Key Takeaways

- Transformative partnerships and long-term lease agreements uniquely position TeraWulf for rapid growth, strong recurring revenues, and enhanced pricing power in AI infrastructure.

- Zero-carbon infrastructure advantages and strategic acquisitions set the stage for sustained above-market growth, margin expansion, and long-term institutional adoption.

- Aggressive expansion into AI and green data centers heightens capital and operational risks amid customer concentration, volatile legacy mining, rising costs, and rapid technology shifts.

Catalysts

About TeraWulf- Operates as a digital asset technology company in the United States.

- Analyst consensus recognizes the strength of the AI hyperscale hosting agreements, but may understate just how transformative the $3.7 billion Fluidstack contract-with Google's $1.8 billion backstop and equity stake-will be in repositioning TeraWulf as a premier AI infrastructure provider, driving recurring, ultra-high-margin revenue and meaningfully reducing the company's cost of capital for future expansions.

- While consensus appreciates TeraWulf's new megawatt capacity and ongoing expansion, it may significantly underestimate how the Cayuga site's 80-year lease, together with contractor expertise and regional dominance, positions TeraWulf to accelerate its build-out pace and capture share as datacenter and crypto infrastructure demand soars, setting the stage for step-function revenue and EBITDA growth over the coming decade.

- The Google partnership serves not only as a major financial vote of confidence but also as a catalyst for attracting additional blue-chip tenants and strategic partnerships, potentially creating a virtuous cycle of demand, pricing power, and further margin expansion, all of which will enhance both top-line growth and bottom-line profitability.

- With the mainstreaming of AI, digital assets, and sustainability mandates, TeraWulf stands to benefit uniquely from surging institutional adoption of Bitcoin and the growing necessity for zero-carbon infrastructure-drivers which could sharply increase mining profitability, customer stickiness, and long-term fleet utilization.

- As consolidation accelerates in the mining and digital infrastructure sectors, TeraWulf's strengthened balance sheet, proven execution, and hard-to-replicate zero-carbon sites should enable accretive acquisitions and outsized market share gains, ultimately translating into above-market revenue growth and structurally higher operating margins.

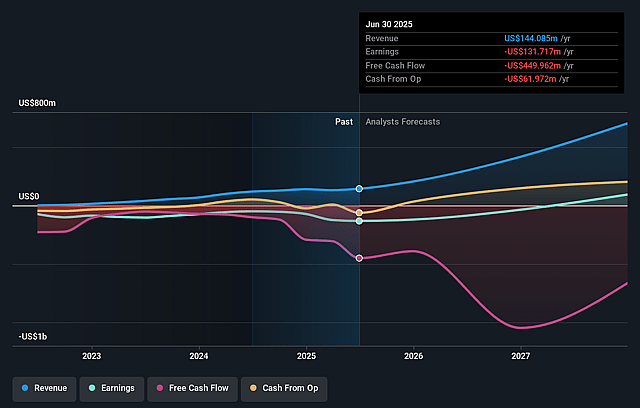

TeraWulf Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on TeraWulf compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming TeraWulf's revenue will grow by 113.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -91.4% today to 44.5% in 3 years time.

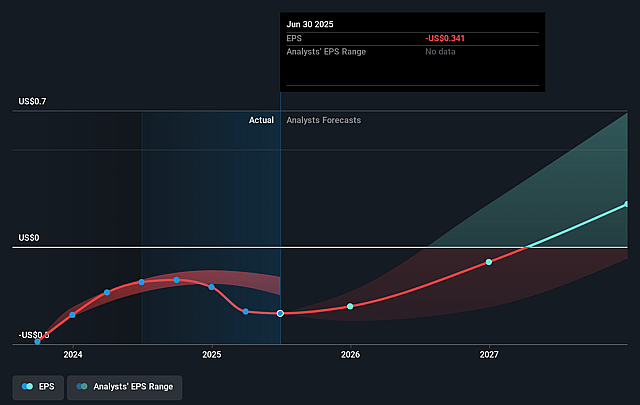

- The bullish analysts expect earnings to reach $623.4 million (and earnings per share of $1.28) by about September 2028, up from $-131.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 13.2x on those 2028 earnings, up from -31.9x today. This future PE is lower than the current PE for the US Software industry at 36.2x.

- Analysts expect the number of shares outstanding to grow by 1.56% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.75%, as per the Simply Wall St company report.

TeraWulf Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- TeraWulf's accelerated expansion into hyperscale AI hosting and HPC infrastructure will substantially increase capital expenditure and operational complexity, posing risks to future net margins and free cash flow, particularly if AI compute demand or contracted tenant revenues fail to materialize as forecast.

- Heavy reliance on major tenants such as Fluidstack, with Google's equity-linked backstop, introduces customer concentration risk and potential operational dependence, making overall revenue and earnings vulnerable to shifts in client strategy or performance failure tied to strict service-level agreements.

- While the company touts low-carbon power and green data centers as a structural advantage, tightening global decarbonization standards and competition for zero-carbon energy may drive up input costs and erode profitability, especially as more capital is committed to large-scale, long-duration energy contracts.

- TeraWulf's legacy bitcoin mining operations remain highly sensitive to bitcoin price volatility, hash rate escalation, and network difficulty, all of which could drive cyclical downturns in mining revenue and compress net margins, especially if resources are diverted to new ventures without commensurate returns.

- Rapid industry-wide innovation cycles in hardware for both bitcoin mining and advanced AI computing could force continuous, expensive upgrades and risk technological obsolescence, which may negatively impact long-term earnings and necessitate ongoing high capital investment just to maintain competitive relevance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for TeraWulf is $15.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of TeraWulf's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $15.0, and the most bearish reporting a price target of just $6.5.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $1.4 billion, earnings will come to $623.4 million, and it would be trading on a PE ratio of 13.2x, assuming you use a discount rate of 8.7%.

- Given the current share price of $10.3, the bullish analyst price target of $15.0 is 31.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.