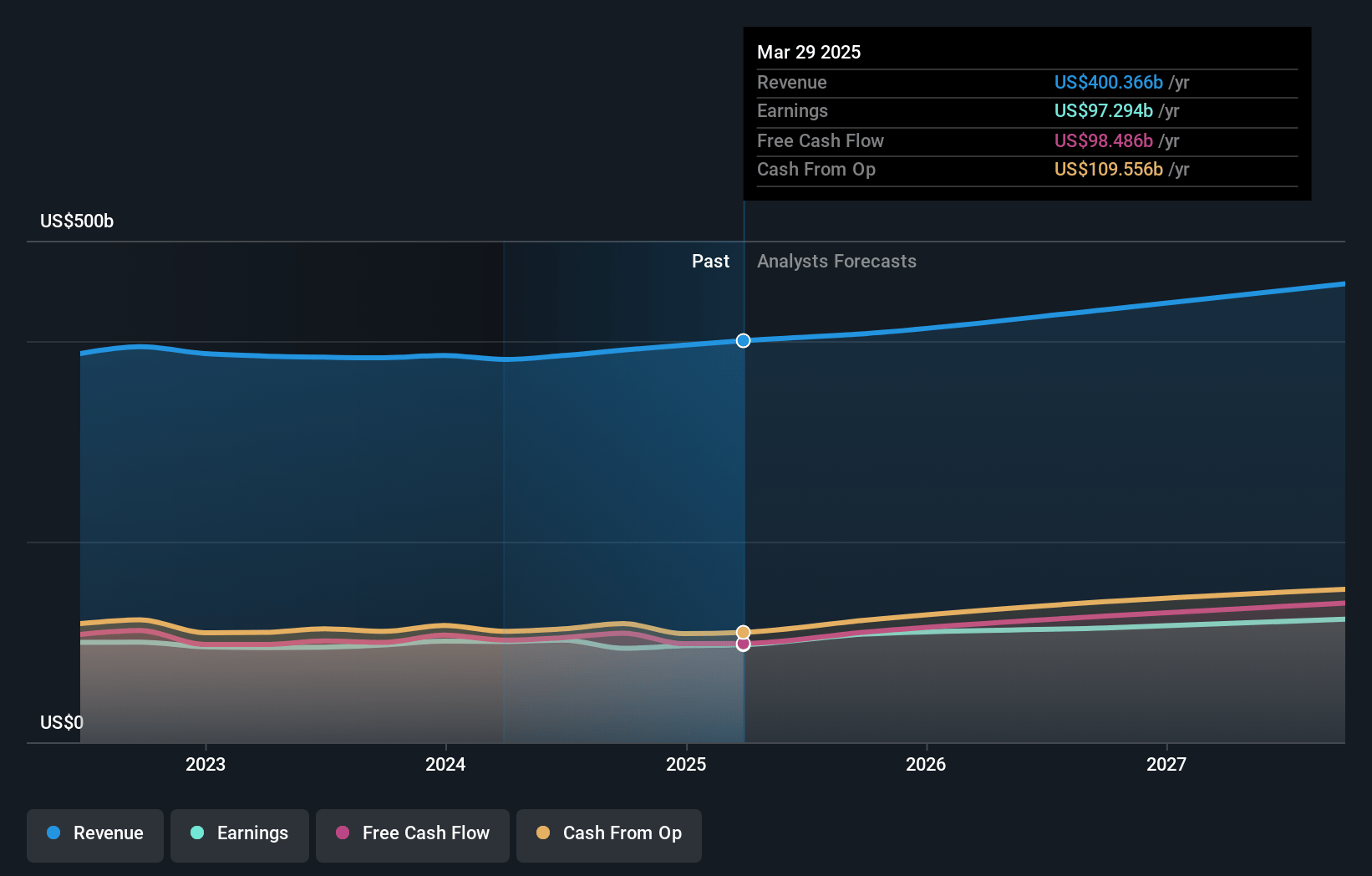

Apple Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Apple's revenue will grow by 5.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 24.3% today to 27.6% in 3 years time.

