Catalysts

About Okta

Okta provides a neutral identity security platform that manages and protects human, nonhuman and AI agent access across enterprise and customer applications.

What are the underlying business or industry changes driving this perspective?

- The rapid shift toward AI driven workflows and agentic applications risks outpacing Okta's ability to productize and standardize controls for nonhuman identities, which could slow adoption of new AI offerings and cap incremental revenue growth.

- As large enterprises rationalize complex identity stacks across IAM, PAM and governance, consolidation projects may stretch implementation cycles and compress pricing, pressuring net retention and limiting upside to current mid single digit to low double digit revenue growth.

- Increased reliance on channel partners and specialized go to market teams introduces execution risk around sales productivity and quota ramp, where any misstep in hiring or ramp timing could erode operating leverage and stall improvements in non GAAP operating margins.

- The industry wide move to embed identity and access directly into major cloud and SaaS platforms threatens Okta's neutral control plane positioning, raising competitive intensity that could force higher R&D and sales investment and weigh on free cash flow margins.

- Growing customer dependence on a single vendor for workforce, customer and AI agent identity amplifies the impact of any security incident or product failure, where an adverse event could drive higher churn, lower upsell and meaningfully disrupt earnings trajectory.

Assumptions

This narrative explores a more pessimistic perspective on Okta compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts. How have these above catalysts been quantified?

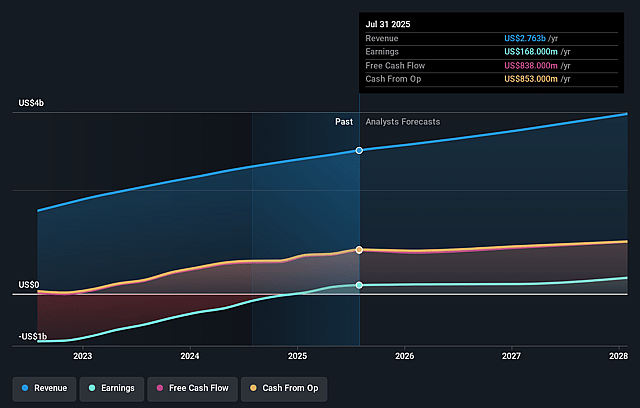

- The bearish analysts are assuming Okta's revenue will grow by 8.5% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 6.9% today to 0.9% in 3 years time.

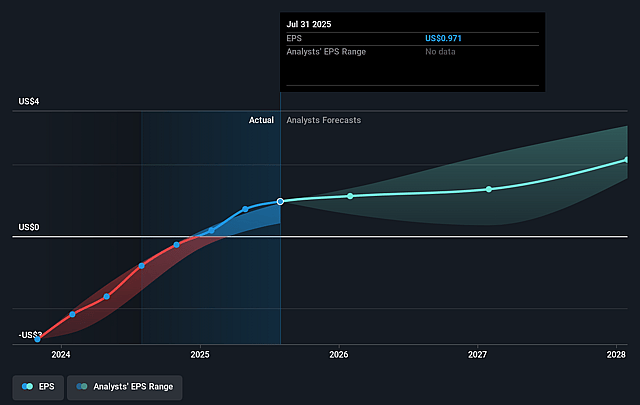

- The bearish analysts expect earnings to reach $31.3 million (and earnings per share of $1.28) by about December 2028, down from $195.0 million today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as $509.5 million.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 609.7x on those 2028 earnings, up from 80.2x today. This future PE is greater than the current PE for the US IT industry at 29.9x.

- The bearish analysts expect the number of shares outstanding to grow by 3.43% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.01%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- Okta is seeing strong and improving sales productivity supported by low attrition and rising tenure in its account executive base. Continued disciplined investment in additional sales capacity could sustain double digit revenue growth and operating leverage, supporting higher earnings over time.

- The expanding portfolio of new products such as Okta Identity Governance, Privileged Access, Identity Security Posture Management and Fine Grained Authorization, combined with suite based packaging, positions Okta to deepen wallet share with its more than 20,000 customers. This could lift net retention and long term revenue and margin outcomes.

- Securing AI agents and nonhuman identities is emerging as a large, long duration market where Okta has early traction, neutral platform positioning and standard setting influence through technologies like Cross App Access and MCP. This could open a total addressable market that eventually exceeds its existing workforce and customer identity markets, driving sustained revenue and earnings growth.

- Industry wide trends toward consolidating fragmented identity stacks onto a single control plane, as illustrated by large enterprises replacing multiple legacy vendors with Okta, could structurally entrench Okta as the strategic identity layer. This would support durable subscription revenue, resilient gross retention and robust free cash flow margins.

- Okta’s demonstrated ability to expand in public sector, large enterprise and agentic commerce use cases, alongside a strong balance sheet with approximately 2.5 billion dollars of cash and healthy free cash flow margins near 30 percent, gives it financial and operational flexibility to keep investing through cycles. This may underpin long term earnings growth and support the share price.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bearish price target for Okta is $75.03, which represents up to two standard deviations below the consensus price target of $111.75. This valuation is based on what can be assumed as the expectations of Okta's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $145.0, and the most bearish reporting a price target of just $75.0.

- In order for you to agree with the more bearish analyst cohort, you'd need to believe that by 2028, revenues will be $3.6 billion, earnings will come to $31.3 million, and it would be trading on a PE ratio of 609.7x, assuming you use a discount rate of 9.0%.

- Given the current share price of $88.2, the analyst price target of $75.03 is 17.6% lower. Despite analysts expecting the underlying business to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Okta?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.