Key Takeaways

- Heavy investment in capacity and reliance on a few key clients exposes TeraWulf to pronounced operational, regulatory, and technological disruptions.

- Rising financing needs and tightening regulation pose risks to profitability, while rapid tech shifts could undermine its fundamental business model.

- Expansion into AI hosting, secured partnerships with major tech firms, and focus on sustainable infrastructure position TeraWulf for diversified growth and improved financial stability.

Catalysts

About TeraWulf- Operates as a digital asset technology company in the United States.

- The company's aggressive capacity expansion and complex hyperscale build-out, including 400 megawatts at Cayuga and over 200 megawatts for Fluidstack, expose TeraWulf to significant long-term operational and capital risk. If demand for AI and HPC infrastructure falters due to regulatory changes or shifts in technology, excess capacity could go underutilized, leading to lower than projected revenue and potential impairment charges.

- TeraWulf remains heavily reliant on a concentrated tenant base for its new digital infrastructure offerings, with deals that are complex and bespoke. Should key customers like Fluidstack or Google materially change their strategic priorities or face business headwinds, TeraWulf could suffer abrupt contract terminations or non-renewals, which would create a sharp decline in future revenue and erode the anticipated increase in net operating margins.

- The company's surging capital expenditures, with large portions back-ended and an ongoing need to raise external financing even after the Google backstop, increase balance sheet leverage and interest expense risk. If macroeconomic or industry-wide credit conditions tighten, TeraWulf may be forced to accept unfavorable debt terms or dilutive equity raises, significantly compressing future net margins and limiting shareholder returns.

- Global regulatory scrutiny targeting the energy consumption and environmental impact of large-scale digital infrastructure, particularly in cryptocurrency and AI data center operations, is mounting. If new rules impose higher compliance costs or restrict TeraWulf's operations, long-run earnings power could be impaired as electricity, permitting, and sustainability requirements become more onerous.

- Rapid advances in computing and blockchain consensus mechanisms, including a potential shift away from energy-intensive proof-of-work to alternative models like proof-of-stake, threaten the very relevance of TeraWulf's core business model. Should these technologies gain widespread adoption, the demand for TeraWulf's services may collapse, rendering much of its fixed-cost, capital-intensive infrastructure obsolete and severely impacting future cash flows and overall valuation.

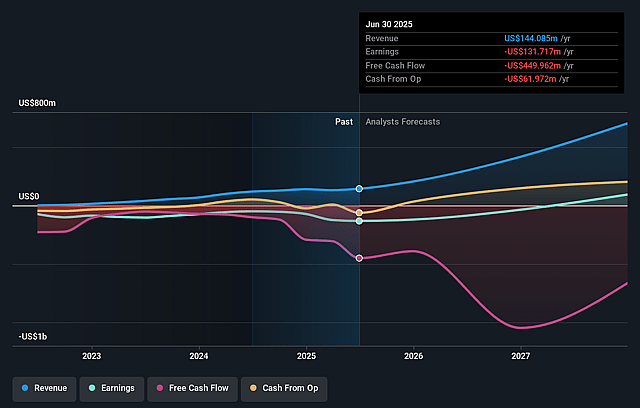

TeraWulf Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on TeraWulf compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming TeraWulf's revenue will grow by 69.4% annually over the next 3 years.

- The bearish analysts are not forecasting that TeraWulf will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate TeraWulf's profit margin will increase from -91.4% to the average US Software industry of 13.1% in 3 years.

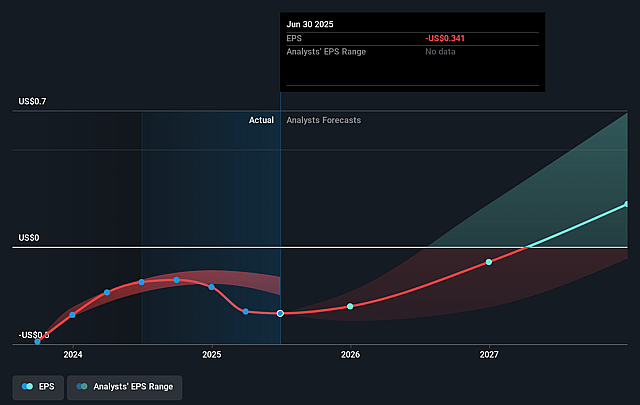

- If TeraWulf's profit margin were to converge on the industry average, you could expect earnings to reach $91.7 million (and earnings per share of $0.21) by about September 2028, up from $-131.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 45.0x on those 2028 earnings, up from -27.8x today. This future PE is greater than the current PE for the US Software industry at 35.7x.

- Analysts expect the number of shares outstanding to grow by 1.56% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.78%, as per the Simply Wall St company report.

TeraWulf Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The execution of a 10-year, $3.7 billion+ hyperscale AI hosting agreement with Fluidstack, backstopped by Google, will diversify TeraWulf's revenue mix beyond bitcoin mining, potentially driving significant top-line growth and improving earnings stability even if BTC prices decline.

- Google's $1.8 billion credit backstop and equity participation significantly enhances TeraWulf's credit profile, enabling access to lower-cost capital, supporting scalable growth initiatives, and likely improving net margins by reducing financing costs.

- TeraWulf's ability to secure long-term, zero-carbon power sources at both Lake Mariner and the newly leased 400MW Cayuga site positions the company to benefit from the rising global demand for sustainable digital infrastructure, supporting competitive advantage and margin resilience.

- Growing enterprise and hyperscaler demand for AI infrastructure, validated by the urgency and scale of recent customer agreements, aligns TeraWulf with robust secular tailwinds in digitalization, which could drive strong, recurring revenue and support valuation multiples.

- The company's ongoing operational momentum, experienced team, and successful delivery on large projects for marquee clients like Core42, Fluidstack, and Google suggest continued execution strength, which may enhance TeraWulf's financial performance and drive improved net income in future years.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for TeraWulf is $7.51, which represents two standard deviations below the consensus price target of $12.18. This valuation is based on what can be assumed as the expectations of TeraWulf's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $15.0, and the most bearish reporting a price target of just $6.5.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $700.5 million, earnings will come to $91.7 million, and it would be trading on a PE ratio of 45.0x, assuming you use a discount rate of 8.8%.

- Given the current share price of $8.98, the bearish analyst price target of $7.51 is 19.6% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on TeraWulf?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.