Key Takeaways

- Expanding security offerings and enterprise customer wins position Fastly for accelerated, high-margin revenue growth and increased stability beyond current analyst expectations.

- Competitive exits and strong demand for edge computing drive sustainable pricing power and operating leverage, enhancing long-term profitability and cash flow outlook.

- Intensifying price competition, customer concentration, weak account expansion, ongoing losses, and rising hyperscale rivalry threaten Fastly's growth, differentiation, and future profitability.

Catalysts

About Fastly- Operates an edge cloud platform for processing, serving, and securing its customer’s applications in the United States, the Asia Pacific, Europe, and internationally.

- Analyst consensus views Fastly's diversification beyond its top 10 customers as a driver for predictable revenue growth, but this likely understates the potential; the surge in enterprise logo wins-especially in verticals like travel, tech, and financial services-signals Fastly could experience a sustained acceleration in revenue growth and stability, raising the likelihood of outsized top-line and bottom-line beats versus expectations.

- While analyst consensus forecasts product cross-sell and new offerings (especially security) to lift margins, Fastly's rapid success expanding its security suite from one product to three-including early stages of adoption in bot mitigation and DDoS-could unlock a multi-year period of above-market revenue growth and gross margin expansion as high-value security penetration in their customer base remains extremely low.

- Fastly is uniquely positioned to capitalize on the explosive demand for real-time and dynamic digital experiences powered by edge computing and programmable infrastructure, positioning its compute and AI-accelerated products to outpace broader CDN industry growth rates and become a primary driver of high-margin revenue.

- Market share gains accelerated by the exit of significant competitors (e.g., Edgio) and improving industry supply-demand dynamics are likely to create lasting pricing stability and substantially improved gross margins, establishing a new trajectory for both earnings and cash flow growth.

- The company's ability to deliver sustained positive free cash flow and its transition to operating profitability in the second half of 2025-while still investing in innovation-suggests increasing operating leverage and long-term upside to earnings as Fastly benefits from trends such as multi-cloud adoption and the globalization of digital content delivery.

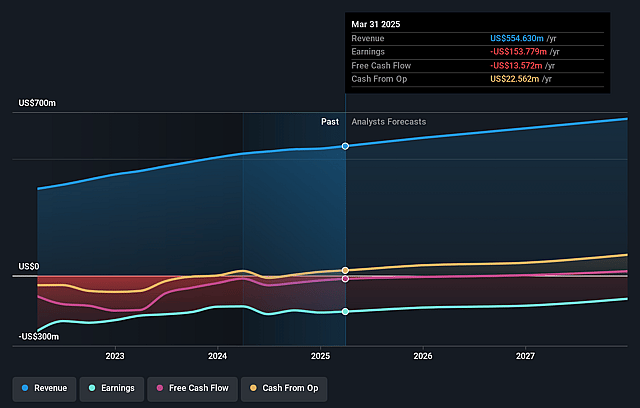

Fastly Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Fastly compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Fastly's revenue will grow by 9.2% annually over the next 3 years.

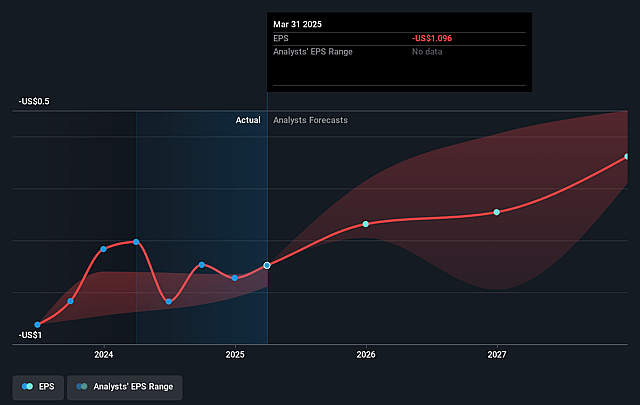

- Even the bullish analysts are not forecasting that Fastly will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Fastly's profit margin will increase from -27.7% to the average US IT industry of 7.1% in 3 years.

- If Fastly's profit margin were to converge on the industry average, you could expect earnings to reach $51.4 million (and earnings per share of $0.31) by about August 2028, up from $-153.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 34.2x on those 2028 earnings, up from -6.0x today. This future PE is greater than the current PE for the US IT industry at 26.2x.

- Analysts expect the number of shares outstanding to grow by 4.47% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.98%, as per the Simply Wall St company report.

Fastly Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Fastly faces persistently intense pricing pressure in its core CDN business, as evidenced by continued high-teens percentage declines in price per gigabit, which threaten long-term revenue growth and gross margins as industry commoditization accelerates.

- Customer concentration risk remains high, with the top 10 customers still comprising about a third of total revenue, leaving Fastly vulnerable to unexpected revenue drops and earnings volatility if any major client churns or significantly reduces spend.

- The company's net retention rate has fallen from 114 percent a year ago to 100 percent, indicating challenges with upselling and growing existing accounts, which could constrain future revenue momentum and operating leverage.

- Despite recent cost controls, Fastly continues to report net and operating losses, and management only projects a breakeven or slightly profitable period ahead, raising questions about the sustainability of profitability and net margin expansion compared to larger, profitable competitors.

- The rapid vertical integration of edge compute and security offerings by hyperscale cloud providers, combined with Fastly's relatively early stage in security product adoption, limits its ability to differentiate and risks long-term erosion of its addressable market and revenue streams as customers favor integrated platforms.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Fastly is $8.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Fastly's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $8.0, and the most bearish reporting a price target of just $5.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $722.8 million, earnings will come to $51.4 million, and it would be trading on a PE ratio of 34.2x, assuming you use a discount rate of 10.0%.

- Given the current share price of $6.38, the bullish analyst price target of $8.0 is 20.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.