- Sector: Information Technology

- Industry: Internet Services and Infrastructure

- Quant Sector Ranking (as of 12/23/2024):11 out of 548

- Quant Industry Ranking (as of 12/23/2024): 2 out of 23

- Market Capitalization: $16.55B

- Quant Rating: Strong Buy

"TWLO is a top Quant-ranked Internet Services and Infrastructure stock and an Alpha Pick selection offering businesses a communications platform that enables companies to integrate various tools into their applications using APIs. It provides services for messaging, voice calls, video, email, and other forms of communication, allowing developers to build customized customer engagement experiences. Twilio is strategically focused on embedding AI and Machine learning throughout its platform, having recently announced an integration with OpenAI’s new real-time API, enabling customers to build powerful conversational virtual agents. This focus has fueled near-term growth, with Q3 revenue up 10% Y/Y, exceeding guidance, and FWD EBITDA growth of 51% vs. the sector’s 6%. This growth has translated to a Q3 non-GAAP operating margin of 16.1%, 290 basis points above the previous year. The company also boasts $830M in cash from operations, which is more than 700% above the IT sector median.

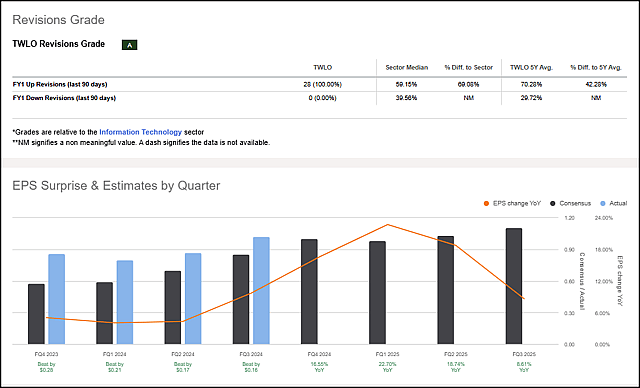

Wall Street analysts have expressed their conviction in the stock’s growth and profitability trajectory, with a whopping 28 FY1 up revisions in the last 90 days and zero down revisions. This has contributed to the stock’s incredible 74% price return in the last three months and 28% over the last year.

TWLO Revisions Grade

Despite the gains, TWLO’s valuation remains attractive across specific metrics, like its 2x P/B ratio, which is a 41% reduction vs. the sector median. With strong revenue growth, improving profitability, and a proven strategy for leveraging AI, TWLO presents an attractive investment opportunity for those looking to capitalize on personalized customer interactions."

Cite:

Have other thoughts on Twilio?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

The user NateF holds no position in NYSE:TWLO. Simply Wall St has no position in any of the companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The author of this narrative is not affiliated with, nor authorised by Simply Wall St as a sub-authorised representative. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimates are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.