Narratives are currently in beta

Key Takeaways

- Integration of advanced video solutions and AI-augmented operations is expected to bolster revenue growth and enhance market share globally.

- Improved gross margins and efficiency-driven cost savings may boost net margins and stabilize earnings.

- Rising competition and uncertainties in software and service rollouts forecast potential revenue growth challenges and dampening earnings potential for Alarm.com in 2025.

Catalysts

About Alarm.com Holdings- Provides various Internet of Things (IoT) and solutions for residential, multi-family, small business, and enterprise commercial markets in North America and internationally.

- Alarm.com's AI-Deterrence (AID) and remote video monitoring solutions are expected to reduce costs for service providers, potentially allowing for increased adoption and revenue growth due to broader market appeal. This will likely impact revenue positively.

- The launch of OpenEye's new cloud cameras provides cost-effective video surveillance solutions, enabling partners to enter and expand in new commercial accounts, which should drive revenue growth.

- International expansion facilitated by the integration of EBS technology is anticipated to add 40,000 to 50,000 subscribers that would not otherwise be captured, positively influencing total revenue and market share.

- Continuous improvements in gross margins due to favorable product mix, as indicated by the increased hardware and SaaS gross margins, suggest potential for improved net margins and overall earnings.

- Anticipated cost savings from AI-driven augmentation and efficiency improvements in operations may allow for maintaining or increasing EBITDA margins, leading to enhanced earnings stability.

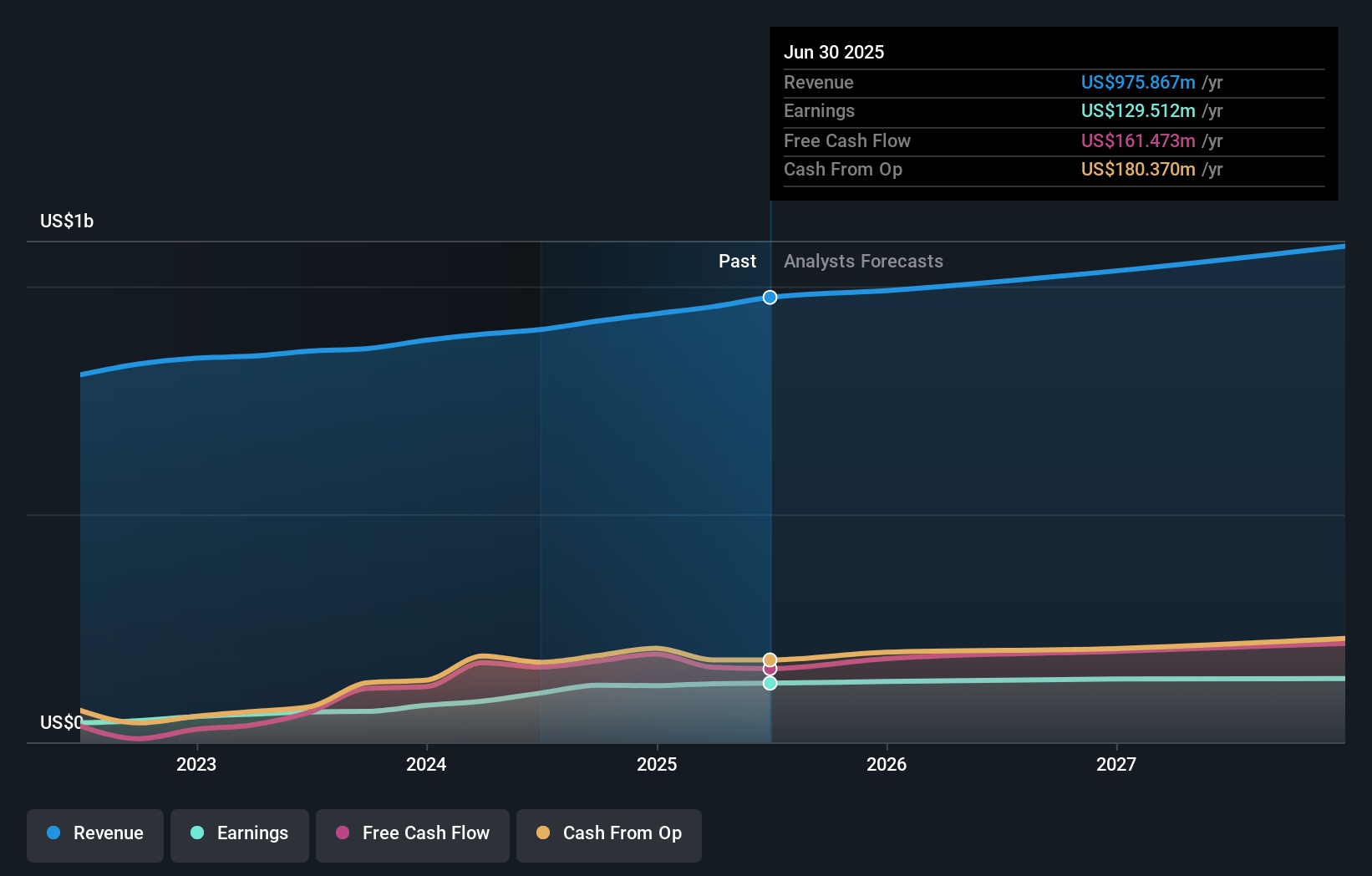

Alarm.com Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Alarm.com Holdings's revenue will grow by 4.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 13.5% today to 14.8% in 3 years time.

