Last Update 21 Nov 25

Fair value Increased 6.86%Resilient performance despite tariff and consumer sentiment pressure

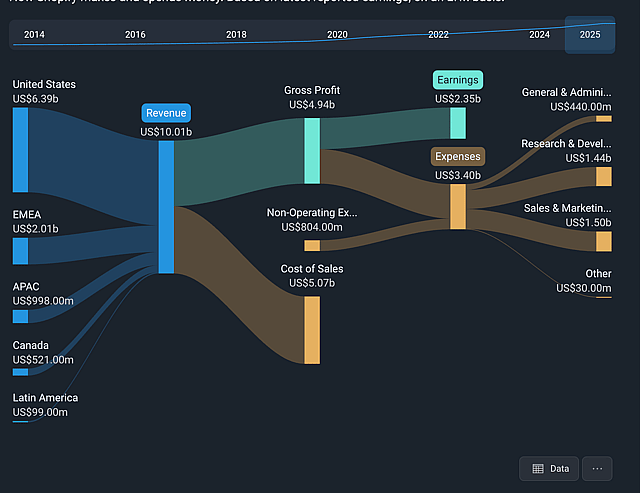

- Shopify’s Q3 2025 results (reported 4 Nov 2025) showed revenue growth of ~32% and GMV up ~32% despite the challenging backdrop.

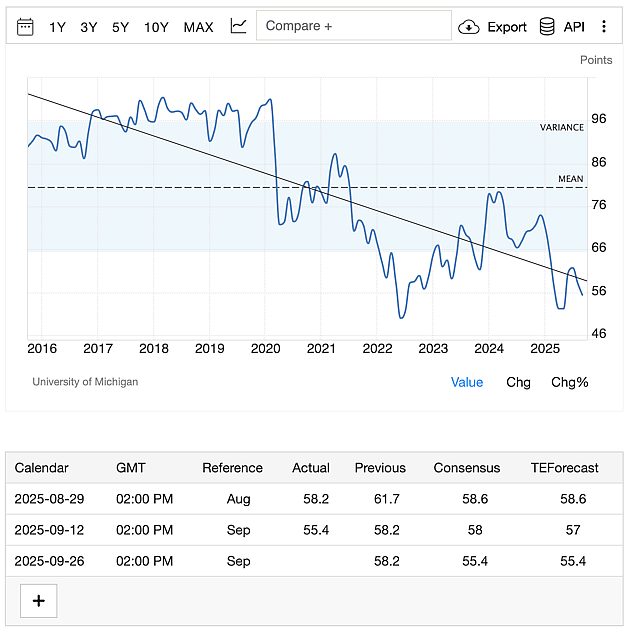

- The The Conference Board Consumer Confidence Index shows the expectations component at 71.5 (October 2025) which is below the ~80 level typically seen as a signal of recession risk. This may have a lagging impact on revenue growth.

- At least for now, increase revenue growth rate to 12% as quarterly results stronger than expected.

Catalysts

-

“Social commerce” presents a massive tailwind with $6.23T market opportunity by 2030.

- Social commerce market is growing at 30.71% CAGR with 91% occurring on mobile devices: https://www.mordorintelligence.com/industry-reports/social-commerce-market

- 25% of Shopify traffic comes from mobile devices: https://www.chargeflow.io/blog/shopify-statistics

-

AI Store Builder + Sidekick features are increasing user engagement and reducing onboarding friction.

- Sidekick users doubled from Dec 2024 to May 2025: https://techcrunch.com/2025/05/21/shopify-launches-an-ai-powered-store-builder-as-part-of-its-latest-update/

-

Strategic partnerships are lowering friction / barriers to entry for merchants, making it every easier to setup stores

- In May 2025 Shopify and DHL announced a partnership to pre‑integrate DHL into Shopify Shipping, letting sellers access DHL’s global network: https://group.dhl.com/en/media-relations/press-releases/2025/dhl-group-partners-with-shopify-to-accelerate-cross-border-shipping-worldwide.html

- Amazon on Thursday announced the expansion of its third-party logistics product, giving merchants on Shopify the ability to pick, pack and ship their products from a single fulfillment: operation.https://finance.yahoo.com/news/amazon-opens-fulfillment-services-shein-163040585.html

Assumptions

- Revenue in 5 Years (2030): $20-22 billion

-

Why?

- Current revenue trajectory shows 26-29% growth (2024: $8.88B, Q2 2025 TTM: $10.01B): https://www.macrotrends.net/stocks/charts/SHOP/shopify/revenue

- Social commerce tailwind with 30.71% CAGR in a $6.23T market opportunity

- AI tools reducing onboarding friction and increasing merchant adoption

- Strategic partnerships (DHL, Amazon fulfillment) lowering barriers to entry

- Over 12% US ecommerce market share with room for expansion: https://www.stocktitan.net/news/SHOP/shopify-merchant-success-powers-q4-outperformance-across-both-top-zcq4nr2tqhzj.html

- Assuming growth moderates from current 25-30% to 15-20% annually as the company matures, this projects to ~$20-22B by 2030.

Risks

- Volatility with US trade tariff policy and increased cost of goods for US merchants may result in smaller businesses using it going under or less consumer demand due to increased prices. Shopify also has large exposure to the US market with bulk of revenue coming from there.

- Projected decline in consumer confidence (both UMCS and CBCS) will have downstream effects on discretionary spending and may result in less sales.

- Increased competitive pressure from large companies (Amazon Prime, Stripe/Square, Social first e-commerce via Meta/TikTok/Google)

Have other thoughts on Shopify?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

nav is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. nav holds no position in NasdaqGS:SHOP. Simply Wall St has no position in any companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.