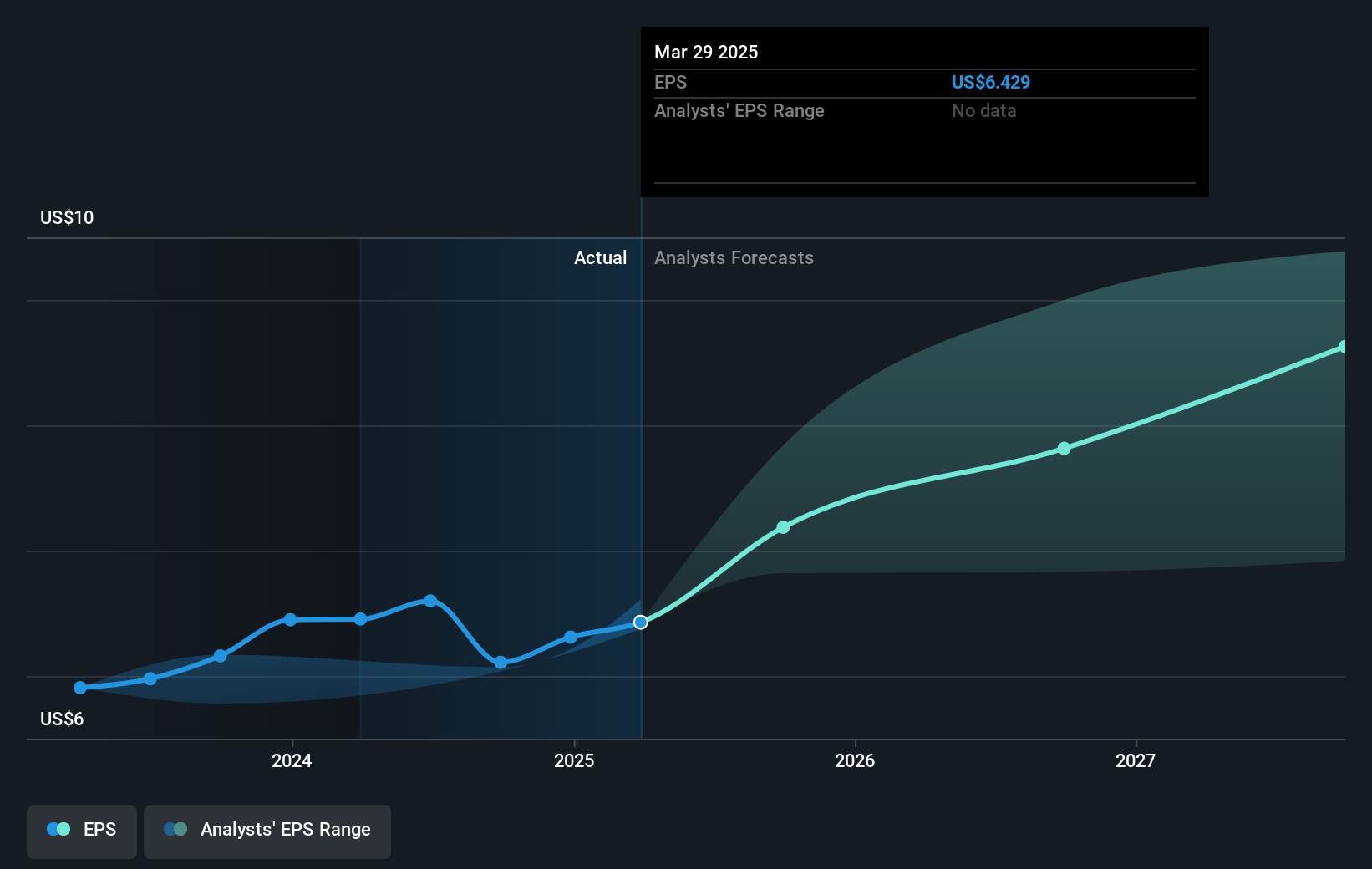

- Analysts expect earnings to reach $130.7 billion (and earnings per share of $9.41) by about May 2028, up from $97.3 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $96.8 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 30.8x on those 2028 earnings, up from 30.5x today. This future PE is greater than the current PE for the US Tech industry at 12.6x.

- Analysts expect the number of shares outstanding to decline by 2.6% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.87%, as per the Simply Wall St company report.

Apple Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Apple's exposure to tariffs, especially related to the country of origin of its products, could increase costs by $900 million for the June quarter, which may impact net margins.

- The company faces ongoing trade policy uncertainty, which could lead to further costs or supply chain disruptions, potentially affecting revenue and earnings stability.

- The foreign exchange headwinds have already affected Apple's gross margin, and fluctuations in currency rates could continue to impact revenue and profits.

- The slow rollout of Siri's new features and delays in AI deployments might hinder consumer upgrade cycles, affecting overall product revenue growth.

- Legal challenges and antitrust concerns, such as the Epic case injunction and Google default search trial, could negatively impact Services revenue if unfavorable outcomes occur.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $232.174 for Apple based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $300.0, and the most bearish reporting a price target of just $170.62.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $473.5 billion, earnings will come to $130.7 billion, and it would be trading on a PE ratio of 30.8x, assuming you use a discount rate of 7.9%.

- Given the current share price of $198.51, the analyst price target of $232.17 is 14.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives