Key Takeaways

- Intensifying competition, client concentration, and regulatory challenges threaten Fastly's market share, pricing power, and revenue stability.

- High investment needs and operational costs in new areas may prevent sustainable profitability without faster adoption or improved expense management.

- Accelerating security and edge adoption, margin improvements, financial discipline, and global market expansion position Fastly for lasting revenue growth and profitability.

Catalysts

About Fastly- Operates an edge cloud platform for processing, serving, and securing its customer’s applications in the United States, the Asia Pacific, Europe, and internationally.

- The ongoing commoditization of content delivery and edge infrastructure services is likely to intensify, causing downward pressure on prices and gross margins. In the long term, providers like Fastly may be forced to continually lower their prices to remain competitive, directly hampering both revenue growth and profitability.

- Large hyperscale cloud vendors are rapidly building out their integrated edge and security solutions, making it increasingly difficult for smaller, specialized providers to defend market share. Over time, this will reduce Fastly's addressable market and could lead to stagnant or declining revenues as enterprise customers consolidate spend with larger competitors.

- Regulatory headwinds, including stricter privacy rules in key international markets and evolving data protection laws, may restrict Fastly's ability to offer differentiated analytics and edge solutions that rely on detailed data. This constraint is likely to limit product adoption and revenue potential, especially as the company seeks to grow internationally.

- Fastly's persistent client concentration exposes it to significant revenue risk, as a considerable portion of sales comes from a relatively small number of enterprise customers. Any reduction in spend or departure from a major client would not only depress top-line results but also increase volatility in future earnings.

- Transitioning into adjacent, high-growth areas such as edge security and compute will require sustained heavy investment. If competitive adoption lags or operating expenses continue to outpace incremental revenue, long-term net margins will remain under pressure and sustainable profitability will be unachievable.

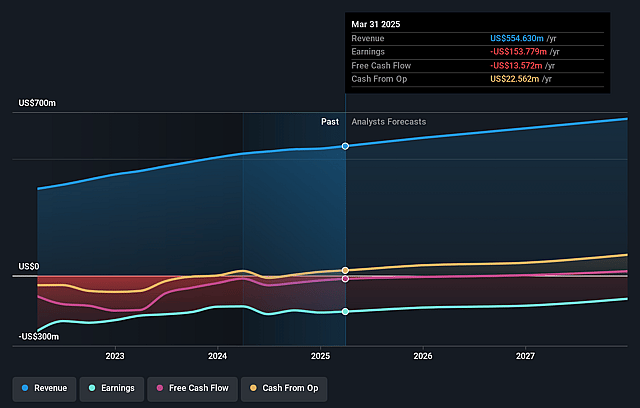

Fastly Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Fastly compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Fastly's revenue will grow by 5.7% annually over the next 3 years.

- The bearish analysts are not forecasting that Fastly will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Fastly's profit margin will increase from -25.8% to the average US IT industry of 7.0% in 3 years.

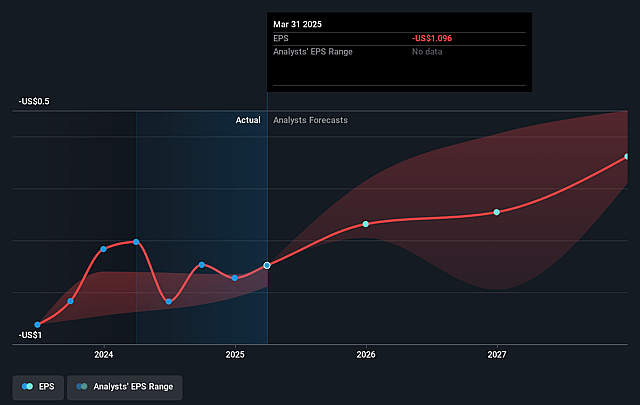

- If Fastly's profit margin were to converge on the industry average, you could expect earnings to reach $47.2 million (and earnings per share of $0.28) by about September 2028, up from $-147.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 28.7x on those 2028 earnings, up from -7.4x today. This future PE is lower than the current PE for the US IT industry at 32.5x.

- Analysts expect the number of shares outstanding to grow by 5.06% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.9%, as per the Simply Wall St company report.

Fastly Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained growth in security and edge computing revenue, with security reaching record highs and comprising an increasing percentage of total sales, demonstrates long-term product-market fit and a widening addressable market, supporting higher overall revenue potential.

- Record-breaking RPO (remaining performance obligations) growth of 41% year-over-year, accompanied by rising customer commitments and broader product adoption through cross-sell and upsell initiatives, indicates growing revenue visibility and mix shift toward predictable, recurring income.

- Improving gross margins, now at 59% with ongoing benefits from network efficiencies and pricing discipline, suggest a structural route to higher long-term profitability and enhancements in net margins.

- Transition to positive free cash flow, successive upward revisions in free cash flow guidance, and disciplined cost control reflect a financial and operational turnaround that strengthens the company's bottom line and boosts earnings sustainability.

- Expanding international and vertical market penetration, supported by new regional leadership in APJ and Southern Europe as well as continued wins in security-heavy verticals such as healthcare, financial services, and omnichannel retail, open new growth avenues that can further propel long-term top-line expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Fastly is $6.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Fastly's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $10.0, and the most bearish reporting a price target of just $6.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $675.0 million, earnings will come to $47.2 million, and it would be trading on a PE ratio of 28.7x, assuming you use a discount rate of 9.9%.

- Given the current share price of $7.36, the bearish analyst price target of $6.0 is 22.7% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.