Key Takeaways

- Multi-year, high-commit contracts and cross-selling are driving durable, high-visibility revenue growth and non-linear margin improvement fueled by new product adoption.

- Developer-focused platform integration, increasing network efficiency, and disciplined operations are expanding long-term customer value, retention, and operating leverage.

- Commoditization, customer concentration, competition, persistent losses, and rising compliance costs threaten Fastly's margin stability, revenue growth, and path to sustained profitability.

Catalysts

About Fastly- Operates an edge cloud platform for processing, serving, and securing its customer’s applications in the United States, the Asia Pacific, Europe, and internationally.

- Analyst consensus sees continued customer diversification as a stabilizer for revenue, but this likely understates Fastly's upside: recurring record highs in RPO, the pronounced acceleration in enterprise wins, and the successful shift toward multi-year, high-commit contracts indicate a step-change in durable, high-visibility revenue that could drive sustained double-digit revenue growth and faster gross margin expansion than currently modeled.

- While analysts broadly anticipate cross-selling and security portfolio expansion to improve margins, the rapid adoption of new edge-native security and compute products-over 50% of customers now use two or more products, with cross-sell-driven revenues outpacing total growth-suggests a flywheel effect is emerging that could deliver non-linear net margin gains as platform unification and AI-powered features cement Fastly's value proposition.

- Fastly is uniquely positioned to capitalize as global internet usage, real-time applications, IoT, and connected device adoption accelerate, which will structurally support increasing CDN and edge compute volume per customer and drive long-term, multi-year compounding revenue growth well above industry averages.

- The platform's programmable, developer-centric architecture is fostering deeper integration into customers' cloud-native tech stacks, resulting in increased retention, higher switching costs, and growing usage intensity-all of which will boost lifetime value, support rising revenue per user, and enhance earnings visibility as usage-based models scale.

- Ongoing improvements in network efficiency, proprietary hardware/software innovation, and operational discipline-as evidenced by sharply rising cash flow from operations, declining capital expenditures as a share of revenue, and projected near-term positive free cash flow-signal a long-run increase in operating leverage and margin expansion that appears underappreciated by the market.

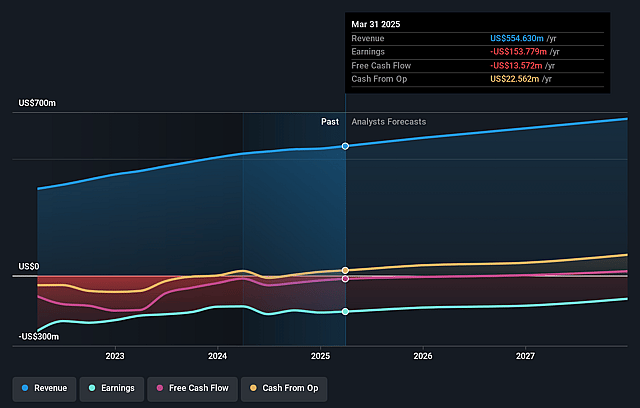

Fastly Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Fastly compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Fastly's revenue will grow by 7.8% annually over the next 3 years.

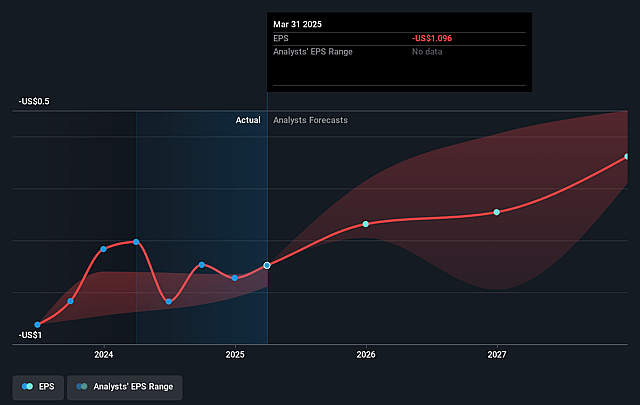

- Even the bullish analysts are not forecasting that Fastly will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Fastly's profit margin will increase from -25.8% to the average US IT industry of 7.0% in 3 years.

- If Fastly's profit margin were to converge on the industry average, you could expect earnings to reach $50.0 million (and earnings per share of $0.29) by about September 2028, up from $-147.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 45.2x on those 2028 earnings, up from -7.6x today. This future PE is greater than the current PE for the US IT industry at 29.0x.

- Analysts expect the number of shares outstanding to grow by 5.06% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.99%, as per the Simply Wall St company report.

Fastly Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The commoditization of CDN and edge computing services, combined with sustained industry price pressure, is likely to create headwinds for Fastly's gross margins and limit its ability to meaningfully increase long-term earnings, especially as much of the recent margin improvement has been attributed to temporarily favorable pricing trends and network efficiencies.

- Fastly remains heavily exposed to customer concentration risk, with its top 10 customers representing 31 percent of revenue, and evidence from last year showing that volatility or churn among a small group of large customers can result in sharp declines in top-line growth and revenue stability.

- Increasing competition from hyperscale cloud providers and the ongoing consolidation within the tech sector could further erode Fastly's market share and pricing power, making it increasingly difficult to maintain or grow revenue and ultimately impacting its ability to expand net margins.

- Persistent operating losses and high infrastructure and R&D expenses continue to challenge Fastly's path to sustained profitability, with the company only now forecasting an operating loss of between 9 million and 3 million dollars for 2025, and a narrow range of free cash flow between breakeven and 10 million dollars, highlighting ongoing profitability risks.

- Rising global regulatory scrutiny and privacy legislation may increase compliance costs and operational complexity for Fastly's platform offerings, posing risks to both expanded market share and the company's ability to maintain or grow net margins in the long run.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Fastly is $10.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Fastly's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $10.0, and the most bearish reporting a price target of just $6.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $715.0 million, earnings will come to $50.0 million, and it would be trading on a PE ratio of 45.2x, assuming you use a discount rate of 10.0%.

- Given the current share price of $7.65, the bullish analyst price target of $10.0 is 23.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.