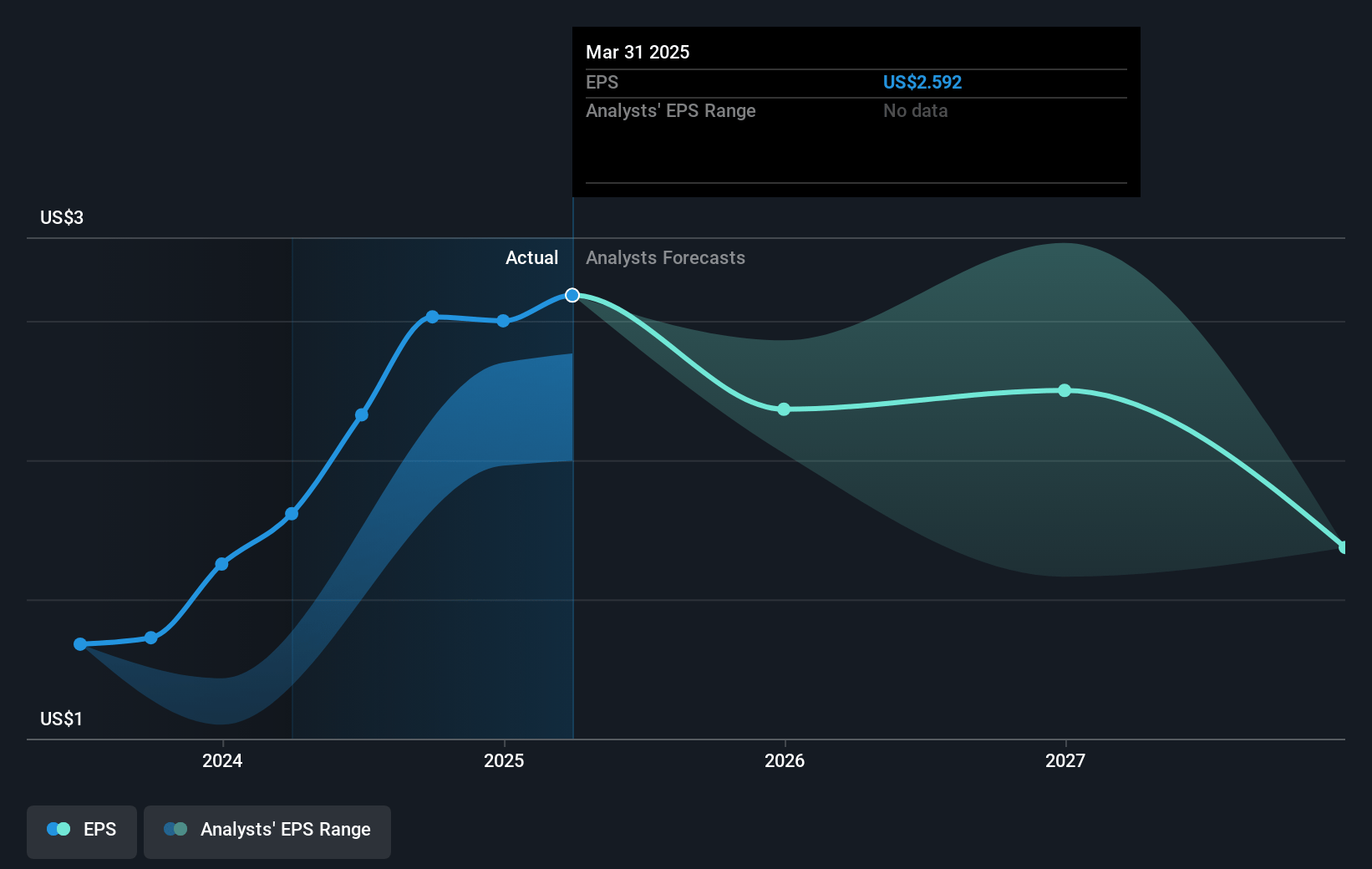

- Analysts expect earnings to reach $155.7 million (and earnings per share of $2.37) by about January 2028, up from $125.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 38.5x on those 2028 earnings, up from 23.7x today. This future PE is greater than the current PE for the US Software industry at 38.4x.

- Analysts expect the number of shares outstanding to grow by 9.9% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.79%, as per the Simply Wall St company report.

Alarm.com Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The rollout of the ADT Google software poses a significant headwind, predicted to create a 200 basis point drop in growth, which could impact SaaS revenue growth in 2025.

- Company has factored in revenue growth challenges related to ADT’s software transition, making financial visibility into 2025 less certain, potentially impacting overall revenue forecasts.

- The strong contribution to SaaS growth from litigation-related IP license revenue in 2024 will not recur in 2025, leading to a potential slowdown in revenue growth.

- Rising competition in the international markets and the time taken for new service providers to fully align with Alarm.com’s offerings could limit international revenue expansion, dampening future earnings potential.

- Unforeseen delays in product and feature rollouts, such as those related to AI and video analytics, could impact the ability to meet revenue and EBITDA margin targets if commercial and residential markets don't adopt new technologies as anticipated.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $73.62 for Alarm.com Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $85.0, and the most bearish reporting a price target of just $50.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.0 billion, earnings will come to $155.7 million, and it would be trading on a PE ratio of 38.5x, assuming you use a discount rate of 7.8%.

- Given the current share price of $59.86, the analyst's price target of $73.62 is 18.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives